Some respite for emerging Asia amid a myriad of risks

China’s economy is grinding into slower gear due to internal and external headwinds. Several economies in the region are vulnerable to adverse developments in China given extensive trade and investment links. Despite China’s growth deceleration, the still-unresolved trade war, and general emerging market financial turbulence midway through last year, growth in the region held up reasonably well through 2018. Furthermore, easier financial conditions thanks to a shift in expectations for monetary policy normalization in advanced economies is growth supportive. There are, however, signs of weakness on the horizon. Risk aversion among investors remains high and there are indeed several risks that could still present significant headwinds to growth in emerging Asia going forward. Such risks include a sharper than expected global growth slowdown or a deterioration of the ongoing trade war negotiations.

Strong regional trade ties

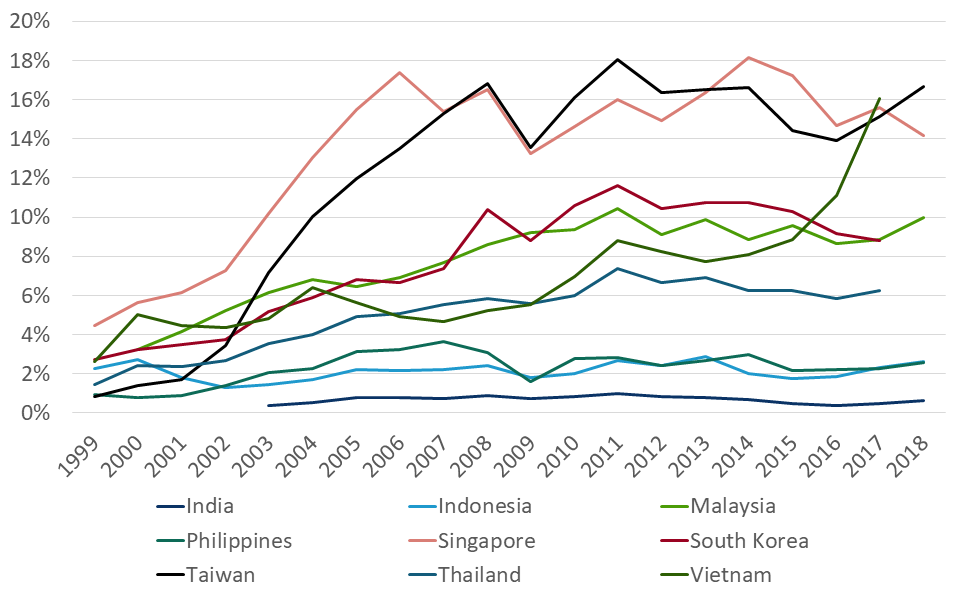

Since China joined the World Trade Organization in 2001, economic ties between China and other regional economies have grown significantly alongside the rise of complex supply chains. Many countries in the region are very open economies. Export-to-GDP ratios range from around 20% in India and Indonesia, to around 70-80% in Malaysia, the Philippines, Taiwan and Thailand, and above 100% and 200% respectively in Vietnam and Singapore. For many of these economies, trade with China accounts for a substantial portion of these exports (Figure 1). As noted in a recent opinion, these exports to China are both intermediate inputs for China’s exports and goods related to final domestic demand in China. An economic slowdown in China, whether due to internal developments or the US-China trade war, is therefore likely to lead to lower growth in many neighbouring countries as well.

Figure 1 - Exports to China (% of GDP)

Moderating growth prospects

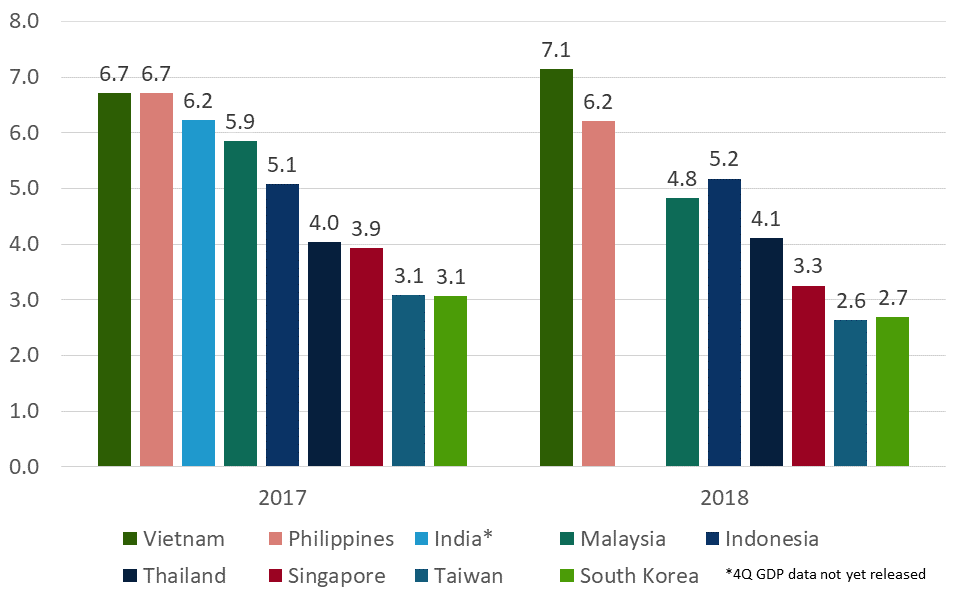

The Chinese economy is indeed slowing, with real GDP growth decelerating from 6.8% yoy in H1 2018 to 6.4% yoy in Q4 2018 (see Box 1 in the February Economic Perspectives for details). Though the economies of some neighbouring countries decelerated between 2017 and 2018 as well, overall growth in the region held up well (Figure 2).

Figure 2 - Annual GDP growth rates (%)

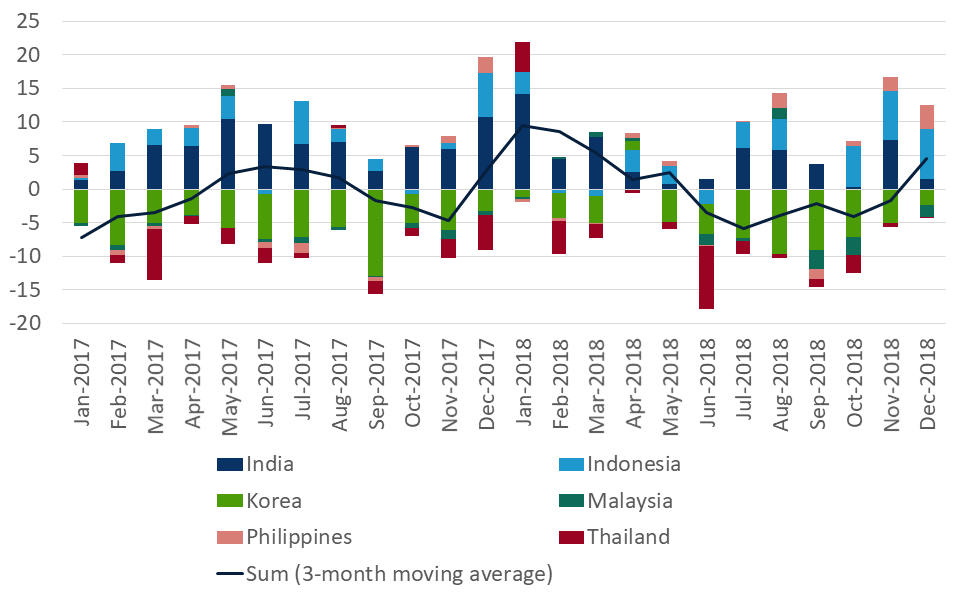

More frequent data, however, suggest growth may be weighed down in the coming months. Manufacturing PMIs for China, Indonesia, South Korea, Malaysia and Taiwan have all dipped below 50, the threshold between expansion and contraction. In Indonesia, the Philippines, South Korea, Taiwan, and Vietnam, industrial production contracted month-over-month in both November and December. In year-over-year terms, industrial production looks sluggish as well in several Asian economies, save for Indonesia. Finally, exports in the region appear to be drifting down since October (Figure 3). Export weakness and a downturn in manufacturing sentiment may suggest cooling demand from China is indeed affecting regional trade. The weakness could also reflect concerns about the electronics sector (a crucial export sector for the region) given the slowdown in global growth and a stark revenue warning from Apple at the beginning of the year.

Figure 3 - Emerging Asia monthly exports by destination

Global central banks provide breathing room…

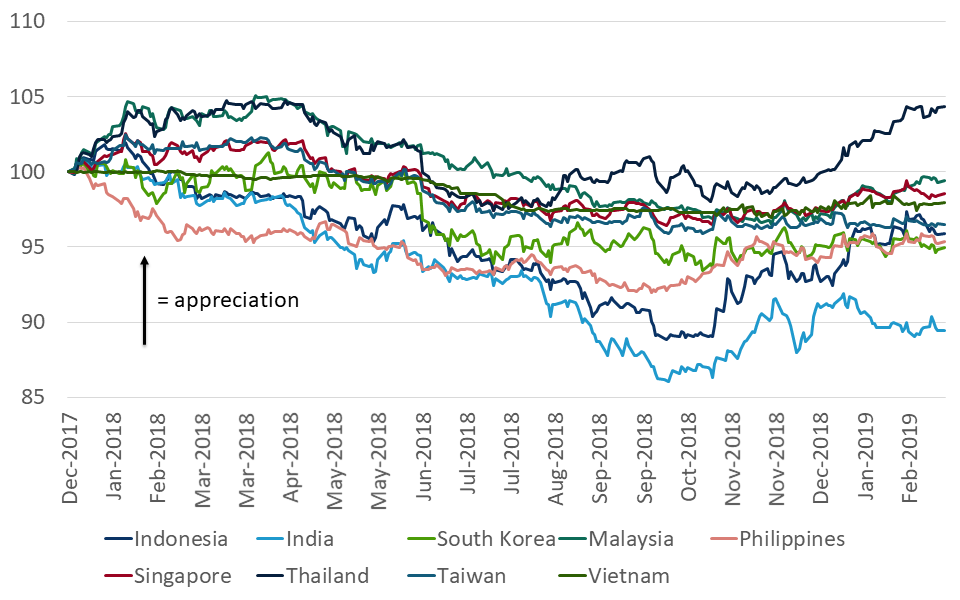

2018 was a turbulent year for emerging markets as expectations for continued tightening by the US Federal Reserve, and expectations for the start of policy normalisation in other advanced economies like the euro area, meant tighter financial conditions globally. Combined with concerns about debt sustainability in emerging markets in general, and some idiosyncratic crises in Turkey and Argentina, emerging market assets took a significant hit. As seen in Figures 4 and 5, the currencies of several Asian economies depreciated notably against the US dollar throughout most of 2018 while inward capital flows declined.

Figure 4 - Asian currencies vs USD (29/12/2017 = 100)

Figure 5 - Net capital flows (USD billion)

However, towards the end of last year, many of these currencies levelled off or even rebounded. Since the third quarter, capital flows have rebounded as well. This shift coincided with shifting expectations for the path of Fed policy. Whereas communication from Fed officials in October suggested US interest rates were still far from neutral, the Fed is now clearly in assessment mode and an extended pause, or even a full stop to the current hiking cycle is possible. Fed officials have also hinted that the size of the Fed balance sheet may remain higher than previously expected, translating into more liquidity in the global financial system. At the same time, given the current slowdown in the euro area and the ongoing lack of inflationary pressures, the ECB is also in assessment mode, with a first policy rate hike likely only coming at the end of 2019 at the earliest.

…giving smaller central banks space to pause

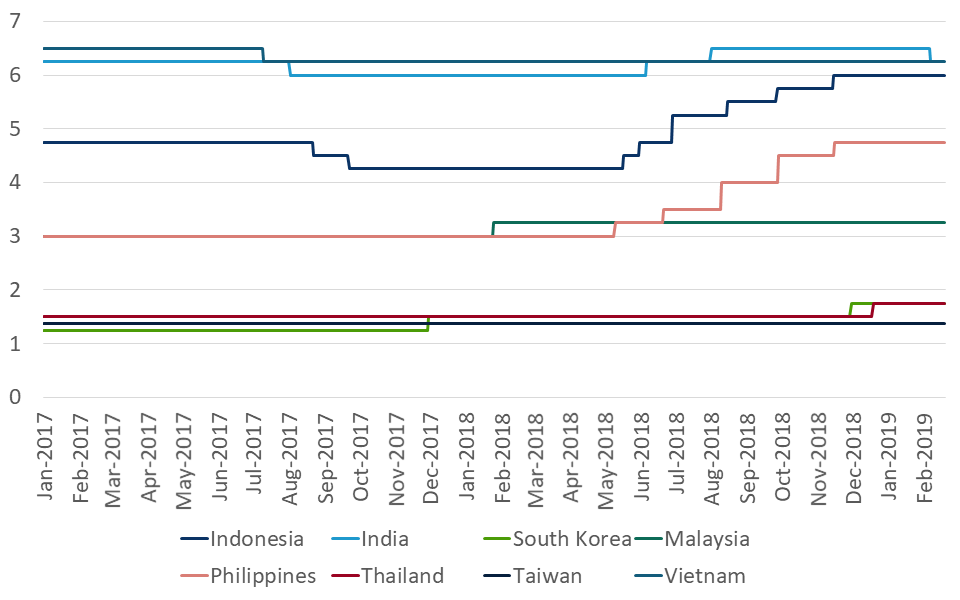

In response to last year’s market turbulence, several central banks in Asia embarked on hiking cycles (Figure 6).

Figure 6 - Monetary policy rates (in %)

Over 2018, the central banks of Indonesia and the Philippines both raised their policy rate by 175 bps, the Reserve Bank of India (RBI) raised rates by 50 bps, and the central banks of South Korea, Malaysia and Thailand all raised rates by 25 bps. Now, however, most of these central banks appear to be in assessment mode as well, with the RBI even cutting rates in February by 25 bps. Policymakers in these countries have room to be less hawkish thanks to both the shift in expectations for global liquidity conditions through 2019 and subdued inflation pressures (Figure 7).

Figure 7 - CPI inflation (% yoy)

The easier monetary policy stances, as well as stronger capital inflows, should be supportive of growth in the region. At the same time however, international investors remain wary of rising risks and a full reversal of the tighter financial conditions seen over 2018 is not likely. The trade war between the US and China is still unresolved and the risk of further escalation remains. Aside from the trade war, the Chinese economy faces internal headwinds as the authorities grapple with containing leverage and shifting towards a ‘high-quality’ growth model, while also maintaining economic and social stability. Given the important links between the Chinese economy and other economies in the region, a slowing China is worrisome for said economies’ growth prospects. Asian economies are not insulated from developments in the rest of the world either, and growth in both the US and the euro area is expected to moderate in 2019 as well. As such, despite some respite in terms of easier monetary policy and financial conditions, risks still abound for emerging Asia.