Oil market in 2021: a vaccine-led rebound

The global oil market has experienced a year like no other in its history. After a period of unprecedented turbulence caused by the outbreak of the Covid-19 pandemic, oil prices stabilised in mid-2020. Most recently, prices picked up strongly following the positive vaccine news, as well as a less-than-feared hit to oil demand from the virus’s resurgence. Furthermore, the OPEC+ alliance agreed to extend the 7.2 million barrels per day output cuts, underpinning the market’s rebalancing until the vaccine-led rebound in oil demand fully materialises. On the flip side, the December OPEC+ agreement introduced a new modus operandi with regular monthly meetings, implying potentially higher market volatility amid the looming risk of no-deal. Overall, we believe that oil fundamentals are on the right track for higher oil prices. As a result, we have upgraded our oil price outlook, now expecting Brent crude to rise towards 55 USD/barrel by the end of 2021.

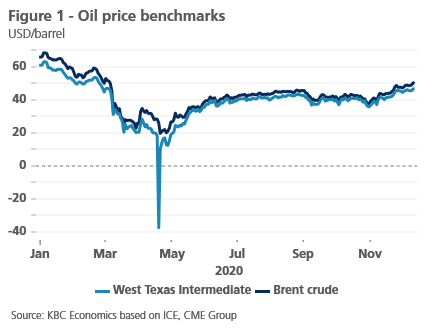

The year 2020 has been an unprecedented one for the global oil market. The outbreak of the Covid-19 pandemic triggered a major collapse in oil prices, exacerbated by a short-lived, yet aggressive Saudi Arabia-Russia price war. A simultaneous negative demand and positive supply shock left the market drowning in supply, with the US crude oil benchmark, West Texas Intermediate, plunging even into negative territory. After a period of historic turbulence, oil prices stabilised in mid-2020, helped by a gradual recovery in oil demand, together with renewed production cuts of 9.7 million barrels per day by the OPEC+ alliance.

A sentiment shift along with stronger underlying demand

Most recently, Brent crude has rallied above 45 USD/barrel on the back of positive vaccine news (figure 1). The higher-than-expected efficacy of leading vaccines candidates sparked a sentiment shift in the oil market, discounting the more optimistic outlook for a post-pandemic future. Across financial markets, other (cyclical) commodities, as well as stocks markets, have seen similar reflation trends.

At the same time, the underlying fundamentals appear supportive of higher oil prices. The oil forward curve has flipped into backwardation, a bullish signal that demand is currently running above supply. This suggests that demand destruction from the second wave of the pandemic has been less severe than feared, with Asia absorbing a large part of the hit from European lockdowns. Nonetheless, oil demand remains fragile, running around 90% of the pre-pandemic level (compared to around 75% at a peak hit from lockdowns in April) with some notable imbalances across refined products, such as still sluggish jet fuel consumption.

Despite some possible softness during winter months, the more optimistic demand outlook is set to gradually emerge through 2021. In line with our December economic outlook, we expect a gradual normalisation in economic activity, accelerating in the latter part of next year along with meaningful progress towards herd immunity through the widespread vaccination. That is to say, a more upbeat macro backdrop should set the stage for a vaccine-led rebound in oil demand, though a full recovery to the pre-pandemic level is not projected before 2022.

OPEC+ supports prices, but changes a modus operandi

On the supply side, the actions taken by OPEC+ to stabilise the market remain a critical factor underpinning prices. The Saudi-Russian-led coalition slashed output by 9.7 million barrels per day in May and June, and by 7.7 million barrels per day through the rest of the year. In early December, the group agreed to extend the 7.2 million barrels per day production cuts through January 2021, implying a moderate output hike of 500,000 barrels per day. While the new deal falls slightly short of expectations (i.e. a rollover of the current curbs), the outcome is significantly more bullish in comparison with the original plan for a 2 million barrels per day production increase.

Importantly, the OPEC+ alliance also came to an agreement to hold regular monthly meetings to examine market conditions and decide on the future production policy. The monthly adjustment should not exceed 500,000 barrels per day in either direction. In our view, such a shift in a modus operandi gives OPEC+ more flexibility but adds to uncertainty ahead of the coming meetings. As a result, we may see higher market volatility amid the looming risk of no-deal, particularly if compliance weakens substantially across the 23-nation coalition.

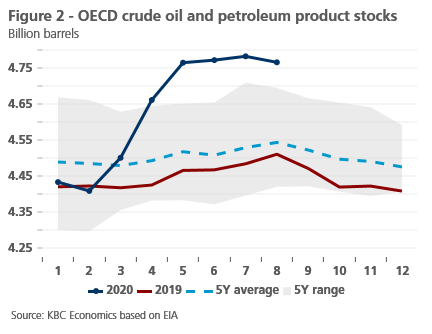

We estimate that the December OPEC+ agreement will keep the oil market in a deficit at the beginning of 2021, implying a further unwinding of the pandemic-induced supply glut (figure 2). In other words, our baseline scenario assumes that the alliance is set to support oil prices until the vaccine-led rebound in oil demand starts to materialise. Against the background of a sustained oil demand recovery, OPEC+ should be then able to ease the output cuts without derailing the market rebalancing and putting downward pressures on oil prices.

Oil fundamentals on the right track for higher oil prices

Still, the oil market faces a number of risks, most of them tilted to the downside. Besides the tail risk of no deal on OPEC+ production cuts, the key supply-side risk is a return of Iran to the global oil market. Conditional on the lifting of the US sanctions under a Biden administration, this could bring back online approximately 2 million barrels per day. The demand outlook, however, remains the biggest uncertainty and risk for the oil market, reflecting the speed of a normalisation of socio-economic activity in the post-pandemic period.

Overall, we believe that oil fundamentals are on the right track for higher oil prices. We have, therefore, upgraded our oil price outlook for 2021. Despite some possible sluggishness early next year, a vaccine-led rebound in oil demand is set to drive the market rebalancing further while boosting Brent crude towards our long-term estimate of 55 USD/barrel by the end of 2021.