Economic Perspectives August 2018

Content table:

- Highlights

- US surprising on the upside

- …while no euro area acceleration

- Central Europe doing well

- EU politics never off the radar

- US-China trade war: the story continues

- Declining trend in FDI flows

- Red flags in Turkey

Read the publication below or click here to open the PDF

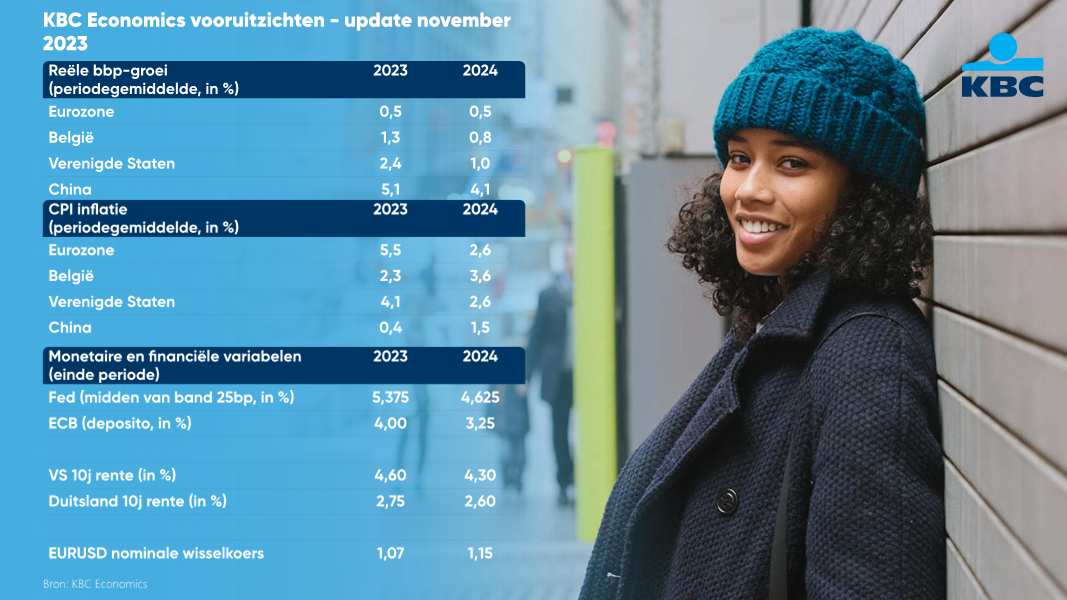

- While the US economy posted surprisingly strong Q2 growth results, the pace of euro area growth merely matched that seen in Q1. Corporate sentiment indicators are softening globally, likely reflecting the negative impact of the trade war, increasing global risk aversion (e.g., with respect to emerging markets) and general geo-political uncertainties. Given the likely further escalation of the US-China trade conflict in the coming months, the risk of negative spillovers to growth prospects in other economies is significant.

- Central European economies have continued to perform well, reflected in robust growth figures for early 2018. Strong dynamics have led to low and still declining unemployment rates and labour shortages, in particular in the Czech Republic and Slovakia. These are putting upward pressures on inflation, which have contributed to the Czech National Bank’s decision to raise its policy rates earlier than expected. We expect one more rate hike by the CNB for this year and two more in 2019.

- Inflationary pressures are rising globally with increasing energy and food price contributions as the main determinants. However, underlying core inflation dynamics still differ. In the US, there is a clear upward trend in underlying inflation supported by increasing wages and solid services inflation. For the euro area, core inflation has yet to show a sustained upward trend. This suggests the ECB will stay cautious for the time being. Reflecting ECB guidance, a first rate hike is expected at the earliest after the summer of 2019.

- The combination of a dovish central bank, disappointing economic data, sticky core inflation, flight to quality capital flows, a scarcity of German benchmark bonds and the persistence of excess liquidity in the euro area will delay and restrain the pace of normalisation of the term premium on euro area bond markets. As a result, we lowered our forecasted path for the German 10y government bond yield, in particular on the shorter-term forecast horizon. We now see it at 0.70% at the end of 2018 and 1.50% at the end of next year.

- Recent Italian political jitters may have provided just a sense of the more fundamental test of the governing coalition that is to come this autumn in relation to budget plans for 2019. If the Italian government parties want to follow through on their campaign promises, the budget plan will be both expansive and expensive. There is a high risk of conflict within the government, and above all with the EU. This could be a cause of ongoing concern for financial markets in coming months and will likely lead to additional volatility. For this reason, we increased our forecasts for the Italian spread against the German 10y government bond yield, most markedly until H1 2019.

Global Economy

The US economy is still doing very well, as shown by preliminary data for Q2 real GDP growth. After a somewhat weaker Q1 growth figure, Q2 GDP growth reached 1.0% qoq (4.1% annualised) (figure 1). The sharp acceleration was driven by the large growth contribution from private consumption. Tax incentives, high consumer confidence and favourable labour market conditions remain strongly supportive of higher US consumer spending. Moreover, federal spending also contributed to strong domestic demand as spending on defence increased markedly. Growth contribution of net trade was exceptionally high, mainly due to unusually high exports of soybeans to China in Q2. There was some frontloading in order to avoid the Chinese tariffs on US imports that were implemented at the beginning of July. Hence, a relapse in net exports is to be expected in Q3.

Recent high-frequency data for Q3 suggest a continuation of decent growth. Labour market performance remains strong and sentiment indicators, although down from their recent highs, are still elevated. Therefore, it seems that negative effects from the trade war are being outweighed by a range of positive factors that are supporting the US economy for now. Based on this, we have revised our 2018 growth forecast marginally from 2.8% to 2.9%. At the same time, we see the risk of overheating and a boom-bust scenario increasing. In this favourable real economic context, we can envisage inflationary pressures rising. Although to a lesser extent than in the euro area at present, the persistently high oil price is pushing up headline inflation. Moreover, labour market tightness continues to increase, causing an upward trend in some wage growth indicators. As a consequence, also our 2018 inflation forecast was upwardly adjusted from 2.4% to 2.5%. Current activity and inflation trends will support the Federal Reserve to continue with their gradual monetary policy path as planned, i.e. two more rate hikes this year and two hikes in 2019.

Figure 1 - Synchronicity in the global economic cycle is declining (real GDP, % change quarter-on-quarter)

Source: KBC Economic Research based on Eurostat, BEA, ONS, Japan

Cabinet Office (2018)

In contrast to the US economy, GDP growth in the euro area remained somewhat lacklustre in Q2 after the slowdown in Q1 from the rapid pace of growth seen through 2017. Real GDP growth in Q2 continued at a 0.4% qoq pace as seen in Q1 (figure 1). Sentiment and activity indicators had already suggested that the recovery in Q2 would be limited. Domestic demand will likely be the main growth contributor. Looking at specific EMU countries, French growth (+0.2% qoq) was weaker than expected as private consumption fell short of forecasts. However, German growth was better than expected with real GDP expanding by 0.5% qoq in Q2, driven largely by private consumption and government spending. In both countries, exports grew, but were outpaced by even stronger import growth, reflecting robust domestic demand.

Nevertheless, some indicators suggest that the first signs of adverse impacts from the trade war are becoming visible. The drop in German industrial production in June (-0.9% mom) and unexpectedly weak German factory orders from outside the euro area could signal that concerns about a trade war are beginning to weigh on activity. Given the euro area’s high trade openness compared to the US, this leaves the euro area more vulnerable to developments on the international trade front. Weak Q2 growth figures and emerging downside risks suggest that our growth forecasts could prove optimistic. Hence, growth forecasts for the euro are as a whole as well as for individual countries may be revised down if warranted by upcoming data and developments. However, for now we leave them unchanged.

Meanwhile, headline inflation is picking up in the euro area. This is mainly driven by oil price movements. Core inflation, excluding prices of energy, food, tobacco and alcohol, remains subdued in the region of 1%. Nevertheless, wage growth measures in several euro area economies have been rising recently, suggesting more inflation support from that corner in the coming months. In any case, as oil prices continued to drive up headline inflation, we increased our 2018 inflation forecast from 1.5% to 1.7%. Therefore, we expect inflation to approach but not reach the ECB’s medium-term target of below but close to 2%. This persistent shortfall from its inflation target explains the rather dovish stance of the ECB and its very gradual monetary policy normalisation plans with a first rate hike at the earliest after the summer of 2019. The combination of a dovish central bank, disappointing economic data, sticky core inflation, flight to quality capital flows, scarcity of German benchmark bonds and a continued presence of excess liquidity in the euro area will delay and slow down the normalisation of the term premium on euro area bond markets. Therefore, we lowered our forecasted path for the German 10y government bond yield, in particular on the short-term forecast horizon. We now see it at 0.70% at the end of 2018 and 1.50% at the end of next year.

Although the euro area economy disappointed somewhat in the first half of this year, Central European economies have continued to perform well. Corporate confidence in the region, as measured by the PMIs, has come down from their peaks at the beginning of this year, but they remain comfortably above the neutral 50 level signalling ongoing growth as well as coming in above their long-run averages. This suggests these countries are still on track for very solid growth figures for 2018 as a whole.

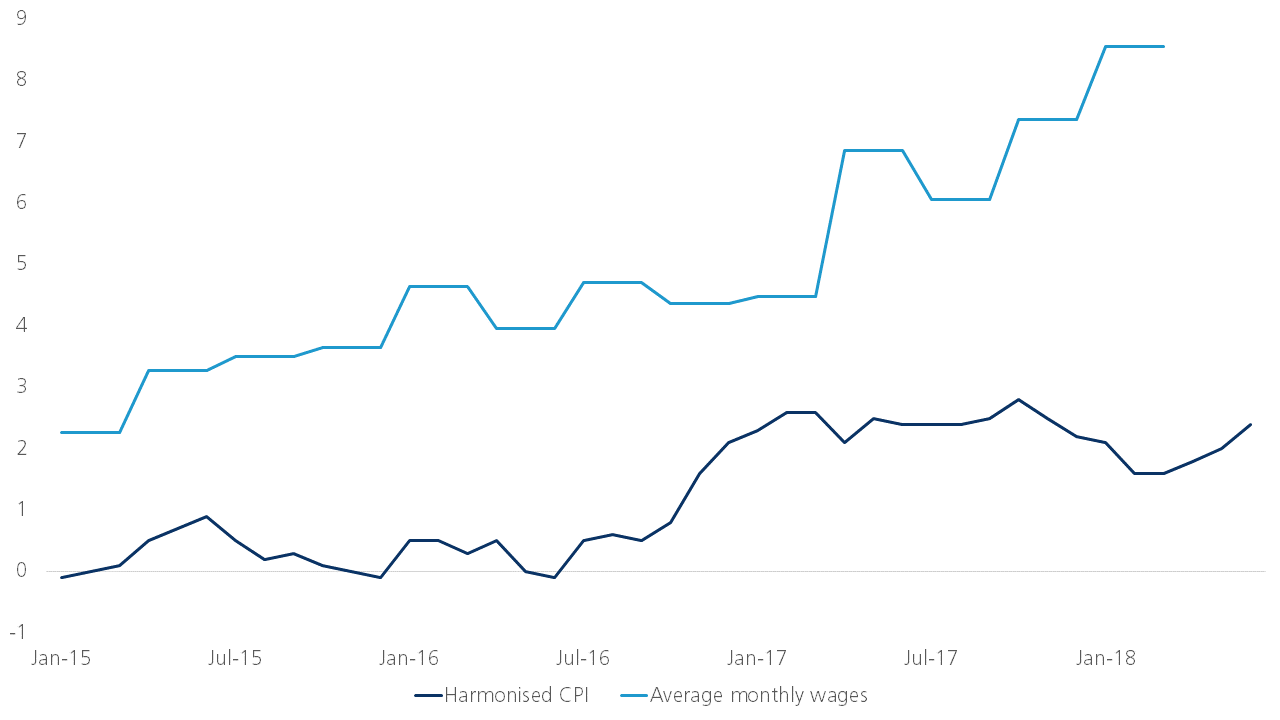

Czech economic growth will probably be somewhat lower this year than the very high growth rate recorded in 2017. However, the overall trend in the Czech economy remains buoyant. Based on increasing labour market tightness that is raising wage growth and inflationary pressures, together with some overheating in the real estate market, the Czech National Bank (CNB) decided to tighten its monetary policy in August (figure 2). The CNB increased its base rate to 1.25%, the Lombard rate to 2.25% and the discount rate to 0.25%. The decision adopted by the Bank Board was underpinned by a new central bank macroeconomic forecast that envisages a slower appreciation of the CZK and higher inflation. Perhaps surprisingly, in view of a faster rate increase this year, the CNB remains conservative in the longer term - especially for 2019 with no more rate hikes in their projections. Our updated forecast contains one more 25 bps hike by the end of 2018, in line with the fresh CNB’s prediction. As for 2019, though, we do not believe the CNB Board that there will be no further hikes. Our base scenario includes two more hikes, with the risk of even three hikes (25 bps each), if the CZK exchange rate lags behind the CNB forecast. The initial market reaction saw a depreciation of the CZK as investors were probably somewhat disappointed by the dovish CNB message for 2019. However, the CZK appreciated again afterwards towards stronger levels than seen last month.

The Hungarian economy now appears on track for a 4% annual GDP growth rate this year, in line with last year’s figure. We expect the fiscal stimulus to be very large as the drawdown of EU funds will likely be concentrated this year. However, this also implies that the EU funds available in 2019 and particularly in 2020 will be far less extensive. Hence, due to this, we see growth slowing down in the coming years to 2.5% in 2020. Despite the current strong performance of the Hungarian economy, the Hungarian central bank (MNB) remains very cautious. The MNB left its interest rates unchanged at its July meeting. As expected, the MNB reiterated its dovish stance - ignoring the recent Forint’s losses - by maintaining loose monetary policy necessary to achieve the inflation target of 3% yoy in “a sustainable manner”. This points towards a very gradual normalisation of monetary policy, which is likely to follow the course of the ECB’s policy path. Hence, we see no change in policy rate for the next 12 months.

Figure 2 - Policy tightening by Czech National Bank driven by sharply increasing wages and building inflationary pressures (% change year-on-year)

Source: KBC Economic Research based on Eurostat, Czech Statistical Office (2018)

It was to be expected that the potentially unstable Italian coalition government between the populist Five Star Movement and the right-wing Lega would cause some financial market unrest from time to time. The recent disagreement about a railway project was the first of probably many clashes between the two government parties. It likely also was the forerunner of more fundamental coalition tests to come this Autumn related to budget planning for 2019. Despite repeated promises by the government that it will comply with the EU’s fiscal rules, many wonder whether this is possible. Both government parties continue to emphasise that they want to implement their election programmes. For example, the Lega promised a flat tax and the Five Star Movement promised a basic income. In addition, they also want to (partially) reverse the pension reform and abandon the planned VAT increase. These budget plans will be both expansive and expensive. Until now, the government has remained vague about the financing. Nevertheless, in Autumn they will have to come up with concrete figures about the implications of such initiatives for the Italian budget deficit. There is a high risk of conflict within the government and, above all, with the EU. This will be a persistent cause of concern for financial markets in the coming months and will likely lead to additional volatility. As such, we increased our forecasts for the Italian spread against the German 10y government bond yield over the entire forecasting horizon, but most markedly until H1 2019. We now expect it to at least remain around its new higher level of 250 bps over the coming six months, incorporating an extra risk premium and high volatility.

Meanwhile, in the more western regions of Europe, the Brexit negotiation ‘process’ - or should we say ‘chaos’- continues to unsettle financial markets. The UK International Trade Secretary, Liam Fox, recently suggested that it was slightly more likely than not that Britain could exit the EU without agreeing a deal on its future relationship with the bloc. Moreover, the Bank of England’s (BoE) governor, Mark Carney, warned for an “uncomfortably high” risk of the UK leaving the EU without a deal. These remarks and other recent developments in the UK suggest that framing a deal that will command widespread political support within the UK could prove problematic. In turn, this suggests a hard Brexit is not unlikely. In light of this, we only expect a very slow monetary policy normalisation by the BoE through the remainder of the forecast period. In case of a hard Brexit, a sudden stop in policy normalisation might even occur. Our base scenario still envisages some kind of soft Brexit with an outcome that is acceptable for both the UK and the EU, without fully derailing economic momentum. However, the risk of a harder Brexit has increased substantially due to the political turmoil in the UK. This also increases the risk of negative spillovers to the euro area and particularly to the highly-related Irish economy, which could suffer significantly in the event of a hard Brexit. To highlight these increased risk factors, we lowered our 2019 growth forecast for the Irish economy from 4.0% to 3.5%.

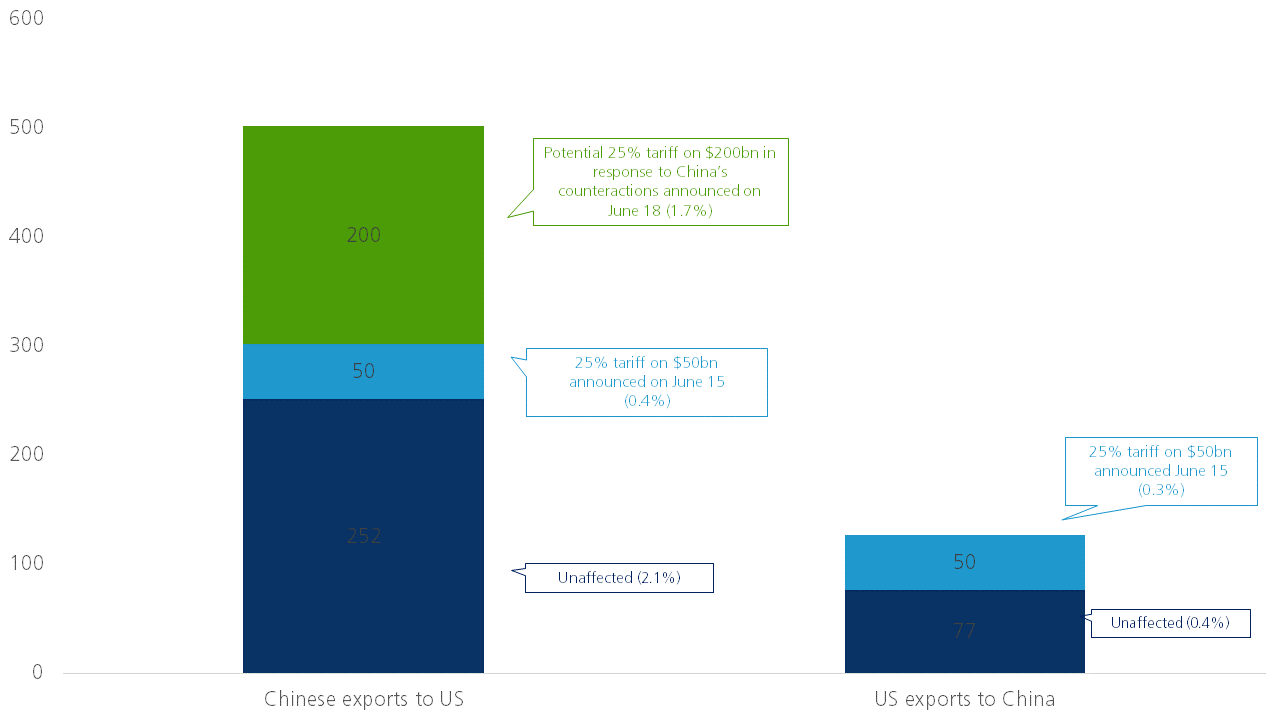

The trade conflict between the US and China has been on an escalating path and can now definitively be called a trade war. While there have been some hopes for a compromise sparked by the suggestion that new trade talks will take place later this month, at present no early resolution seems in sight. On the contrary, a further escalation with the implementation of new import tariffs may be the more likely scenario for the coming months. The US Trade Representative has announced the implementation of the remaining tariffs on $16 billion of imports from China. Those tariffs were already announced in June and were part of a larger set of targeted Chinese products worth $50 billion in total (tariffs on a list of products worth $34 billion were implemented earlier). On top of this, US President Trump requested to increase the proposed tariffs on some $200bn in annual imports from China to 25%, instead of 10% as was initially proposed. The public notice and comment period is still ongoing until September 6, but, in the absence of a breakthrough in the recently mooted trade talks later this month, the actual implementation of these new import tariffs could follow shortly after that date. This would mean yet another escalation in the US-China trade war. The new list of targeted products will inevitably also contain consumer goods, which is almost not the case in the $50 billion list. There will hence likely be an impact on US consumers’ pockets. The overall direct macroeconomic impact in the US and China of the tariffs implemented or announced to date appears limited, as the targeted amount represents only a small share of GDP (figure 3). However, negative effects could be amplified significantly through sentiment and investment and through new retaliation measures.

The immediate threat of an EU-US trade war has diminished due to the deal made by European Commission President Juncker and US President Trump. The two agreed to start negotiations on zero tariffs, zero non-tariff barriers, and zero subsidies in the non-auto industrial sector. Moreover, talks will be held about a reduction of barriers and an increase in services trade, chemicals, pharmaceuticals, medical products and soybeans trade. There will also be a strengthening of the EU-US cooperation with respect to energy and the EU agreed to start importing more liquified natural gas. The imposed steel and aluminium import tariffs by the US as well as the EU retaliatory tariffs remain in place for now, but will also be discussed. As long as these negotiations are ongoing, further tariffs are put on hold. This has largely reduced the likelihood of new US import tariffs on EU products and of the trade dispute spreading to one of Europe’s key sectors, the automotive industry, in the short to medium term. However, a successful ending of these negotiations is not a certainty yet. The ‘deal’ was a nice diplomatic effort, but a lot of uncertainty remains. Moreover, the negotiations will not cover the automotive industry. Hence, US import tariffs on European cars and car parts could still be imposed in the longer term. The short-term menace has hence declined somewhat for the EU thanks to the deal. Nevertheless, a global escalation of the trade conflict involving the EU and Japan, with particular attention to the automotive industry remains a risk to the base scenario.

The new bilateral trade agreement between the EU and Japan was a remarkable step in the context of the ongoing trade conflicts. The Economic Partnership Agreement (EPA) is an important step forward in the liberalisation of bilateral trade between the two blocs. It is also a counter-attack to the global trade conflict spurred on by US President Trump. The deal eliminates almost all of European import tariffs for Japanese products. European producers will also see 99% of Japanese tariffs disappear in the long term, albeit with more transitional periods for sensitive products. This could give an important boost to the European economy as Japan is Europe’s sixth important trading partner. Moreover, the agreement transcends international trade in the strict sense. It also focuses on public procurement, services, social protection, climate change, among other important areas. The partnership contains a few weaknesses though. The sensitive discussion on international investment protection was postponed and some transition periods are very long. More importantly, the agreement has yet to be ratified. Whether this will be success story for European companies hence remains uncertain. Nevertheless, increased trade can also bring countries closer together to counterbalance American protectionism.

Figure 3 - Limited direct economic impact from import tariffs but other amplifying factors at play (targeted amount in USD billions; % share in origin country’s GDP between brackets)

Source: KBC Economic Research based on IMF Art.IV Consultation People’s Republic of China (July 2018)

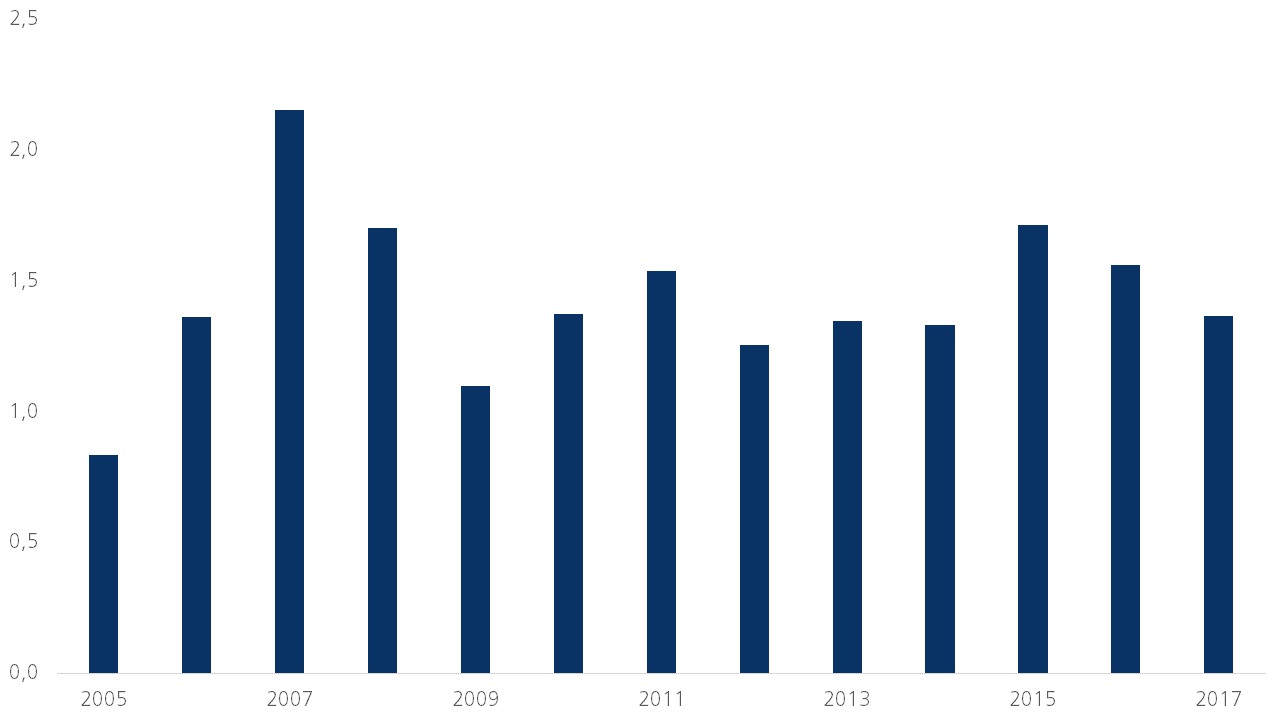

In the context of the ongoing trade conflicts, it is interesting to look at developments in global investments since they are related to the international environment. According to OECD data, global Foreign Direct Investments (FDI) flows fell in Q1 2018 by USD 105 billion relative to the previous quarter, continuing a declining trend seen since 2015 (figure 4). One factor that contributed to lower FDI flows in Q1 2018 was negative outward FDI from the United States for the first time since Q4 2005. This was likely a result of the US tax reform which introduced incentives for multinational corporations with parent companies in the US to repatriate cash held overseas. Incentives to reduce reinvestment of retained earnings will likely persist, and therefore represent a structural shift in global FDI flows from US multinationals. UNCTAD’s annual World Investment Report also highlights that declining rates of return on FDI are likely contributing to the decline in global FDI flows. Furthermore, though FDI flows are expected to grow modestly in 2018, the ongoing trade war could weigh on multinationals’ investment decisions, and particularly investment into global value chains.

On the global stage, out of 126 national investment policy measures taken in 2017, 93 of those were favourable to investors and emphasized attracting foreign investment. This suggests that on net, there is still a push for liberalizing global investment flows. In cases where policy measures focused on restricting international investment, they were motivated by concerns over national security and resource ownership.

For emerging markets, FDI has been an important and steady source of capital inflows. Despite the reversal in outward FDI from the US on a global level, FDI to emerging markets is expected to remain resilient. This should help bolster overall capital flows to emerging markets in the face of rising US interest rates and USD strength, which in turn have led to a decline in portfolio flows. Idiosyncratic factors, such as debt sustainability concerns in Argentina, political and institutional worries in Turkey, and the implementation of new sanctions on Russia add to downside risks for some countries.

Figure 4 - Declining trend in global FDI flows since 2015 (global FDI outward flows, in trillion USD)

Source: KBC Economic Research based on UNCTAD World Investment Report 2018

A full-blown currency crisis hit Turkey last week. The economy had been on the brink of a crisis since May, when the Turkish central bank delivered an emergency rate hike intended to curb the Lira fall. Nevertheless, recent developments again led to a Lira free-fall. After a massive depreciation against the USD - year-to-date the Turkish currency had lost more than 40% at its trough – the Lira partially recovered in response to the recent central bank’s intervention. However, concerns over Turkish economic and monetary policies remain a source of potential volatility. The recent trigger for the Lira slump was the imposition of US sanctions against Turkey in response to the closely watched case of an American pastor’s imprisonment in Turkey.

Turkije werd de afgelopen weken getroffen door een ware

wisselkoerscrisis. De economie stond als sinds mei, toen de Turkse

centrale bank een noodrenteverhoging doorvoerde om de val van de lira

te beteugelen, aan de rand van een crisis. Ondanks deze renteverhoging

leidden recente ontwikkelingen echter opnieuw tot een vrije val van de

lira. Na een massale waardevermindering ten opzichte van de USD, op

het dieptepunt bedroeg de waardevermindering 40% ten opzichte van de

koers een jaar eerder, herstelde de lira zich gedeeltelijk als gevolg

van een interventie van de centrale bank. De bezorgdheid over het

Turkse economische en monetaire beleid blijft echter een bron van

potentiële volatiliteit. De meest recente aanleiding voor de

instorting van lira waren de Amerikaanse sancties tegen Turkije, in de

vorm van hogere importtarieven op staal en aluminium, die er kwamen

als reactie op het gevangenschap van een Amerikaanse priester in

Turkije.However, Turkey’s problems are fundamental. First, Turkey

suffers from significant macroeconomic imbalances with a rapidly

growing twin deficit on the current account and government budget

balance. Moreover, to finance its large current account deficit (above

6% of GDP), Turkey heavily relies on volatile short-term capital

inflows. In addition, after Erdogan’s victory at the June elections

and a formal constitutional change to the presidential system, the

central bank has come under severe political pressure from the

president. As a result, at the latest central bank meeting governors

left the policy rate unchanged (17.75%), despite booming inflation at

almost 16%, well above the inflation target of 5%. This further

undermined the credibility of monetary policy which has come under the

influence of Erdogan’s un-orthodox economic views and his strong

opposition to higher interest rates. Last but not least, external

conditions have become more unfavourable due to the tightening of US

monetary policy. Additionally, diplomatic ties between the US and

Turkey, both NATO allies, are worsening. Not only the issue of the

American pastor, but also the Turkish purchase of a Russian missile

system and the continuous oil imports from Iran (which is under

sanctions by the US) to Turkey are adding to deteriorating relations.

Turkey’s possible options to avoid another Lira fall, which is not

unlikely given that fundamental problems are still in place, include

aggressive monetary policy measures by the central bank. Other,

potentially complementary, options are some form of capital controls

and/or an IMF rescue package to bring back market confidence.

Fundamentally, credible fiscal and monetary policies, with budgetary

austerity measures and the guaranteed independence of the central

bank, will be crucial to deliver a sound commitment in the longer

term. In the light of recent Erdogan comments, however, this still

seems far away as these options are not deemed desired by the

president, who instead opted for a risky ‘wait and see’ alternative.

This will most likely keep the Lira under pressure, leaving the

Turkish economy at risk of a sharp economic slowdown.

De echte problemen van Turkije zijn evenwel fundamenteler van aard. Ten eerste kampt Turkije met aanzienlijke macro-economische onevenwichtigheden, namelijk een snel groeiend tweevoudig tekort op de lopende rekening en op de overheidsbegroting. Bovendien is Turkije sterk afhankelijk van een volatiele instroom van kortetermijnkapitaal voor de financiering van haar grote tekort op de lopende rekening van de betalingsbalans (meer dan 6% van het bbp). Daarenboven is de centrale bank onder zware politieke druk komen te staan na de overwinning van president Erdogan bij de verkiezingen van juni en de formele grondwetswijziging van het presidentiële systeem. Onder druk van de president hebben de gouverneurs van de centrale bank besloten de beleidsrente ongewijzigd te laten (17,75%), ondanks de hoge inflatie van bijna 16%, die ruim boven de inflatiedoelstelling van 5% ligt. Dit heeft de geloofwaardigheid van het monetaire beleid ondermijnd. Een monetair beleid dat onder invloed is gekomen van de onorthodoxe economische opvattingen van president Erdogan en zijn sterke verzet tegen hogere rentetarieven. Ook zijn de externe omstandigheden ongunstiger geworden door de verkrapping van het Amerikaanse monetaire beleid. Bovendien zijn de diplomatieke relaties tussen de VS en Turkije, beide NAVO-bondgenoten, steeds verder verzuurd. Niet alleen de kwestie van de Amerikaanse priester, maar ook de Turkse aankoop van een Russisch raketsysteem en de aanhoudende Turkse olie-invoer uit Iran (een land dat sancties opgelegd heeft gekregen van de VS) dragen bij aan de verslechtering van de betrekkingen.

Verdere volatiliteit in de koers van de lira is niet onwaarschijnlijk gegeven de fundamentele problemen van Turkije. Turkije heeft verschillende opties om een koersval te voorkomen, waaronder agressieve monetaire beleidsmaatregelen van de centrale bank. Andere, eventueel complementaire opties zijn een of andere vorm van kapitaalcontroles en/of een reddingspakket van het IMF om het marktvertrouwen te herstellen. In wezen zal een geloofwaardig begrotings- en monetair beleid, met bezuinigingsmaatregelen en de gegarandeerde onafhankelijkheid van de centrale bank, van cruciaal belang zijn om de markten gerust te stellen. In het licht van de recente opmerkingen van president Erdogan lijkt zo’n beleid echter nog ver weg, aangezien de nodige maatregelen niet gewenst worden geacht door de president. Hierdoor zal de lira hoogstwaarschijnlijk onder druk blijven staan, waardoor de Turkse economie het risico loopt sterk te vertragen.

Click here to find our other forecasts