Economic Perspectives for Belgium

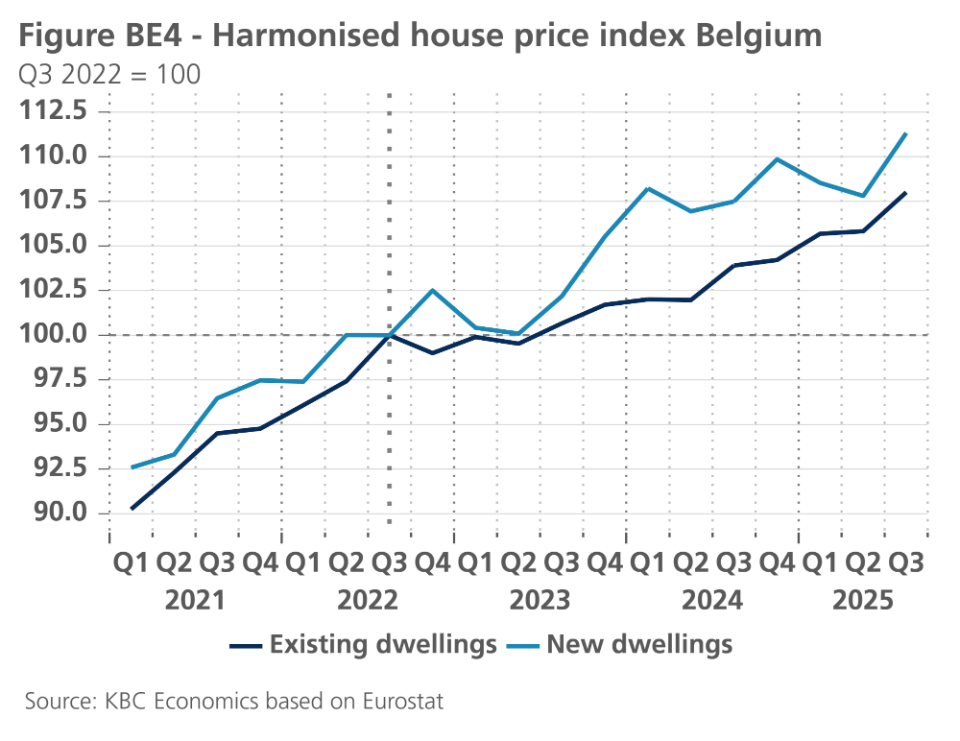

Both consumer and business confidence dropped in the final month of 2025, reversing the almost continuously rising trend over the previous months (see figure BE1). Consumers have become more pessimistic about the general situation of the Belgian economy. In January, consumer confidence rose sharply again, due mainly to a sharp decline in concerns about unemployment. Business confidence weakened in December in industry, construction and trade, but remained relatively stable in business-related services.

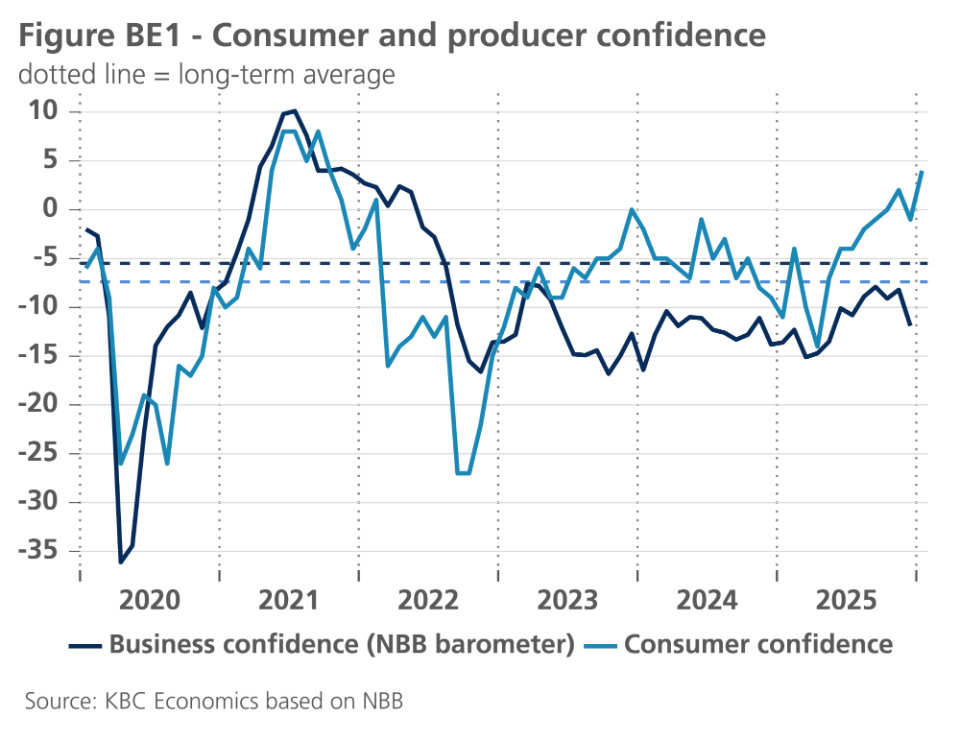

The worsening sentiment in December may partly have resulted from the agreement on the budget framework for 2026-2029, reached by the federal government late November, which included several tax measures. As sentiment in the broader euro area also deteriorated, the still challenging international climate more likely explained the confidence turn-around in Belgium end 2025. In that context, the sharp fall in export-order books in December may well be a first indication of some impact from US tariffs on Belgian exports (see figure BE2).

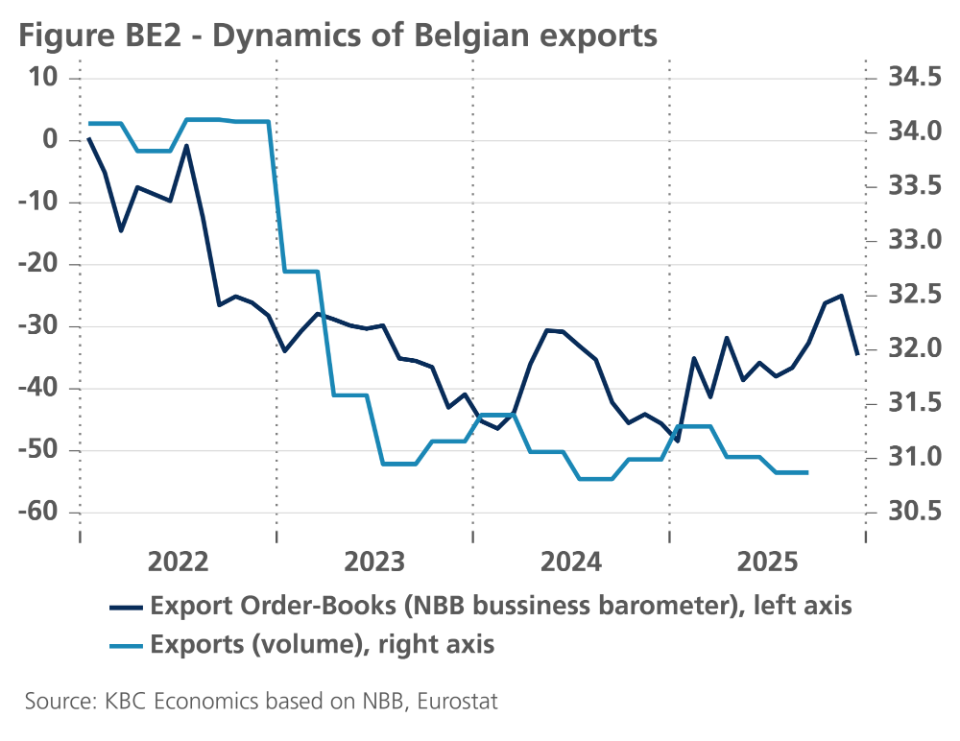

Revised employment data

Last month, we reported on the Belgian labour market having remained resilient through 2025. However, revised figures cast a somewhat different light on the situation. Employment data for the first three quarters of 2025 were recently revised by the National Accounts Institute (NAI). In particular, the Q3 2025 figure was much less rosy than previously reported, resulting in the rebound in employment dynamics no longer being visible in the updated data series (see figure BE3). Looking at sectors, Q3 employment in industry and in human health and social works activities was revised strongly downwards. Meanwhile, the harmonised unemployment rate remained stable at 6.4% in November, after having risen in previous months. We project the rate to stay somewhat above 6% in the coming years.

While headline inflation declined further in December (from 2.6% to 2.2%) on the back of lower energy inflation, the core inflation rate (excluding energy and food) edged up further (from 2.7% to 2.9%). For the full year 2025, the headline inflation rate averaged out at 3.0%, down from 4.3% in 2024. Average core inflation was at 2.4% in 2025, down from 3.4% in 2024. As part of the budget agreement reached by the federal government late November last year, several new tax measures have been decided which are expected to exert some upward pressure on inflation. As a result, we have revised our outlook for average headline inflation in 2026 upwards, from 1.6% to 1.9%. For 2027, we forecast Belgian inflation to still be at a low 2.0%, as the introduction of the emissions trading system (ETS2) was postponed from 2027 to 2028.

We decided to not change the outlook for Belgian real GDP growth. After an estimated average growth of 1.0% in 2025, we see Belgian growth at 1.1% and 1.3% in 2026 and 2027, respectively. This is a scenario in which effective GDP growth in Belgium gradually converges to its potential rate (estimated by the EC at 1.4% in 2027). The risks surrounding this scenario are quite large, though, and are tilted to the downside. These include a delayed impact of US tariffs, or even worse an escalation of the trade war, a less resilient labour market, and the new government measures exerting downward pressure on purchasing power and consumption growth.

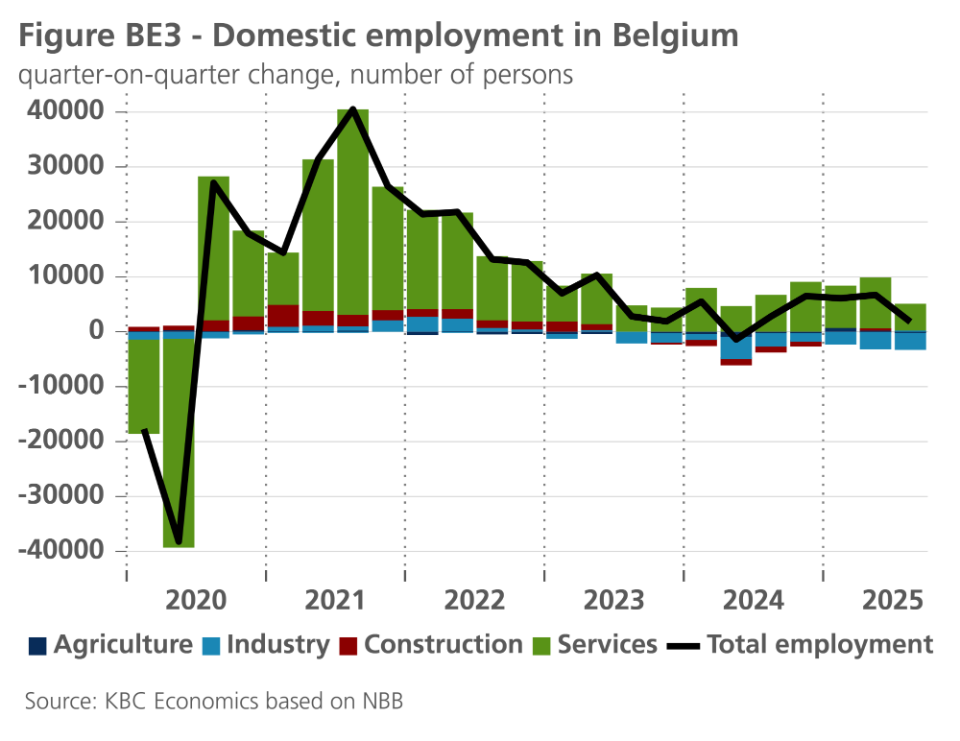

Q3 house price data

In early January, Eurostat published harmonised house price figures for the third quarter of 2025. Prices rose by 1.6% qoq in the total EU, the same rate as in Q2 (see also Economic Brief 20 January 2026 “EU housing market continued on the same strong momentum in Q3 2025”). The quarterly price rise was the strongest (more than 4%) in Latvia, Slovakia and Portugal. Five countries witnessed a price decline (Sweden, Estonia, Slovenia, Finland and Luxembourg). In Belgium, house prices rose by a strong 2.4% qoq in Q3, after having declined by a small 0.1% in Q2. Prices of new dwellings (+3.3%) rose somewhat more than prices of existing dwellings (+2.1%) (see figure BE4). While the second-quarter figure brought some tempering to the pace of previous prices rises, the Q3 data clearly point to house price dynamics strengthening again. The Q3 data led us to revise our outlook for Belgian house price growth in 2025 and 2026 to an annual average of 3.3% and 3.4%, respectively, up from 2.6% and 3.1% previously.