Emerging Markets Quarterly Digest: Q3 2022

Rough waters ahead

The current economic landscape is rife with the conditions that tend to put emerging markets in a tough spot. Inflation is on the rise, the Fed is on a policy tightening spree, global growth appears set to deteriorate in the coming months, and investor sentiment is on edge given the sharp repricing of equity and bond markets during the first half of the year. It is therefore safe to say that choppy waters are ahead for emerging markets in the coming months.

And yet, the situation among most major emerging markets is not quite so dire as the above-mentioned conditions might suggest. Despite the increasingly gloomy outlook taking hold, signs of distress in major emerging markets are currently limited (though not non-existent). This is supported by various factors, such as still limited current account deficits (though there are exceptions, and the commodity price shock will erode the cushion somewhat for commodity importers), a decline in the share of government debt held by foreign investors, early and aggressive tightening by many emerging market central banks, an expected rebound in China in H2 2022, and the fact that much of the bad news for emerging markets has already been priced in over the past year or so.

That is not to say that no emerging market will find itself in dire straits in the near future. A number of small, low-income economies are already in or seeking talks to restructure their debt, such as Sri Lanka, Zambia and Ghana, and regional or country-specific factors are weighing on the assets (and the outlook) of some larger emerging markets (such as the impact of years of unorthodox policy in Turkey or the looming threat of an energy crisis in Central and Eastern Europe). Meanwhile, the combination of higher energy prices, higher food prices and higher borrowing costs will continue to put pressure on even economies with very sound fundamentals. Indeed, most emerging market currencies are weakening versus the US dollar year-to-date and the IIF estimates negative portfolio flows to emerging markets were realized for the past four months, reflecting not only the difficult environment but also the rebalancing of capital as the Fed raises its rates. But so far, signs of broad-based, systemic crises among emerging markets have not yet materialized, and there are reasons to remain marginally optimistic.

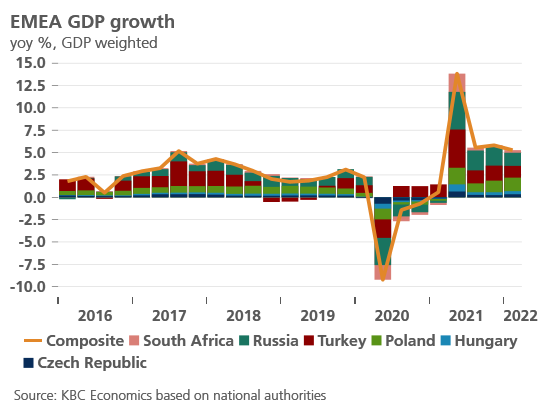

A weak growth outlook with a silver lining

Thanks to a string of weak data releases in the US and rising concerns about a potential energy crisis in Europe and its upward impact on inflation, the global growth outlook has strongly deteriorated in recent months. Weaker growth in advanced economies often has spillover effects for growth in emerging markets, particularly through the trade channel. On top of this, emerging markets are generally facing deteriorating conditions at home as commodity and food price inflation eat into consumers’ discretionary income. Furthermore, rising inflationary pressures together with accelerated Fed tightening and a strong dollar put further pressure on emerging market central banks to continue tightening their policy stance, which will weigh on growth further. As such, slowdowns can be expected in many emerging markets through the second half of the year.

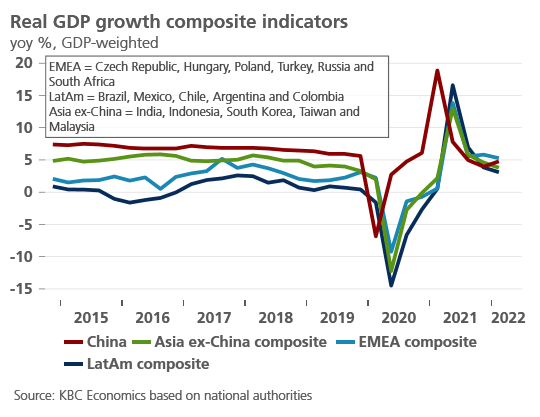

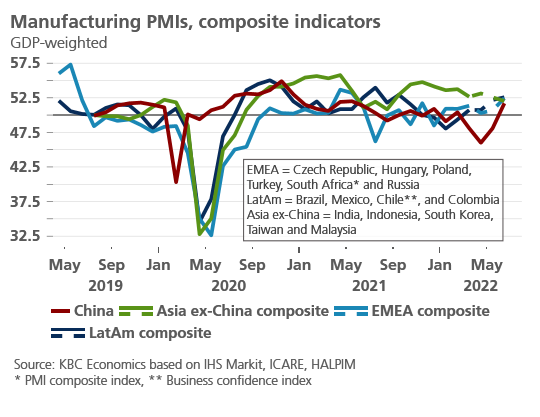

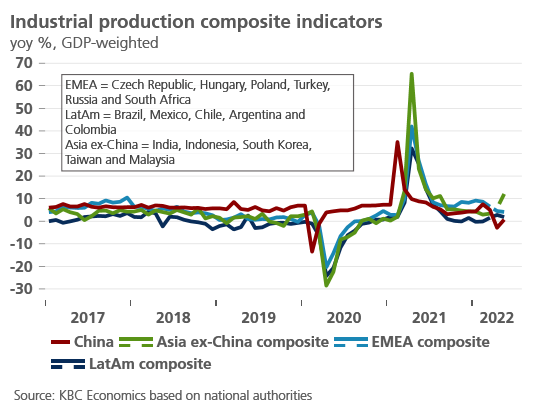

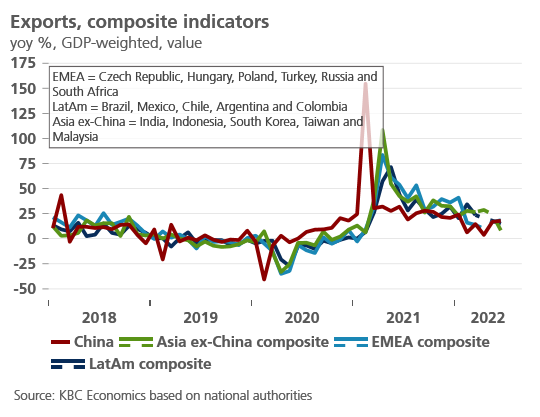

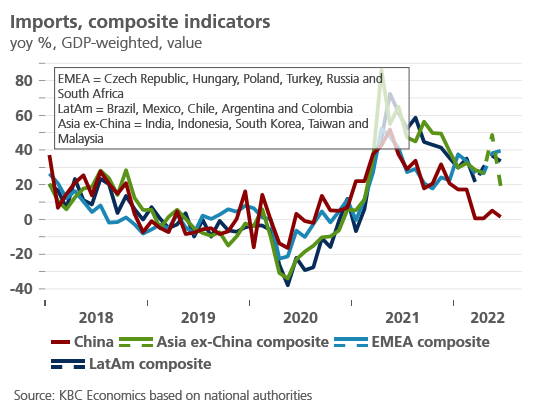

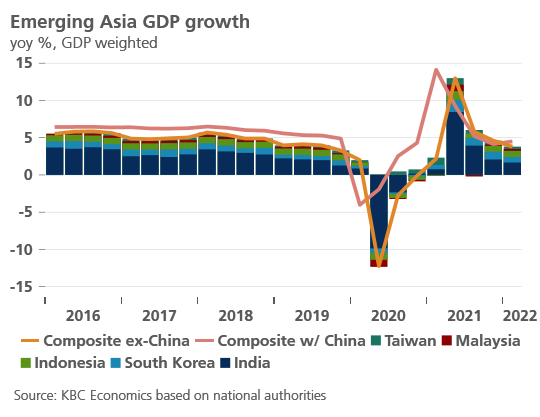

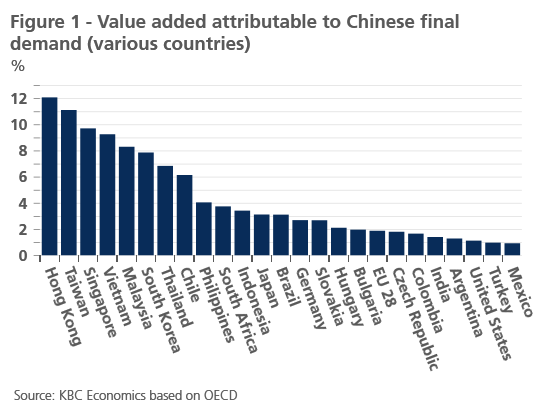

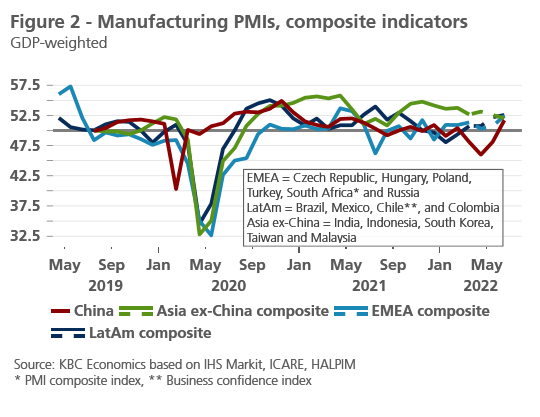

The growth outlook is not all doom and gloom, however. Most notably, China has finally emerged from a wave of lockdowns in major cities, including Beijing and Shanghai, which had caused economic activity to plummet in the first half of the year. Business sentiment surveys rebounded sharply in June and hard data such as industrial production and trade data suggest the start of a recovery was already underway in May (see below for further details). A recovery in China in the second half of the year, even if the strength of it is held back by ongoing deleveraging efforts and weakness in the real estate sector, will have positive spillover effects for other emerging markets, especially those in the region (figure 1). Notable as well is the fact many emerging markets have actually seen an improvement in business sentiment indicators through the second quarter, suggesting a degree of resilience to the deteriorating outlook (figure 2).

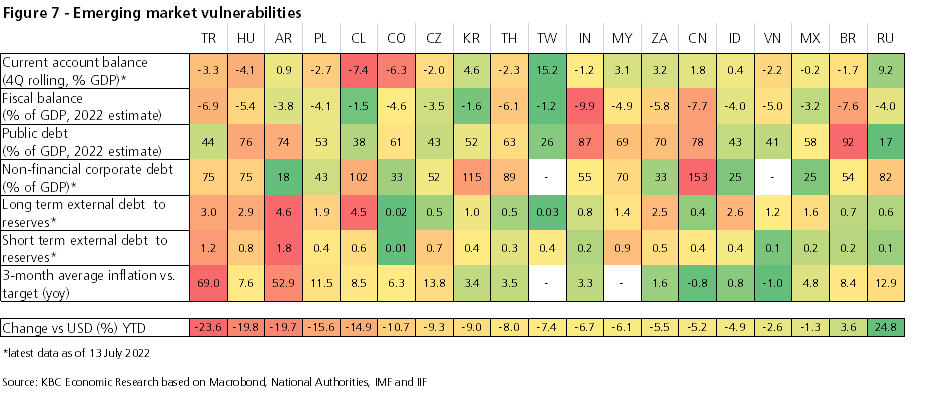

Strong dollar, weak equities

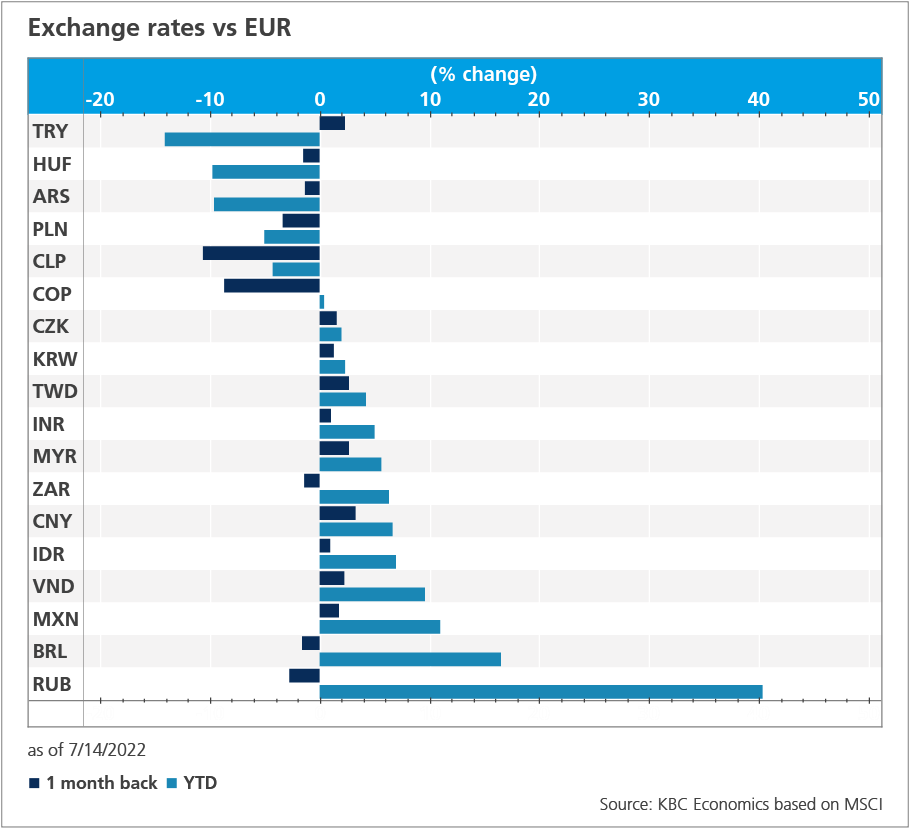

A look at financial market developments confirms that the current environment is difficult for emerging markets. Most major EM currencies are down versus the dollar year-to-date following on general depreciations versus the dollar last year as well. Aside from Turkey and Argentina, both of which face inflation above 60% year-over-year, among other well-documented challenges, CEE currencies (such as the forint, zloty and koruna) have declined the most, ranging from more than 19% against the US dollar for the Hungarian forint, to more than 15% for the Polish Zloty, to almost 10% for the Czech Koruna year-to-date through 13 July. But CEE currencies are far from alone in seeing sizable currency depreciations, with the Chilean Peso down 15%, the Colombian Peso down 11%, the Indian Rupee down 6%, and Chinese yuan down 5% over the same period. The Russian rouble is the odd one out, showing strong appreciation against the USD on the back of a.o. very unbalanced trade flows.

While there are country-specific factors at play (political disputes between Hungary and the EU, current account deficits in Chile and Colombia, and several months of severe lockdowns in China to name a few) the general strength of the dollar vs emerging market currencies also reflects the Federal Reserve’s turn toward a more aggressive tightening of monetary policy over the past several months. Global interest rates have risen sharply as a result, ending the era of ultra-loose financial conditions that helped direct investment towards riskier, relatively higher yielding assets in emerging markets. Some further rebalancing away from emerging markets can therefore be expected, and while it complicates policymaking and can heighten vulnerabilities (such as for economies with wide current account deficits and high levels of dollar-denominated debt – more on the latter below), it is not necessarily a sign of a developing crisis.

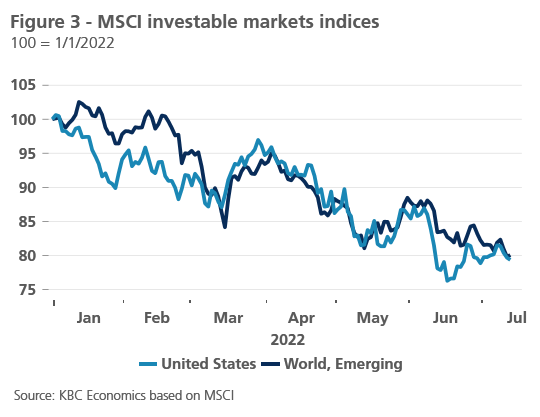

The above pattern – i.e. a rebalancing and repricing of risky assets in the face of tighter financial conditions – continues when we look at overall capital flows to emerging markets. As the IIF notes, equity flows to emerging markets1 have been negative for several months and were particularly weak in June excluding China. However, since the start of the year, the decline in EM equity markets has generally tracked that of the United States (Figure 3).

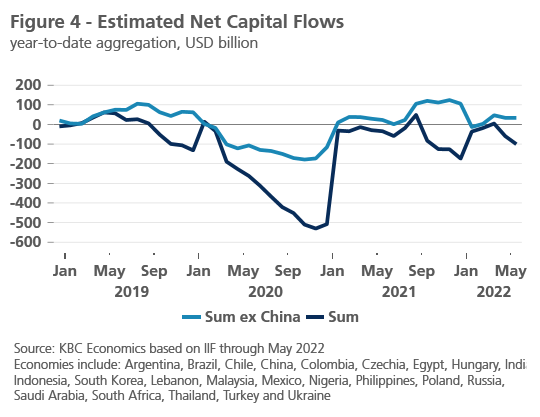

And while there have been significant net capital outflows from emerging markets this year (which includes not only debt and equity portfolio flows but also direct investment and changes in reserves), much of this was due to outflows from China, which experienced a sharp downturn in the first half of the year due to its strict covid policies. Ex-China, according to IIF estimates through May, net capital flows to emerging markets have remained largely balanced through the start of the year and are even slightly positive year-to-date (figure 4). This suggests that while investors are re-assessing risk in a post-ultra-accommodative-policy-environment and reducing their exposure to EM equity (as well as to advanced economy equity), capital flows are not yet signaling severe market disruptions for emerging markets.

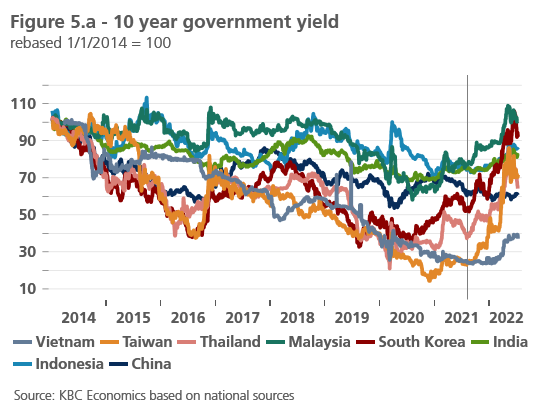

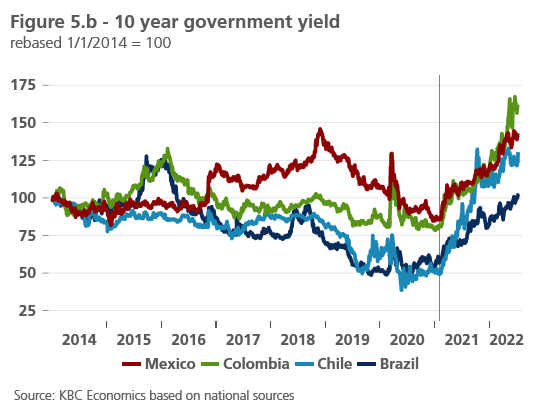

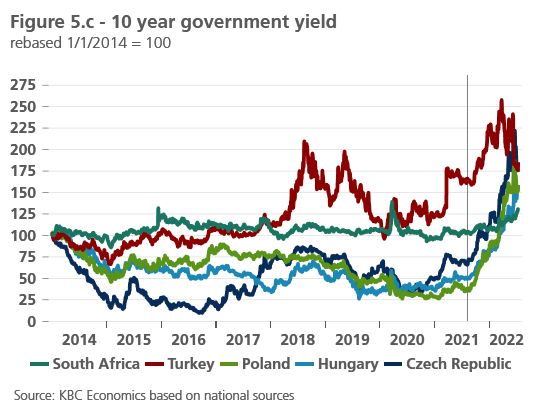

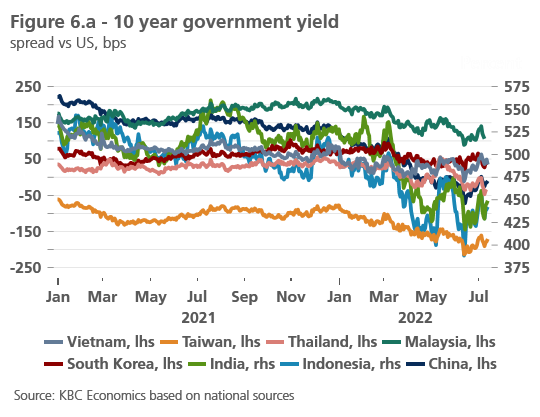

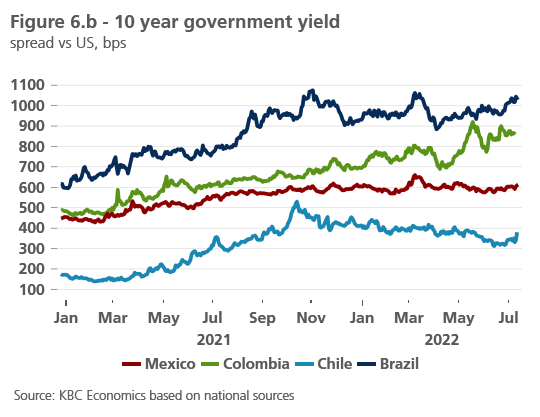

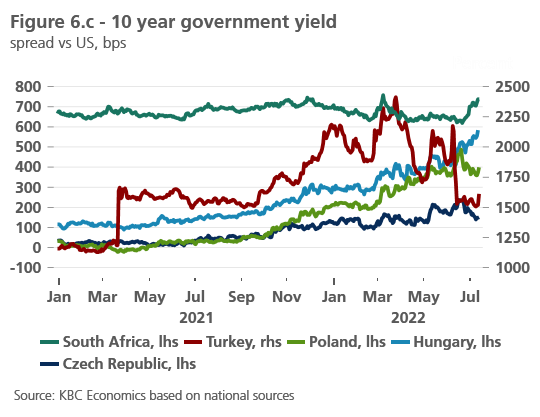

Higher debt, but a different kind of risk

A similar story can be seen in interest rate developments in bond markets. Yields on 10-year benchmark government debt have risen nearly across the board, led by the sharp rise in US interest rates from around 1.5% at the start of the year to around 3% as of July (figures 5.a-5.c). But even before that, emerging market interest rates were on the rise, starting an upward trend as early as Q1 2021 in many Latin American economies as emerging market central banks commenced with tightening cycles well ahead of advanced economy central banks. While the upward trend in interest rates is clear and will put pressure on the borrowing capacity of governments, spreads between US 10-year yields and those of emerging markets tell a slightly more nuanced story (figures 6.a-6.c). In certain central and eastern European economies (like Poland and Hungary), spreads have widened throughout the year, which is consistent with the more sizable moves registered in foreign exchange markets as well. In Latin America, spreads clearly widened through 2021, but have since stabilized in most major economies besides Colombia. And in much of Asia, spreads were actually trending down throughout most of the year (with a slight widening registered in late June). All this suggests that while the environment is indeed complicated for emerging markets, signs of acute systemic debt concerns are so far limited.

One reason for this could be a change in the vulnerabilities associated with emerging market debt over the past few years. Emerging market debt has increased since the pandemic, reaching 228% of GDP as of end-2021 according to the BIS. That’s more than double where the ratio stood at the end of 2008 and significantly higher than at the onset of the pandemic (203% of GDP). At the same time, however, the ownership structure of debt has changed of late. Whereas the share of government debt held by foreign investors increased after the Global Financial Crisis, that share has been declining sharply since late-2019 according to the IMF.2 At the same time, government debt held by domestic banks has increased. While this raises its own risks (as debt sustainability concerns can spillover into domestic financial stability concerns – through sovereign-bank feedback loops – and lead to lower growth), it also means emerging economy debt markets are less exposed to changing global investor sentiment, the risk of strong capital outflows, or sharp currency depreciations. For corporate debt markets as well, the relative share of foreign currency denominated debt in emerging markets declined between 2008 and 2018.3 On top of this, foreign currency reserves have generally been stable or increasing since the start of 2020, and reserve coverage relative to short-term debt remains adequate (under 1) for most major emerging markets (figure 7).

Hence, a bit of nuance is required when considering the outlook for emerging markets in the coming months. Given the external environment, it will by no means be an easy ride. Economic activity will come under pressure from still strong inflation and weaker demand in advanced economies, while rising interest rates will put pressure on government budgets. As such, financial markets may remain volatile for some time, and it is unlikely that a strong rebound in emerging market assets is on the immediate horizon. Furthermore, lower-income economies are likely to suffer the most from the deteriorating external environment, and we are already seeing evidence of this as some smaller, vulnerable economies have started to seek debt restructuring plans. At the same time though, it is important to note that signs aren’t currently pointing toward a more systemic crisis developing across major emerging markets.

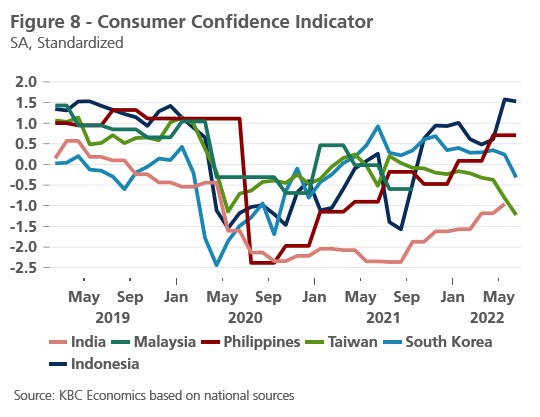

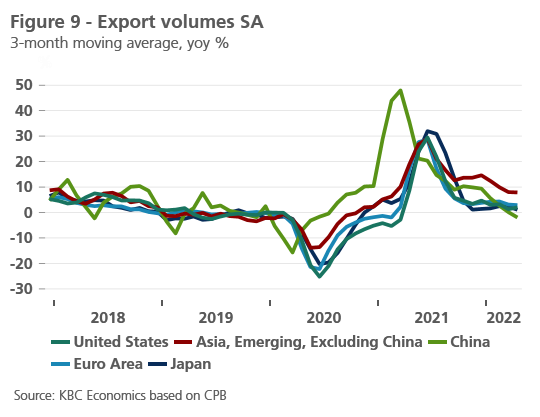

Emerging Asia

Like much of the rest of the world, Asia faces a complicated landscape of rising inflation, rising recession risks abroad and volatile financial markets. There are a few bright spots among an otherwise gloomy outlook, however. For example, while business sentiment surveys for the manufacturing sectors have been trending down in recent months, for many economies in the region they remain above 50, signaling a continued expansion. Meanwhile, consumer confidence has deteriorated in some economies (e.g., Taiwan, South Korea), but is on the rise in others (figure 8). Finally, while the external environment continues to deteriorate, and trade volumes continue to normalize from the extremely elevated levels of 2021, export volumes from emerging Asia (excluding China) are holding up better than in many other regions (figure 9). Coupled with a rebound in China expected in the second half of the year, this suggests that growth in EM Asia may prove to be rather resilient in the coming months.

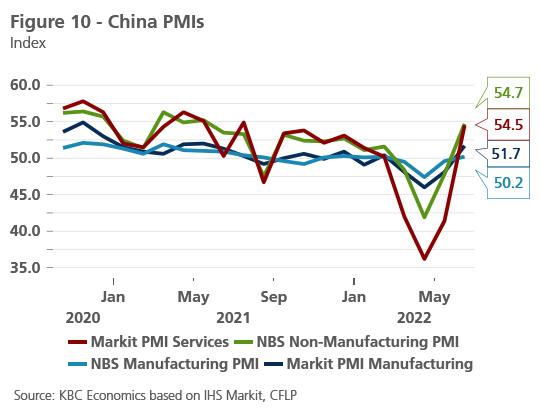

China

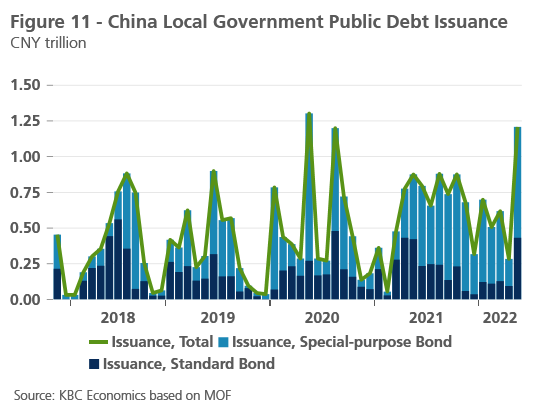

The tide finally appears to be turning in China with promising signals of a recovery coming through in new data releases. Notably, business sentiment survey indicators for both the manufacturing and services sectors rebounded significantly in June after collapsing in March and April (figure 10 on next page). This could suggest some room for a relative surprise to the upside in the Q2 GDP figures, which likely registered a sharp contraction in quarter-over-quarter terms. The extent of that contraction (to be released on 15 July) will provide information on how far the authorities are from reaching their official growth target for 2022 (5.5%) and could provide some hint as to the extent of the rebound that can be expected in the current and coming quarter. Even with a strong rebound, we do not expect the annual average growth figure to reach the target, with growth of only 3.7% in 2022 before a rebound in 2023 to 5.3%. However, it is important to note that the Chinese authorities have not abandoned the zero-covid policy that led to the strict lockdowns in the first part of the year. Given the ongoing spread of highly transmissible new Omicron variants, the risk of renewed lockdowns continues to hang over the expected recovery.

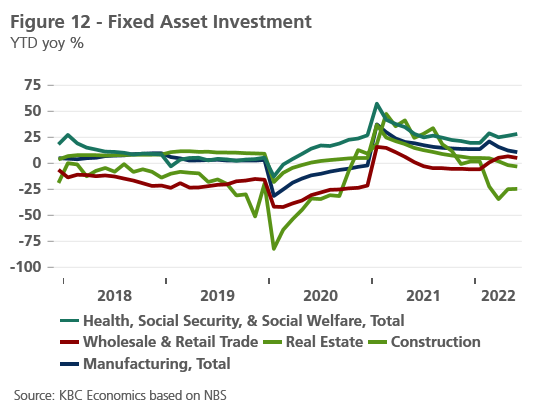

Government support for the recovery appears to be coming mainly on the fiscal side in the form of increased local government bond issuance (figure 11). There are also unconfirmed reports that local governments will be permitted to pull forward issuance quotas for next year already to the end of this year. This should help boost infrastructure spending, which has been weighed down by weakness in the real estate and construction sectors (figure 12).

Signs of further support from the monetary policy side appear so far limited. Total liquidity outstanding via the PBoC’s various lending facilities has remained relatively stable for the past several months, and though the PBoC lowered the reference rate for five-year mortgages (5-year LPR) in May by 15 basis points to 4.45%, the other reference rates (one-year LPR and MLF rate) have remained unchanged since January. This signals the PBoC is hoping to orchestrate targeted (and limited) easing in a way that will support demand in the housing market while still allowing for a deleveraging of the economy. Such deleveraging efforts can be seen in a notable decline in the GDP-to-debt ratio of China’s non-financial corporations from 163% in Q3 2020 to 153% as of Q4 2021. Indeed, Total Social Financing growth (a proxy for total credit growth) has been roughly flat throughout 2022, despite the clear signs that the official growth target will be far from achieved this year.

The economy’s emergence from the strict lockdowns of the first half of the year have also led to a stabilisation of the yuan against the US dollar after a sharp depreciation between mid-April to mid-May. The yuan is about 5% weaker versus the dollar year-to-date (through mid-July) but has been hovering around 6.7 CNY/USD since early-June. While the move clearly coincided with increased risks to China’s economic outlook stemming from the lockdowns, dollar strength and increased interest rate differentials are also major factor in the depreciation year-to-date and one of the main reasons we haven’t seen a rebound in the currency despite the reopening. Whereas the Fed is moving at an unprecedented pace to quickly tighten policy (with a 75-basis point rate hike in June likely to be followed by similar-sized moves in the coming meetings), the PBoC has marginally eased policy rates this year and unlikely to tighten any time soon given headwinds to economic growth and the fact that both headline and core inflation remain relatively subdued. We therefore anticipate relative stability in the CNY/USD exchange rate throughout the rest of this year despite the expected recovery in China.

India

Limited data is available yet for the second quarter of 2022, but business sentiment surveys point to continued growth resilience. The services PMI has climbed to 58.7 in June while the manufacturing PMI has remained somewhat stable at a still very strong 54.4. Meanwhile, the Reserve Bank of India’s consumer confidence index has continued to improve since September of last year to new highs since the onset of pandemic. Inflation does remain elevated at 7.0% year-over-year in May but is down slightly from the previous peak reached in April (7.8%). However, given the 6% depreciation of the Indian rupee versus the dollar year-to-date (which brings the rupee to an all-time low), pressure has mounted for the RBI to pull forward its hiking cycle. Though the RBI was one of the later emerging market central banks to commence on a hiking cycle (starting in May 2022), the RBI has already increased the repo rate by 90 basis points to 4.9% over two rate hikes. Given the external environment and the growth headwinds posed by the central bank’s ongoing tightening, we expect growth to slow to 6.5% in FY 2022 from the 8.7% registered in FY 21.

Meanwhile, an extreme and long-lasting heatwave in India together with a below normal monsoon rainfall has threatened India’s wheat crop production. Together with rising food inflation (both globally and in India), this prompted the government to introduce an export ban on wheat in May, dashing hopes that India could fill some of the global supply deficit caused by Russia’s invasion of Ukraine. While the ban remains in place, there reportedly may be some exceptions for nearby countries.

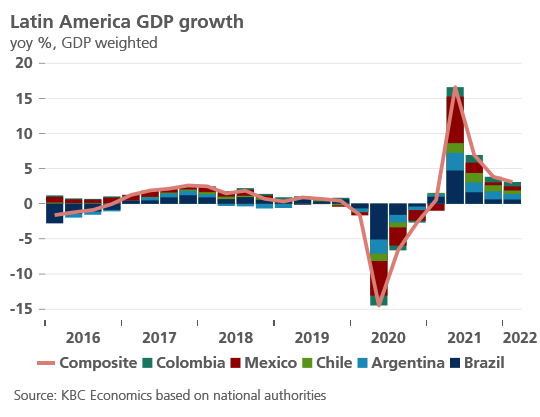

Latin America

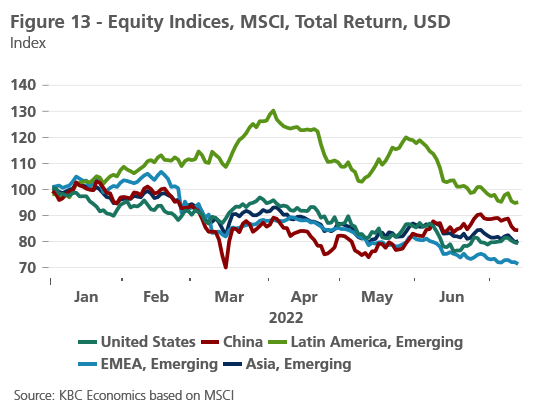

In the previous publication of the emerging markets quarterly digest, Latin American economies were still benefiting from an increase in commodity prices across the board (i.e., in addition to the increase in energy prices). At the time, countries in the region were also more shielded from developments related to the war in Ukraine and the covid lockdowns in China. Now, however, the outlook has dimmed somewhat for the region but is not all negative. Metal commodity prices have come down significantly (though they are still moderately above pre-pandemic levels) on growing recession concerns, and inflation has continued to climb to new highs (reaching 8% yoy in Mexico, 9.7% yoy in Colombia, 11.9% in Brazil and 12.5% yoy in Chile). Despite this, business sentiment indicators have held up well (in expansion territory) and have even increased lately in Colombia, Brazil and Mexico. Meanwhile, the risk-off sentiment seen globally has caught up with the region, with equity markets declining and the Chilean peso, Colombian peso and Brazilian real leading the way in major EM currency depreciations versus the dollar over the past month (CLP: -15%, COP: -13%, BRL -8%). As mentioned above, Chile and Colombia are two of the major emerging markets with the deepest current account deficits, while Brazil continues to deal with budgetary concerns and some political risk (general elections are scheduled for October 2022). Still, year-to-date, LatAm assets have held up compared to some other regions, a trend that is particularly visible in equity markets (figure 13).

Still, risks are mounting for the region, particularly on the inflation and growth front. For example, the region’s significant trade links with the US mean that growing recession risks there will likely have negative spillover effects. In Brazil, industrial production declined unexpectedly by 0.3% year-over-year in May after trending up for several months, and confidence indicators for the services and construction sectors remain weak (below 100). We therefore expect growth to slow to 1.4% this year from 4.6% last year, and to remain relatively weak at 0.84% in 2023 (partially reflecting low overhang effects).

1. Emerging markets tracked by the IIF include Argentina, Brazil, Chile, China, Colombia, Czechia, Egypt, Hungary, India, Indonesia, South Korea, Lebanon, Malaysia, Mexico, Nigeria, Philippines, Poland, Russia, Saudi Arabia, South Africa, Thailand, Turkey and Ukraine.

2. IMF Sovereign Debt Investor Base for Emerging Markets

3, Abraham et. Al, Growth of Global Corporate Debt, Main Facts and Policy Challenges, World Bank Group, September 2020

Tables and Figures