Economic Perspectives October 2019

Read the full publication below or click here to open the PDF.

- The latest IMF world economic outlook confirms our view that the global economy is facing a growth slowdown. Fears for a full-blunt recession seem, however, exaggerated. In particular, for the European economy, we expect a gradual recovery and stabilization in the current business cycle in the coming years.

- Global deterioration of economic momentum continued over the last month. Pessimism in the manufacturing sector intensified across the globe, mainly due to international trade challenges. Some negative spillovers to services industries are becoming visible. However, there are still signs of resilience as private consumption remains the stronghold in most economies. For the euro area in particular, fiscal policy is also expected to be more supportive for growth, and credit growth in the private sector remains strong.

- Overall, the risks to euro area growth are still tilted to the downside. The longer uncertainty about external factors such as Brexit and trade tensions linger on, the higher the risk of a more severe impact on sentiment, investments and corporate hiring. Moreover, a no-deal Brexit and a further escalation of trade tensions with a potential direct confrontation between the US and the EU, remain important risks to watch.

- Hopes for a Brexit deal have risen following the conclusion of a new agreement at the EU summit on October 18th. However, it remains unclear if the new deal will succeed in being ratified by the UK parliament where the previous agreement repeatedly failed.

- Accommodative monetary policy remains supportive to the economic outlook, but increasing internal and external criticism of ECB unconventional monetary policy signals a declining support for the exceptional measures currently being implemented in the euro area. Very loose monetary policy and increased recession fears are causing bond yields to remain low.

Resilience dominates negative spillovers

The euro area economy, and, in particular, the manufacturing sector, remain in a weak spot. Business sentiment indicators were weaker than expected in September and the persistent trend of worsening corporate pessimism in the manufacturing sector is not a purely European phenomenon. Similar dynamics are seen in other major economies such as the US, China and Japan. This reflects a global deterioration of economic momentum, which is particularly pronounced in trade-dependent sectors. The latter is also illustrated by the weak readings for new export order components of corporate sentiment indicators. Data on global international trade volumes continue to give the same message: trade conflicts and industrial weaknesses are weighing on trade flows and there are no signs of improvement in the near term. The continuing weakness in euro area manufacturing is also spilling over to services industries, though the deterioration is less severe.

These factors have led us to revise down our growth forecast for the euro area. Quarterly growth dynamics for the second half of this year were marginally downgraded. However, due to some upward revisions of historical figures by Eurostat, there we don’t see any significant impact on the 2019 annual average growth figure. For 2020, our annual average growth forecast was cut from 1.1% to 1.0%. From a country-level point of view, this was mainly the consequence of downward growth revisions for Germany, Spain and the Netherlands. With these updated growth forecasts for the euro area we are slightly more pessimistic than the IMF in its October 2019 World Economic Outlook (1.1% for 2019 and 1.4% for 2020). The difference is mainly related to the speed of the recovery. Compared to the IMF, we believe the rebound in the euro area economy will take longer.

The downward revision to euro area growth is limited as there are several factors that keep us from projecting a more severe slump. First, there are some signs of resilience. In most euro area countries private consumption remains robust and consumer confidence remains at solid levels. For example, survey results on consumers’ plans for major purchases in the next 12 months remain elevated – particularly in Germany where the economy will be hit hardest (figure 1). Moreover, business sentiment in retail trade and construction remains strong. Furthermore, solid real wage growth combined with continued employment growth suggest that private consumption will likely remain one of the main growth contributors going forward.

Figure 1 – European consumers remain confident (consumer confidence – major purchases planned in next 12 months, standardised balances)

We also expect that there will be further support to growth in the form of fiscal policy. Available budget proposals, such as those from Germany, France and the Netherlands, all put fiscal consolidation on hold or even contain additional stimulus measures. Therefore, we expect government consumption and investments to contribute positively to GDP growth in the coming years. This is encouraged by open calls for governments to do even more – for example from central banks and international institutions. Under the assumption that there will be no further negative external shocks weighing heavily on euro area growth, this supports our vision of only small downward growth revisions.

Nevertheless, the risks our euro area growth scenario are still tilted mainly to the downside. Uncertainty in relation to Brexit remains a pressing risk. Also a further weakening of the external environment – in particular in the US economy – could weigh harder on euro area growth than we currently anticipate.

Besides this, a further escalation of trade tensions with a potential direct confrontation between the US and the EU, remain important risks to watch. The recent WTO ruling in the longstanding conflict about illegal European subsidies to Airbus entitled the US to impose countermeasures at a level of maximum USD 7.5 billion. As a consequence, the US decided to impose import tariffs of 10% on European airplanes and 25% on a wide range of European agricultural and industrial products from October 18th onwards. Though the amount of trade volumes affected remains rather limited, the actions increase the chance that the EU will take similar countermeasures in case the WTO concludes that the US has also been illegally supporting Boeing. The verdict in the latter court case is expected in a few months' time. Moreover, the new US levies threaten to make bilateral trade relations even more difficult.

Mixed signals from the US economy

Over the past month, there has been no substantial change to the outlook for the US economy. Overall, incoming data have been mixed but in line with our projected growth path. Perhaps the most remarkable trend emerging is the seemingly contradicting picture for businesses and consumers (figure 2). The September manufacturing ISM is at a 10-year low and reported its weakest reading since the end of the last recession. Also the non-manufacturing ISM went down sharply though it is still signalling expansion. In line with global trends, US businesses are becoming more pessimistic and some signs of spillovers from manufacturing to services industries are becoming visible. On the other hand, similar to the euro area dynamics, the US consumer is showing remarkable resiliency despite the uncertainty and deterioration among corporates. Disregarding significant monthly volatility, consumer confidence indicators remain strikingly upbeat and retail sales generally surprised to the upside during the summer months, though September saw the first monthly decline in seven months. Hence, US consumers and businesses don’t seem to be on the same page for now.

Figure 2 – US businesses and consumers not on the same page (% change year-on-year)

low, at levels not seen since 1969 (3.5%). Meanwhile, employment growth has shown some choppiness in recent months and this may continue in coming months. Non-farm payrolls growth was below expectations at +136k in September, but the prior two months saw a total of +45k in upward revisions. Overall the softer trend in jobs growth since the beginning of this year is as expected. Wage growth has been somewhat below expectations in recent months. Most indicators are showing that earnings growth is rolling over. All in all, this is in line with our scenario of a late-cyclical economy with gradually falling growth. Though several recession indicators - such as the recession probability indicator of Federal Reserve Bank of NY - continue to inch upwards, current data continue to support our outlook.

In the meantime, uncertainty remains very elevated (figure 3). Political noise surrounding the impeachment inquiry coupled with trade war rhetoric means lots of uncertainty for American consumers and businesses. As mentioned earlier, until now, the impact on business and consumer sentiment has been different. However, the risk that this uncertainty will weigh more heavily on business investments and start to negatively impact consumers’ spending behaviour, is becoming larger.

Figure 3 – Global policy uncertainty at historical highs (policy uncertainty index)

BOX 1 - Economic slowdown hardly noticeable in credit growth

The slowdown in economic activity raises questions in relation to credit growth. On the one hand, a slowdown in credit growth would be logical, because if companies produce or invest less, they have less need for credit. Low household consumption or a weakening of housing construction would also reduce demand for credit. On the other hand, a reduction in the availability of credit could also be the cause of a slowdown in growth. This would not be illogical either, since in the event of great uncertainty and a worsening economic outlook, banks and other lenders could put a lid on credit growth out of prudence.

However, neither the US nor the eurozone are today showing clear signs of a significant slowdown in bank credit growth. At most, since spring 2019, the US has seen some weakening in the growth rate of bank loans to non-financial corporations, following the sharp acceleration in growth in 2018 (Figure B1.1). However, in September 2019, growth was still close to 6% (annual change in outstanding amounts), which is more than the (expected) nominal GDP growth at that moment. The overall debt ratio of US non-financial corporations stabilised in the second quarter of 2019, which does not point to a drying up of other sources of credit either.

Figure B1.1 - Bank loans to non-financial corporations (outstanding amounts, year-on-year, %)

Source: BC Economics based on Fed & ECB

In the eurozone, growth in bank lending to businesses is slightly lower than in the US (4.3% in August 2019), but has picked up slightly in recent months. However, there are large growth differences among the euro countries. According to ECB figures, growth in August was highest in Austria (9.5%), France (8.3%) and Belgium (8.1%), while Spain (-0.3%), Italy (-1.1%) and the Netherlands (-1.6%) still experienced a contraction. These growth differences are still related to the legacy of the previous pre-crisis period. The excessive debt build-up at the time has not yet been completely eliminated in these countries, which hampers net borrowing. But the Spanish and Dutch examples illustrate that deleveraging does not necessarily make economic growth impossible. After all, both economies have been among the fastest growing in the eurozone in recent years.

Lending to households also continues to grow steadily. Both in the US and in the eurozone, the growth rate of consumer credit and housing loans is stable or only slightly moderating (Figure B1.2). In both economies, banks are generally tightening up on consumer credit. This may slow down future growth. With regard to housing loans, the banks have stopped easing credit standards, and at most there is a very cautious tightening of credit standards. The same applies to the granting of corporate loans. This suggests that loan growth may ease going forward, but doesn’t announce a sudden stop.

The overall picture of credit growth is in line with the economic picture of still resilient domestic demand. There is no reason to fear a drastic reduction in lending, which would further stifle economic growth, especially as monetary policy will do everything in its power to keep lending afloat.

Figure B1.2 – Bank loans to households (outstanding amounts, year-on-year, %)

Source: KBC Economics based on Fed & ECB

UK consumers calm, UK businesses concerned

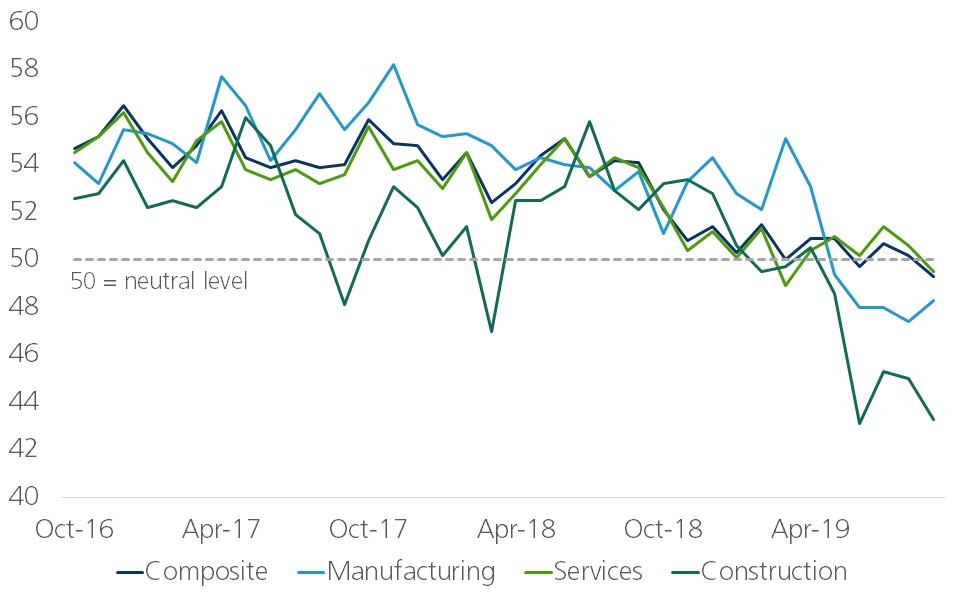

The political situation in the UK is becoming more complicated as he October 31st Brexit deadline approaches. UK companies have been suffering from the persistent uncertainty about the future relationship with the EU. This was reflected in corporate sentiment indicators. For the first time since the financial crisis, all three sectoral PMI’s – for manufacturing, services and construction – dipped below the neutral level of 50 into contractionary zone in September (figure 4). The business blues don’t seem to be infecting British consumers much though. The low unemployment rate remains supportive for private consumption and growth of retail sales volumes has been solid in recent months. Surveys also suggest that consumers continue to be relatively unconcerned about the potential economic consequences of (a no-deal) Brexit. There are more and more signs of Brexit fatigue among the British population and an increasing desire (as the slogan for the recent Tory party conference put it) ‘get Brexit done’.

Figure 4 – UK business blues across sectors (UK PMI’s measuring corporate sentiment, 50 = neutral level)

At the time of writing, there is significant uncertainty about the likely outcome of the UK parliamentary vote to be held (October 19th) on the new withdrawal agreement endorsed by the EU summit earlier this week. The fact that there is uncertainty reflects notably greater new found optimism as there was a strong sense of inevitability about the defeat of previous parliamentary votes earlier in the year on Theresa May’s proposed deals.

It is still unclear even if the UK parliament approves the deal that technical work on the deal both in the UK and EU can be completed sufficiently quickly to allow the UK leave on October 31st and this means a delay of up to a couple of months is possible. If the deal is rejected by the UK parliament, it is likely that an extension of 3 to 6 months will be reluctantly agreed by the EU, allowing for UK elections and the possibility of a further Brexit referendum.

The deal now agreed between the EU and Boris Johnson’s government removes the contentious issue of the Northern Ireland ‘backstop’ by setting out a quasi-permanent position for Northern Ireland. This envisages Northern Ireland will have effective ‘dual membership’ of the EU and UK economic areas for a four year period after a transition period to December 2020 ends by legally being part of the UK customs area but in practice being part of the EU customs area. Its subsequent position, either continuing to adhere to EU regulations or reverting to their UK counterparts, will be determined by a 60% majority vote of the Northern Ireland assembly, with various mechanisms attached to deliver a smooth process in this regard. However the deal also envisages notably less close links between the EU and UK in terms of trade and related regulations.

If the deal is agreed, the avoidance of a hard border between Northern Ireland and Ireland together with an agreed implementation period to December 2020 would remove the threat of a severe and sudden economic dislocation associated with a ‘no deal’ Brexit. However, such an outcome would remain a possibility after the transition period if a lasting agreement is not reached. Moreover, by opting for a path towards a free trade agreement rather than a closer relationship with the EU, the UK has chosen a likely weaker economic path for the British economy in coming years and this option may see some impediments emerge to EU/UK trade albeit to a markedly lesser extent than in the case of a ‘no deal’ scenario.

Internally divided central banks

As expected, both the European Central Bank (ECB) and the US Federal Reserve (Fed) decided to ease monetary policy at their latest policy meetings. The ECB opted for a combination of measures – a deposit rate cut by 10 basis points, a restart of the asset purchase programme, easier modalities for targeted longer-term refinancing operations (TLTRO’s), a tiered deposit rate system and an altered forward guidance. The ECB Governing Council “now expects the key ECB interest rates to remain at their present or lower levels until it has seen the inflation outlook robustly converge to a level sufficiently close to, but below, 2% within its projection horizon”.

Hence, the ECB continues to signal an easing bias. More remarkable was the strength of the plea for fiscal stimulus by national government to support economic activity. However, probably the most notable aspect of the ECB’s September deliberations was the extent of public disagreement with the decisions taken, voiced by a range of influential members of the ECB’;s governing council. Internal disagreement within the ECB Council now appears to be seep-rooted and in many respects echoes growing external criticism of the negative side-effects of unconventional monetary policy. It’s becoming clear that many Council members believe that the ECB is running out of ammunition and opinions are divided on how effective recent stimulus measures will be in supporting the economy and boosting inflation. Given our downward revision of euro area inflation for this and next year, we stick to our scenario of persistent and very accommodative monetary policy by the ECB throughout the forecast horizon.

A similar internal disunity about the uncertain economic and monetary future was seen at the latest Fed meeting. Some of the Fed governors continue to adhere to a more orthodox course and look mainly at domestic economic indicators. US growth, although slowing somewhat, is still doing well and inflation remains around the 2% target. Hence, they see no reason to relax monetary policy. Another camp within the Fed, including Chairman Powell, has been preaching caution for some time now and is paying more attention to the possible negative consequences of external developments. In the end, a majority of Fed governors voted for a policy rate cut by 25 basis points. However, the divergence makes the new Fed policy rate projections less relevant. For now, we maintain our view of one more rate cut in the remainder of this year and no further changes to the policy rate next year. The latter is also supported by the fact that it would be highly unconventional for the Fed to take action during a presidential election year.

Box 2 - Tension on the American money market: more than a technical accident?

Mid-September saw significant turmoil on the American money markets because of a shortage of short-term liquidity. As a result of the shortage, money market interest rates surged (figure B2). This is undesirable for several reasons. First of all, a well-functioning money market is a basic condition for a smooth settlement of transactions in other markets, for example in the bond market. In addition, investors still remember that tensions in the money market were an early warning signal in the run-up to the major crisis in 2008. A (too) high money market rate also disturbs the monetary transmission mechanism and can even weaken confidence in the Fed somewhat. This is especially problematic if interest rates rise above the level that the Fed deems necessary to achieve its policy objective (Fed fund money market rates within the target zone, which currently stands at 1.75%-2.0%), which they recently did.

After the net purchases of government bonds in the QE programme by the Fed stopped in 2014, and especially since the cautious reduction of the Fed’s balance sheet started in October 2017, the liquidity surpluses held by US banks at the Fed have steadily decreased. This means that they have less money available, especially for short-term, interbank money market transactions. In September, the surplus turned into a deficit. At first glance, this seems odd as the Fed has left a lot of 'surplus' liquidity in the market when stopping the reduction of its balance sheet. However, stricter regulation after the crisis requires banks to maintain larger liquidity buffers. In addition, the US Treasury is absorbing a lot of liquidity through increased bond issuance to finance the Trump government's widening deficit. Finally, there were temporary factors like numerous companies paying taxes to the Treasury. The US Treasury places these proceeds (at least temporarily) with the Fed, thereby de facto sterilising this part of the excess liquidity.

Initially, the Fed responded to pressures in the money market through a series of ad hoc repo operations (cash against bonds), either on a daily basis or for a slightly longer maturity (14 days). However, a structural solution was also needed, especially with the end of the year approaching, a time when demand for liquidity is traditionally high. As a structural solution, the Fed announced that it would be buying up Treasury bills at a rate of $60bn per month from October to the second quarter of 2020,which means that extra liquidity will be injected into the market. The Fed is also keeping repo facilities in place until the end of the year. With these actions, the Fed claims to have found a technical solution to the money market problem. Although this means additional purchase of assets, the Fed insists that this should not be interpreted as a form of monetary easing such as quantitative easing (QE). Others dispute this and see it as an illustration that the Fed has no other option than to provide the economy with increasing liquidity through its balance sheet, even if in practice this implicitly leads to a form of monetary financing of the government. Determining who is right is a technical debate. We can, however, already say that the balance sheet has become a more important instrument in the toolbox of central banks, even at a time when there is no acute crisis. We can only hope that the Fed is right in saying that this is only a technical problem. If not...

Figure B2 – Overnight repo rate spiked unexpectedly in September (secured overnight financing rate, in %)

Source: KBC Economics based on Federal Reserve Bank of New York

All historical quotes/prices, statistics and charts are up-to-date, up to and including 14 October 2019, unless stated otherwise. The views and forecasts provided are those of 14 October 2019.