Robust recovery of Belgian car market in 2023 masks structural saturation

With no fewer than two new, non-classic automotive events at Brussels Expo (Brussels Auto Show on January 17-21 & Automotive eMotion Summit on February 20-22), the car sector is once again in the spotlight in the coming weeks. Significantly more new car registrations in 2023 give the events wind in their sails, although the number of registrations remains well below pre-pandemic figures. Notable is the ongoing transformation toward fleet electrification. More structurally, car ownership in Belgium is approaching its saturation point, with car sales being driven mainly by replacement demand. When exactly the "peak car" moment will be reached, however, is difficult to say and depends on both demographic factors and changes in mobility behaviour.

According to figures from sector federation Febiac, 476,675 new passenger cars have been registered in Belgium in 2023. This is a sharp increase (+30%) compared to 2022, when car sales had reached their lowest level since 1995. Despite the strong recovery, the 2023 number of registrations did remain well below the 2019 pre-pandemic figure, when that number peaked at just over 550,000. The better 2023 figure is remarkable in a number of ways and requires clarification and nuance.

First, the recovery should be seen in light of earlier production problems in the auto industry, including a global chip shortage. These caused particularly long delivery times. Many cars ordered in 2022 were not delivered until 2023, pushing up registrations in that year. In the past, new car registrations generally coincided well with consumer confidence (figure 1). 2021 and 2022 were an exception. Through 2023, confidence improved and that year household consumption was a major driver of GDP growth in Belgium. The recovery in auto registrations was in line with this.

On the other hand, the robust recovery surprises in light of changing mobility behaviour. Although the car continued to occupy a dominant position, its share of total travel decreased in recent years. According to the latest study by the Flemish government on the travel behaviour of the Flemish people, that share dropped from 65% in 2019 to below 60% in 2022. Perhaps this is partly related to the constraints and aftermath of the pandemic (e.g., more telework). The delayed delivery of many cars may have mitigated or even reversed the trend of lower popularity of travel by car in 2023. The fact that there were never before such heavy traffic jams on Flemish roads as in 2023 is an indication of this.

It is also notable that the Belgian market in 2023 was driven by an increasing share of electrified cars (see also KBC Economic Research Report of November 16, 2023 "The rise of electric cars in Europe"). Almost half of the cars newly registered in Belgium last year were electric, coming from one third in 2022. Specifically, plug-in hybrid, self-charging hybrid and fully electric cars had market shares of 21.0%, 7.6% and 19.3%, respectively. For gasoline and diesel cars, the market shares were 42.4% and 8.9%. The success of electric cars can be largely credited to the commercial vehicle market. More than nine in ten electric cars newly registered in 2023 were copany cars.

More generally, company cars accounted for about two in three newly registered cars in 2023. The increase in the proportion of company cars is probably partly explained by the strong job creation in recent years. A portion of newly hired employees were eligible for a company car. The fact that more employees are opting for a car within a cafeteria plan may also have to do with doubts about what vehicle type is the best when buying an own car and with the still high price of electric cars. Meanwhile, some 25% of employees with a permanent contract in Belgium have a company car.

"Peak car" moment approaching

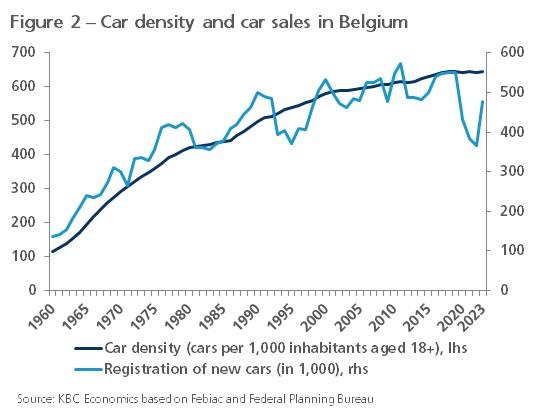

2023 may have seen a strong rebound in registrations, but the number remained well below the peaks reached earlier. This confirms that the Belgian market is stagnating, with car ownership (i.e., the number of cars per 1,000 population aged 18+) no longer growing strongly and car sales largely driven by replacement demand (figure 2). That car ownership is approaching its saturation point is not surprising given that Belgium is among the countries with the highest vehicle density in the world. However, when the "peak car" point (the maximum number of cars that will ever circulate) will be reached in Belgium is difficult to say precisely and depends on both demographic factors and changes in mobility behaviour.

A simple calculation shows that at an unchanged car ownership rate, from a demographic point of view (i.e. taking into account only the increasing number of citizens aged 18+ and leaving aside the replacement demand) there would only be a need for about 30,000 additional cars per year in Belgium in the period until 2030. However, societal, technological and other changes (e.g. car-sharing, telework, climate change, growing traffic congestion, higher cost of car ownership, car discouraging government policies) may lead to a less car-dependent lifestyle. Vias Institute's mobility barometer shows that young adults in particular are driving less and less by car.

Over the past half century, increasing car ownership in Belgium has been driven by growing prosperity (allowing families to own more than one car) and increasing driver's license ownership as well as higher life expectancy among the elderly (allowing them to drive longer). These effects are fading, or diminishing, and the mobility behaviour of younger age cohorts is likely to carry more weight. The "peak car" moment may therefore be close at hand.