Economic Perspectives December 2020

Read the full publication below or click here to open the PDF.

- Developments related to Covid-19 continue to shape the economic outlook and financial market sentiment. The better-than-expected efficacy of the frontrunner vaccines is a game-changer, providing some sense of clarity for consumers, businesses, and policymakers in terms of eventually containing the spread of the virus. The global economy is thus entering the ‘end phase’ of the pandemic, with a brighter economic outlook and reduced uncertainty going forward. The improvement in the macroeconomic landscape will nonetheless emerge only gradually after a softer patch in winter months, particularly in the euro area. Our economic scenario, therefore, assumes a gradual normalisation in economic activity, with an acceleration in the latter part of 2021 on the back of meaningful progress towards herd immunity through mass vaccination. However, the uncertainty surrounding the outlook remains substantial.

- The euro area started the fourth quarter on a positive note, but the new lockdowns interrupted the recovery. High-frequency data suggest that services are once again more heavily affected while industrial activity remains robust. Though the economic impact from renewed lockdowns will be milder than earlier this year, a contraction in GDP in Q4 2020 is very likely and subdued activity through Q1 2021 is projected. The outlook beyond this horizon is, however, gradually improving, reflecting the widespread roll-out of vaccines and additional fiscal support through various EU programs. We have improved the growth outlook for the euro area to 2.4% in 2021, up from 1.9% previously, while keeping our annual growth forecast for 2020 unchanged at -7.5%.

- At the time of writing, it is unclear whether the UK will strike a limited trade deal with the EU before the completion of its exit from the bloc on December 31st. Major differences in priorities and approach have dogged Brexit negotiations from the start despite the clear reality that both sides will suffer economically, and UK losses will be much more severe in the event of a ‘no deal’ exit. While the prospective scale of economic losses in the near term resulting from no deal would be very modest compared to the impact of the pandemic, it does imply a markedly more limited recovery for the UK and an unwelcome headwind facing those countries that trade significantly with the UK.

- US economic activity appears somewhat resilient despite a record-breaking rise in new Covid-19 cases. In the absence of widespread lockdowns, high frequency data point to better momentum in activity compared to Europe, both on the consumer and business side. While the risks related to a contested election have declined, the near-term evolution of the pandemic and the potential fiscal stimulus gridlock remain major concerns. However, we do expect a new fiscal package to be approved, which together with the imminent vaccine roll-out will put the US on track towards a gradual normalisation of economic activity. Overall, we have marginally upgraded our real GDP outlook to -3.6% from -3.7% in 2020, with a knock-on effect for annual growth in 2021, which was revised up from 4.0% to 4.2%.

- Following the positive vaccine news, financial markets have seen two distinctive trends. One is a reflation tendency in stock and commodities markets in anticipation of an economic normalisation and the ‘end phase’ of the pandemic. Meanwhile, bond markets continue to factor in a persistent accommodative monetary policy stance on the back of both near term virus resurgence risks, current downward inflationary pressures and the forward guidance of central banks. Still, we see some room for limited upward movements in long-term government bond yields going forward, particularly in the US and to a lesser extent in the euro area. In the currency markets, the euro has gained a foothold above 1.20 EUR/USD. We expect to see a further structural strengthening of the euro vis-à-vis the US dollar towards 1.25 by end-2021.

With large parts of the world still in the grip of the virus, the global economy remains in pandemic mode heading into the end of 2020. Along with the major health crisis, causing a death toll of more than 1.5 million across the globe, the outbreak of the Covid-19 has left the global economy on track for the worst contraction in decades. However, for the first time since the virus began spreading, there is now justified hope of a clear path out of the crisis thanks to encouraging news on a number of effective vaccines. Against this background, we believe that the global economy is entering the ‘end phase’ of the pandemic, brightening the economic outlook for 2021.

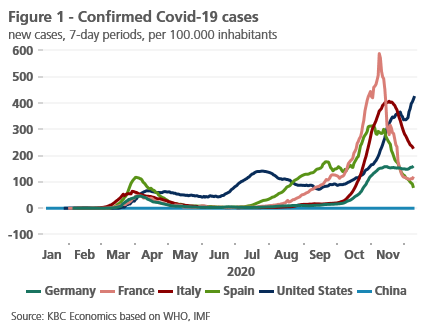

An improvement in the macroeconomic landscape is nonetheless set to emerge only gradually after a soft patch in the coming months. This is because the positive vaccine developments – while promising - do little to help the near-term outlook, which remains clouded by the headwinds from the second wave of Covid-19. The good news is that the major European countries appear to have turned a corner, posting declining numbers of new confirmed cases. The outbreak in the US, in contrast, continues to set daily new records (figure 1). The bad news is that the governments in Europe have flattened the curve only through renewed lockdowns, significantly dampening the momentum in economic activity gained in the third quarter. Furthermore, despite some tentative easing, we expect the strict restrictions to remain in place through the winter months, carrying this weak underlying momentum into early next year.

A post-pandemic economy is now within the reach

Looking beyond the near-term sluggishness, especially in the euro area, there is a good reason to be more optimistic than in our November outlook. This is due to the developments on the vaccine front in the past weeks, namely a positive surprise on the high efficacy of vaccines. Both Pfizer and Moderna trials reported efficacy rates of 95%, significantly above the 50% threshold for approval. AstraZeneca, a third major drug company to report late-stage results, showed its vaccine to be about 70% effective in preventing disease. The exceptionally high efficacy rate is particularly important since it implies – all else being equal – fewer vaccinations to achieve ‘herd immunity’, or an earlier normalisation of socio-economic activity. Additionally, we think that effective vaccines are critical to bring the pandemic under control, which will help reduce elevated uncertainty, while boosting sentiment and allowing consumers and businesses to start planning for the post-pandemic future.

A gradual vaccine roll-out has already begun in the UK, and the US is likely to begin vaccinations by mid- to late-December 2020. In the European Union, a roll-out is likely to kick off at the beginning of 2021 with all Member States having access to vaccines at the same time on the basis of population size. The governments have already indicated that the high-risk groups, i.e. health-care workers, elderly people and those with pre-existing conditions, will receive the first doses of vaccines. A wider roll-out should gain momentum with vaccine supply catching up over the course of 2021 across the advanced economies. While the recent vaccine news has materially reduced a major tail risk (i.e. a multi-year pandemic, or a relapse causing major economic damage), there remain downside risks, potentially hindering the speed of widespread vaccination. Among others, these mainly include the logistical challenges with the distribution or the scepticism towards the vaccine among parts of the population.

All this considered, our baseline economic scenario assumes a gradual normalisation in economic activity, accelerating in the second half of 2021 on the back of meaningful progress towards herd immunity. The widespread availability of rapid antigen tests, currently being developed, should also support the normalisation in advanced economies. Compared to last month, we have improved the growth outlook for 2021 in the euro area, as well as in the US. China, a global frontrunner in terms of a post-lockdown recovery, has seen minor growth upgrades too. In general, emerging markets should follow the course of advanced economies, though the recovery may be delayed in some of the least developed economies due to the more limited vaccine supply.

Although we are now confident about entering the ‘end phase’ of the pandemic, the uncertainty surrounding our outlook remains substantial. Hence, we continue to flag three scenarios: the baseline (a gradual recovery gaining traction from H2 2021 onwards), to which we attach a probability of 55%; the pessimistic (a disrupted and unsteady recovery) with the probability of 35%; and the optimistic (a sharp and strong recovery already in H1 2021) with a 10% probability.

Furthermore, we see a number of risks, roughly divided into three categories. The first is related to the virus evolution, namely new local outbreaks or the possibility of a third wave of the pandemic. The second relates to developments on the vaccine front that could affect the timing of reaching herd immunity. The third relates to political risks that are now skewed towards Europe with the Brexit negotiations in the final phase.

An interrupted recovery in the euro area

The first batch of hard data signals that the euro area entered the fourth quarter on a positive note. Retail sales, for example, picked up by 1.5% in October compared to the previous month, implying a further rebound above the pre-pandemic level. Still, the lockdowns in place since early November cast a shadow over the recovery, putting activity in the euro area under renewed pressure.

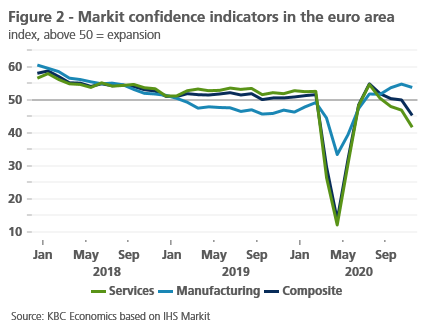

As a result, November sentiment indicators show a more accurate picture of the latest underlying dynamics of the economy. On the consumer side, the last month saw a notable weakening of confidence, according to the EC’s consumer confidence indicator, dragged down particularly by Spain and France, where the index dropped to the April lows. On the business side, the composite PMI for the euro area fell to 45.1, marking contraction territory, largely due to the services sector weakness (figure 2).

This should come as no surprise given the fact that services are most heavily affected by renewed lockdowns with restaurants, bars and non-essential shops closed in many countries. On a more positive note, we notice some offsetting effects from increased adaptability, e.g. robust online shopping (also see KBC Economic opinion of 24 November). In addition, some countries, such as France and Belgium, have already relaxed restrictions somewhat for the Christmas period; others, including Germany, have chosen a more cautious approach by extending most containment measures beyond Christmas.

While the services sector is weakening further, industrial activity remains robust. The November manufacturing PMI held up comfortably in expansion territory, further widening its gap with services sentiment. Euro area industrial output is supported by ongoing strong foreign demand, namely from China, and the absence of the spring-like global supply chain disruptions. Germany in particular, with its relatively large manufacturing sector, seems to benefit from this more benign international backdrop. German industrial orders picked up for the sixth month in a row in October, recording a first positive year-on-year figure since the virus outbreak (also see KBC Economic Opinion of 10 December).

Against the background of more targeted containment measures, a resilient industrial sector and extended fiscal support, we maintain our view that the economic impact from renewed lockdowns will be notably milder than earlier this year. We nonetheless expect an economic contraction for the euro area as a whole in Q4 2020 and subdued activity through Q1 2021 amid ongoing restrictions to avoid the virus’s resurgence. The outlook beyond this horizon is now more positive, reflecting a gradual onset of normalisation that will come with the roll-out of vaccinations. In the latter part of 2021, the recovery will be further underpinned by the disbursements of the EUR 750 billion Next Generation EU recovery plan (also see KBC Economic opinion of 23 November). All in all, we have improved the growth outlook for the euro area to 2.4% in 2021, up from 1.9% previously. Our annual growth outlook for 2020 remains unchanged at -7.5%.

The risk of ‘no deal’ Brexit increasing markedly

At the time of writing, the agreement of a narrow trade deal between the UK and the EU hangs in the balance with the risk of ‘no deal’ increasing markedly in recent weeks as last minute sticking points emerged that require political rather than technical compromises to be recognised and reached. Notably greater diplomacy than has been seen through the Brexit process will be needed in the coming days to avoid a last minute unravelling of fragile and still tentative arrangements that had suggested a deal was in sight.

Difficulties have persisted until the last moment to reach satisfactory solutions to longstanding difficulties in relation to State aid, a related concern over governance and dispute resolution, and the economically unimportant but politically sensitive area of fishing rights. Any resolution of remaining problems on these issues is likely to rely on cosmetic or temporary measures with the intention of arriving at more permanent outcomes through future reviews.

The difficulty in reaching more tractable solutions suggests that regardless of whether a deal is or isn’t reached, practical obstacles to EU-UK trade may arise in early 2021. Recent weeks have seen the realisation that movement of certain foodstuffs between the UK and EU (and possibly between Great Britain and Northern Ireland) could be banned or prevented even if a narrow deal is reached. While measures are being introduced to limit such impacts, similar, as yet unanticipated, difficulties could arise in other areas.

Reflecting the difficulties that have dogged negotiations, there appears to be a sense on the UK side that talks could run for another couple of weeks but logistical issues in getting the deal through a range of bodies mean that unless a deal is agreed over the weekend (12-13 December), all energies will shift to preparing for ‘no deal’. As a result, the EU moved to release contingency plans that will temporarily limit any extreme dislocation to trade and travel.

As trade with the EU is much more important to the British economy than trade with the UK is for the EU, prospective difficulties will fall far more heavily on UK-based businesses and households. With trade volumes depleted by the fallout from the pandemic, logistical problems and transport-related disruptions may be less marked in early 2021 than might earlier have been feared. Temporary contingency plans set to be introduced by both sides will also serve to reduce immediate disruptions. However, a Brexit related drag on activity will be a central feature of the UK economy in the coming year and will also have a materially adverse effect on those European economies who trade most closely with it.

The US economy shows signs of resilience

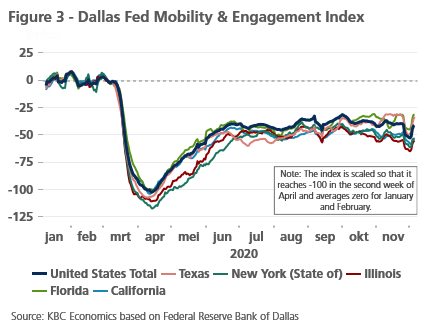

Approaching the end of 2020, the US economy appears on stronger footing than the euro area. Despite a record-breaking rise in new Covid-19 cases, the country has seen no widespread re-emergence of lockdowns at the national or state level as seen in the spring. In a handful of states, the most heightened level of restrictions includes business curfews, spacing and capacity restrictions. Perhaps more importantly, there is limited evidence that people alone (i.e. without the imposition of state-wide restrictions) have responded to the surge in new cases with an in-kind reduction in mobility. In fact, mobility has seen only moderate declines lately, implying a lesser hit to economic activity (figure 3).

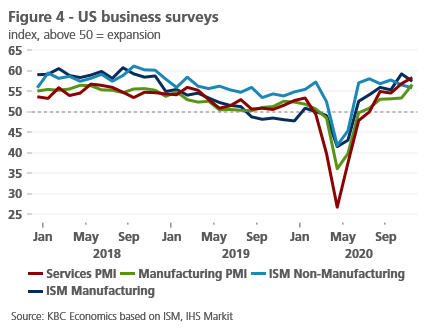

Along these lines, the incoming fourth-quarter high frequency data point to solid momentum in the economy. Retail sales, for example, rose 5.7% year-on-year in October, close to the highest annual increases in the last several years. Some news reports suggest Black Friday hit new records in spending, likely bolstered by elevated savings and incomes due to fiscal supports, as well as improvements in the labour market. With November’s consumer sentiment reading, it is hard to separate election factors from pandemic factors, but the usual indicators of spending, income and saving remained relatively stable albeit down on the month. Meanwhile, business sentiment remains upbeat with both ISM and PMI indicators entrenched well above the 50-threshold, signalling a continued expansion also in Q4 2020 (figure 4).

While the risk of a contested presidential election has declined substantially after a decisive Joe Biden win, important downside risks remain on the table. Besides the near-term evolution of coronavirus cases, the fiscal stimulus gridlock remains a major concern. Congress has so far been unable to reach an agreement on further fiscal support, and this is against the backdrop of an imminent deadline to avoid a government shutdown. Some elements of the fiscal relief introduced in spring have already expired, and others are expiring by year-end, such as some key unemployment insurance expansions in the CARES Act which have been integral to the consumer-led rebound seen in the second half of the year. The expiration of key fiscal supports would, in our view, start to weigh heavily on consumers as time passes with no new stimulus, ultimately challenging the resilience of the US economy in 2021.

However, we do expect a new fiscal package to be approved, which together with the imminent vaccine roll-out will put the US on track towards a gradual normalisation of economic activity. Overall, we have marginally upgraded real GDP outlook to -3.6% from -3.7% in 2020, which has a knock-on effect for annual growth in 2021, that was revised upward from 4.0% to 4.2%.

Two distinctive trends in the financial markets

Following positive news on the vaccine front, financial markets have seen a mixed reaction with two distinctive trends emerging. On the one hand, there are asset classes following a forward-looking reflationary trend, pricing-in already the more optimistic outlook for a post-pandemic future. The notion of entering the ‘end phase’ of the pandemic has been an important driver across stock markets, pushing the S&P 500 index to an all-time-high. Commodities have also experienced a reflation rally across the board, with oil prices, for example, surging more than 15% since the first announcement on vaccine safety and efficacy (see Box 1: Oil prices on an upward trajectory).

Box 1 - Oil prices on an upward trajectory

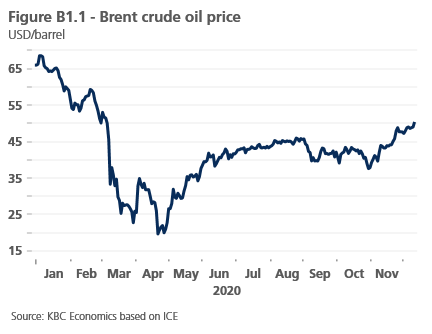

Following a period of range-bound oil prices, Brent crude has rallied above 45 USD/barrel on the back of positive vaccine news (figure B1.1).

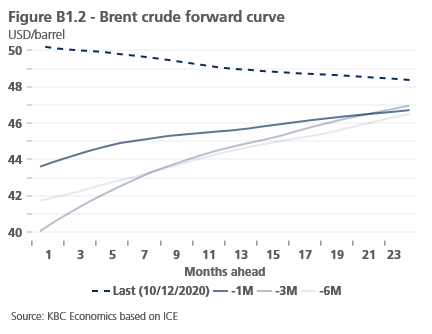

The surprisingly high efficacy rates of leading vaccine candidates triggered a sentiment shift in the oil market, discounting a strong post-pandemic recovery in the course of 2021. At the same time, the underlying fundamentals also appear constructive to higher oil prices. While it is true that the recovery remains fragile, demand destruction from the second wave of Covid-19 has not been as bad as feared, with Asia absorbing a large part of the hit from European lockdowns. As a result, the oil forward curve has flipped into a backwardation, a bullish signal that demand is currently running above supply (figure B1.2).

Furthermore, the OPEC+ alliance has agreed to extend the 7.2 million barrels per day output cuts through January 2021, implying a moderate output hike of 500,000 barrels per day. While this falls slightly short of what the market had expected, it is significantly more bullish in comparison with the original plan for a 2 million barrels per day production increase. Surprisingly, the Saudi-Russian-led coalition also came to an agreement to hold a regular monthly meeting to decide on the future course of output cuts (the monthly adjustment should not exceed 500,000 barrels per day in either direction). In our view, this gives OPEC+ more flexibility, but ultimately brings more volatility to the market with a looming risk of a no-deal.

We estimate that the December OPEC+ agreement will keep the oil market in a deficit at the beginning of 2021, implying a further unwinding of the pandemic-induced supply glut. That is to say, the alliance is set to support the oil prices in the near term amid the headwinds from the second wave of the pandemic. Once the vaccine-led rebound in oil demand starts to materialize visibly – likely in the latter part of next year – OPEC+ will be poised to ease the output cuts without risk of putting severe pressure on oil prices.

All this considered, the fundamental picture now appears more favourable. We have therefore upgraded our oil price outlook for end-2020 and 2021. Despite some possible sluggishness early next year, a vaccine-led rebound in oil demand is set to drive the market rebalancing while triggering a cyclical upswing in oil prices towards our long-term estimate of 55 USD/barrel by the end of 2021.

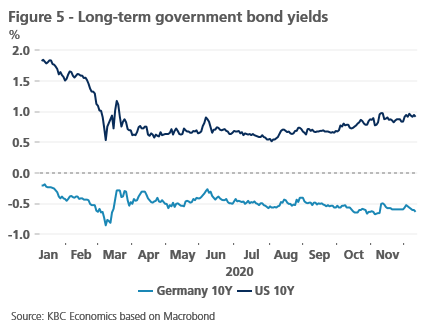

On the other hand, long-term government bond yields remain under the spell of persistent accommodative monetary policy and appear to pay more attention to near-term lacklustre economic activity than improving post-pandemic prospects. The reason is that the former has fed the expectations about additional easing measures by central banks, in particular the ECB. As a result, 10-year government bond yields, both in the US and in the euro area, have mostly resisted the reflationary trend and are moving sideways (figure 5).

Nonetheless, our outlook for long-term interest rates assumes some room for limited upward movement next year. While the ECB’s loose monetary policy is set to keep a lid on long-term government bond yields in the euro area, we expect the 10-year German bond yield to trend moderately higher, reaching -0.20% by end-2021. In the US, we have revised our outlook towards a more marked rise in 10-year Treasury yields to 1.4% (from 1.0%) by the end of 2021, reflecting additional fiscal stimulus and a tolerance for higher inflation by the Fed. The outlook for policy rates remains unchanged, with the expectation that ultra-loose monetary policy will remain in place on both sides of the Atlantic over the forecast horizon.

Box 2: Euro gains importance in international payments

In the month of October, the euro surpassed the US dollar for the first time since 2013 as the most used currency in cross-border transactions according to data compiled by Swift. About 37.8% of global Swift cash transfers were handled in euro whereas the dollar accounted for 37.6%. The euro’s share has accelerated since April, registering a 7 pp increase at the expense of the dollar. While the greenback lost overall appeal over issues ranging from trade upheaval and a growing political divide, the euro in itself is perceived as a much more stable and reserve-worthy currency since the creation of the common EU Next Generation Recovery Fund.

Nonetheless, it would be wrong to conclude the euro effectively became the most important currency in October. First, there is a statistical issue. The Swift cross-border payments include intra-EMU payments, artificially boosting the international use of the euro by its very definition. Accounting for these intra-EMU payments, the dollar was still used in approximately 42% of the cross-border cash flows in October whereas the euro share stood at 38.5%. That said, we do note the dynamics are tilting in favour of the euro: in 2016, its share was only 29.9% while that of the dollar amounted to 47.1%.

Second, the dollar still remains the top funding currency. A study by the Bank of International Settlements (BIS) in July 2020 concluded that about half of all cross-border loans and international debt securities are denominated in dollars, also mentioning that 85% of all foreign-exchange transactions occur against the dollar and that the greenback still accounts for 61% of official FX reserves. The euro is definitely an ever more attractive alternative to the dollar, but it is still some way off from being the world’s number one currency.

In currency markets, the euro seems to have gained a foothold above 1.20 EUR/USD for the first time since mid-2018 (see Box 2: Euro gains importance in international payments). The upward movement of the currency pair is, in our view, driven more by dollar weakness than euro strength; the declining real yield differentials have dealt the dollar a heavy blow, while a decisive victory of Joe Biden in the presidential election has led to a relief rally with a similar effect. In addition, we expect that the reflation theme in global financial markets is set to further weigh on the dollar. As a result, we have adjusted our end-2020 forecast to 1.21 EUR/USD (from 1.19 EUR/USD). From a longer-term perspective, we maintain our view of structural appreciation of the euro vis-à-vis the US dollar towards 1.25 by the end of 2021.

All historical quotes/prices, statistics and charts are up to date until 7 December 2020, unless otherwise stated. The positions and forecasts provided are those of 7 December 2020.