Is Germany becoming the destabilizer of the euro area?

The German industry is hard hit by the weakening of world trade, while it is also struggling with structural problems. In other euro area countries growth is holding up remarkably better. However, there are fears that the recession in German industry could contaminate growth in the eurozone, especially if the trade slump continues. Because of its relative openness to the rest of the world, the German economy was in the past often a channel for growth dynamics elsewhere in the world to transmit to Europe. The resilience of domestic demand still provides a counterweight, but it is also beginning to weaken. In a worst-case scenario, Germany could destabilise the eurozone. It would be in stark contrast to its role during the recent recessions and highlights German policymakers’ European responsibility to prevent this from happening.

German growth engine stalls

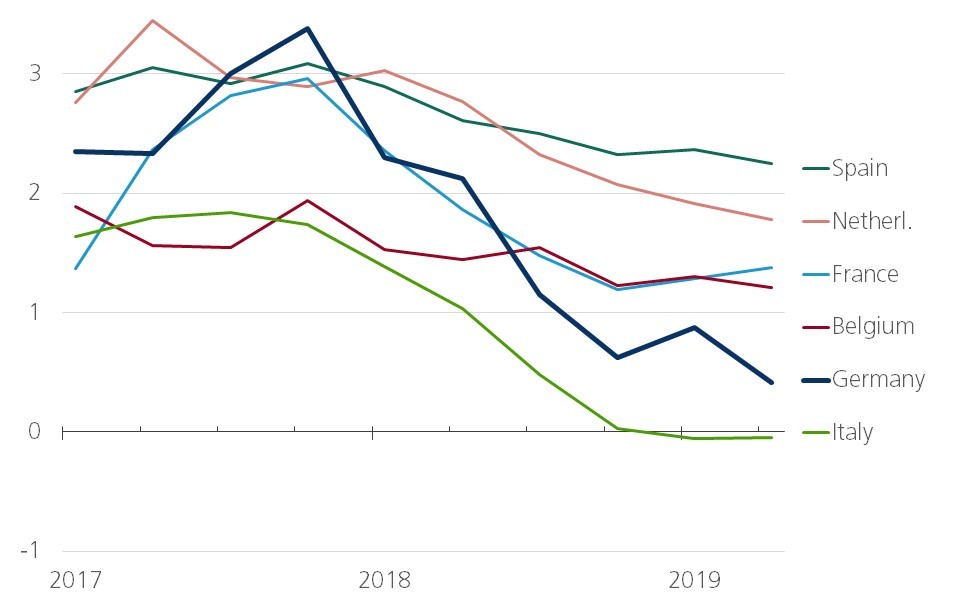

For the last ten years, the German economy has been the growth engine of the eurozone. It pulled the eurozone out of the recessions that followed the Lehman crisis (2008) and the euro crisis (2011). In 2017, it recorded an unexpectedly strong growth spurt. Real GDP growth in the fourth quarter of 2017 was again higher in Germany than in any other large euro area country (Figure 1). Since then, the growth rate has slowed down much more than in the other euro area countries. In the second quarter of 2019, the annualised growth rate of German GDP, at 0.4%, was less than a third of French growth. Growth in Spain was more than five times higher than in Germany. Only Italy, where the previous government’s controversial policies completely eroded economic growth, recorded a growth rate even worse than that of Germany.

Figure 1 - Real GDP growth (year-on-year change, %)

The growth slowdown has several causes. To some extent, it was a normal cyclical phenomenon after a long period of expansion. Pent-up demand from postponed consumption during the recession was gradually being met. The demand stimulus from the reception of the migration crisis, which caused an additional growth contribution from public consumption in 2016 in particular, also faded away. On the supply side, the economy began to run up against growth limits in 2018. Capacity utilisation had risen sharply, while the very low level of unemployment made it increasingly difficult for employers to find suitable employees.

However, a major cause of the growth slowdown is due to the slowdown in world trade, which is itself the result of, among other things, the trade war between the US and China, the uncertainty caused by the Brexit and the growth slowdown in China. Germany is much more sensitive to world trade than any other major industrialised country, inside and outside Europe. Exports of goods and services account for more than 47% of GDP, compared to an average of only 25% in the six other G7 countries (OECD figures for 2018). In the US, the figure is as low as 12%. A relatively large share of German exports is concentrated in goods and less in services. This is closely related to the structure of the German economy, in which industry still has a relatively high weight. Compared to the other large euro area countries, Germany exports more to China, the US and the UK. Germany is, so to speak, the gateway from the eurozone to the rest of the world.

The trade slump is hitting German industry relatively hard as it coincides with the environmental challenges and technological transition in the car industry, which is very important to Germany, at a time when global demand for cars is weakening. The chemical industry is also having a hard time. Manufacturing output has been declining since October 2018, while in most of the other major industrialised countries there has been only a growth deceleration, stabilisation or a much more limited contraction.

Destabilising the eurozone?

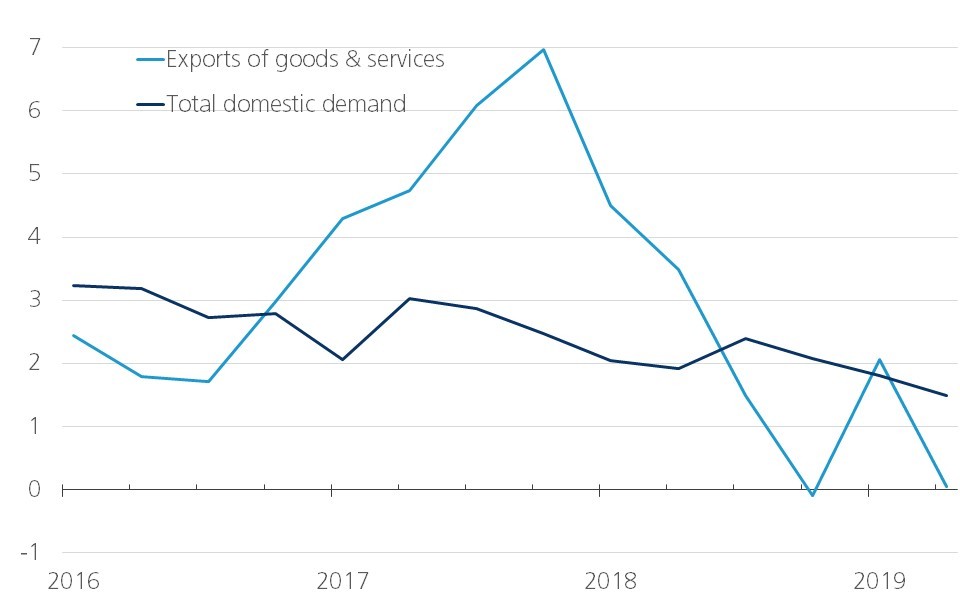

Due to its relatively high degree of openness to the rest of the world, the German economy has in the past often been a channel for growth dynamics elsewhere in the world to reach other European countries (IMF, 2011). In 2017, for example, the economic boom in the eurozone coincided with an acceleration in German export growth in the wake of the (then) recovery in world trade (Figure 2).

Figure 2 - Recent growth dynamics in the German economy (year-on-year, %)

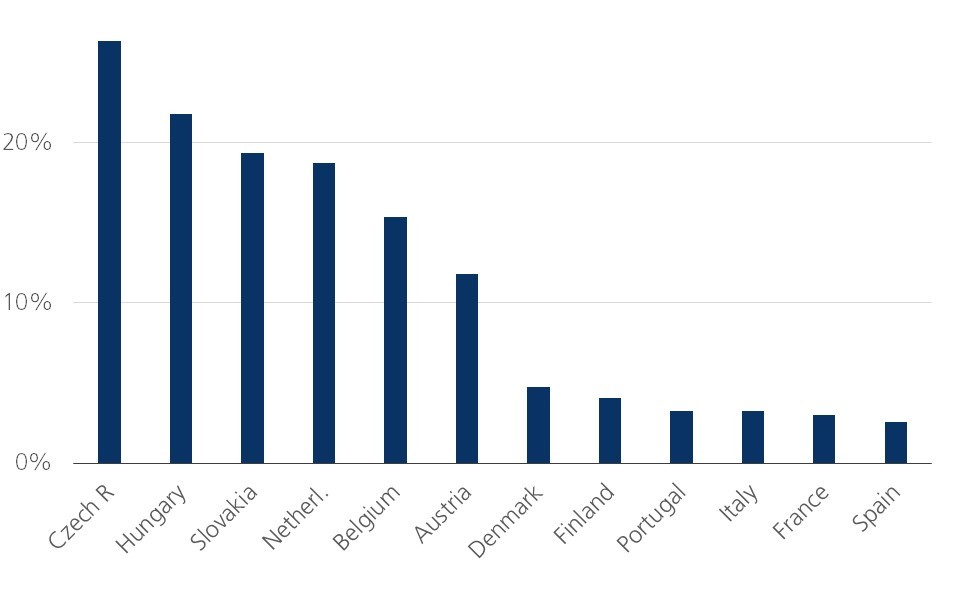

Today, there are fears that the recession in German industry will plunge the entire eurozone into a recession, especially if the trade slump continues. This may cause trouble, as France, Italy and Spain have their households less in order than Germany. Unemployment is significantly higher in those countries and public finances are more vulnerable. A slowdown in growth threatens to destabilise economies relatively quickly. Fortunately, the sensitivity of the large euro area countries, as measured by the share of exports to Germany in their GDP, is not very high (figure 3). It is rather Germany’s smaller neighbours that are heavily dependent on the German economy. The economies of the large euro area countries are more dependent on domestic demand and their exports are more oriented towards countries other than Germany. This will temper fears of the German recession spreading to these countries.

Figure 3 - Exports of goods to Germany (% of GDP)

However, they are not completely insulated from developments in the German economy. If the recession in German industry were also to affect German consumer demand, this would also have consequences for the large euro area countries. After all, the economies there are slightly more focused on the production of consumer goods and services. For the time being, domestic demand in Germany has been relatively spared from the industrial recession (figure 2). However, signs of a further weakening of the economy are emerging. Moreover, in structural terms, domestic demand in Germany is less developed than in the other large industrialised countries. A worst-case scenario, in which Germany becomes the destabiliser of the eurozone, cannot therefore be completely ruled out. It would be in stark contrast to Germany’s previous role in the euro area and highlights German policy makers’ European responsibility to prevent this from happening.