Trade war in steel and aluminium: history repeating itself

President Trump has announced an executive order to raise import rates on steel and aluminium. The increase will apply to all countries that export to the United States, although the measure is clearly a response to unfair trade practices by China. The US government is defending the decision as being necessary for national security. The rates on steel will rise by 25% and those on aluminium by 10%. This announcement comes as no surprise, given that this has been the topic of debate in the United States for some time.

There are a great many reasons for regretting this decision by Trump.

Firstly, this decision is clearly a protectionist measure. Raising rates is not allowed by the World Trade Organisation, in principle, apart from in exceptional circumstances. Although national security can be used as an argument in theory, the real danger is that many other countries will use the same argument to launch countermeasures, and these measures will not be restricted to the steel and aluminium industries. This could send the world economy into a protectionist downward spiral. It might result in a sharp reduction in world trade, which will undoubtedly have consequences for global economic growth and prosperity. Trump has opened a Pandora’s box, and the consequences could be far-reaching.

It would certainly have been wise to have used an economic argument, rather than that of national security. Indeed, the rules of the World Trade Association allow individual countries to put in place temporary protective measures (known as safeguards). These are temporary increases in rates that protect a domestic sector, and allow it to adapt to a change in market conditions. It’s only logical that the implementation of temporary protective measures is governed by strict conditions. For example, the United States must demonstrate that its steel and aluminium industries have been struck by a sharp and unpredicted growth in imports. This is a difficult argument to make, given that the American steel and aluminium industries have been struggling for many years. This is not the first time an American government has tried to protect them. President George W. Bush implemented temporary protective measures, for example, but they were met with protests from the World Trade Association, which argued that the American government could have foreseen the problems in both industries, and had failed to deal with these problems. President Trump is probably trying to avoid a similar scenario by playing the national security card.

In addition to protective measures, the World Trade Association also offers alternative instruments for the combating of unfair trade practices. Imports of steel and aluminium can be restricted, by means of anti-dumping policies and anti-subsidy measures, on condition that there is evidence that those products are being sold at unfair prices. Unfair prices are often the result of an unfair support policy in the country of production, in the form of domestic production or export subsidies. Western countries could cooperate and jointly respond to this situation.

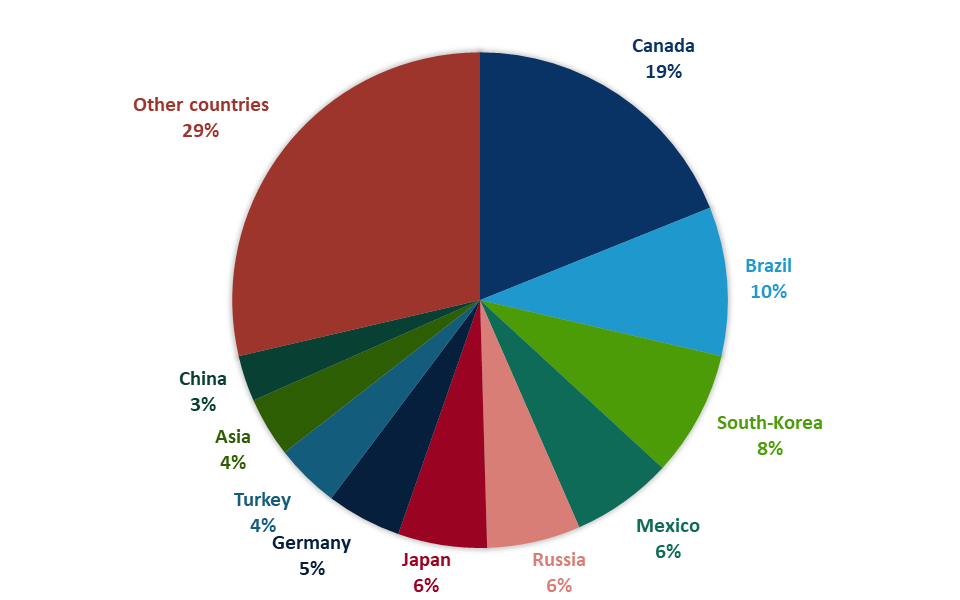

Secondly, there is little point in announcing a general increase in rates. This barely affects China, but it does affect a number of important regional and Western trade partners. The largest importers of steel to the United States are, after all, Canada, Brazil, South Korea and Mexico (see figure). The EU will also be affected. In other words, the impact on China is limited. Here too, President Trump may well have learned lessons from the past. A few measures aimed at all trade partners are more acceptable to the World Trade Organisation. In recent months, the American government has considered multiple scenarios including targeted rates and quotas. The US government may be hoping that this general increase in rates will avoid condemnation by the World Trade Organisation, but the measure will obviously impact a number of important trade partners. The move is stirring up ill feelings again, and threatens to elicit countermeasures.

Figure 1 - US imports of iron and steel (2016, in % of total imports)

Source: Comtrade 2018

Thirdly, import restrictions are not the right response to the challenges faced by the steel and aluminium industries. Naturally, the American steel and aluminium industries have been hit by competition from Chinese manufacturers, but the export market is more affected than the American domestic market. A correct and wise policy decision would have been to offer a stimulus to American competitiveness and exports. Compared to the European Union, which is also subject to increased competition from emerging economies, the United States has invested too little in reinforcing its own steel and aluminium industries. Europe decided on a policy aimed at innovation, up-scaling and production renewal to fight the competition with the lower-quality and cheaper steel from emerging economies. This is a wiser response than the defensive attitude adopted by the United States.

Lastly, the American president’s decision is cutting off his nose to spite his face. The higher import rates will cause a rise in the prices of steel and aluminium products in the United States. American manufacturers may be able to profit from the protection against foreign competition, but average market prices will rise. Steel and aluminium are, of course, mainly inputs in the industrial process. This will also bring about an increase in the prices of end products. The fact is that this decision boils down to a tax increase for American companies and consumers. The first thing that comes to mind is vehicles, but other products such as electronic devices and construction applications may also be affected. Ultimately, American consumers will pay the price of this policy measure.

The decision by the American President to increase the import rates on steel and aluminium is therefore not a sensible one, economically, and it is potentially extremely dangerous for the global economy. Defending the decision based on national interest sets the stage for an international political trade war. The defensive attitude of the United States is not the right answer. Reinforcement of the American steel and aluminium industries would have been a better option. The current situation also highlights the importance of multilateral trade negotiations. Donald Trump does have a point when he says that state intervention in some countries (read China) is clearly disrupting the global market. This is distorting the level playing field in many industries, which, in turn, will undermine other economies. One solution could be international negotiations. It is clearly time to learn lessons from history and strive, by way of international trade negotiations, towards a balanced and free global trade.