Wallonia is stagnating and no one cares

Are certain comments simply masking the objective and unequivocal findings of the European Commission? It is regrettable that this news has passed by with little in the way of reactions or remarks, despite the gravity of the situation.

According to the 8th report on EU cohesion policy published a few days ago, Wallonia is one of a group of regions that suffered from economic stagnation in the period from 2001 to 2019, along with certain regions of Southern Italy, as well as regions of Portugal, Greece and Cyprus, and several regions of France.

The Commission notes that ‘Many of them are caught in a development trap. They have struggled to recover from the crisis in 2008 and are now in need of public sector reforms, an upskilled labour force and a stronger capacity to innovate.’

Objective measures

The Commission based its findings on three indicators: GDP per capita at constant prices, gross value added per employee (productivity) at constant prices, and the level of employment in relation to the total population.

For each of these three variables, the region's growth rate during the five-year period preceding the year in question was compared to three benchmarks:

- The growth rate of the region itself during the five years preceding that five-year period

- The growth rate of the region’s Member State during the five-year period

- The average growth rate of the EU during that period

Striking points

Let us consider two of the points highlighted in this report, namely an upskilled labour force and a stronger capacity to innovate. The report underlines what everyone already knows, which is to say that innovation is the key to long-term regional economic growth.

If we take a look at the EU Regional Innovation Scoreboard for 2021, we see that compared to a base score of 100 for the EU as a whole, Belgium scores an average of 127, with Brussels at 135, Flanders at 130 and Wallonia at 114. Wallonia is therefore lagging behind in terms of innovation and must catch up as soon as possible if it is to get out of its current rut.

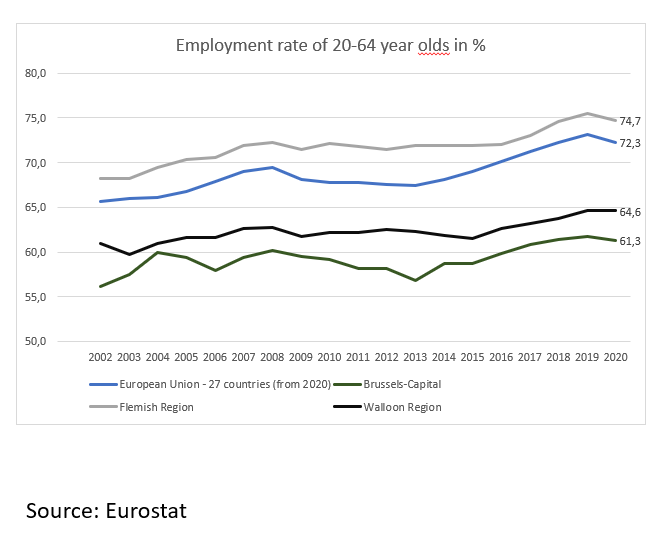

It is the second point highlighted in this report, however, that is particularly striking, that being the labour market. This point is measured by examining the level of employment in relation to the total population, as illustrated in the graph. Not only does the Walloon region have a very low employment rate, we see that while this rate increased by 9.5% in the Flemish region during the period from 2002 to 2020, the Walloon region only experienced an increase of 6.07% in the same timeframe.

At a time when businesses large and small are facing labour shortages, this figure is unacceptable, as is its slow growth. This is undoubtedly the major issue with Wallonia's stagnation as highlighted by this report.

Let's stop hiding behind so-called provocative comments, and let's start facing up to the full scope of the challenge that it’s time for Wallonia to take on.

In addition to the necessary development of innovation, it’s time to shake up the labour market by quickly getting the unemployed back to work through accelerated training programmes that respond to the needs of the labour market.

Wallonia's future is at stake, and the time to procrastinate is over. It would be unthinkable to open up the same EU report in a few years, only to read that Wallonia is stagnating.