The impact of changing demography on the global economy

Link to the PDF

Abstract

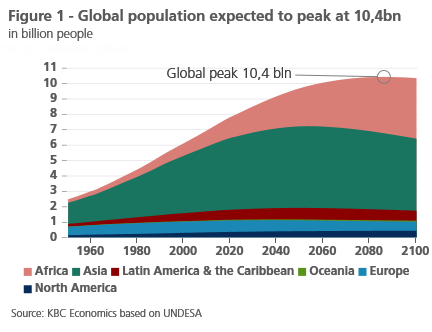

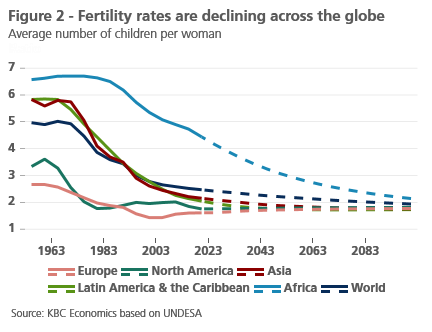

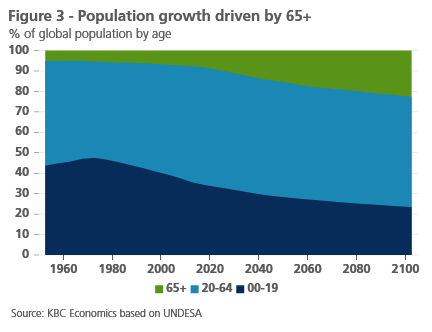

The world is undergoing a major demographic transition. As birth rates are falling worldwide, global population growth is slowing down every year and is expected to peak in 2086 at 10.4 bln. The age composition of the population will also shift dramatically. The number of 65+ year olds is expected to increase fourfold and dependency ratios are expected to increase worldwide. Furthermore, there are wide regional demographic discrepancies as high-income countries are expected to see rapid declines in active population, while low-income countries are expected to experience big increases. If we take these demographic evolutions in isolation, we expect changing demographics to cause GDP per capita to decrease by a quarter this century. Thankfully, demographics don’t operate in a vacuum and we expect humanity to adapt to this new reality by adopting new technology, allocating existing technology better, increasing participation, allowing more migration and integrating poorer countries further in the global economy. This will likely more than compensate the stagnatory effect of changing demographics.

Introduction

Auguste Comte, a French sociologist, is often quoted as having said, “demography is destiny”. Demography indeed affects the development of cities, nations and even the global economy. Historians have linked, e.g., demographic changes to the rise and fall of the Roman Empire1 . Demographic growth also helped the industrial revolution in Britain and the rise of the United States. More recently, demographic changes are said to have spurred the economic development of the Asian tigers.

From demographic boom to bust

Nowadays, our global demographic journey is taking a new turn. By 2086, the UN projects that the global population will start to decline for the first time since the 14th century, this time not driven by war or famine, but by globally falling birth rates. As education levels and access to contraception improved and households became richer, the average family size decreased. This trend has developed across regions and cultures. In Europe and North America, fertility is already lower than the replacement level, with fertility rates in 2021 at 1.6 and 1.75, respectively. In Latin America and Asia, fertility rates are close to the replacement level of 2.1 children per woman, ith fertility rates in 2021 at 2.0 and 2.1, respectively. Only Africa has a high fertility level of 4.2, but even there, birth rates are declining rapidly. The global fertility rate in 2021 was 2.4. The UN therefore forecasts that global population will most likely not surpass 10.4 bn people (see figures 1 and 2). The global population is already around 8 bn people.

The UN population projections might even be inflated. Some demographers question underlying assumptions such as Africa’s slow demographic transition and the convergence in the developed world and in China towards the respective replacement levels. According to the Institute for Health Metrics and Evaluation, and the International Institute for Applied Systems Analysis, 10 bn people would constitute a possible upper bound for the world population, which might already peak by 2050.

Turning the pyramid upside down

Regardless of the exact scenario, it is clear that the remaining population growth will be driven more by the ageing of the current population than by increasing birth rates. That will cause major shifts in age pyramids across the globe. According to the UN, by the end of the century, the number of 65+ year-olds is expected to almost quadruple (see figure 3), while the number of 0-19 year-olds is expected to remain stable and the working age population will only increase by 30% (an average of 0.3% growth per year this century).

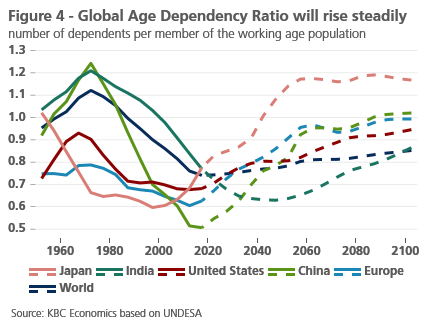

As a consequence, the global dependency ratio has bottomed out in 2015 and will start rising steadily through the course of the century. In some regions, the shift is more abrupt. China’s and the EU’s dependency ratios bottomed out at 0.6 and 0.5 respectively and are expected to reach 1.0 in both regions by the end of the century. Japan, which already started ageing rapidly last century, is expected to have a staggering dependency ratio of 1.2 (see figure 4).

Demography will pressure the economy

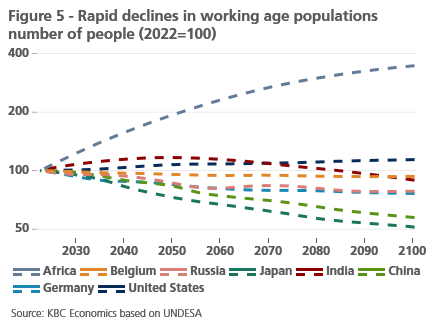

This evolution will have a big impact on the global economy. A shrinking labor pool limits an economy’s growth potential as fewer people can produce goods and services. The growth slowdown in the global working population is a major cause of the decline in potential economic growth. The most rapidly ageing countries will obviously be hit most severely. Russia and Germany will see their working age population decline by around 20% relative to today in this century (see figure 5). In China and Japan, the working age population will nearly halve. In contrast, the US will see its working age population increase by 14%, mainly due to high net migration. India’s working population will increase by 17% in 2050 and then decline steadily in the second half of the century. Africa’s working age population will more than triple.

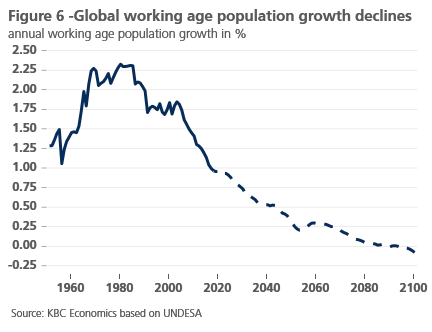

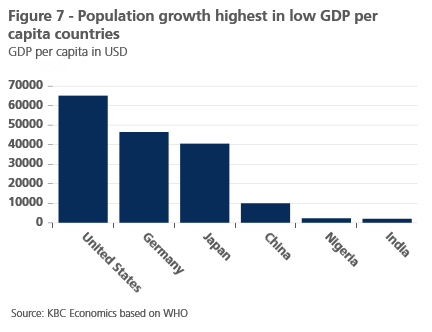

Globally, working age population growth will slow dramatically versus past decades (see figure 6). This will severely constrain global potential growth if not compensated by strong productivity increases. The regional composition of the labor force might exacerbate this worrying trend further. As we mentioned, the available labor force will diminish in high-productivity regions such as Eastern Asia & the EU and increase in low-productivity regions such as India & Africa, where GDP per capita is 20 to 30 times lower than in Western countries (see figure 7).

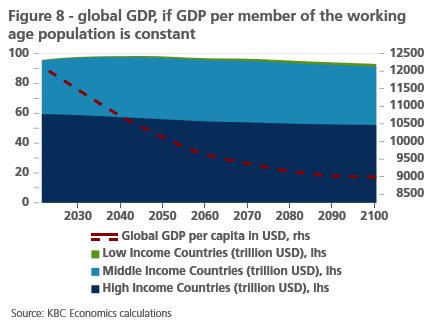

To estimate the impact of both the lower global working age population growth and the effect of the unfavorable regional composition on the global economy, KBC Economics made a simulation. We simulate the impact of demography on GDP per capita, leaving all other growth factors unchanged. By doing so, we can isolate the pure impact of demographics. Obviously, other factors (discussed below) will compensate some of the losses and drive up GDP per capita. We separated the world into the three income categories used by the World Bank – high, low and middle income – and assumed GDP per working person remains constant at 2021 levels in each of the income categories. The results are unsettling. The global economy would only grow by 2.6% in the next 20 years and decline by 3% in 2100 vs current levels. Global GDP per capita would decline by more than a quarter. Contrary to last century, our current demographic outlook will clearly hinder economic growth (see figure 8).

Thankfully, the demographic shift doesn’t operate in a vacuum. Other trends might counterbalance its stagnating effect. In the following sections, we’ll explore how other factors such as technology, increased participation, migration and catch-up growth in Africa and India could counterbalance this effect.

Technology to the rescue

In 1943 Thomas Watson, chairman of IBM, said, "I think there's a world market for maybe five computers." That turned out to be spectacularly wrong. Over the past decades, computing power has been growing exponentially. The average iPhone has over 100,000 times the processing power of the computer that landed the first man on the moon 53 years ago. An estimated 80% of the global population now owns a smartphone.

The IT revolution is far from over. Technologies such as AI, blockchain, robotics, self-driving cars and 3D-printing have yet to reach their full potential. In the coming decades, they are likely to transform every sector of the economy. According to the OECD, 14% of current jobs are at high risk of automation and another 32% could significantly change in the future. This leaves plenty of upward potential for productivity increases in Western economies, which have been limited in recent years.

The demographic shift itself might rapidly accelerate the adoption of these new technologies as firms facing scarcer and more expensive labor are more inclined to re-engineer their processes in order to keep costs down. A recent study by Daron Acemoglu, an MIT economist, found that ageing alone explains 35% of variation of robot use among countries. A growing demand for IT solutions, along with their rapid development might support productivity growth.

A further positive evolution is the speed at which technology disseminates within the global economy. This was laid out by the IMF in its 2018 Global Economic Outlook. Over the past decades, cross-border patent citations have steadily increased both within continents and across continents, driven by increased globalization, improved education, and increased access to better communication technology. This increased diffusion has provided important benefits to emerging economies. The IMF estimated that from 2004 to 2014 foreign knowledge accounted for about 0.7 percentage points of their labor productivity growth a year, compared with 0.4 percentage points of annual growth during 1995–2003. As education and access to communication and translation technology further improves, this contribution might even further increase in the future. This would be welcome news to regions with high population growth such as Africa (see further).

Participating is more important than winning

Higher participation rates might also ease the pressure on global labor markets. Two important trends can be of vital importance here.

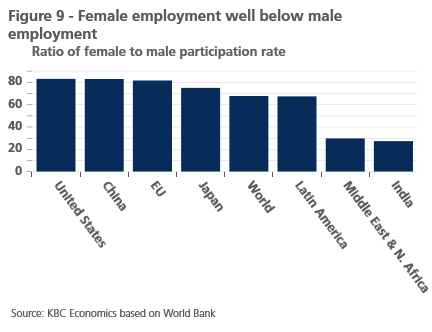

A first one is the increase in female participation rates. Across the globe, improvements in women’s education and women’s rights have led to sizable improvements in women’s participation rates in the labor market. Yet there is further scope for improvement. Globally, participation rates of women are about a third lower than men (see figure 9). If participation rates were equal, the global workforce would be 20% higher today. The gap is particularly big in emerging economies such as India, where the female participation rate is 70% lower than the male participation rate. But even in regions with unfavorable demographics such as the EU, Japan and China, female participation rates are around 20% lower than male participation rates. Tighter labor markets in these ageing countries might spur governments to improve working conditions for women. In rapidly ageing Japan, the Abe government introduced policies such as lower tax rates for married women, better-compensated family leave, enhanced child-care availability, and targets for women’s representation in business leadership, among others. Its female-to-male participation ratio increased by 10% in the past two decades. Other ageing countries might take similar measures.

Another important trend is the increased participation of the elderly population. Though COVID has recently reduced participation rates (see our November research report), in the long run, participation rates will trend back upwards, underpinned by two major drivers.

Improvements in public health are one important driver. Global healthy life expectancy has increased from 57 years in 1990 to 63 years in 2016. COVID will definitely present a setback. Nonetheless, after the pandemic, the trend towards longer healthier lives is likely to continue, thanks to medical developments such as mRNA-vaccines, immunotherapy, CRISPR and nanotechnology. When people live longer healthier lives, they are likely to participate for longer in the labor market.

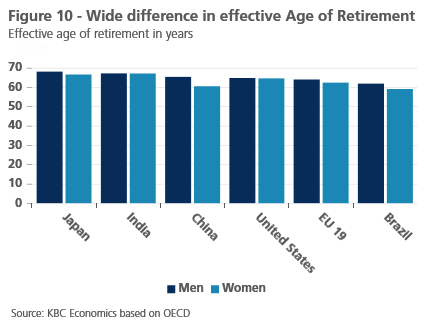

A second driver is the pressure ageing generates on public finances. As pensions and medical care eat away an ever-increasing portion of public budgets, raising retirement ages becomes increasingly necessary for governments. Case in point is again Japan, the most rapidly ageing major economy, which has recently increased the retirement age to 70 (see figure 10). Many other governments are likely to follow Japan in its footsteps.

Can labor migration boost the global economy?

Increased labor migration could be another way to counteract the stagnating effects of the demographic shift. By moving from a country with poor institutions and infrastructure to a more developed country, immigrants vastly increase their earning potential and contribution to the global economy. Immigrants (with a job offer) who move from India to the US quintuple their earnings on average, while those from Nigeria increase their earnings more than tenfold in PPP terms .

Migration can also speed up catch-up growth in developing countries. Research has shown diaspora networks and return migrants to have a positive and significant effect on the growth and export diversity of small and medium enterprises in countries of origin through technology transfer . Emigrants also send about 700 bn USD annually to their origin countries, a larger sum than all development aid combined.

Governments might become more open to labor migration as their working populations decline. Germany’s new government, e.g., announced last year it would ease the path to citizenship and loosen family reunification rules. Interestingly, Germany is one of the fastest ageing countries in Europe.

The elephant in the room

The most important way to ease the stagnation pressures of shifting demographics would be to further increase productivity in developing countries. As we mentioned, further integration in the global economy of India and especially Africa would be critical in this respect. The COVID-crisis hit Sub-Saharan Africa hard, unfortunately. Poorer governance, less developed healthcare systems, constrained government budgets, limited homeworking and homeschooling infrastructure, an overdependence on the tourism industry and limited access to vaccines made the COVID-crisis especially painful for poorer countries. Rising food prices and subsequent instability will only make matters worse. That’s why the IMF expects Sub-Saharan Africa’s growth to be lower than 4% in 2022 & 2023, its rapidly growing population notwithstanding.

Yet looking further ahead, demographics will improve the economic prospects of the region. Contrary to the western world, declining birth rates are likely to benefit poorer countries. When families grow smaller, the education budget parents allocate per child increases. New education technology will further improve matters. Human capital in poorer countries is therefore likely to grow fast, which will increase productivity.

Countries shifting from high birth rates to low birth rates also generally experience what is called a demographic dividend, a period of time during which their dependency ratios are very low and GDP per capita increases as a result of an increased labor pool.

The declining labor pool and related labor shortages outside of Africa are likely to spur multinationals in the manufacturing sector to transfer production capacity to the continent where labor will be plentiful. In the service industry, increased broadband access, along with an increased adoption of homeworking and translation technology will open further opportunities for delocalization. Thanks to these developments, international companies will have easier access to cheaper labor in developing countries and local companies will be able to more easily export their services. This increased delocalization will speed up technology transfers and boost productivity.

Time to update our simulation

The economy clearly doesn’t operate in a vacuum and the drag caused by slower demographics is likely to be compensated by other trends. To make a more realistic simulation of possible future growth, we therefore assumed labor productivity would increase by 1.27% in the coming years in high income countries (the OECD average in the last three decades). We also assume that middle- and low-income countries will see their productivity increase by an extra 1% and 2%, respectively, as technology transfer continues.

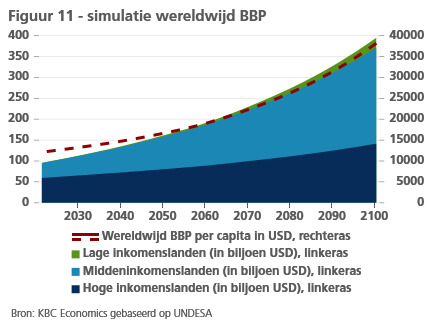

In this more realistic simulation (see figure 11), productivity and catch-up growth easily compensate for demographic headwinds. High-income countries would still grow at an annual average of 0.4% this century, middle-income countries at 2.1%, and low-income countries at a healthy 4.9%, sustained by both demographic and productivity growth. GDP per capita would more than double in high-income countries over the century to 108,000 USD, in medium-income countries it would quintuple to 32,000 USD, while in low-income countries it would increase fifteen-fold to 9,700 USD. Overall, global GDP per capita would triple to 38,000 USD.

Conclusion

The decline in working age population will pose a massive challenge to the global economy as it will hamper GDP growth. Thankfully, humanity is likely to adapt to this new reality by adopting new technology, allocating existing technology better, increasing participation, allowing more migration and integrating poorer countries further in the global economy. Demographic changes will challenge growth in the coming years, but fears of prolonged stagnation might be overblown. Though the global is unlikely to grow as fast as last century, it will still grow healthily. Demography might not be destiny after all.

1David C. Baker, 2014, "Demographic-Structural Theory and the Roman Dominate".

2Werkgelegenheidsvooruitzichten OESO 2019

3Acemoglu & Restrepo , 2021, "Demographics and Automation", The Review of Economic Studies.

4Lessons from the rise of women’s labor force participation in Japan (brookings.edu)

5Clemens, Michael, Claudio Montenegro, and Lant Pritchett,

2009, “The place premium: wage differences for identical workers across the US

border." HKS Faculty Research Working Paper Series

6Stephen Gelb and Aarti Krishnan, 2018, “Technology,

migration and the 2030 Agenda for Sustainable Development”