A new commodity supercycle underway?

A recent surge in commodity prices has prompted talks about the arrival of the new supercycle – an extended period during which a broad range of commodity prices rise significantly above their long-run trend. There are indeed some signs that we could be at the start of a secular bull market in commodities, underpinned by massive fiscal stimulus favouring the green transition. Nonetheless, we think it is premature to declare a full-blown supercycle as it is yet to be seen if the spell of strong demand generated by the green push will be sustained. Furthermore, not all commodities are set to benefit equally with fossil fuels unlikely to participate in robust long-term structural growth. All this has some important macroeconomic implications, namely supporting our view of well-anchored and moderate medium-term inflation in advanced economies.

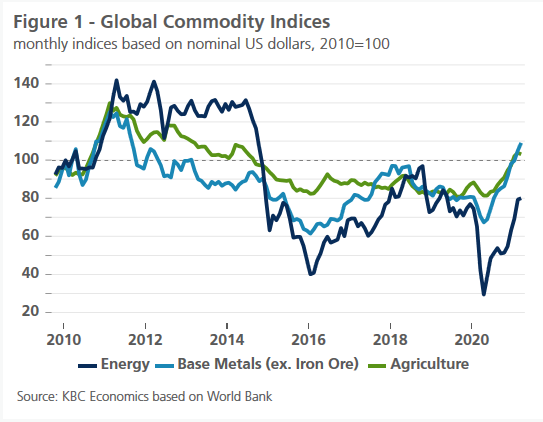

The commodity market has enjoyed a strong start to 2021 with sizable price gains across energy, metals, and agricultural commodities (figure 1). The sharp rise in commodity prices has, in general, reflected at least three important factors. First, the global economic recovery from the pandemic driven in part by China, the leading consumer of a broad range of commodities. At the same time, vaccine-fuelled optimism has had a particularly positive impact on commodity prices, further adding to the momentum since late 2020. Finally, with rising inflation expectations, and even some concerns about runaway inflation, financial investors are increasingly seeking to buy real assets as a hedge against inflation.

What is a commodity supercycle?

The rally in commodity prices has spurred discussions about a new supercycle – an extended period during which a broad range of commodity prices rises significantly above their long-run trend. Supercycles differ from short-run fluctuations in three important ways. First, they predominantly reflect major structural changes in the global economy. Second, they tend to span a much longer period (as long as a couple of decades) with a complete trough-to-trough movement. Third, supercycles are observed over a broad range of commodities, including energy, metals, and even agricultural commodities.

Commodity prices are, in general, driven by supply and demand fundamentals, and it is precisely the disconnect between demand and supply that creates the basic conditions for supercycles. These are typically demand-driven, i.e. a sustained spell of unusually strong demand growth that producers are unable to match sparks a lasting surge in prices. No two supercycles are, however, the same with both the length of the upswing and downswing varying significantly from cycle to cycle.

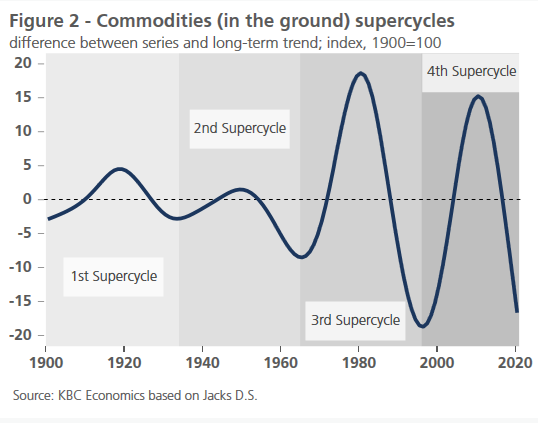

Since the early 1900s, there have been four full-blown commodity supercycles (figure 2). While the first one coincided with the US industrialization at the turn of the 20th century, the second was a result of the post-war reconstruction in Europe and Japan. The third supercycle reflected primarily the energy spike in the 1970s. China’s emergence as a major economic superpower in the late 1990s then spurred the last supercycle that extended until the Global Financial Crisis. The rapid pace of industrialization and urbanization in China (and some other emerging markets) provided a substantial boost to demand in commodity markets. As a result, the real prices of energy and metals more than doubled in the 2003-2008 period, while the real price of agricultural commodities increased by 50%.

Will Covid-19 kick-start a new commodity supercycle?

For some analysts, the current rally in commodity prices is driven by similar structural forces as during the China-led boom in the early 2000s. Predictions of a new commodity supercycle are rising in view of the robust post-pandemic recovery, underpinned by massive fiscal stimulus across the major economies. Importantly, a considerable amount of this stimulus is expected to be directed to the green transition with higher investments needed to fight climate change. More aggressive environmental policies are now gaining traction in the US, but the EU’s Next Generation, as well as China’s commitment to carbon neutrality, should also add to the momentum of a green push. All this is supposed to provide a significant boost to demand for commodities needed to build renewable energy infrastructure.

While there are indeed some signs that we could be at the start of a secular bull market in commodities, we think it is premature to declare a new full-blown supercycle as of now. Given the demand-driven nature of supercycles, we would need to see strong and sustainable demand growth in the years ahead. The energy transition has the potential to provide a structural rise in commodity demand, however, it remains to be seen how bullish its demand implications eventually become. Furthermore, even if the green transition provides an unusually strong demand boost, not all commodities will benefit equally. While some industrial metals such as copper, aluminium or cobalt are poised for a stellar decade, fossil fuels are unlikely to participate in this longer-term structural growth amid the green transition.

Important macroeconomic implications

All this has some important macroeconomic implications, particularly related to the inflation outlook. Commodity prices, and most importantly oil prices, are among the key drivers of consumer inflation as raw material costs are usually passed on to consumers. In the coming months, major advanced economies are expected to see a notable pick-up in inflationary pressures, in part due to higher oil prices (see April KBC Economic Perspectives). We nonetheless view these upward pressures as temporary, despite some growing concerns about substantially higher inflation in the coming years. Overall, we expect well-anchored and moderate medium-term inflation across the advanced economies, partly also on the assumption of reasonably behaved commodity prices in the upcoming years.