Economic Perspectives November 2020

Read the full publication below or click here to open the PDF.

- Both positive and negative factors have triggered changes to the economic outlook, partly counteracting each other. The global economy bounced back strongly after spring lockdowns, but impressive third-quarter GDP data across Western economies are becoming overshadowed by the rapidly unfolding second wave of the Covid-19 pandemic. We expect a setback in the recovery heading to year-end, particularly in Europe, and to a lesser extent in the US. Looking beyond this year, we see a more promising economic picture, namely in the second half of 2021 under the assumption of a gradual vaccine roll-out. Recent vaccine developments are encouraging, but an extensive roll-out strategy will still be challenging. Hence there remains considerable uncertainty as to the pandemic’s evolution, policy reactions to contain it and future vaccination. Downside risks remain key features of our outlook.

- The euro area recorded a robust and broad-based recovery in Q3. However, a surging number of Covid-19 cases since October has prompted a wave of new lockdowns. They are generally less stringent compared to the spring, which together with ongoing policy support implies a milder, yet longer-lasting economic impact. As a result, we now project another decline in Q4 growth and some sluggishness carrying well into Q1 2021, with the gradual payback from a vaccine coming from H2 2021 onwards. On the whole, we have marginally upgraded our annual growth outlook for 2020 to -7.5%, reflecting better Q3 GDP figures tempered by the worse Q4 GDP outlook, but reflecting our expectation of a markedly poorer Q4 carrying over into a weak Q1, we reduced our 2021 growth outlook from 4.9% to 1.9%. Hence, 2021 will be a more challenging year.

- The US economy also recovered sharply in Q3 and appears to maintain solid economic momentum heading into Q4. Growth is strongly supported by consumption growth, driven, not least, by a recovery in employment. However, there are clear downside risks, in particular from a record-breaking number of new infections, which has not yet resulted in many new restrictions. Furthermore, uncertainty surrounding the political transition after Joe Biden’s win in the presidential election and the still-stalled negotiations for new fiscal stimulus leave the short-term outlook more clouded. Overall, we have upgraded annual growth in 2020 from -4.5% to -3.7% on stronger-than-expected Q3 GDP growth and we maintain our forecast of 4.0% GDP growth in 2021.

- China leads major economies in its post-lockdown recovery with output rebounding already well above the pre-pandemic levels. In Q3, the pace of the recovery slowed, reflecting a normalization of growth dynamics following the large swings seen in the first half of the year. Higher frequency sentiment indicators suggest that the fourth quarter got off to a strong start, and China remains on track to grow 2.0% in 2020.

- Monetary policy on both sides of the Atlantic is set to remain supportive and synchronised with developments on the fiscal side. Given underlying economic weakness and still negative inflation, the ECB has pre-announced another round of easing measures coming in December, with ECB president, Christine Lagarde, hinting at adjustments focused on the PEPP and TLTRO programmes. This should further keep a lid on long-term government bond yields and intra-EMU spreads. Meanwhile, the Fed has so far resorted to a wait-and-see approach, maintaining its loose monetary policy unchanged both in respect to benchmark rates and ongoing asset purchases programmes.

Following a deep downturn in the first half of the year, global economic activity rebounded strongly over the summer. Recent third-quarter GDP data have showed growth rates significantly above expectations both in advanced economies, led by the euro area and the US, as well as in many emerging markets. Given the unprecedented size of the economic shock caused by the Covid-19 pandemic, however, most economies still have not fully recovered pandemic-induced output losses. What seems more important, however, is the fact that the underlying capacity to recover from strict lockdowns appears more robust across economies than previously envisaged, particularly on the private consumption side. Undoubtedly, massive policy support in place since the spring has underpinned the recovery, containing more negative economic fallout from the pandemic.

A strong recovery is already a thing of past

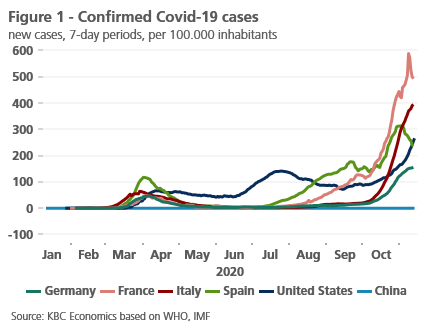

Despite the optimistic signal from the latest GDP readings, the rapidly changing pandemic landscape causes new clouds on the horizon. Since our last edition in October, the second wave of Covid-19 has spread further in the US and, particularly, in Europe, while remaining mostly muted in Asia, likely due to the long-lasting socio-economic restrictions in place (figure 1). The pandemic evolution remains the single most important driver of our economic outlook. This is notably the case for Europe, where a broad-based resurgence of Covid-19 and a surge in ICU occupancy rates have prompted governments to implement additional containment measures, or lockdowns 2.0, putting the economic recovery into reverse heading towards the end of the year.

These new lockdown measures, which are so far largely Europe-centred, come with a sense of déjà vu. But generally, they have been more targeted and localised this time, effectively less stringent compared to the spring episode. This implies a more limited negative impact on the economy, also thanks to the continued policy support. Moreover, we notice that the recovery in industrial production has so far been strongly resilient to the new pandemic wave, thanks to adapted ways of working and increased global demand, particularly originating from Asia. We expect that mainly services activities will suffer (again) during this second wave. On the flip side, without full lockdowns in Europe, social-distancing measures are set to last for longer, probably well into the first quarter of 2021, ultimately depending on hospital ICU spare capacity. Hence, in total we expect a milder but longer-lasting economic impact from this second pandemic wave. Note that we explicitly assume that additional pandemic waves will be avoided.

Against this background, our economic scenario now assumes a setback in the recovery heading to year-end. Our near-term outlook is particularly weak for the euro area, which has negative implications for annual growth in 2021. The US economy is expected to be on a somewhat stronger footing, yet with pandemic and post-presidential election-related risks in the forefront. China, in contrast, is projected to continue on its swift recovery path. At the same time, it is important to note that uncertainty around our outlook remains elevated, largely, but not exclusively due to the course of the pandemic. Therefore, we maintain three economic scenarios, including the baseline (a slow but steady recovery), to which we attach a probability of 55%, the pessimistic (a protracted and slower recovery potentially disrupted by setbacks from the virus) with a 35% probability, and the optimistic (a swift recovery with minimal structural damage to the economy) with the probability of 10%.

Looking beyond the next few months, we see a rosier economic picture, emerging progressively, particularly from the second half of 2021. Developments on the vaccine front are crucial in this respect, boosting sentiment and allowing businesses to plan for the post-pandemic future. At this point, there is growing optimism that the question is not ‘if’ but rather ‘how many’ and ‘when’ coronavirus vaccines will work despite many unknowns such as durability of protective immunity or the speed of mass deployment. Precisely because of still high uncertainty, gauging the exact timing of the vaccine boost to the economy remains a difficult exercise. While it is possible that vaccine roll-out for emergency use, i.e. for high-risk groups, will start as soon as the end of 2020, we assume that broad vaccination will not become established until well into 2021. This means that the gradual payback from the contraction should be seen from the second half of next year onwards. The longer-term outlook remains stable, despite the new short-term challenges, supported by increased global efforts to roll-out the Covid-19 vaccines, once available, and the expectation of strong fiscal stimulus beyond 2021.

Lockdowns 2.0 put the recovery in the euro area into reverse

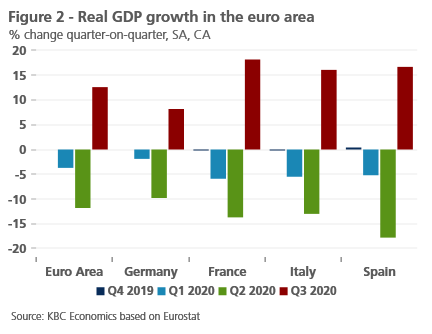

Although the third-quarter GDP readings in the euro area were widely expected to show a strong expansion, preliminary data point to an even more robust recovery from the first wave of the pandemic. The euro area economy bounced back by 12.6% qoq, following a decline of 11.8% qoq in the second quarter (figure 2). A detailed breakdown at the aggregate level is to be published later, but available details for France and Spain indicate a broad-based recovery across the demand components. In particular, household consumption has recovered ground firmly, fueled by pent-up demand from the end of the spring lockdowns.

Among the major economies, the strongest rebound was recorded in those that contracted most sharply during H1 2020. France (18.2% qoq), Spain (16.7% qoq) and Italy (16.1% qoq) therefore outperformed Germany (8.2% qoq). Nonetheless, in terms of output levels, there is a surprisingly strong commonality of experience; all major economies have recovered to around 96% of the pre-pandemic level, with exception of Spain, now being a clear laggard with GDP still more than 9% below the pre-crisis level (also see KBC Economic opinion of 10 November).

At the time of the release of the Q3 data, the euro area recovery was already under pressure from new containment measures, mainly affecting non-essential activity in the services sectors, such as restaurants and bars, as well as culture and leisure activity. France has gone furthest in this respect, targeting also non-essential retail shops, while the government in Germany has imposed milder restrictions. Both Spain and Italy initially implemented relatively soft nationwide measures, but adverse pandemic developments have prompted more stringent measures particularly at the regional level. Importantly, primary and secondary schools remain open, limiting the overall stringency of the current measures across Europe.

Meanwhile, the fiscal backdrop remains supportive and substantial with many programmes extended or new fiscal resources being introduced to support sectors most heavily affected by restrictions. In addition, this stimulus will be followed by new fiscal initiatives at the EU-level, namely the EUR 750 billion Next Generation EU in the second part of 2021 (see Box 1: EU enters fast-growing ESG niche market).

Box 1 - EU enters fast-growing ESG niche market

To alleviate the catastrophic impact of the Covid-19 pandemic on the European economy and labour market, European leaders established two funds, SURE (Support to mitigate Unemployment Risks in an Emergency, EUR 100 billion) and Next Generation EU (EUR 750 billion). The former has social objectives (protection of the labour market), while part of the latter pursues climate objectives. The funds to finance these operations are raised by the European Commission via financial markets. For this specific purpose, social bonds and green bonds are issued, both being part of the ESG bond market.

ESG stands for Environmental, Social and Governance, and only papers for social, environmental and/or other sustainability purposes bonds can be traded on the underlying bond market. The European Union has been an important player in this field since last month as it sought financing for EUR 17 billion (as part of the total EUR 100 billion SURE fund). The operation was a great success with above-expectation investor interest: applications were submitted for more than EUR 230 billion. In other words, the European Commission could have raised more than double its end goal for the whole SURE fund.

Such an enormous interest is not insignificant with respect to the large financial resources that the European Commission still has to finance. Based on a snapshot in mid-October, if the European Commission were to finance SURE and Next Generation EU in one fell swoop, it would dominate as much as 65% of the ESG bond market. Of course, the financing of the funds is set out as a gradual process over many years, giving the ESG-market time to grow in volume. Nevertheless, the signal is already clear: the European Union is becoming a mammoth in this very fast-growing niche market, and this impact of this should not be underestimated.

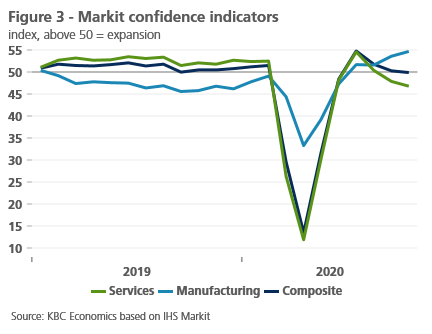

Furthermore, in line with the global picture, European industrial activity has so far proved resilient, owing to both a limited exposure to the renewed restrictions and the absence of spring-like distortions in global value chains. As a result, the divergence between manufacturing and services has become even more pronounced recently in Europe. The October PMI confirms this underlying trend with the manufacturing index rising to 54.8, while services dropped to 46.9, further below the 50-threshold marking a contraction (figure 3). Germany, in particular, illustrates the current two-speed nature of the economy, benefiting from its robust industrial capacity amid a more benign international backdrop, especially a rapid economic recovery in China. More services-oriented economies, however, are expected to feel stronger headwinds.

Despite a relatively upbeat outlook for manufacturing, the downturn in services, accounting for a much larger part of the economy, is set to interrupt the recovery. We now expect a dark winter in the euro area, with another contraction in Q4 and weak momentum carrying over into Q1 2021. Overall, our growth outlook for 2020 has seen a marginal improvement to -7.5% due to the better-than-expected Q3 figures. At the same time, we have downgraded 2021 growth from 4.9% to 1.9%, assuming slower lifting of containment measures and a gradual boost from the expected broad vaccination coming after mid-2021.

US economy records a swift Q3 bounce-back

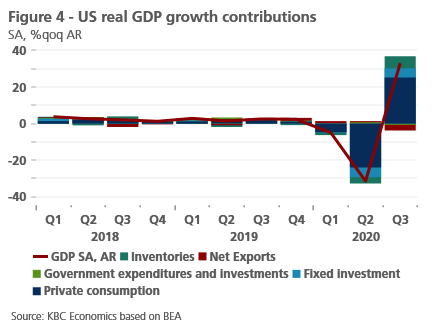

The US economy also witnessed a massive rebound from the lows seen in the second quarter. At an annualised growth rate, real GDP surged by a record 33.1% qoq in the third quarter, following a 32.9% qoq drop in the previous three months (figure 4). The US economy has now recouped around two-thirds of the pandemic-induced output loss, leaving GDP 3.5% below its fourth-quarter 2019 peak.

The bounce-back in Q3 was driven by private consumption, accounting for a vast majority of the annualised growth rate. While both goods and services consumption saw a robust expansion, the latter has lagged and is yet to surpass the pre-pandemic level, mostly due to the nature of the Covid-19 shock. Business investment also picked up strongly, reflecting a jump in equipment investment. Meanwhile, government spending contracted, subtracting from growth amid gradually fading stimulus support.

Although growth rebounded from a very low base in Q3, and as such could be described as mechanical, solid economic momentum appears to be maintained heading into Q4. Business sentiment, for example, continued to improve in October, and high-frequency indicators for consumer spending and personal income came out in a solid shape. Furthermore, the labour market shows signs of resilience, despite visible structural challenges ahead, in particular a steady rise in long-term unemployment. Most recently, the headline unemployment rate has surprised on the positive side, having dropped to 6.9% in October from 7.9% a month earlier.

Nonetheless, there are notable downside risks to activity in the fourth quarter. At least for now, the fact that new Covid-19 cases have been hitting all-time highs has not prompted widespread re-emergence of lockdown-type restrictions at the national or state level. Hospitalisation rates have accelerated markedly of late. Should this trend continue, the heath-care system strain would likely result in a re-imposition of broader containment measures. In addition to the virus resurgence, uncertainty surrounding the power transition after Joe Biden’s win in the November 3 presidential election and the still-stalled negotiations for the new fiscal stimulus package leaves the near-term outlook more clouded (see Box 2: Uncertainty remains high in American politics after a Biden win).

Box 2 - Uncertainty remains high in American politics after a Biden win

Despite the lack of a concession speech from President Donald Trump and continuing threats of legal action from his campaign, it is clear that former Vice President Joe Biden has been elected the next President of the United States. However, President-elect Biden will not take office until January 20th, 2021 and will not be able to enact any meaningful policy until then. So, Biden’s election will have little impact on policy between now and his inauguration.

This doesn’t mean new initiatives are entirely ruled out in the interim. As it currently stands, no meaningful fiscal package has been passed since the Spring, which will lead to negative impacts on economic activity if this remains the case. One positive sign for fiscal stimulus that has emerged in the post-election environment is that Republican Senate Majority Leader Mitch McConnell has signaled a willingness to pass new stimulus as soon as possible. He has even suggested he is open to Democratic demands on providing state and local aid.

Looking at the policy environment through the next couple of years, it is likely that there will be a divided government, with the Democrats holding the Presidency and the House of Representatives but the Republicans holding the Senate. This would be a return to the usual congressional gridlock that we have seen for the last decade or so. This environment means that while a fiscal package is likely, the size and scale may not match what current times call for due to a combination of the fiscal hawkishness of many Republicans and the at-times unyielding demands of some Democrats.

There is also some possibility of a unified government in all but name that would make for a more cohesive policy setting. The composition of the Senate hinges on January run-off elections for Georgia’s two seats. If Democrats manage to win both seats, that would put that Senate at 50 Republicans and 50 Democrats. In the event of a tied vote, Vice-President-elect Kamala Harris will be the tie-breaker. This would be a boon for the Biden administration that would improve its chances of implementing its agenda, which includes more spending on infrastructure, healthcare, education, and the social safety net. These plans will be in part deficit-financed, but will also be paid for by higher taxes on corporations and the wealthy.

In general, uncertainty remains high in American politics. While the dust has more or less settled in terms of the Presidential election, in-fighting has already begun between moderate Democrats and the leftist wing of the party. Democrats will need to synchronise both their messaging and their efforts to pass legislation in order to be effective in the first two years of the Biden administration, or they may lose their hard fought seats in the 2022 mid-term elections.

As a consequence, we see somewhat softer end-year growth dynamics in the US than previously envisaged. Still, despite a slight downgrade to our Q4 outlook, a sharper-than-expected outturn in Q3 leads, on balance, to improved annual growth in 2020 from -4.5% to -3.7%. For next year, we continue to pencil in a major payback from the contraction, projecting annual growth of 4.0% amid a more constructive macro backdrop, in particular, buoyed by a gradual mass roll-out of a Covid-19 vaccine.

China leads major economies in a post-lockdown recovery

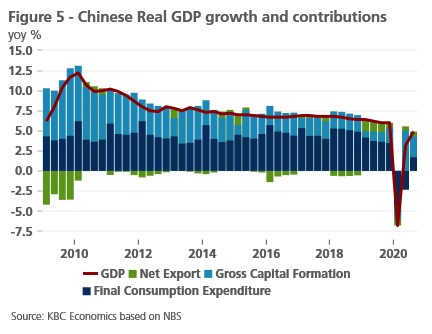

China remains on track to grow 2.0% in 2020, with the latest GDP figure confirming that the economy continued to recover in the third quarter (4.9% yoy growth). Though the pace of the recovery did slow from 11.7% qoq in Q2 to 2.7% qoq in Q3, this partially reflects a normalisation of growth dynamics following the large swings seen in the first half of the year. Investment continued to lead the economic recovery, but consumption is also picking up (figure 5). Higher frequency sentiment indicators suggest that the fourth quarter got off to a strong start as well, with the Markit manufacturing PMI climbing to 53.6 in October and the Markit services PMI jumping to 56.8 (where anything above 50 signals expansion). Notably, exports have held up well, growing 7.6% yoy in October according to Chinese customs data. However, the emergence of Covid-related lockdowns in many other parts of the world could weigh on China’s export performance going forward.

Meanwhile, the Chinese renminbi has appreciated 8% against the USD between 27 May 2020 and 6 November 2020. This relative strength reflects the stronger, V-shaped recovery experienced by the Chinese economy as well as interest rate differentials (as the PBoC has been more moderate in its policy stimulus through this year), which together with more financial openness, has attracted investment inflows into China. Growing expectations over the past few weeks for a Biden victory in the US elections may have also contributed to some CNY strength. However, it is not fully clear how the future Biden administration will approach the United States’ trade and technological relationship with China.

Monetary policies are set to remain supportive

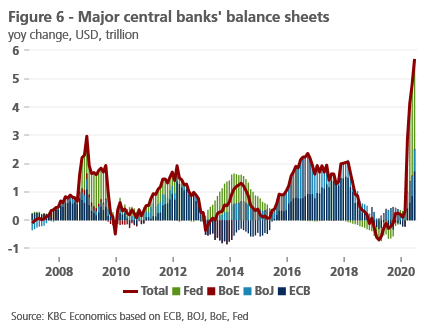

Besides massive fiscal support in place since spring lockdowns, major central banks have continued to maintain a highly accommodative monetary policy stance. A synchronised macroeconomic policy response to the pandemic crisis has been an important step forward, contrasting to the period after the Global Financial Crisis. Specifically, enormous liquidity injections have helped prevent a serious deterioration in global financial conditions (figure 6). Looking ahead, we assume that monetary easing measures are unlikely to be withdrawn anytime soon given the unprecedented size of the Covid-19 shock. Still, their focus is likely to shift from cushioning the immediate pandemic impact to containing negative second-round effects and underpinning a recovery.

Among the major central banks, the ECB appears particularly concerned at the threat of a renewed deterioration in economic conditions amid already low underlying prices dynamics. Both headline and core inflation rates remained unchanged in October at -0.3%, and 0.2% yoy, respectively. Nonetheless, demand-driven weakness, namely softer services inflation from new lockdown measures, is set to exert further disinflationary pressures. Furthermore, our updated oil outlook now envisages a lower trajectory for prices compared to last month with limited upside potential through mid-2021. Accordingly, we have further revised the euro area inflation downward to 0.2% this year and 0.9% yoy in 2021.

Against the background of more subdued inflation dynamics, the ECB announced at its October meeting an intended ‘recalibration of its instruments’ at its December meeting. This is a highly unusual dovish signal from the Governing Council, that we see as an effective pre-commitment to another round of easing measures in December. The new easing package will likely include an extension of the Pandemic Emergency Purchase Programme (PEPP) beyond June 2021, but adjustments to in Targeted Longer-Term Refinancing Operations (TLTRO) rates to keep financing costs for banks low are also on the table. Despite some speculation about another cut in the deposit rate, this seems rather unlikely given possible side-effects and an adverse impact on the banking sector. Hence, we continue to project the deposit rate at a current -0.50% at least through the end-2021.

Additional ECB liquidity will keep a lid on government long-term bond yields in the euro area. This, compounded with the more challenging backdrop in Europe, has led us to lower our year-end expectation for the 10Y German bond yield to -0.50% (from -0.30%). Over the course of 2021, moderate normalization is projected with end-year outlook for -0.20%. Intra-EMU spreads will remain more or less stable over the forecasted horizon, though a risk of country-specific events could spur some temporary bouts of financial market nervousness.

At the same time, the expectations about different near-term policy actions between the ECB and the Fed affect our short-term outlook for the euro. Compared to the last month, we adjusted our end-2020 forecast to 1.19 EUR/USD (from 1.21 EUR/USD). In the aftermath of the US presidential election resulting in a Joe Biden’s win, the euro has already regained a somewhat firmer ground. From a longer-term perspective, we maintain our view of structural strengthening of the euro vis-à-vis the US dollar, reflecting a gradual unwinding of its fundamental undervaluation.

Looking to the other side of the Atlantic, the Fed maintained a wait-and-see approach at its November FOMC meeting, keeping the policy rates, as well as its asset purchase programmes unchanged. In contrast to the ECB, the Fed is since its recent policy review less focused on inflation at present and, additionally, less immediately worried about underlying price dynamics, with inflation not markedly changed since the start of the year. However, the uncertain fiscal backdrop continues to be a concern for the FOMC as hinted again by chairman Powell during the last meeting, but without any further take on the presidential election outcome and its impact on the economy. Therefore, without any meaningful change in Fed communication, we continue to expect no rate cut over the forecast horizon.

Alle historische koersen/prijzen, statistieken en grafieken zijn up-to-date, tot en met 9 november 2020, tenzij anders vermeld. De verstrekte posities en prognoses zijn die van 9 november 2020.