Economic Perspectives October 2021

Read the full publication below or click here to open the PDF.

- In light of the recent surge of energy prices, we now expect the price of a barrel Brent to stay around its current peak of about 80 USD until Q1 2022. The surge of the oil price is driven by a combination of strong energy demand during the post-pandemic reopening of the global economy, price spill-overs from the currently very tight gas market (especially in a European context) and continuing disciplined supply side management from OPEC+. As most of these drivers are expected to be temporary, we expect that the current elevated oil price level will not be sustainable and will turn out to be of a transitory nature. Therefore, we expect the oil price to gradually fall again in the subsequent quarters towards 65 USD per barrel by the end of 2022.

- In line with higher expected energy prices, we have also revised upward our inflation estimate for the US, the euro area and most of KBC home markets for 2021 and 2022. In addition to higher energy prices, continuing supply chain disruptions are still causing shortages of specific critical production components such as semiconductors. The European car industry is particularly affected by this, not only in Germany, but also in KBC Central European home markets with a sectoral specialisation towards this sector. So far, market-based inflation expectations are rather normalising towards the Fed’s and the ECB’s inflation target, without becoming unanchored.

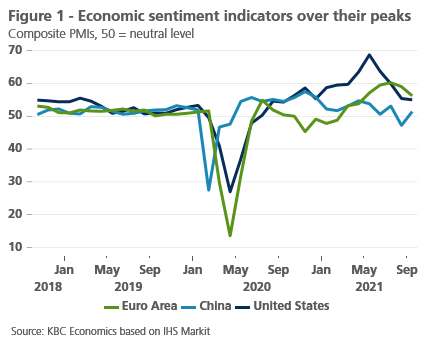

- We revised downward our general growth forecasts for 2021 and 2022. The dynamic peak of the reopening cycle in the US and the euro area appears to have been in the second quarter of 2021. Quarterly growth dynamics in subsequent quarters are expected to slow, but will still remain above the potential growth rate. The common timing of the cyclical peak also indicates that the global business cycle is becoming more synchronised again.

- We continue to expect the Fed to start its ‘tapering’ process of bond buying before the end of this year. The first Fed rate hike is likely to happen in 2022, after the tapering process is completed. This scenario is consistent with the Fed’s own forward guidance, the overall favourable US labour market performance of the US economy and strong current inflation dynamics.

- In an attempt to bring inflation back into its symmetric tolerance band around the inflation target of 2%, the Czech National Bank (CNB) raised its policy rate by 75 bps. This was stronger than expected. We expect the CNB to add another 50 bps by the end of 2021 and two more rate hikes of 25 bps each in 2022. This amounts to a stronger and more frontloaded tightening cycle.

- We expect a more frontloaded reaction of US and German bond yields to the more hawkish Fed policy cycle. Once this is fully priced into bond markets, further bond yield increases will remain more moderate. German yields are also expected to rise, in correlation with US yields. Moreover, the looming end of the ECB’s PEPP (expected March 2022), a need for clarity about the future nature of the APP, and debate around guidance about a first step towards ECB policy rate normalisation in 2023 should also support German bond yields.

The pace of improvement in the global economic rebound appears to have peaked in the second quarter, with the latest activity data showing a step-down from the post-pandemic highs (figure 1). A slowdown from unusually high sequential growth rates reflects, in part, the fading boost from reopening and the peak impulse from fiscal and monetary policy support. That said, the economic catch-up from the pandemic-induced recession is now largely finished, with activity above (the US and China) or close to (the euro area) pre-pandemic levels. At the same time, the global economy is facing a number of transitory headwinds that are weighing on forward momentum, ranging from the spread of the Delta variant, persistent supply chain disruptions, and most recently the global energy crunch.

Bumps in the road of recovery

Against this background, our overall outlook remains favourable, but we have pared our growth forecasts for major economies. That is to say, we are confident that the recovery remains on track, however, its pace is under increasing pressures from some material headwinds as we head to 2022. We have revised down our forecast for the US real GDP growth to 5.7% in 2021 and to 3.6% next year. In the euro area, we now expect moderately lower growth of 4.8% in 2021 and 4.4% in 2022. Finally, our China outlook has seen the most sizable downward revision, with real GDP growth picking up by 8.2% this year and slowing down to 5.1% in 2022.

China’s problems at the centre stage

While these annual growth rates are still impressive from a historical perspective, and point to ongoing recovery, our growth downgrades underscore the material headwinds that have built in recent months. In particular, China has seen an accumulation of pressure points, fuelling concerns regarding its outlook.

Several factors are currently weighing on Chinese economic activity, the latest of which are the power shortages and planned outages that picked up steam in late September and have continued into October. The electricity shortages stem from several factors coalescing at once, including a reduction in coal production and electricity production due to China’s new emission efficiency targets, reduced coal imports due to geopolitical disputes, and spiking coal costs which, combined with capped electricity prices, have eaten into electricity producer’s profits. Given that China still derives roughly 60% of its electricity from coal, the result is that electricity production can’t keep pace with China’s still fairly elevated, albeit slowing, economic growth rate (particularly on the industrial side). Planned (as well as some unscheduled) outages will weigh significantly on industrial production in Q4 and likely also impacted Q3 activity. Reduced production capabilities in China could add further fuel to the ongoing global supply chain disruptions. While the government is stepping in to improve flexibility around electricity production, the shortages could last until Q1 2022. Furthermore, the long-term nature of decarbonisation efforts means that this may not be the last we hear of energy market disruptions in China.

On top of these electricity shortages, China also faces possible headwinds in the real estate sector, especially as the Evergrande saga remains unresolved, and other highly-indebted property developers are reportedly running into liquidity problems as well. There has been growing financial stress stemming from the potential collapse of Evergrande, the China’s largest property developer saddled with liabilities estimated at USD 300 billion. This comes on the back of increased regulatory efforts to rein in an overleveraged housing market, in part to mitigate risks to financial stability.

While there has been some clear market reaction within China, on the real economy side, severe impacts are yet to be seen in the high-frequency data. However, widespread turbulence across the sector could weigh further on economic activity in China, as fixed asset investment in real estate development amounts to 12% of Chinese GDP. There could also be spill overs to consumer confidence and the production of certain inputs such as steel and cement.

Given these headwinds, we have downgraded 2021 real GDP growth to 8.2% from 8.8% previously. Given overhang effects, and the possibility that electricity shortages last into Q1 2022, we have also downgraded 2022 real GDP growth to 5.1% from 5.4% previously.

While the above-mentioned headwinds have raised the risk of a more severe slowdown in China, it is important to note that the Chinese government still assigns a high importance to economic stability and will step in to counteract any significant downward pressure on the economy. Indeed, aside from the government stepping in to address the energy shortage, it is also increasingly likely that the PBoC will moderately ease policy conditions further in the coming months, likely through some combination of reducing the reserve ratio requirement, increasing liquidity operations and potentially reducing the Medium-term Lending Facility interest rate. In this context, the limited convertibility of the Renminbi and the resulting incomplete integration of Chinese financial markets in the global financial system also help to reduce the risk of potential contagion to the global financial system should a financial stress event in china occur.

Global energy squeeze hits Europe

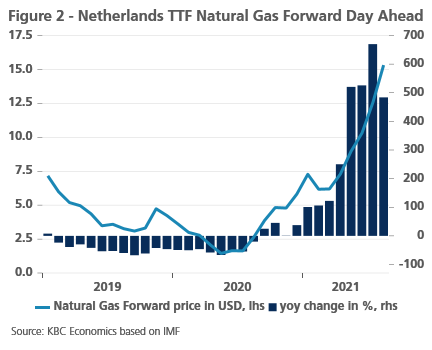

In addition to soaring coal prices, the global energy market has seen a surge in natural gas, electricity and crude oil prices in recent weeks. Europe is at the centre of the latest energy price shock with natural gas prices skyrocketing by more than 600% year-on-year to an all-time high just when the heating season began (figure 2). The surge in European gas prices reflects a major dislocation in the natural gas market, including exceptionally low inventories (partly due to extreme cold winter season in the Northern Hemisphere earlier this year), less accommodating supplies from Russia, a tight market for liquified natural gas globally, and weak output from Europe’s renewables (particularly wind energy).

Looking ahead, the outlook for the European gas market remains subject to significant uncertainty. In particular, should the winter season turn out to be unusually cold, the supply-demand imbalance could become even more pronounced with elevated prices likely to persist. This is raising concerns about the strength of the economic recovery in the region, potentially weighing on households’ disposable income, as well as downstream industries (with likely temporary factory closures). On the other hand, we believe that most European governments will step in to cushion the blow with some mitigating measures, which should contribute to contain the drag on growth across the region.

Importantly, the energy price shock is another supply-side factor clouding the near-term inflation outlook. Along with persistent supply chain disruptions, higher energy prices are set to spill over into heightened inflationary pressures, though some regulatory and contractual measures are likely to limit the immediate pass-through in Europe. Still, we have raised our near-term inflation outlook for the euro area and the US, largely on the back of higher energy costs. And while we maintain the view that headline inflation is set to gradually ease in advanced economies next year, the risks to inflation in the coming quarters are clearly tilted to the upside.

Euro area: so far, so good

The euro area witnessed an unexpectedly strong rebound in the second quarter, and the latest activity data point to ongoing recovery from the pandemic. Although the major boost from reopening is now behind us, we see room for further normalisation in economic activity with a still solid magnitude of consumer pent-up demand expected to materialise as we head to the year-end. As a result, we maintain the view that the euro area output will return to the pre-crisis level in the final quarter of 2021.

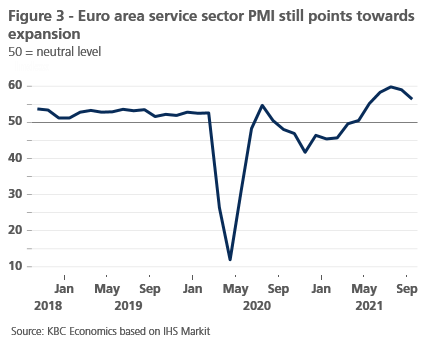

At the same time, there are clear signals that growth momentum is now slipping in the euro area. On the consumption side, after a sharp 2.6% mom decline in July, retail sales increased by 0.3% mom in August, highlighting the waning reopening effect. In September, activity in the services sector remained firmly established in expansionary territory as suggested by the euro area PMI, yet sentiment is gradually deteriorating (figure 3). Since we assume that services did most of the heavy lifting to support growth in the third quarter, the pace of recovery has most likely slowed.

On the production side, euro area industrial output recovered in July with a 1.4% pick-up, following soft readings in May and June. However, a 4.0% drop in German industrial output in August disappointed markedly and prompted a 1.6% drop in output for the euro area as a whole pointing to ongoing sluggishness. In fact, the manufacturing sector in Germany stands out as a major casualty of global supply chain disruptions, namely semiconductor shortages. These supply-side frictions are the most severe in the auto sector, highlighted by a significant 17.5% slump in auto production in August.

Supply bottlenecks remained the main headwind in September, as indicated by the euro area manufacturing PMI. The index softened somewhat to a still solid 58.6 from 61.4 in August amid a broad-based easing in the pace of output, demand, and employment growth. At the country level, the hit to activity was to a large extent concentrated in Germany. On a more encouraging note, the euro area manufacturing index remains high by historical standards, and points to continued expansion, albeit at a slower pace.

All in all, we expect near-term growth to remain healthy but somewhat slower than earlier envisaged as an external backdrop has turned less supportive. This is reflected in a moderate downward revision of our annual growth outlook for 2021 from 5.0% to 4.8%. Assuming that current headwinds, especially supply chain disruptions, ease in the coming quarters, we forecast real GDP growth at a substantially-above-potential 4.4% (from 4.5% previously) in 2022, driven by private consumption which is set to benefit from the elevated savings accumulated by households during the pandemic crisis. Moreover, there is still some scope for some growth catchup relative to the euro area’s potential growth path.

Moreover, fiscal policy is projected to remain supportive of growth next year, meaningfully also thanks to the disbursements of the NGEU funds. While the EU fiscal rules will remain suspended in 2022, the outcome of the September German federal election is crucial with respect to future of domestic and euro area fiscal policies. A centre-left block, so called ‘traffic-light’ coalition of the SPD, the Greens and the FDP now appears to be the most likely outcome in Germany, although coalition talks will take some time given the parties’ different views, in particular on fiscal policy. We believe that the SDP-led coalition will likely bring more continuity than a sharp policy shift in the fiscal stance, including limited appetite for a fundamental overhaul of the current EU’s fiscal rules. On balance, however, the new coalition government is likely to be somewhat more accommodative fiscally than the previous one, with increases of the minimum wage and pensions probably on the agenda. While the debt brake a such will probably not be touched since it requires a two-thirds majority to change the constitution in this respect, the likely new coalition will however look more favourably at future common European fiscal projects along the lines of the current NGEU. The likely next Chancellor Scholz is, after all, the current Finance Minister who wholeheartedly supported this European project as a means of creating a European fiscal policy layer.

US: growth cooling down

Following a strong recovery in the first half of the year, third-quarter data point to a loss in momentum in the US economy. In particular, consumer spending data have come out weaker than expected, likely reflecting a broader set of factors such as the waning effect of government stimulus, rising concerns about the Delta variant and lingering supply bottlenecks. Although retail sales rebounded in August (0.7% mom), this comes on the heels of a disappointing July report (-1.8% mom). On a similar note, real durable goods consumption also disappointed, having declined for the fifth consecutive month in August.

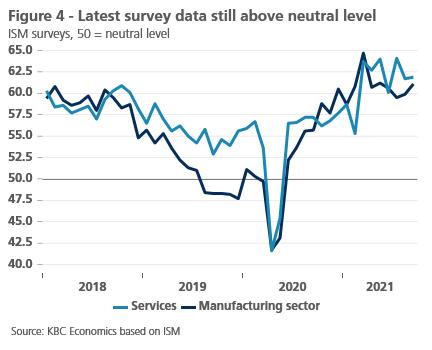

The latest survey indicators, however, paint a somewhat more upbeat picture. While it is true that the underlying momentum appears to be softening, activity is well entrenched in expansionary territory (figure 4). In the services sector, the ISM index edged up to 61.9 in September, while the PMI index eased marginally to 54.9, suggesting that the sector has weathered the recent Delta infection wave. Meanwhile, activity in manufacturing also point to the overall strength despite persistent supply-side bottlenecks, including material and labour market shortages. Indeed, after three months of easing, pressures on input prices and supplier delivery times re-intensified in September.

On the labour market, the employment data showed that the US economy added 194,000 new jobs in September, significantly below market expectations. The weakness in job gains reflected disappointing figures for the leisure and hospitality sector which are the most sensitive to the path of the pandemic but it may also have been affected by non-seasonal trends in education hiring. On a more encouraging note, the August employment gain was revised upward (+169,000), and some details of the September household survey also look better than the disappointing headline figure, including a drop in the unemployment rate from 5.2% to 4.8% (though partially reflecting a decline in the labour force participation rate). Overall, despite a weaker-than-expected September jobs report, we believe the Fed will regard the cumulative progress in the labour market as sufficient to announce the beginning of its asset purchase tapering at the November FOMC meeting. As a condition for a first rate hike, which we pencil in for 2022, there is still some way to go in terms of necessary job creation.

All things considered, the US economy is now clearly past its peak sequential growth, and we expect for a moderation in the pace of expansion in the coming quarters. Taking on board the recent weaker consumption data, we have lowered our real GDP growth forecast for 2021 from to 6.0% to 5.7%. Our growth outlook for 2022 has been also downgraded from 3.9% to 3.6%. Importantly, the outlook for 2022 and beyond will depend crucially on the extent of further fiscal spending, which remains one of the biggest uncertainties with respect to next year’s projections. So far, Congress has narrowly sidestepped another government shutdown, and has reached an agreement on a temporary increase of the debt ceiling.

Soaring energy prices boost global near-term inflation, but no need to fear stagflation

Following a sharp drop in prices after the outbreak of the pandemic in early 2020, inflationary pressures have accelerated considerably over the summer months. Headline inflation has reached more than a decade high in both the euro area (3.4% yoy in September) and the US (5.4% yoy in September), and has consistently come out as an upside surprise to the financial markets. However, very low inflation in 2020 (annual average 0.2% in the euro area and 1.2% in the US) implies that the underlying inflation during the whole pandemic cycle 2020-21 is still behaving relatively normally.

There are several factors behind the current high inflation readings, largely reflecting the unique nature of the post-pandemic economic recovery. Since early 2021, the rise in inflation has been mainly driven by higher energy prices (and base effects from weak or falling prices in 2020) that have yet to fully run their course. While Brent crude oil is currently up by 90% on the year-on-year basis (and the highest in three years), gas prices in Europe (as measured by Dutch TTF) have surged even more spectacularly by more than 600% yoy due to some notable dislocations on the global gas market. However, because the year-on-year price comparison relates current elevated prices with the extraordinary low energy prices in 2020, it likely serves to exaggerate the underlying momentum in energy costs.

Finally, unprecedented supply-chain disruptions have led to a surge in pipeline price pressures and robust core goods inflation across advanced economies. In essence, amid strong demand conditions, many manufacturers are unable to increase output fast enough at present due to pandemic-induced production cutbacks, input shortages (e.g., essential raw materials and most prominently semiconductors), and surging shipping costs.

While we note that inflation is likely to remain elevated in the remainder of 2021 and somewhat stickier also throughout 2022, we maintain the view that that inflation is currently driven mostly by transitory factors. That is to say, we expect price pressures to moderate eventually as 1) the energy base effects turn more favourable (with an expected stabilisation in oil prices in 2022), 2) the disruptive effects of the pandemic ease (i.e. once ‘opening up’ is completed), and 3) supply bottlenecks start to abate.

At the same time, we acknowledge a significant degree of uncertainty around the inflation profile going forward, and, while we do not anticipate runaway inflation, the risks to inflation in the coming quarters are clearly tilted to the upside.

Pandemic developments remain critical in this respect as recently seen in the rapid spread of the Delta variant in Asia. Any major setback in reopening is likely to lead to longer – if not more intensified – supply chain disruptions and related higher cost-push inflation. Furthermore, we acknowledge the risk that temporary inflationary pressures could become more persistent if they feed through to long-run inflation expectations. Finally, as ECB president Lagarde mentioned, there is a risk that the structural trend of decarbonisation of the economy may add to the annual inflation rate in the coming years in a non-negligeable way.

Importantly, the recent surge in inflation has not dislodged inflation expectations, which we view – along with still ample capacity and a significant employment gap in the euro area and the US – as crucial arguments in favour of a judgement as to the temporary nature of currently elevated inflation prints. In addition, we continue to hold the view that the structural forces weighing on inflation such as globalisation and ageing have not been removed by the pandemic. As a result, the so-called transitory narrative of inflation continues to dominate not only the main central banks’ assessments but also among most financial markets participants.

Still, we continue to monitor closely inflationary developments across advanced economies, in particular those with a potential leading to more entrenched inflationary pressures. These include especially the evolution of market-based inflation expectations, for example implied by inflation swaps. In line with our expectation, financial markets are pricing in the scenario of a temporary inflation surge, with inflation expected to normalise again from 2022 on. In other words, inflation expectations remain well-anchored. In the case of the euro area, these market expectations even suggest that longer-term inflation could again fall to levels that are below the symmetrical inflation target of the ECB of 2%.

A second critical element that we are closely monitoring is whether a negative feedback loop between inflation expectations and wages could emerge. While this is not currently being observed in the euro area, these developments remain prominently on our radar going ahead. We are aware of the importance of this risk of a negative cost-push spiral, since central banks would then face a painful trade-off between supporting growth and containing inflation. Precisely to pre-empt this risk, the Czech National Bank and the National Bank of Hungary have already started their tightening cycle. Given the potentially large impact of this risk on our overall economic outlook, we are monitoring this risk very closely.

All historical quotes/prices, statistics and charts are up to date, through 11 October 2021, unless otherwise noted. Positions and forecasts provided are those of 11 October 2021.