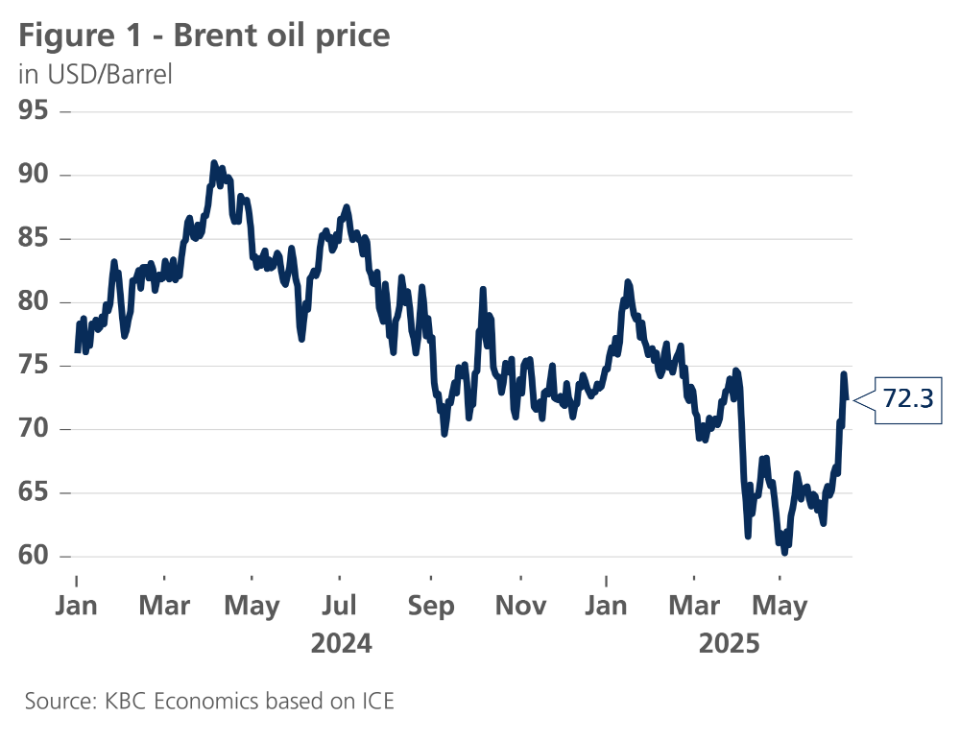

Middle East unrest pushes up oil prices

Oil prices surged above $70 a barrel late last week in response to Israel's attack on Iranian military and nuclear targets. This shock comes at a time when oil is in a predominantly declining market (due to concerns about large oversupply and weaker demand). Any further escalation or de-escalation of the conflict between Iran and Israel will determine the future movement of oil prices and the overall economic impact.

Impact on EU economy

The direct trade effect of higher uncertainty in the Middle East on trade with the EU will most likely be small. The volume of trade between the Middle East and the EU is limited and the summer revival of trade tensions between the United States and the EU (postponement of reciprocal tariffs until July 9, 2025) still seems to pose a much greater threat in this regard.

Indirectly, through significantly more expensive oil or natural gas, the conflict between Iran and Israel could well pose a significant problem for the European economy. Not only is Iran responsible for 3.5% of global oil production, it also controls the Strait of Hormuz, where roughly 20% of global oil and gas production passes.

If we assume that, after this temporary escalation of the conflict, there is a lull and that critical infrastructure and transport arteries are not disrupted, the rise in oil prices will ultimately be temporary. In that case, there would only be a slight price increase at the pump in the EU, with some delay.

If the essential transportation arteries for oil or even gas were really threatened, we would be in a new scenario. In that case, oil price increases could be much more significant and prolonged, and not only oil prices but also natural gas prices could rise. And the combined increase in fuel and energy prices could end up having a much larger knock-on effect of a wider range of prices in the consumption basket.