Chip shortage is a harbinger of the digital future

The current global shortage in semiconductors (also known as chips) is mostly a result of temporary bottlenecks, in part driven by a pandemic-induced spike in demand for high-tech electronics. Though these demand shocks can be seen as temporary, COVID-19 has accelerated the digitalisation of the economy, which is a trend that won’t disappear anytime soon. As such, to think of the increased demand for semiconductors as only a passing development would be a mistake. Rather, the current chip shortge should be seen as a harbinger of the increasing importance of high-tech innovation in the global economy. Accordingly, the EU must continue to innovate and invest in a digital future to maintain its advantage in advanced manufacturing technologies.

Temporary factors…

Semiconductors are in short supply globally leading to long wait times for various consumer electronics and causing significant disruptions for car manufacturers. For the most part, the root causes of the current shortage can be seen as temporary rather than structural. On the supply side, bottlenecks in international shipping, geopolitical tensions between the US and China that led to sales restrictions and therefore stockpiling of semiconductors, and multiple fires in Japanese semiconductor plants have all contributed to the shortage. However, the main contributing factor seems to be temporary demand shocks stemming from the COVID-19 crisis. First, the pandemic increased demand for consumer electronics (laptops, mobile devices, gaming devices, etc). Second, a temporary drop in demand for cars at the outset of the pandemic led manufacturers to cut back on supply orders. By the time the economy and demand began recovering, chip manufacturers had promised their deliveries to electronics manufacturers instead.

…but a long-term trend

While the current shortage can be mostly chalked up to temporary disruptions that will be smoothed out eventually, one can still pull important lessons for the future from these developments. The higher demand for high-tech products may have been caused by the pandemic, for example, but it represented an acceleration of ongoing economic trends rather than a wholesale shift in a new direction. Afterall, the European Commission adopted its strategy for a digital future long before the onset of the pandemic. Hence, to think of the increased demand for semiconductors as only a temporary development would be a mistake.

Digitalisation and Europe’s advantage

While digitalisation in its broadest meaning is the switch from analogue to digital technologies, in practice it has a wide variety of applications, from internet connectivity and cloud computing, to the use of big data and A.I., to robotics and e-commerce. Underlying the European Commission’s strategy on digitalisation is an acknowledgement that such advancements are required to maintain economic competitiveness. This is particularly important for the industrial sector. According to a November 2020 report by the Commission, advanced manufacturing technologies are the EU’s last remaining area of international advantage in terms of trade, and one of the technological areas where the EU maintains a clear advantage in terms of patent applications (30.5% globally)1.

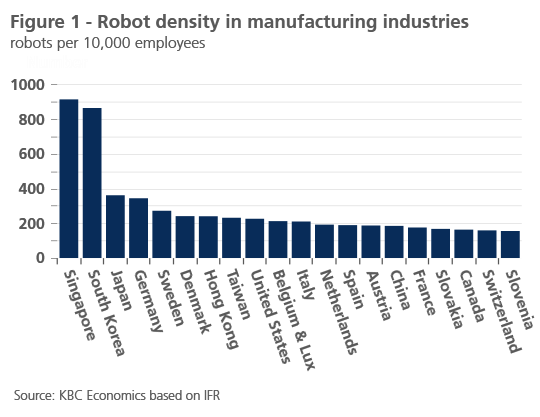

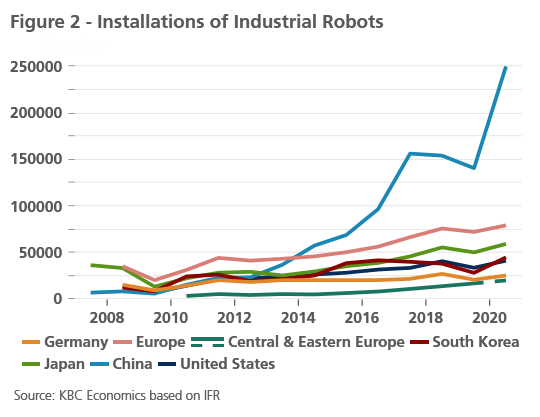

One facet of advanced technologies in manufacturing is the use of robotics in the industrial sector. Currently, Germany has the fourth highest robotics density in manufacturing in the world behind Singapore, South Korea and Japan, at 346 robots per 10,000 employees (figure 1). The US and China, in comparison have about 228 and 187 robots per 10,000 employees respectively. However, China appears to be working toward rapidly catching up, with a substantial acceleration of installations of industrial robots in 2020 (figure 2).

While industrial robotics may seem like one niche area of technological trends, it connects directly to many facets of digitalisation. As the International Federation of Robotics points out, Singapore’s high robot density reflects the importance of its electronics industry, in particular semiconductors. South Korea’s high robot density reflects its market position in making memory chips, LCDs (i.e. screens) and batteries for electric cars. And for Japan and Germany, high robot density is in part due to the importance of the auto industry.

All of these industries and products are deeply integrated with digitalisation. Semiconductors, as alluded to earlier, are becoming an ever more important part of the global economy, from computers and consumer devices to cars and smart technology. Connectivity, whether through mobile devices or laptops, has become even more vital as the pandemic reduced face-to-face interactions and prompted mass teleworking arrangements. Even the car industry is rapidly adopting new digital technologies, from connectivity and data analysis to electrification and autonomous vehicles.

Hence, while we may be able to look through the current chip shortage as a temporary disruption, it can also serve as an important reminder of the future that lies ahead. Digitalisation is, in many respects, already here, and it will only continue to become a more important trend for the economy. Europe has a solid advantage in advanced technologies in manufacturing, but this advantage should not be taken for granted. Innovation and continued investment in new technological trends are key to maintaining a competitive edge.

1EU Report - Technological trends and policies | Advanced Technologies for Industry (europa.eu)

2Robot Race: The World´s Top 10 automated countries - International Federation of Robotics (ifr.org)