International uncertainty causes further growth slowdown in the Belgian economy

Increased international uncertainty and the higher probability of a disruptive Brexit are weighing on the Belgian economy. In general, the growth slowdown that started mid-2018 is expected to continue this year and the next. More and more indicators are pointing to an accelerated slowdown in the Belgian economy. Given the remarkably weak sentiment indicators in the industrial sector and the growth slowdown in our main trading partners, KBC has lowered its growth forecasts for Belgium in 2019 and 2020 to 1.2% and 1.1% respectively. These forecasts are considerably below the current market consensus. Hopeful signals, however, are emanating from the Belgian labour market. Continued job creation and income growth will continue to support domestic consumption going forward. Simultaneously, however, these positive developments trigger higher import growth too, affecting real growth negatively. Moreover, in an unfavourable international environment, higher wage costs are again a threat to Belgium’s international competitiveness.

Euro area economic climate deteriorates

Various sentiment indicators point to a further growth slowdown in the euro area. Together with disappointing recent hard data releases, we expect that economic growth in the fourth quarter of 2018 will disappoint. Recent growth figures for the German economy for the entire year 2018 confirm this expectation. 2019 is starting on a weak basis too. Producer confidence continues to decline throughout Europe, with a downward trend in the manufacturing sector for six months in a row. In several economies, in particular in France and Italy, a substantial growth slowdown seems unavoidable. In addition, the hard data paint a disappointing picture. Take for example, the remarkable collapse in industrial production in November 2018 in all four major economies (Germany, France, Italy and Spain). In December consumer confidence started to fade too, although it remains considerably stronger than producer confidence. Continued job creation and increasing wages are clearly offering support.

The weaker figures are consistent with a less favourable and more uncertain international environment. Specifically, international trade is cooling down. Uncertainty regarding the US-China trade war continues. Though a bilateral conflict, the trade war has unsurprisingly led to a weakening in global trade. Moreover, an escalation of the trade war towards Europe remains possible. In addition, due to the lack of agreement between the UK and the EU27 on an orderly Brexit-process, Brexit-uncertainty persists as well. Governments and companies are currently preparing for a no-deal Brexit, leading to further disruption in the European economy. Within the euro area the French ‘gilets jaunes’ protests are negatively weighing on sentiment and growth too, and there appear to be no straightforward solutions to this social conflict. On the contrary, social unrest is spreading across Europe. Italy, as well, continues to struggle with several structural challenges. Despite the agreement between the European Commission and the Italian government on the Italian 2019 fiscal deficit , it is clear that the budget issue will be on the agenda again later on this year. On top of all of these negative risks contributing to uncertainty, European economic growth is jeopardized by temporary production issues in the German automotive industry. While these issues are temporary, they clearly had a negative impact on the fourth quarter growth in 2018.

These uncertainties will continue to be on the agenda in the upcoming months. A further deterioration of producer and consumer sentiment is most likely. Unfavourable winds from various directions have convinced us to lower our growth forecasts for the euro area in 2019 to 1.5%, despite being already very cautious. Such growth performance remains decent and is close to potential growth. The euro area unemployment rate has dropped to its lowest level since the financial crisis. The tight labour market will put upward pressure on wages, supporting consumption growth.

...the Belgian economy is following suit

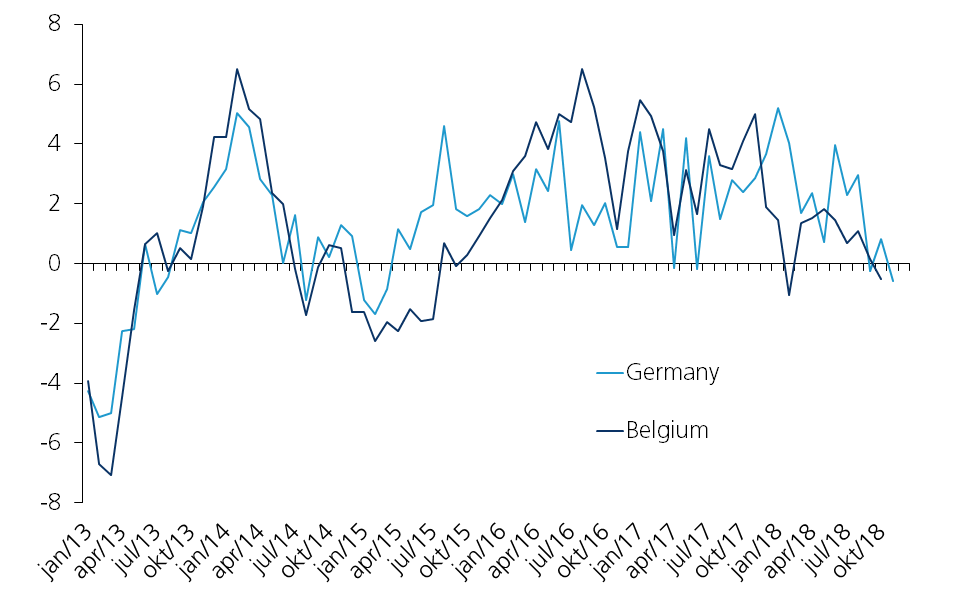

In line with the industrial production slowdown in Germany, Belgian industrial production figures at the end of 2018 have been similarly disappointing. The weaker industrial activity in Belgium is not new and started mid-2017. The declining production trend has even been stronger in Belgium than in Germany.

Figure 1 – Industrial production (excl. construction, volume, yoy % change, 3 mma)

Source: NBB.Stat; Statistiches Bundesamt Deutschland

Other recent indicators also point to a weak picture. For instance, companies expect a further decline in their export orders and the willingness to invest is over its peak. Most striking is the sharp fall in consumer confidence to its lowest level in the past two years. The fear that unemployment will rise has increased as well.

The downward revision in our growth forecasts for the euro area necessitate a lower growth forecast for the Belgian economy in 2019, and such a downgrade is consistent with the picture painted above. We therefore lower our growth forecast by 0.2% compared to December. Hence, we now expect the Belgian economy to grow by 1.2% in 2019 and by 1.1% in 2020. These figures are below the growth expectations published by the National Bank of Belgium in mid-December (respectively 1.4% and 1.2%). If the KBC scenario comes to pass, it would imply that GDP growth this and next year drops below the potential growth rate for the Belgian economy, calculated at 1.3% by the European Commission.

Strong labour markets good and bad for growth…

The declining trend in Belgian GDP growth is mainly due to the worsening international business climate that has triggered weaker export growth. Domestic demand will continue to support the Belgian economy. The dynamics in household consumption will be better than suggested by the latest consumer confidence indicators, as in practice the correlation between the two is not always perfect. It is more important to look at the ‘hard’ consumption determinants. The purchasing power of Belgian families is going up, as real disposable income is expected to grow by 2.2% in 2019, supported by several factors. First, employment growth will remain strong in 2019, although slowly lower than in 2018. Second, wage growth is accelerating as a result of the tight labour market. Third, the tax shift will stimulate income growth in 2019 too. Finally, real income growth is also supported by lower inflation due to lower energy prices. We expect Belgian inflation to equal 1.8% in 2019, versus 2.4% in 2018.

However, there is another side to the coin. In the small open Belgian economy, a stronger consumption demand leads to more imports. The expected higher import growth will, together with the expected lower export growth, lead to a decline in net exports. In our scenario, net exports in 2019 and 2020 will lower GDP growth by 0.2% and 0.4%.

With a potential growth of only 1.3% and an effective GDP growth slightly below that figure in 2019, Belgium performs worse than the euro area aggregate. This signals that the challenges to the Belgian economy remain enormous. As a small open economy, it is hard to compensate for the global circumstances, but through enhanced and necessary reform we can create an environment that stimulates structural investments in our economy. There is still a lot of work to do.