Industrial confidence shines amid gloom

Business confidence in the manufacturing sector is high in all major industrialised countries. In the wake of the second Covid-19 wave, sentiment nevertheless weakened again in most of the large euro countries. In Germany, however, confidence has held up well for the time being. This is a ray of hope amid today’s gloomy economic news. German industry was already in recession when the coronavirus crisis broke out. But following the first Covid-19 wave, a recovery has started. The relatively favourable international economic situation for industry can ensure that this recovery does not come to a standstill. Indeed, for the highly industrialised and relatively open German economy, demand from outside the euro area could counterbalance weaker demand from other euro area countries. That would allow the German export machine to save the euro area economy from a worse outcome, just as it did after the euro crisis. Recent order figures support that hope.

Strong confidence in the manufacturing industry

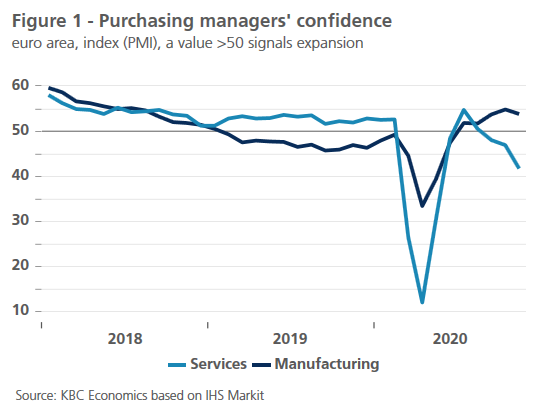

Amid the gloomy economic news about the Covid-19 crisis in Europe, the recent indicators of business confidence in the manufacturing sector are a ray of hope. According to the IHS Markit research bureau’s indicator, confidence in the euro area in October was at its highest level since mid-2018 (figure 1). Judging by recent trends, the second wave of the virus hardly seems to affect manufacturing. In November, there was only a slight loss of confidence. As in the first wave, the hard blows are mainly to the service sectors. The coronavirus recession thus confirms its atypical character. Usually, industry is subject to greater fluctuations — recessions strike harder and the recovery is often stronger. In many service sectors, the fluctuation of activity over the economic cycle is often more limited. This is different in the current crisis because the measures taken against the spread of the virus make the provision of services particularly difficult, especially if it requires close contact between people. In industry and construction, the maintenance of social distancing can also hamper activity, but in general these sectors are better able to adapt. This is already apparent from the first data on the impact of the second lockdown in Belgium. At the beginning of November, the fall in turnover in the construction sector was limited to ‘only’ 9%, compared with 45% in April. In the industrial sectors, the drop at the beginning of November was on average 12% compared to an average of 37% in April (source: Economic Risk Management Group). The Institut national de la statistique et des études économiques makes a similar assessment for the French economy.

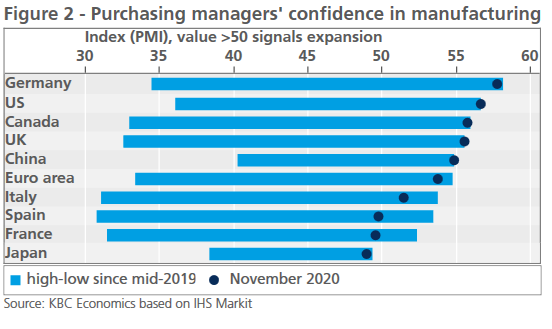

However, the second wave of the Covid-19 pandemic is not entirely without consequences for European industry. In recent months, all the major industrialized countries have seen a resurgence of business confidence in the manufacturing sector. But while confidence rose further in November to reach its highest level since mid-2019 in the US, Canada, the UK, China and Japan, it fell slightly in the large euro area countries (figure 2). Germany was more or less the exception with a stabilisation of confidence. In addition, German confidence is currently the highest among all major industrialised countries. It is therefore mainly thanks to Germany that confidence in the euro area is holding up relatively well.

German export machine a strong hold again?

This relatively strong confidence in Germany may be due to the fact that, despite recent concerns, the second Covid-19 wave remains more limited there than in the other European countries. Moreover, Germany intervened earlier in order to curb the flare-up of the virus, and the measures are aimed more at directly limiting social contacts than in the other countries while preserving as much economic activity as possible. For example, non-essential movements are restricted, but all shops remain open. Such a quick and targeted approach can help limit the loss of confidence among entrepreneurs. Business confidence also remains stronger in the service and retail sectors in Germany than in the other major euro countries.

The relatively high level of optimism shown by German industrialists probably also reflects the international climate. Of all the large industrialised countries, Germany is the most export-oriented, and goods account for the lion’s share of exports (37.9% of GDP in 2019, source: OECD). Manufacturing still accounts for a remarkably large share of the economy: over 20% of GDP, which is almost double the share in the US (2018 figures, source: OECD). Nearly half of German goods exports in 2019 went to non-EU countries (source: Statistisches Bundesambt). German industry can thus be seen as the gateway for the European economy to the rest of the world.

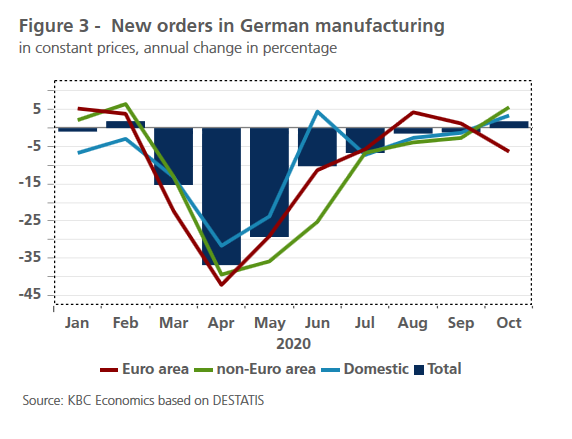

It is precisely for this reason that global optimism in industry is a ray of hope. When the Covid-19 crisis broke out, German industry was already in recession, partly due to structural problems in the automotive industry. However, a recovery has begun and the relatively favourable international climate for industry can ensure that this recovery will not be halted by the second pandemic wave in Europe. The October figures for new orders in German industry justify this optimism. They rose again thanks to domestic orders and orders from outside the euro zone. This compensated for the drop in orders from the other euro area countries, which have been more severely affected by the second wave (Figure 3). If this trend continues, the German export machine could save the euro area economy from a worse outcome, as it did after the 2011-2012 euro crisis.