Economic Perspectives November 2018

Read the publication below or click here to open the PDF

- While the US economy continued to lead the way with 0.9% qoq real GDP growth in Q3, the aggregate GDP growth figure for the euro area disappointed (0.2% qoq). In general, the overall sentiment deterioration and increased uncertainty seemed to be important negative factors, influenced by Brexit, the Italian budget process, political turmoil and the ongoing trade war. Preliminary growth figures point to large divergences within the euro area. The German economy shrank by 0.2%, although this effect is likely to be temporary. Clearly, Italian growth (0% qoq) has been the main worrisome disappointment. As a consequence of the weak third quarter, we revised down our euro area 2018 growth forecast by 0.2 p.p. to 2.0%. Moreover, for 2019 we adjusted our GDP growth forecast from 1.9% to 1.7%.

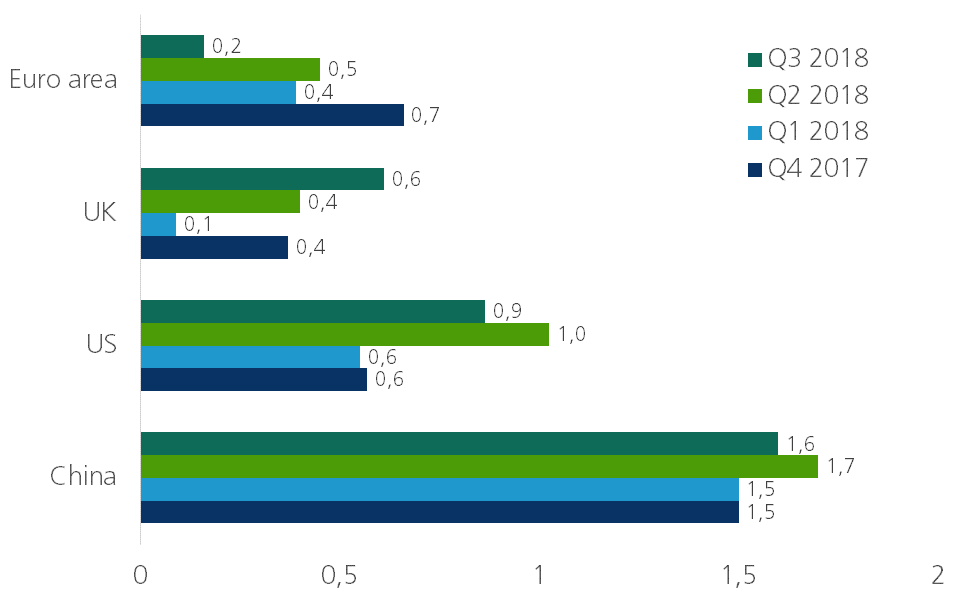

- Chinese economic growth continues to decelerate. Sentiment indicators as well as export data, though still resilient thanks to front-running in order to avoid tariffs, suggest that Chinese trade performance is suffering from the ongoing trade war. Fiscal and monetary stimulus measures have been implemented. Simultaneously, limited debt deleveraging has taken place in response to excessive credit creation. Our general view on China remains one of a soft landing path, though the probability of a harder landing has increased.

- The Czech National Bank (CNB) unexpectedly raised its policy rate (two-week repo rate) by 25 basis points to 1.75%. The rate hike was based on new macroeconomic forecasts of the CNB staff. These assume an acceleration of the Czech growth momentum and a later renewal of the appreciation of the Czech Koruna (CZK). In particular, the rate increase was a response to the recent depreciation of the CZK and the associated inflationary pressures via higher import prices. We continue to expect one more rate hike in 2019 as the relative weakness of the CZK will, in our view, give the CNB a window of opportunity to raise its policy rate while economic growth momentum will slow down.

Euro area growth disappointing

The release of Q3 preliminary real GDP growth figures for several countries and regions around the world in recent weeks reflected the picture set out by higher frequency data. As expected, the US economy continued to lead the way with 0.9% qoq growth (figure 1). In particular private and government consumption posted very strong performances. This was in line with the previous quarter and for a large part driven by continued robust labour market performance and ongoing fiscal stimulus. One development possibly warranting attention in future releases is a slowdown in corporate investment growth. The deceleration compared to the previous quarter might be a sign that the corporate tax cuts have not induced as much capital accumulation as was hoped for. Net exports were a drag on Q3 growth, with high import growth and a drop in exports, while inventories grew substantially. The export decline, which mostly reflected a slump in goods exports, was not completely unexpected as Q2 exports were boosted by companies trying to front-run tariffs in the US-China trade war.

Nevertheless, weaker export performance was not limited to the US. New exports orders are weakening around the world, signalling a deterioration in international trade momentum. All in all, the fundamentals for the US economy remain favourable for now as consumer and corporate confidence remains high and the labour market continues to perform well. However it is likely that the positive impact from the fiscal stimulus measures will gradually fade. Other factors such as the tightening of the labour market and the negative effects of the trade war may also pose a risk to US growth. Summarising all this, we stick to our US growth scenario. For the remainder of this year and for 2019, we remain relatively optimistic but in terms of growth dynamics we project a slowdown from current elevated levels

Figure 1 – US economy continues to lead the way, while euro area growth disappointed (real GDP, % change qoq)

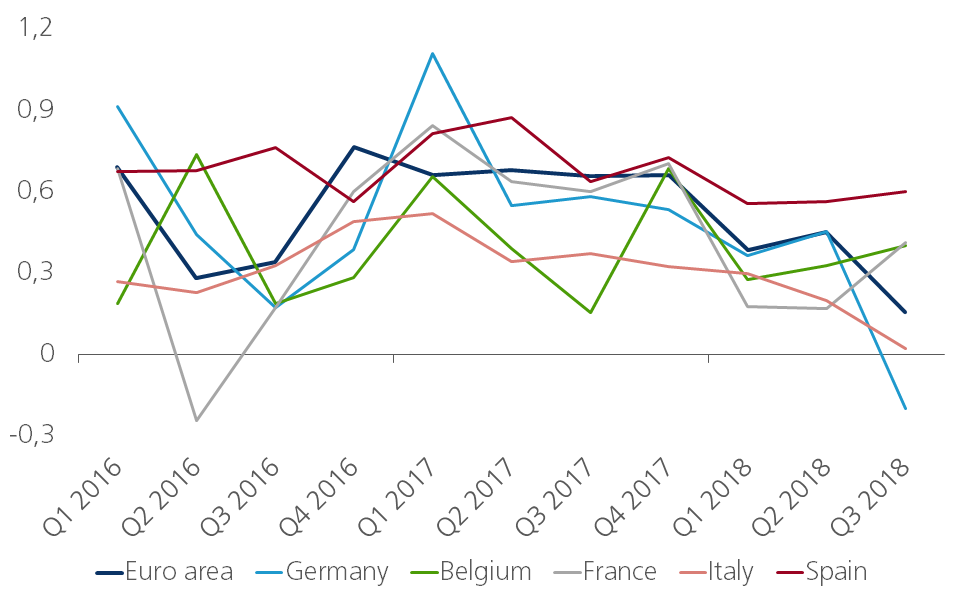

In sharp contrast to the strong US performance, the aggregate Q3 GDP growth figure for the euro area was disappointing. Real GDP growth only reached 0.2% qoq, which was considerably below expectations. In general, the overall sentiment deterioration and increased uncertainty seemed to be important negative factors, influenced by Brexit, political turmoil and the ongoing trade war. While the disaggregated details are not yet available for all euro area economies, recent data point to large divergences within the euro area (figure 2). Belgium (+0.4% qoq) and France (+0.4% qoq) performed relatively well and Spain (+0.6% qoq) clearly outperformed the rest of the euro area. The most disappointing outturn was the German growth figure (-0.2%) which showed a substantial decline in export growth, in combination with weaker domestic demand and increased imports. The weaker export growth is likely a combination of the negative international trade as well as issues in the car industry surrounding the emissions standards scandal. Nevertheless, the underlying trend in the German economy remains positive with substantial job creation and continued investment growth. Meanwhile, the most worrisome disappointment came from Italy where growth came to a standstill in Q3. The zero percent qoq growth figure resulted from a flat contribution of the domestic and external demand side. Growth composition details are still lacking but this disappointment might signal a negative impact of political instability on households’ and corporates’ spending decisions. Moreover, it comes as an unwelcome surprise in the light of the ongoing budget process where Italian authorities are assuming a markedly higher growth pace in the coming years in their budget calculations.

Figure 2 – Aggregate euro area growth figures hide large disparities between countries (real GDP, % change qoq)

Despite still possible revisions of the euro area Q3 growth figures in upcoming releases, our previous growth forecast of 2.2% for 2018 seems unreachable given the Q3 setback. Therefore, we downwardly revised it to 2.0%. Moreover, for 2019 we adjusted our GDP growth forecast from 1.9% to 1.7%. Dynamically speaking, these projections do envisage a recovery from the weak Q3 performance as some temporary factors were at play. In fact, our forecasted quarterly growth dynamics for 2019 are still quite positive as fundamentals (solid labour market, continued robust performance in the services sector) remain supportive.

Several risks continue to create uncertainty in the European economy and may ultimately further distort the European economic cycle. The most immediate is the very negative political reaction in the UK to the recent preliminary Brexit-deal between the European Commission and the British government. It remains to be seen whether sufficient political support can be found in the British Parliament for the current proposal or for some arrangement that avoids a disorderly Brexit with the UK crashing out of the EU without a deal or transition arrangement in four months. Further, we expect continued confrontation between the Italian government and the European Commission on the Italian budget. If Italy is forced into the excessive deficit procedure, the uncertainty might last well into 2019. Finally, a further escalation of the ongoing international trade conflicts cannot be excluded after the US mid-term elections and taking into account that China has not yet fully retaliated to the announced US trade interventions.

No systemic emerging market crisis

As previously suggested by activity and sentiment indicators, Chinese real GDP growth slowed down further in Q3, reaching 6.45% yoy. Some debt deleveraging took place, in response to excessive credit creation in recent years and contributed to the growth decline. This was mainly seen in infrastructure and real estate investment. In addition, weaker domestic demand with a marked deceleration in retail sales growth contributed to the fall in GDP growth. The full effects of the ongoing trade war with the US are still undetermined. However, sentiment indicators as well as export data, though still resilient thanks to front-running in order to avoid tariffs, suggest that Chinese trade performance is indeed feeling adverse effects. To counteract all this, Chinese authorities have been using several stimulus measures - such as tax cuts, monetary policy easing and measures to support private companies. Their goal is likely to control the pace of the slowdown and to avoid instability rather than to boost growth to levels seen in recent years. Our general view on China remains one of a soft landing path, though the probability of a harder landing has increased somewhat.

Meanwhile, the Chinese currency, the Renminbi (RMB), has depreciated since the end of last year (USD/RMB almost -6%). In the first half of 2018, the fall in the USD/RMB exchange rate was in line with the movements of other emerging market currencies. This signals that the moves in the bilateral exchange rate were mainly driven by the USD strength. However, since the summer months, there has been a clear underperformance of the RMB relative to the other emerging market currencies. This was a consequence of the combination of weaker economic growth figures and monetary policy stimulus. However, despite accusations made by US President Trump, there are hardly signs of any currency manipulation by the Chinese authorities to keep the Renminbi weaker. On the contrary, China has even been using its foreign reserves to limit the downward moves of the RMB. Hence, although volatility has increased, we do not see any signs of an ongoing currency war. This is in line with China’s strategy of a stable currency. After all, China aims to give its currency a larger role in foreign trade and international reserve management. Moreover, in the past, a RMB depreciation often caused capital outflows, with a negative impact on domestic assets (including equities and bonds). This kind of instability would be undesirable as it often required costly interventions in financial markets.

In other emerging markets, political developments were the main market-moving triggers in recent weeks. Brazilian assets rebounded as now President-elect Jair Bolsonaro solidified his lead in the Brazilian presidential race and eventually won the second round of the election. He is viewed by markets as more market friendly than his left-wing opponent. At the same time, the Brazilian congress remains fragmented. Passing much needed pension reform to help address Brazil’s sizable fiscal deficit and growing debt burden will, therefore, still prove to be very challenging for the new president. Mexico’s President-elect Lopez Obrador has also been the subject of market attention lately after cancelling the ongoing construction of a new airport in Mexico City. The move has spurred investor concern that the new leftist administration could cancel other contracts or investment projects and move away from the previous administration’s market-friendly reforms. In his latest pledge not to change banking laws during his first three years in office, Obrador sought to reassure investors. Markets, however, remain wary of the President-elect’s more interventionist approach to the economy.

Overall, we expect country-specific risks and vulnerabilities in emerging markets to remain a source of market concerns going forward. These will likely cause returning spikes in volatility on financial and exchange rate markets. However, we don’t expect them to cause significant spillovers to other emerging markets and lead to a systemic crisis in the emerging economies. As our economic scenario for China doesn’t envisage a hard landing - which would be particularly harmful for other Asian emerging markets – we don’t see that as a trigger for a systemic emerging markets crisis.

Underlying inflationary pressures rising gradually

September inflation figures in the US were somewhat weaker than expected. Headline and core PCE, the preferred inflation indicator by the Federal Reserve (Fed), are now at 2% yoy, with the headline figure recording a drop in recent months, coming from 2.3% yoy in July. A similar movement was seen in the CPI figures, caused by a combination of a fall in energy (-0.5% mom) and a flatlining in food price inflation (0.0% mom) together with somewhat weaker core inflation. The latter was largely influenced by a sharp dip in used car prices (-3.0% mom) in September, which was mainly a consequence of a methodological change in the way used car prices are reported. However, October figures again showed a rebound in headline inflation. In general, underlying developments still point to upward inflationary pressures going forward. Wage growth is continuing its upward trend (figure 3) and since labour market tightness is rising, this will likely remain the case. Hence, we see no reason to adjust our projected path for US inflation containing annual headline inflation of 2.5% in 2018 and 2.6% in 2019. Recent inflation developments don’t imply any alteration to the Fed’s monetary policy path. We continue to look for another rate hike in December of this year and four more hikes in 2019.

Figure 3 - Wage inflation indicators on an upward trend (% change yoy)

Euro area inflation figures for October were in line with expectations. Headline HICP inflation climbed marginally higher to 2.2% yoy, while underlying core inflation recovered by 0.2pp to 1.1% from its dip in September. The energy component delivered the main contribution (+10.6% yoy) while also services price inflation increased to 1.5% yoy from 1.3% yoy the month before. Hence, this means that headline inflation has been above the ECB’s target of 2% for several months now. However, on the core inflation side, price pressures are much more muted, with the recent uptick being more of a correction than the start of an upward trend. As a consequence, our euro area inflation forecasts are unchanged. Given our oil price assumptions, headline inflation will likely stay at or somewhat above the 2% level. We think headline inflation will likely fall down again and converge towards gradually increasing core inflation as oil prices will remain relatively stable over the coming years and wage pressures are gradually building. Accordingly, our view on the European Central Bank (ECB) policy path isn’t altered either. At the October ECB meeting, there was a strong determination to signal that economic and financial conditions remain sufficiently healthy to warrant the ECB remaining on its current course towards a gradual and predictable reduction in the degree of policy support it now provides. In our view, a first policy rate hike will only take place at the earliest after the summer of 2019.

CNB surprise

At its November monetary policy meeting, the Czech National Bank (CNB) unexpectedly raised its policy rate (two-week repo rate) by 25 basis points to 1.75%. It was the fifth instance of policy tightening in 2018, thereby increasing its policy gap compared to the ECB. The latest rate hike of the CNB was based on new macroeconomic forecasts of the CNB staff. These assume an acceleration of the Czech growth momentum and a later renewal of the appreciation of the Czech Koruna (CZK). Moreover, the rate increase was a consequence of the recent depreciation of the CZK and the associated inflationary pressures via higher import prices. We continue to expect one more rate hike in 2019, as opposed to none expected by the CNB. In our view, economic growth momentum will slow down in 2019 and the CZK’s appreciation will likely be more gradual than the path projected by the CNB. A driving force is the negative sentiment on FX markets, which will not change in the near future. Furthermore, the large amount of speculative capital in the Czech Republic will not decrease meaningfully either. This relative weakness of the CZK will, in our view, give the CNB a window of opportunity to raise its policy rate by 25 basis points in 2019.

Predictable Trump unpredictability

The market reaction to the US midterm elections has been generally subdued as the results were widely anticipated. Republicans maintained their majority in the Senate while the Democratic Party gained the majority in the House of Representatives. Given the vast differences between the Democrats’ and Republicans’ legislative agendas, and the precedent set in past years to reject bi-partisan compromise, little to nothing is expected to be accomplished over the next two years. The more progressive wing of the Democrats will likely urge party leadership to move further left rather than compromise with the current administration while the increased Republican majority in the Senate will mean fewer opportunities to strike a bipartisan deal on any future legislation. Now that Democrats have control of the House committees, an increase in subpoena-backed investigations into corruption or ethics scandals, such as potential Russian election interference in 2016, has increased in probability.

The Congress will, however, be less able to stymie President Trump on trade policy. Due to specific presidential trade authorities implemented by Congress over the last decades, import tariffs are under control of the executive branch of the President in certain circumstances. This is also the case in the ongoing US-China trade war. Moreover, Democrats are unlikely to turn the trade war into a major partisan battle. After all, there is some bipartisan support for pushing China to change its trade practices. Though there may be a momentary lull in trade war escalation now that there are no more elections in sight in the short-term, that could change rapidly if Trump needs to distract from an onslaught of investigations. Prospects for a rapid truce in the trade war are therefore gloomy. Also major showdowns over the funding of the US government in the divided Congress are a high possibility. Hence, the US political path over the next two years could be rather bumpy. As a result, increased economic and financial market uncertainty going forward should be expected. (also see 'Predictable midterm results. Still unpredictable Trump', 7 November 2018).

Focus article

All historical rates/prices, statistics and graphs are up to date, up to and including 18 November 2018, unless otherwise stated. The views and forecasts provided are those prevailing on 18 November 2018.