The seductive utopia of Modern Monetary Theory

Modern Monetary Theory (MMT) is a controversial topic in the economic-political debate. In essence, it is a discussion within the Keynesian school of thought about the specific role of monetary and fiscal policy. MMT focuses on fiscal policy as the main policy instrument, while monetary policy serves to finance deficits. However, MMT is also often used to create the illusion that there are actually no hard budgetary constraints. After all, central banks can finance all kinds of projects through the money printing press. The icing on the cake is that this could even be possible without derailing inflation. However, entrusting a significant part of financing fiscal policy to the central bank creates a huge moral hazard problem for fiscal authorities. In practice, this will inevitably lead to derailing inflation. After all, even in the world of MMT, there is no ‘free lunch’ and we still have to make political choices about how scarce economic resources should be allocated.

There are currently a number of ongoing public discussions on policy proposals that could sometimes have large budgetary implications. One example is the international climate debate. There is also the proposal for a ‘Green New Deal’ by the US Representative Ocasio-Cortez, which includes a number of far-reaching social and climate-friendly measures. Of course, this raises the question how these plans could be financed if they were to be approved.

Some supporters of such policies rely explicitly on central banks for such financing. In support of this line of thought, reference is made to the so-called ‘Modern Monetary Theory’ (MMT). In itself, this framework is not new, but the proposals to implement its recommendations in practice are more recent. The principles of MMT go back to the so-called ‘chartalism’ of the beginning of the twentieth century. In short, it is a forerunner of the concept of fiat money. In this view, money has no intrinsic value, but derives it from the fact that it is a legal tender and that it is necessary to pay taxes owed to the government. Money is by definition a short-term debt of the government, and the central bank, as part of that government, can, in theory, issue such securities without limits. This also means that a government with its own currency can always formally repay its debts in that currency if it so wishes. The purchasing power of this repayment is, of course, another matter.

What role should monetary policy play ?

The academic debate on MMT mainly focuses on the interrelationship between fiscal and monetary policy. Following the experience of inflation in the 1970s, there was a broad consensus in most developed countries that the central bank should be independent and, first and foremost, ensure price stability (i.e. low and stable inflation). As long as price stability is assured, monetary policy has room to help stabilise the business cycle. The US central bank is to some extent an exception because of its dual mandate of price stability and maximum sustainable employment (together with moderate long-term interest rates).

In general, therefore, business cycle stabilisation was mainly left to fiscal policy. Any budget deficits should be financed through bonds or loans and not through central banks, because sooner or later, this would inevitably jeopardise the desired price stability.

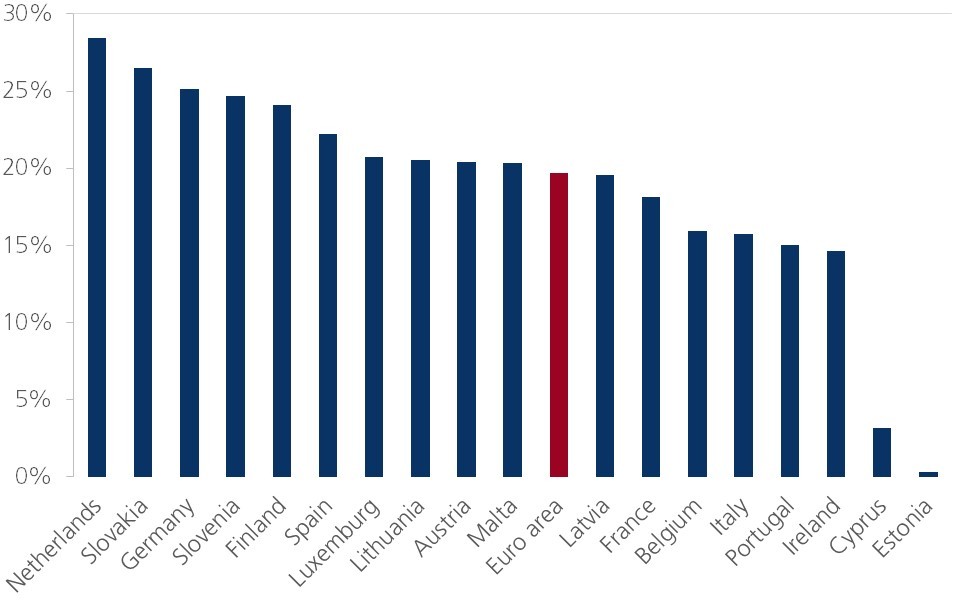

However, the necessary consolidation of public debt increasingly constrained the fiscal policy instrument. As a result, its role as a business cycle stabiliser increasingly transferred to the central banks. For example, the ECB had to bear a large part of the burden of the Great Recession and even of the sovereign debt crisis from 2010 onwards. Figure 1 illustrates that the ECB was forced to exceed by far the once sacred boundary between monetary and fiscal policy. The fact that the ECB is the central bank of many (fiscally) sovereign Member States makes this evolution even more complex and controversial.

Figure 1 - Blurred separation between monetary and fiscal policy (public debt held by ECB, in % of outstanding debt, end of 2018)

In the academic debate between, for example, Keynesians Stephanie Kelton (advocate) and Paul Krugman (critic), MMT pushes this trend to its extreme. In MMT, the budget balance is the central policy instrument used to stabilise the business cycle around an unemployment rate target. The actual budget balance mechanically derives from this. The task of monetary policy is then to finance any deficits that may occur. In MMT, budget deficits as such are irrelevant as long as the country issues its own currency (see above) and inflation does not rise excessively as a result. In order to keep inflation under control, MMT proposes to remove any excess liquidity from the economy by means of additional taxes or bond issuance.

Utopia

No one disputes the fact that monetarily financed public expenditure can stimulate economic growth, especially when there is still unused production capacity. In 2003, for example, the then Fed governor and later president Bernanke proposed that Japan should be able to tackle its growth and deflation problems in extremis in exactly that way, on a temporary basis. His message was that this is some kind of ultimate life insurance.

However, it is dangerous to generalise such an emergency scenario. It creates a huge moral hazard problem for governments. In the short term, the fiscal authorities may avoid necessary policy choices, as central bank financing is always secured. This temptation would now be particularly strong due to the currently extremely low inflation (expectations). The associated risks have not disappeared but will only occur in the longer term. So a short-sighted government can chose to ignore them for a while.

The experience of the 1970s also shows that the monitoring of price stability should be entrusted to an independent authority. Which politician will raise taxes (or issue bonds to slow down economic growth) just before elections if inflation risks are building up? Moreover, even with such political discipline, the process of levying new taxes is likely to take far too long to allow for quick and efficient reactions to price shocks.

Money creation is also an arbitrary and non-transparent form of taxation. It particularly affects those parts of the population that are least able to protect themselves against money slowly losing its value. This is not a socially responsible policy.

The academic debate on MMT will undoubtedly continue for some time to come. It questions economic taboos, but that doesn’t make it nonsensical by definition. In practice, however, MMT would quickly hit operational limits, almost certainly causing inflation to derail. After all, history teaches us that the temptation of the money printing press is too great.