The Japanese growth model: an inspiration for Europe

Since the mid-1990s, the Japanese economy has been facing a sharply declining working age population. So far, however, this has not been a major problem in terms of per capita economic performance. Even in absolute terms, the Japanese growth potential is evolving relatively well. According to OECD estimates, it is currently not far below the growth potential of the euro area, despite the striking difference in the dynamics of the working age population. This remarkable performance is partly the result of increased labour force participation. The main cause, however, is the much higher Japanese investment rate, which boosts productivity growth. For the euro area, the lesson is clear: its insufficient public and private investment rate is not only weighing on cyclical growth. It is also damaging the longer run growth potential of the European economy.

Demographic challenge...

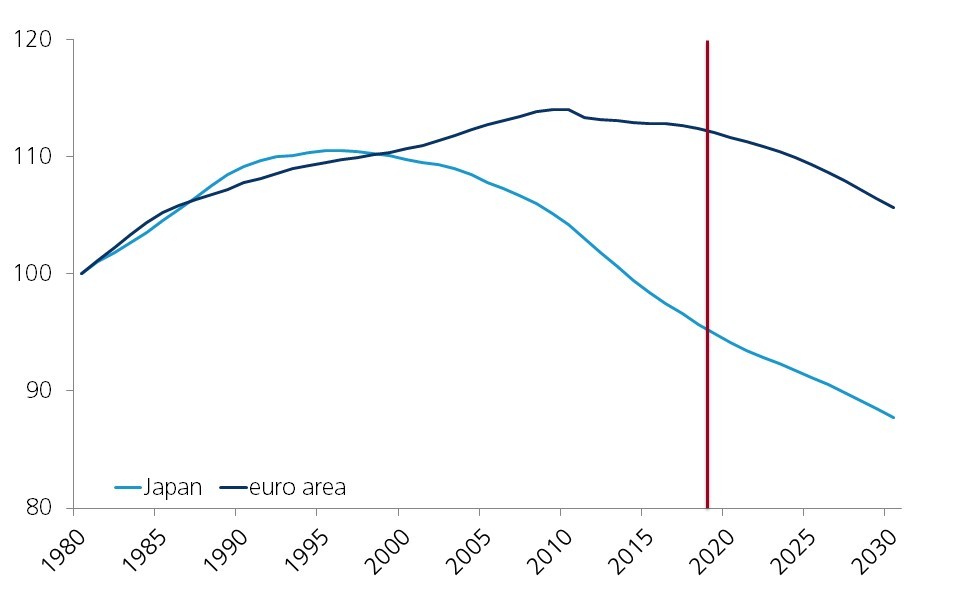

For more than two decades, the Japanese economy has been facing a major demographic challenge. In the mid-1990s, its working age population started declining, much earlier and faster than in the euro area (see figure 1). This is all the more worrying since it is projected to further shrink in the coming decades. This is not only threatening its economic growth potential. According to the IMF, it also makes the high level of public debt unsustainable if no further policy measures are taken.

Figure 1 - Japanese labour potential rapidly declining ((projected) evolution of working age population (15-64 years), 1980=100)

Source: KBC Economics based on World Bank

...triggered policy response

Since his first election in December 2012, Prime Minister Abe has been implementing an economic reform programme in close cooperation with the Bank of Japan. In short, the policy objectives have been to boost economic growth potential, consolidate public finances and lift Japanese inflation away from deflationary levels. As far as the latter two objectives are concerned, not much progress has been made, despite an extremely accommodative monetary policy and efforts to reduce the still substantial budget deficit, such as the planned VAT rate hike in October 2019.

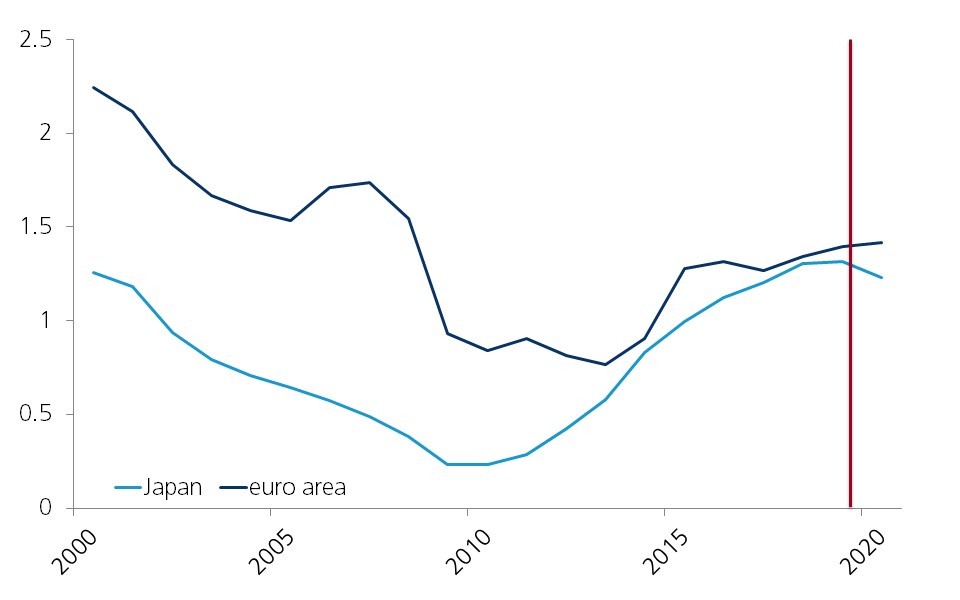

Boosting the economy’s potential growth rate has clearly been more successful (see figure 2). A major policy focus has been on labour market reforms, since the current unemployment rate is consistent with full employment, suggesting that the Japanese economy is operating near full capacity. Consequently, policy has primarily aimed to raise labour force participation, in particular of women.

Figure 2 - Japanese growth potential not far below the euro area (in %)

Source: KBC Economics based on OECD

This policy has been effective so far. Despite the shrinking working age population, both total employment and the employment rate are above their levels in 2000, with an increasing trend. Structural rigidities of the labour market have been addressed too. A major problem remains the strong dualism between regular and non-regular employment, as e.g. reflected by the high share of employment in fixed term contracts and part-time work. Reducing this dualism, as well as removing negative incentives to join the work force stemming from the tax and social security system, also contributed to increasing the labour supply.

Investments play a crucial role

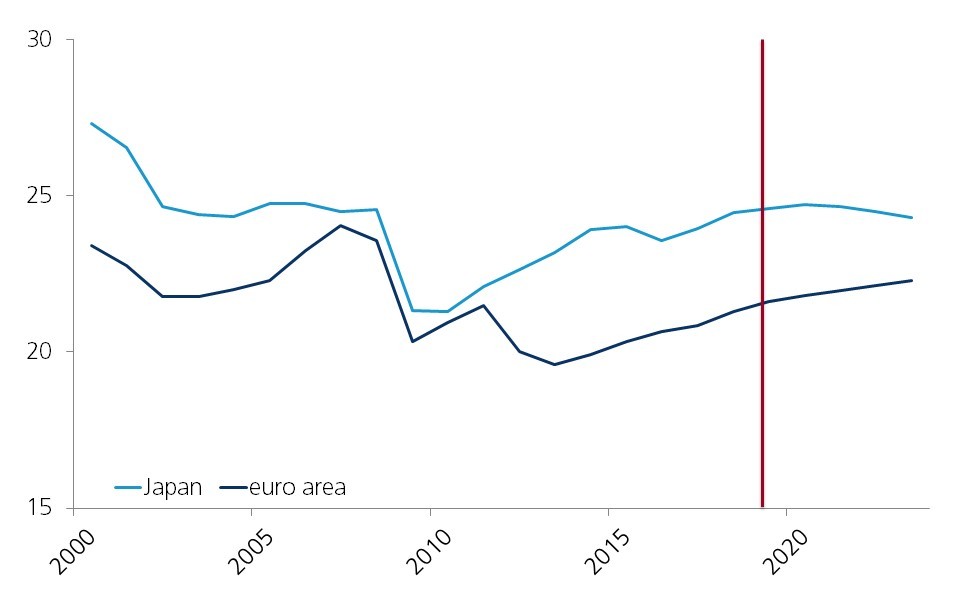

Despite higher labour force participation, the IMF estimates that the main contribution to higher potential growth was made by capital investments and their associated productivity gains. These gains are resulting both from a higher capital-labour ratio and from technological progress in general (the so-called total factor productivity). Japanese firms tend to deal with the persistent labour shortage by increasing labour-saving and automating investments. This is reflected in the Japanese investment rate (in percent of GDP) that lies well above the rate in the euro area (see figure 3). This is the case for both the private and public sectors. As a result, the OECD estimates that, despite much more unfavourable demographics, the Japanese growth potential is currently above 1%, and close to the potential rate of the euro area. While other estimates are a bit more cautious (e.g. the latest IMF estimate is 0.8%), they confirm this view.

Figure 3 - Japanese investment rate higher than in the euro area (total investments, in % of GDP)

Source: KBC Economics based on IMF

The lesson for the euro area is clear. Its current underinvestment not only leads to lower cyclical growth, imbalances between euro area member economies and an overall current account surplus for economically unhealthy reasons. By lowering productivity growth, it also jeopardises the medium term growth potential of the European economy. In that sense, a ‘Japan scenario’ for Europe may not be that bad after all.