Gentle summer breeze blowing through EU economy

The Covid-19 crisis has severely impacted in the European economy. The trade-off between a further reopening of the economy and the risk of new virus outbreaks remains an extremely difficult challenge. Yet we see a robust recovery taking shape, despite mixed signals from various indicators. In the short term, economic optimism is gaining the upper hand, helped by a number of structural and positive policy measures. Once again, Europe needed a crisis to move forward. In order to fully recover from the corona crisis, the EU will need to maintain this momentum. The road to recovery is still long, but we see steps in the right direction.

The trees through the forest

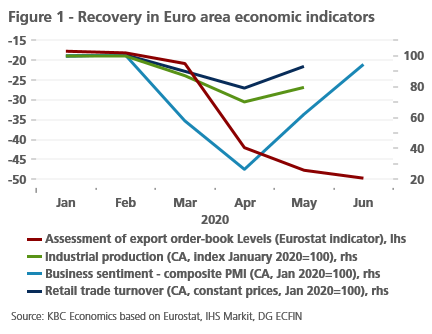

The interpretation of recent economic indicators is not easy in corona times. Virtually all indicators point to a recovery. This is a relief after the hellish lockdown months that caused major, but not necessarily lasting, damage to our economy. But how convincing and structural is that recovery? And how strong and widespread is the recovery in different sectors of the economy? Let us sum up some insights. First, we look at the sentiment indicators. These point to a spectacular, V-shaped recovery pattern. In May and June, for example, business sentiment almost completely recovered from the downturn in March and April. Sentiment indicators, however, are traditionally influenced by subjective interpretations. The recent spectacular recovery is mainly a reflection of the relief following the unprecedented severe economic downturn. This in itself is good news, but not enough to achieve an effective recovery. Retail followed this strong recovery pattern, with sales up 17.8% in May compared to April, which has already significantly cushioned the 21.4% decline between February and April. This is extremely good news, as it indicates that consumers are consuming again, a prerequisite for starting the recovery.

A different picture emerges from the evolution of industrial production in the euro zone. It recovered by 13% in May compared to April as a result of the phasing out of lockdown measures. However, industrial production was still 20.61% lower than a year earlier. Compared to January 2020, the difference is also still 20.37%. We can therefore speak of an '80% economy' rather than a '90% economy', as some describe the post-corona era. The evolution of export orders provides an explanation. Export demand is still under pressure. There is absolutely no recovery there yet. The analysis of the recent cyclical dynamics is therefore a complex exercise. In any case, the differences between monthly indicators (see figure 1) indicate that the recovery is not taking place uniformly across the economy as a whole.

Policy as a guide

Policy measures can certainly explain part of the difference in recovery rates. Policies have focused strongly on stimulating domestic demand through temporary unemployment and income support. In this respect, Europe excels in a global comparison thanks to the automatic stabilisers inherent in the European welfare model. This explains, among other things, the relatively strong recovery in the retail sector. A structural strengthening of the supply side of the economy requires a different kind of policy initiative and these are only slowly taking off today. All EU member states are working on their own recovery plans, but the democratic decision-making process is slow, and implementation takes time. Nevertheless, we see many hopeful signs. Europe has clearly renounced the mantra of austerity and more and more European countries are opting for a sizeable fiscal stimulus. The fact that Germany has drawn up an economic aid package worth EUR 500 billion is particularly welcome news. These support measures have been approved by the European Commission, which was a difficult balancing act. After all, the massive deployment of public funds by one Member State is a potential threat to the level playing field in the European single market. But from the point of view of economic recovery, the German stimulus is of course good news, not only for the German economy, but for the entire European economy as other countries will benefit too.

The recent developments in the field of European stimulus are also positive. The 'Next Generation EU' plan to structurally strengthen the European economy and make it more resilient in times of crisis is a valuable initiative. The injection of 750 billion euros through a combination of loans and subsidies, with a strong focus on the EU countries that were deeply affected by the corona crisis (read Southern Europe), is undoubtedly a historic victory for those who believe in the importance of more European financial solidarity and a more European approach to economic policy. Nevertheless, the resistance of the 'thrifty' opponents shows that such support measures should not be too non-committal. The Dutch opposition to the European plans was understandable and justified. The EU does not benefit from issuing a blank cheque. Financial solidarity must go hand in hand with responsible economic policy, even if this implies a partial curtailment of national sovereignty. But ultimately, the 'Next Generation EU' plan will give a long-term boost to the European economy through structural investments. It is particularly positive that the EU is opting for a structural stimulus with a long-term focus.

The EU lacks the instruments and budget to implement a counter-cyclical policy. This has always been the responsibility of national governments within the EU. In this sense, the EU cannot be blamed for doing relatively little and nothing concrete economically in the early days of the corona crisis. Nevertheless, we should not underestimate the economic role of the EU. Due to the flexible interpretation of the EU rules on state aid and the stimulation of temporary unemployment, the EU did play a role in absorbing the initial economic shock of the corona crisis. Nevertheless, the EU added value lies mainly in longer-term structural measures. The 'Next Generation EU' plan gives the EU much higher leverage than the traditional instruments in the European budget. Hence our optimism. But at the same time, we hope that this is only the starting point of a much more structural European approach to common challenges.

New EMU friends

Other good news comes from the European Monetary Union (EMU). The door is open for Bulgaria and Croatia to join the Eurozone in the coming years. For the time being, both countries will only have access to the EMU waiting room, the so-called Exchange Rate Mechanism II (ERMII). This procedure builds on the provisions of the Maastricht Treaty that new EMU member states must first go through a period of exchange rate stability. Together with a number of economic criteria relating to public finances and inflation, this will determine effective EMU membership. The decision to embrace Bulgaria and Croatia is not insignificant despite the limited economic importance of both Member States. Above all, it is a sign that the EMU is alive and well in a period of crisis which many again thought would be the deathblow of the EMU.

So, there is a positive breeze blowing through the European economy this summer. The economic recovery will take a long time, especially because the Covid-19 virus is clearly not yet under control and because there are many hotbeds of international tension. Nobody can rule out a turbulent autumn after a quiet and hopeful summer, when the corona crisis takes its toll through higher unemployment and bankruptcies. But policy initiatives in the EU at least feed European optimism, which is always the best breeding ground for economic progress.