European housing market continues to steam ahead in second quarter 2025

Click here to open the PDF.

According to new Eurostat figures, prices in the European housing market continued on the same strong momentum in the second quarter of 2025. Although the annual house price growth across the EU weakened somewhat, it remained quite robust at 5.4%. Compared to the previous quarter, price growth stood at 1.6%, a slight acceleration compared to the quarterly increase in the two previous quarters. Again, there were considerable differences between member states. Compared to the first quarter, there were more countries with a quarterly increase of more than 3% in the second quarter. Especially in Portugal, Croatia, Spain and Bulgaria, prices continued to rise sharply unabated. Only in two EU countries (France and Belgium) prices fell, albeit very slightly. The price correction in Belgium affected only new construction, while prices of existing houses continued to rise (to a limited extent).

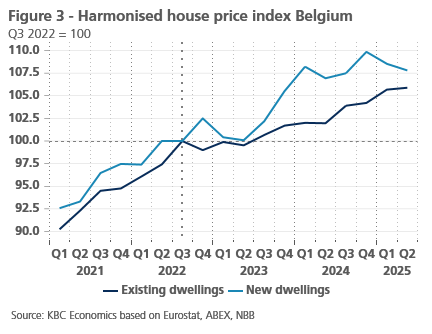

Eurostat recently published house price figures for the second quarter of 2025. These are the harmonised price index for EU member states, which takes into account both existing and new dwellings and corrects for price changes due to changes in the characteristics of the property sold. In the EU as a whole, house prices rose by 1.6% in Q2 2025 compared with the previous quarter, as against 1.4% in Q1 2025 and 0.7% in Q4 2024. Compared to the same quarter a year earlier, house prices in the EU were 5.4% higher in Q2 2025. That annual price rise, which is less volatile than quarterly changes, has accelerated quite a bit since Q1 2024. Although the annual rate of increase in Q2 (5.4%) was slightly lower than that in Q1 (5.7%), it remains indicative of continued strong price dynamics (see figure 1).

Country differences

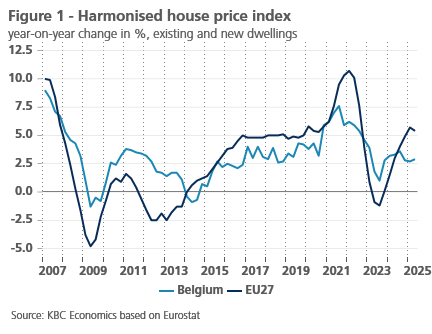

In Q2 2025, there were only two countries, Belgium and France, where prices fell compared to the previous quarter, albeit very slightly (see figure 2). At the peak of the European housing market cooling in Q4 2022, there were 16. In Belgium, the slight correction in Q2 (-0.1%) followed three previous quarters of decent price growth and, given also the volatility of quarterly changes, does not raise concerns (see below). Moreover, compared to many other countries, the period of market cooling in Belgium was quite orderly. In France, by contrast, the house price correction in Q2 2025 (-0.2%) was yet another in a long series, admittedly interrupted a few times by a positive figure. The level of house prices there in Q2 2025 was still 6% below the earlier peak in Q3 2022.

In nine EU countries, quarterly house price growth exceeded 3% in Q2 2025 (see figure 2). In Q1 2025, there were six. Quarterly price dynamics remained particularly strong in Portugal (+4.7%), Croatia (+4.4%), Spain (+4.0%) and Bulgaria (+3.8%), as in previous quarters. In Slovenia, where dynamics have also been robust in recent years but prices had fallen by 2% in Q1, prices rose sharply again in Q2 by 3.8%. In the group of strong risers in Q2, Luxembourg stands out (+4.5%). After prices there corrected sharply between late 2022 and early 2024, the Luxembourg market recovered slowly, followed by another correction in Q1 2025 that is now more than offset in Q2 2025.

In the group of EU countries with more moderate price growth in Q2 2025, Hungary (+1.1%) and Finland (+0.9%) stand out. After already a string of solid quarters, house prices in Hungary had risen further by as much as 8.4% in Q1. Given the risk of a rising overvaluation of the market, the more moderate price rise in Hungary in Q2 2025 is a welcome development. In Finland, where the housing market has persistently struggled with a correction since late 2022, including in Q1 2025, the positive price development in Q2 2025 points to a possible start of recovery. Also worth reporting is the German price development. Germany was one of the countries where the cooling-off turned into a solid price correction. After already four consecutive quarters of price recovery, prices there continued to rise at a moderate pace in Q2 2025 (+1.1%).

Belgian market

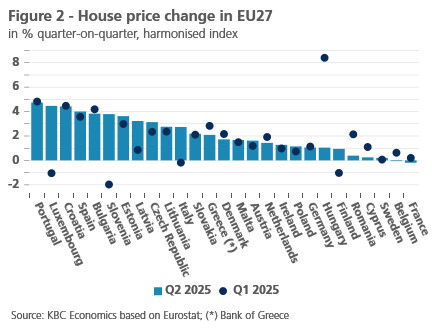

Across the EU, house prices in Q2 2025 were 6.6% above the previous peak level in Q3 2022, when the cooling of the European market began. In Belgium, it was 6.0%, so not very different from the EU figure. Compared to the EU, Belgium experienced a milder cooling, on the one hand, and a milder rebound in prices during recent quarters, on the other. The minuscule price fall for Belgian housing in Q2 2025 (-0.1%) followed a series of positive quarterly figures and does not in itself raise concerns, especially as quarterly price changes tend to be volatile. Moreover, behind the slight fall in prices in Q2 lies a divergent development for the individual segments of existing and new homes. The correction concerned only new construction: its prices fell by 0.7%, after also already falling by 1.2% in Q1 (see figure 3). The first- and second-quarter figures effectively provided a ‘healthy’ correction to the relatively robust pace of price increases in new construction since spring 2023. By contrast, prices of existing homes continued to rise in Q2 2025, this time by just 0.2% (1.4% in Q1).

The Q2 figure does not substantially change our view of Belgian real estate. For existing and new homes combined, we now see an annual average nominal house price increase of 2.6% in 2025 and 3.1% in 2026. In our previous forecast, before the release of the Q2 figure, it was 3.0% for both 2025 and 2026. For 2025, our current forecast does imply another real house price fall (i.e. adjusted for expected general HICP inflation) of 0.4%, after also already a 1.1% real price fall in 2024. In 2026, however, real house prices would increase again by 1.3%.