The corona crisis will expose unique US labour market weaknesses

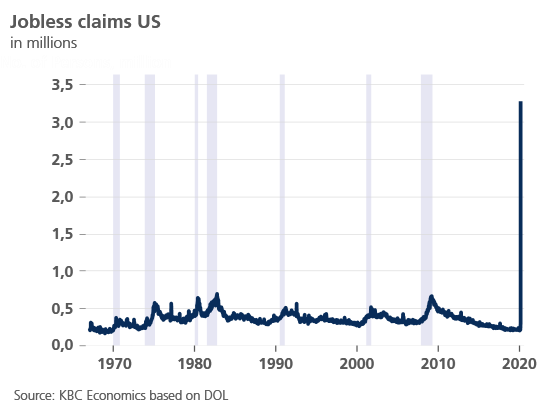

In recent years, the performance of the US labour market has consistently and substantially exceeded expectations while showing scope for even further improvement. The unemployment rate has continued to drop past expectations and has hovered at or around 3.5% since October. However, due to the corona crisis, and given stay-at-home orders in many states as well as closures for both public spaces, such as schools, as well private spaces, like several retail stores nationwide, the US faces a sharp decline in consumption and a corresponding jump in layoffs. The most recent weekly initial jobless claims figures have already seen a staggering increase of more than 3 million, which is nearly five times higher than the previous peak seen in 1982. It is likely that claims will continue to reach record levels in the weeks to come. As such, the quick and painful impact that COVID-19 will have on American businesses and workers will likely expose some of the underlying structural weaknesses in the US labour market. If these weaknesses are not addressed quickly and with the goal of sustainable and permanent change, they will amplify any economic or financial losses seen in both the current corona crisis and any future crises.

Coronavirus is sweeping through the labour market

Large swathes of the US economy will be hit hard and fast by coronavirus closures. While sectors like manufacturing will be hit directly by supply chain issues, jobs in social consumption sectors, such as restaurants, bars, and hotels, will be strongly affected by local, state or federal mandates for closure as well as a large reduction in demand because of social distancing or self-isolating. The best-case scenario is that these sectors see severe but short-term job losses. The recent stimulus package deal passed by the Senate, which significantly expands the current unemployment insurance scheme and gives an additional temporary payment to address the corona crisis directly, will alleviate some of this pain. However, it still needs to pass the House before it can be signed into law by President Trump. The worst-case scenario is that many small and medium size businesses close their doors for good. Additionally, given the fact that many workers in these jobs are paid low base wages and, in most instances, rely heavily on tips to supplement their income, they will continue to work even if they are sick. This might hasten the spread of COVID-19 and worsen short term health and long-term economic outcomes.

Up until recently, there was no national paid sick leave available in the US, which would have discouraged many workers from taking time off if they were ill. However, the US Congress passed a coronavirus emergency relief package on Wednesday, March 18th, which gives workers two weeks of paid sick leave if they are sick due to coronavirus or had to take care of a family member sick with coronavirus. It also gives 12 weeks paid leave to those who must take care of their children whose schools are closed because of coronavirus. However, the glaring weakness of this policy is that it excludes companies with 500 people or more. This means nearly 50% of all American workers will not be able to benefit from this new federal sick leave policy.

The nature of this current crisis also highlights a unique problem for the United States: many Americans get their health insurance through their employer. While there is a federal government program in place that allows workers to have continued coverage after losing their jobs (the Consolidated Omnibus Budget Reconciliation Act, or COBRA), it requires worker-paid premiums. It is likely that many Americans will not have the ability to continue to pay these premiums. As such, the double loss of employment and health insurance may again lead to many Americans avoiding testing and treatment.

Need for broad overhaul of labour market and health care system

While the fiscal and monetary packages announced to date will support economic activity and assist workers and businesses, the coronavirus-related fallout is unlikely to be wholly offset by spending and lending alone. One of the keys to flattening the transmission rate curve for the coronavirus and other infectious diseases is self-isolating when ill. The lack of national paid sick leave for all workers and the dependence on employer-provided health insurance for many Americans means that there are strong financial incentives for many to either continue to work even if they are presenting with coronavirus symptoms, or to avoid testing and treatment given their loss of income and health insurance. The legislation on paid sick leave was a good first step in the right direction, but in order to future-proof American workers, the US needs to make it universal and permanent. Additionally, some movement towards either a public health care option or universal health care would make the US more resilient to future crises such as the one we are experiencing now.