The US housing market is a drag on the US economy

Read the publication below or click here to open the pdf.

US housing prices have been declining this year, in contrast to major prices increases seen in the post-pandemic period. The decline is primarily driven by continued elevated mortgage rates, which increase costs for aspiring homeowners. Slower population growth, driven by lower birth rates and the recent drop in migration, is also lowering demand for housing. Economic uncertainty also adds downward pressure on housing prices. Meanwhile, the market is well supplied as housing inventories are at elevated levels. Housing prices are likely to remain under pressure as many metrics suggest housing prices remain overvalued. The situation in the housing market has important broader economic implications as it puts downward pressure on residential investment and inflation

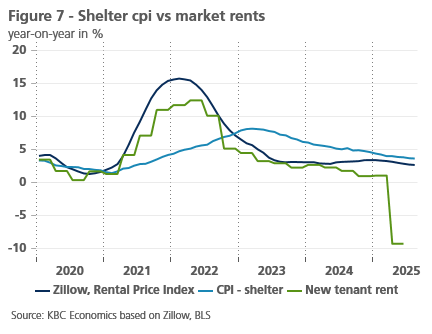

The US housing market is under severe strain. As mortgage rates remain close to 7%, population growth is slowing and the economy is under pressure, house prices are declining. In Q2, prices declined by 0.9% according the S&P/ Case Shiller National Home Index. Prices are now down on a year-to-date basis and the year-on-year trend is slowing markedly too (see figure 1).

Underlying factors

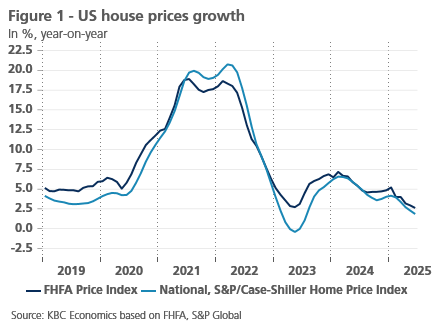

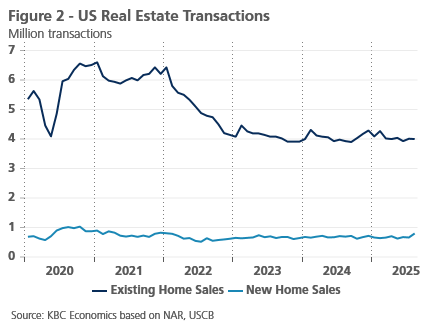

Demand for housing remains subdued. Home sales dipped markedly in 2023 and remain at low levels (see figure 2). The main reason for this has been the sharp rise in mortgage rates. As inflation shot up and the Fed started tightening interest rates in 2022, mortgage rates shot up. 30-year mortgages increased from 3.1% end of 2021 to 6.4% end of 2022. 30-year mortgage rates remained elevated ever since. They now average 6.6%.

The high interest rates made buying a new home prohibitively expensive for aspiring homeowners. Meanwhile, actual homeowners were reluctant to sell their home and buy a new one, as many had refinanced their mortgages during the pandemic at low rates. Selling their homes would force them to refinance their mortgage at a much less favourable rate (see also our economic opinion of November 2023). Still, today a large portion of households enjoy lower mortgage rates. The effective mortgage interest rate was 4.1% in Q2 2025, still well below the rate on new mortgages. According to research by Realtor, a real estate listing website, 72.1% of mortgage holders still had an outstanding rate below 5% in Q4 2024. 20.9% still pay mortgage rates below 3%. Slowly but steadily, however, low mortgage rate contracts are ending, and more homeowners could be enticed to sell their houses. This could increase supply in the market and put further downward pressure on prices.

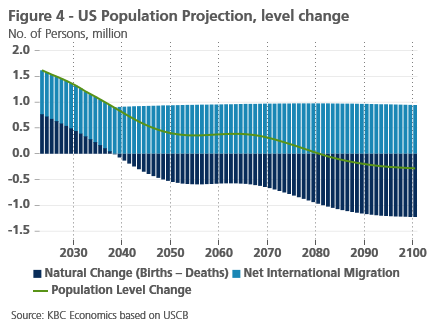

Another factor influencing prices is population growth. Though the US has a more favourable demographic outlook than many other developed nations, its population growth is still expected to slow down. The Census Bureau expects population growth to slow gradually from 0.5% in 2023 to -0.1% by the end of this century (see figure 4). The forecasts don’t incorporate the recent immigration crackdown by the Trump administration, however. According to the BLS, the foreign-born population fell by 310k persons year-on-year in August. As funding for immigration control has been drastically expanded (see also our research report of 16 September), further migration declines are in the cards.

This lower migration is a double-edged sword for the housing market. In the short run, lower migration will weigh on housing demand, thus pushing down prices. Yet, migrants are overrepresented in the construction sector. An estimated 30% of construction workers are migrants. In contrast, migrants represent 18.7% of the total US workforce. The migration crackdown might thus exacerbate labour shortages in the construction industry, thus prolonging average construction times and driving up costs. This could thus affect housing supply in the medium term.

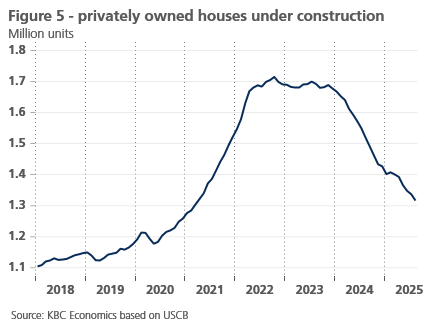

In the short term, the market is well supplied, however. Housing inventories have increased markedly. In June, the ratio of houses for sale to houses sold reached 9.8, up from 8.4 in June 2024. New housing supply is slowing down, however, as the number of houses under construction is declining (see figure 5). It remains above pre-covid levels, however.

Finally, income growth plays an important role for house prices. For now, disposable personal income growth remains healthy (4.3% year-on-year). Yet Americans expect economic conditions to worsen. According to the Michigan Survey, 57% of Americans expect unemployment to increase, while only 16% expect a decrease. Only 30% of Americans say jobs are plentiful (down from 44% in July 2023). As Americans expect labor market conditions to worsen, they might be more reluctant to make a significant long-term housing investment.

Is the market overvalued?

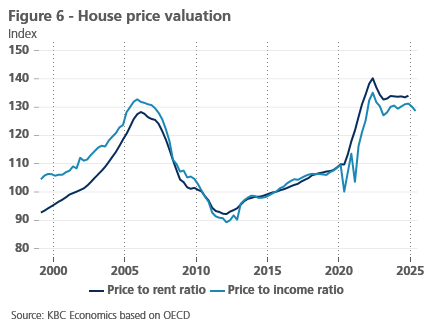

An important question for the evolution of house prices is whether the market is currently under- or overvalued. Most indicators seem to suggest some overvaluation in house prices. Despite the recent slowdown in house price growth, both price-to-rent and price-to-income ratios remain at very high levels (see figure 6). Price-to-rent ratios are even higher than in 2007, when the housing market was in a major bubble. The housing affordability index, measuring total debt servicing costs, is also at levels seen just before the Global Financial Crisis. Americans also view the market as overvalued. 80% of them say it is a bad time to buy a house, according to the Michigan Survey.

Economic implications

The situation in the housing market has important implications for the US economy as construction of buildings and real estate activities make up 15.6% of US gross value added. Residential investments have been a drag on the economy since rates started rising in 2022. In real terms, they were lower in Q2 2025 than before the pandemic (in Q1 2020) and are 14.6% lower than the Q1 2021 peak. Sentiment indicators indicate that residential investments are likely to continue to act as a drag on the economy. The NAHB homebuilder sentiment indicator dropped to 32 in August, a low not seen since December 2022.

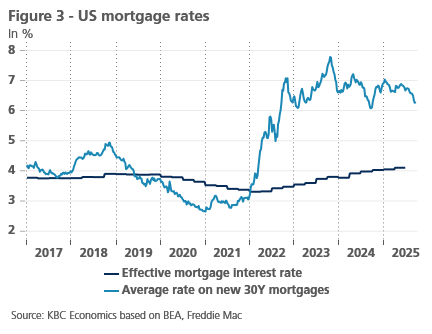

The decline in house prices is good news on the inflationary front, however. Declining house prices will have an influence on rental prices. Rental price inflation has been moderating in recent months (see figure 7). Forward-looking indicators indicate further moderation in rental inflation. The sharp drop in new tenants is especially encouraging for near-term rental inflation. As shelter prices have a 35% weight in the total CPI basket, a moderation in shelter inflation has important implications for overall inflation. For PCE inflation (the Fed’s preferred measure), where housing only has a 15% weight, the moderation in rents will have a smaller impact, though it remains significant.