Italy must seize unique opportunity to strengthen economy

The covid-19 virus has undermined many, but not all, of our certainties: Italian governments continue to walk a tightrope. In mid-January, the ministers of Viva Italia, the new party of former Prime Minister Renzi, resigned. The remaining minority government did gain the confidence of Parliament but resigned afterwards anyway. Italy is thus in a political impasse at a time when the recovery plan for the post-covid-19 crisis needs to be drawn up. With that plan, it can receive financial support from the European Recovery Fund (Next Generation EU) for investments that strengthen the economy structurally. That is exactly what Italy needs to keep its fragile public finances under control. It must seize this unique opportunity.

Hard hit, but resilient

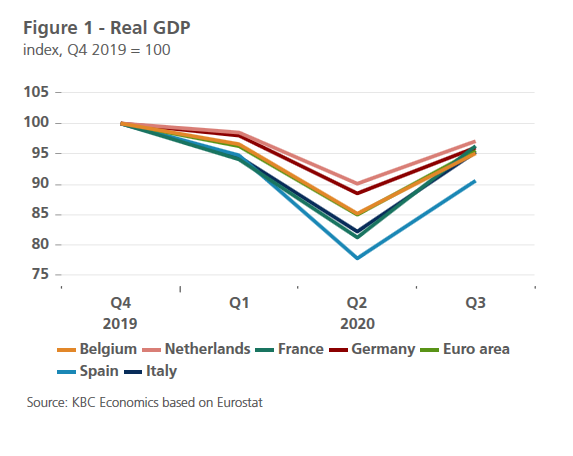

About a year ago, Italy was in the news as the country through which the covid-19 pandemic entered Europe. The shocking images of overcrowded northern Italian hospitals made the severity of the pandemic painfully clear. According to the Oxford University measure, the country had by far the most severe lockdown in Europe in the period February-April 2020. The economic downturn was huge, although in the second quarter it was even worse in France and especially in Spain. The Italian economy also recovered more strongly than Spain’s in the third quarter. The economic damage was comparable to that in less affected countries, such as Germany and the Netherlands (Figure 1).

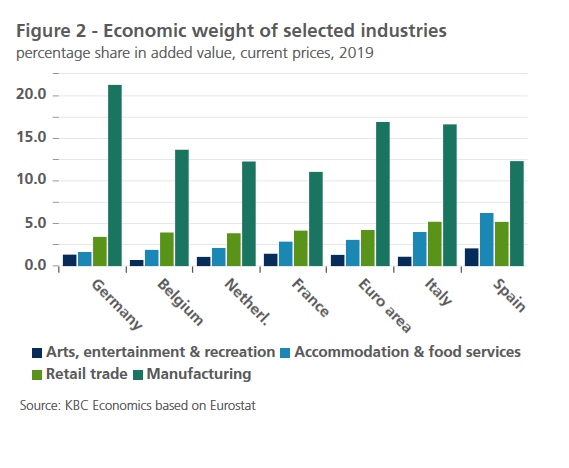

Apart from the dynamics of the pandemic and the reaction of policymakers, households and businesses, the economic impact of the pandemic also depends on the sector composition of the economy. The Italian economy is particularly vulnerable due to the relatively large weight of the hospitality sector, although its importance is half that of Spain (Figure 2). Retail trade, which was particularly affected by the lockdown measures during the first wave, also has a larger economic weight in Italy than in the other major euro area countries, with the exception of Spain. In contrast, the share of the arts, entertainment and recreation sectors, which were also hit hard, is relatively small. Moreover, Italy has a relatively large manufacturing sector. As a result, the country can benefit more than Spain or France from the global manufacturing boom that started in the summer of 2020 (see KBC Economic Opinion of 10 December 2020). This contributed to the strong economic recovery in the third quarter of 2020 and may help the resilience of the economy during the second wave of the pandemic.

Towering public debt...

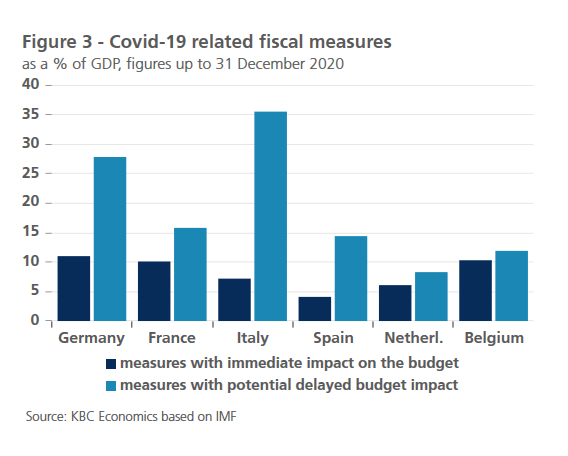

Like everywhere else in the world, the covid-19 crisis is leaving a deep mark on public finances. Figure 3 summarises the fiscal measures taken in 2020 in response to the crisis for the main euro area countries. The measures are classified according to their impact on public budgets. The figure illustrates that measures with an immediate impact, such as increased or frontloaded spending and various tax cuts, were significant in Italy, amounting to 7% of GDP, but remained relatively modest compared to most of the other countries shown.

This is encouraging against the background of Italy’s precarious public finances. According to European Commission forecasts, the structural primary budget deficit of the Italian government would fall to ‘only’ 1.2% of potential GDP in 2022. It would be slightly smaller than in Germany and three times lower than in Belgium. However, the overall deficit would still be 6% of GDP. Italy’s public debt - the second highest in the eurozone after Greece’s - would rise to almost 160% of GDP, with no decline in sight.

This is more worrying. Moreover, Figure 3 also shows that the Italian government is generous with measures that could further burden public finances in the future, such as the possibility of guaranteeing private debt. If these guarantees were to be called, they would further increase the deficit and the debt.

... crying out for strengthening the economy

The prospect of sharply deteriorating government finances made investors in Italian government paper nervous immediately after the outbreak of the pandemic in February 2020. Interest rate spreads vis-à-vis German Bunds, a measure of the risk premium, widened sharply, especially after ECB President Lagarde let it slip that the ECB is not there to keep interest rate spreads low. With the launch by the ECB of the Pandemic Emergency Purchase Programme (PEPP), immediately after this statement, peace returned to the financial markets. The recent crisis hardly affected the risk premium.

As long as the pandemic rages, central banks’ implicit support of fiscal policy by providing cheap financing conditions is defensible. But it will not last. There will come a time when markets will again call governments to account on the sustainability of their debt.

For decades, Italy’s public debt problem has been primarily a problem of weak economic growth (see KBC Economic Opinion of 12 May 2020). With the financial support from the Next Generation EU recovery fund, Italy has a unique opportunity to work on strengthening its economic growth potential. The approval of this fund was a difficult process, partly due to the fears of some Member States about the lack of discipline from other Member States in spending the money. The fact that the Italian Government stumbled, among other things, over the drafting of the recovery plan that Europe requires in order to disburse the aid, illustrates how difficult it is to make use of the opportunity that is being offered. Still, Italy must not miss this opportunity.