EU housing market continued on the same strong momentum in Q3 2025

According to new Eurostat figures, prices in the European housing market continued to show an upturn in the third quarter of 2025. Compared to the previous quarter, house price growth in the EU stood at 1.6%, while the annual price growth was at 5.5%. Both rates of change were the same as in Q2 and show that the EU housing market continues to steam ahead. As in previous quarters, there were considerable differences among member states, though. Compared to Q2, there were more countries with a quarterly price decline and less countries with a price increase of more than 3% in Q3. Especially in Latvia, Slovakia, Portugal, Bulgaria and Hungary, prices continued to rise sharply unabated. At the other extreme, prices in Luxembourg and Finland recorded the sharpest quarterly fall in the EU. In Belgium, prices rebounded in Q3 (+2.4% qoq), after a slight fall (-0.1% qoq) in Q2.

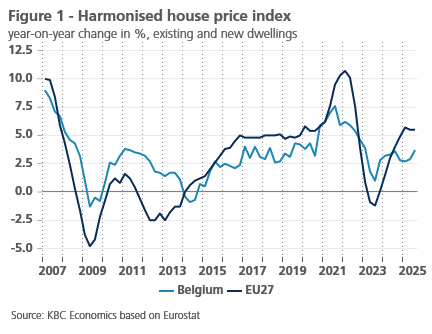

Eurostat recently published house price figures for the third quarter of 2025. This is the harmonised price index for EU member states, calculated according to the same methodology which makes it possible to compare the evolution of house prices across the different countries. The index takes into account both existing and new dwellings and corrects for price changes due to changes in the characteristics of the property sold. In the EU as a whole, house prices rose by 1.6% in Q3 2025 compared with the previous quarter, which is the same rate as in Q2 2025. Compared to the same quarter a year earlier, house prices in the EU were 5.5% higher in Q3 2025. That annual price rise, which is less volatile than quarterly changes, has accelerated quite a bit since end 2023 and was at (slightly above) 5.5% in the first three quarters of 2025 (see figure 1).

Country differences

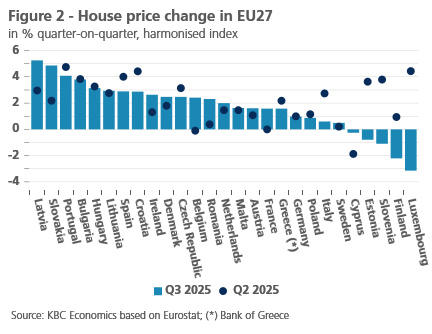

In Q3 2025, there were five countries (Cyprus, Estonia, Slovenia, Finland and Luxembourg) where house prices fell compared to the previous quarter, versus only two countries in Q2 (see figure 2). With the exception of Slovenia, these are countries which experienced already several quarter-on-quarter price declines over the past few years. In particular, in Luxembourg (-3.1%) and Finland (-2.2%) the Q3 price correction was yet another in a long series, admittedly interrupted a few times by a positive figure. The correction in Luxembourg strikes the most, as it reversed a strong Q2 performance (+4.4%). The Q2 price surge in the country was widely attributed to buyers rushing to complete transactions ahead of expiring tax incentives. The level of house prices in Luxembourg and Finland in Q3 2025 was still 13.4% and 14.5% below the earlier peak in 2022, respectively.

In Q3 2025, quarterly house price growth exceeded 3% in five EU countries. In Q2 2025, there were nine. Quarterly price dynamics remained particularly strong in Latvia (+5.2%), Slovakia (+4.9%), Portugal (4.1%), Bulgaria (+3.8%) and Hungary (+3.1%), as in previous quarters. In ten countries, among which Belgium, prices rose by between 2%-3%. In Belgium, a 2.4% price rise in Q3 followed a slight correction (-0.1%) in Q2. In the group of countries with more moderate price growth in Q3, Germany (+1.0%), France (+1.6%) and Austria (+1.6%) are worth mentioning. These three countries had faced a sharp price correction between late 2022 and early 2024 and continued their path of consecutive price rises.

Compared to the same quarter a year earlier, only one EU country, Finland (-3.1%), showed an annual decline in house prices in Q3. The highest annual price increases were recorded in Hungary (+21.1%) and Portugal (+17.7%). Six other (Eastern and Southern) EU countries posted double-digit yoy increases in Q3, too: Bulgaria (+15.4%), Croatia (+13.8%), Slovakia (+13.4%), Spain (+12.8%), Czechia and Lithuania (both +10.8%). In Belgium, house prices were 3.7% higher than a year earlier, which is an increase compared to the rate of 2.9% observed in the previous quarter.

Belgian market

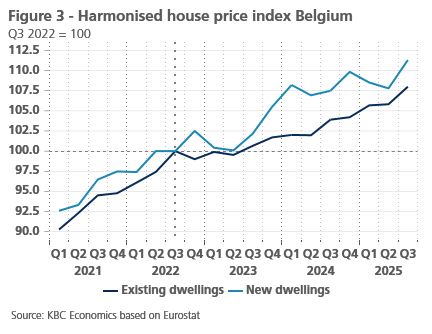

Across the EU, house prices in Q3 2025 were 8.4% above the previous peak level in Q3 2022, when the cooling of the European market began. In Belgium, it was 8.5%, so very close to the EU figure. Compared to the EU, Belgium experienced a milder cooling, on the one hand, and a milder rebound in prices during more recent quarters, on the other. Behind the general price development over the period mentioned lies a divergent development for the individual segments of existing and new homes. Between Q3 2022 and Q3 2025, prices for existing and new dwellings rose by 8.0% and 11.3%, respectively, in Belgium (see figure 3). In the EU, these figures were 6.3% and 17.1%, respectively. In Q3 2025, prices of existing and new dwellings in Belgium were up by 2.1% and 3.3%, respectively, compared to the previous quarter (both 1.6% in the EU). (beide 1,6% in de EU).

The Q3 2025 figure does not substantially change our view of Belgian real estate. For existing and new homes combined, we now see an annual average house price increase of 3.3% in 2025 and 3.4% in 2026. In our previous forecast, before the release of the Q3 figure, it was 2.6% for 2025 and 3.1% for 2026. Our current forecast implies a small real house price increase (i.e. adjusted for general HICP inflation) of 0.3% in 2025, after a 1.1% real price fall in 2024. In 2026, real house prices would increase by 1.5%. Despite the somewhat more upbeat forecast, we do not see Belgian real estate becoming (significantly) overvalued again. Risks of a rising overvaluation however do exist in other countries, given the strong price rises over a longer period. When comparing the third quarter of 2025 with 2015, house prices more than tripled in Hungary (+275%) and have more than doubled in eleven countries, with the largest increases seen in Portugal (+169%), Lithuania (+162%) and Bulgaria (+156%).