Economic Perspectives May 2023

Read the full publication below or click here to open the PDF.

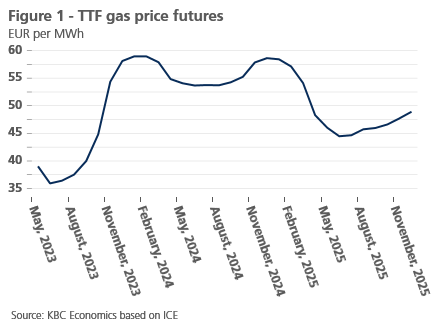

- Thanks to high EU gas reserves and all-in-all moderate demand, European gas prices continued their steady decline. They reached 38 EUR per MWh, 88% lower than their August levels. Meanwhile, after shifting down, oil prices remained relatively stable as the upward price effect of the 1 million barrel OPEC supply cut was mostly compensated by growing fears about the state of the global economy. Other cyclical commodities such as copper, iron and lumber also faced downward pressure last month.

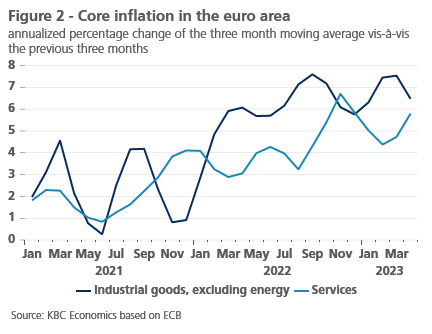

- Euro area inflation marginally increased from 6.9% in March to 7% in April, mostly as a result of energy-related base effects. Core inflation slightly decreased from 5.7% to 5.6%, as goods inflation is decelerating while service inflation is accelerating. Given the slower than expected deceleration in core inflation, we upgrade our 2023 headline inflation forecast for the euro area from 5.8% to 5.9% and our 2024 forecast from 3% to 3.1%.

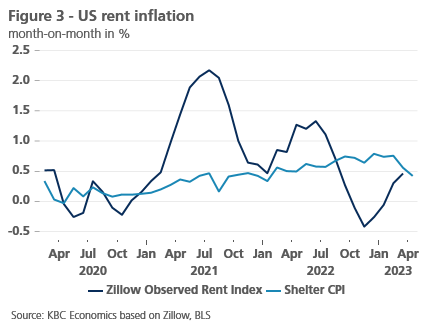

- In the US, headline inflation declined from 5% to 4.9% in April thanks to stagnating food prices. Core inflation also declined by 0.1 percentage point to 5.5%, as shelter inflation decelerated. Goods inflation, however, accelerated as used cars and truck prices sharply increased again. Service inflation also increased, as wage pressure accelerated. We downgrade both our 2023 and 2024 forecasts by 0.1 percentage point to 4.3% and 2% respectively.

- Financial stability concerns came back to the forefront in April, as First Republic became the latest regional US bank to fail. Several other regional banks also experienced further pressure on their stock prices and in some cases continued deposit outflows. Nonetheless, in their latest monetary policy meetings, central banks remain focused on fighting inflation. In the US, the Fed still hiked its policy rate by 25 basis points to 5.125%. We expect this to be the last rate hike. The ECB also raised its policy rates by 25 basis points in May, with its deposit rate now reaching 3.25%. As inflation is more persistent in the euro area, we forecast two more rate hikes. We don’t expect either central bank to start cutting rates this year.

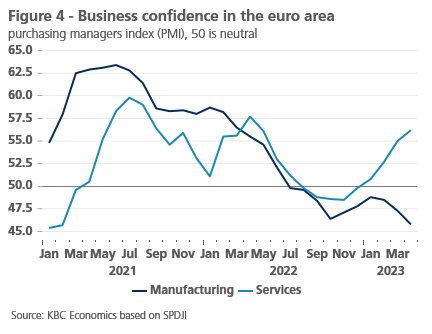

- The euro area grew by only 0.1% quarter-on-quarter in Q1. The low figure was partly the result of a big decline in Irish GDP, while Italy and Spain overperformed. Net exports is expected to be the key contributor to EU growth. Nonetheless, the economy is showing some resilience in the face of increasing monetary pressure as sentiment indicators for the service sector are improving and the labour market remains robust. We slightly downgrade our 2023 forecast from 0.8% to 0.7%, while we maintain our 1.1% 2024 growth forecast.

- In the US, growth slowed down to 0.3% quarter-on-quarter in Q1, as lower investments and especially the depletion of inventories weighed on growth. Private consumption continued to support growth, but slowed down significantly at the end of Q1. Furthermore, the tightening lending standards in light of continued financial sector turbulence may weigh on growth going forward. We downgrade our growth forecast from 1.3% to 1% for 2023 and from 0.3% to 0.1% for 2024.

- With the Chinese economy now fully reopened, its economy grew at a solid 4.5% over a year ago, as export, consumption and investments made strong contributions. There are nonetheless some signs of weakness in manufacturing, private investment and construction. Meanwhile, inflationary pressure remains subdued. We upgrade our 2023 growth forecast from 5.2% to 5.4%, while maintaining our 4.9% 2024 forecast.

Recent GDP figures showed that the economic environment in advanced economies is weakening as monetary tightening is starting to bite. The euro area economy grew by only 0.1% quarter-on-quarter in Q1, lower gas prices notwithstanding. Further rate hikes by the ECB on the back of persistently high (core) inflation will likely keep euro area growth significantly below potential. In the US, growth slowed down to 0.3% quarter-on-quarter in Q1, as inventory growth turned deeply negative and consumption growth, while still contributing to growth, weakened in February and March. There, continued monetary tightening is exposing weakness in the financial sector, especially among mid-sized US banks. Four banks already went bankrupt or were taken over. First Republic Bank, the latest victim, is the largest bank failure since the Great Financial Crisis of 2008. Though a system-wide financial crisis is not in our base scenario, tighter lending standards are likely to contribute significantly to the slowdown of US growth in H2 2023 and in 2024. The Chinese economy, meanwhile, grew by 4.5% over a year ago, as its economy recovers from the strict zero-Covid lockdowns of 2022 and travel-related services rebounded. Nonetheless, the manufacturing and construction sectors are showing signs of weakness. Overall, our scenario expects global economic growth to slow down significantly. Furthermore, risks remain tilted to the downside as further financial sector turbulence and a potential US debt ceiling breach could further derail growth prospects.

Gas prices decline, while oil prices remain surprisingly stable

European gas prices declined for the fifth month in a row in April, dropping to 38 EUR per MWh, a 12% decline versus last month. Gas prices are now slightly less than the double of the pre-war levels and are 88% lower than their August peak. Europe’s steady replenishment of gas reserves (and still moderate global gas demand) is the prime driver of these lower prices. EU gas reserves now stand above 60%, more than 20 percentage points higher than typical at this time of the year. This significantly lowers the risk of severe gas supply disruptions in the winter of 2024. Nonetheless, futures markets still expect gas prices to rise by around 50% to around 60 EUR per MWh by the end of the year (see figure 1).

Oil prices meanwhile remained remarkably stable, with Brent prices reaching 80 USD end of April, a 2% month-on-month increase. At the start of the month, OPEC announced a 1 million barrel daily supply cut, which pushed oil prices up by 6% on the day of the announcement. However, over the course of the month, recession fears pushed prices back down. Early May, when markets went in risk-off mode, as a result of the failure of First Republic Bank, prices dropped significantly to almost 70 USD per barrel. They bounced back up, however.

Oil was not the only commodity to be affected by increasing recession fears. Metal prices also declined for the fourth month in a row. Cyclical commodities such as iron ore and copper posted notable month-on-month declines of 4.5% and 8.6% respectively. Lumber, another cyclical commodity, also posted a 5.6% decline.

Further down the line, positive news on global supply chains continued. Thanks to China’s reopening and continued post-Covid adaptation, the Global Supply Chain Pressure Index now stands at -1.31, the lowest point since 2008. This easing pressure on global supply chains will support the global economy, while reducing inflationary pressure somewhat.

Upward pressure on euro area services inflation

As expected, euro area inflation rose slightly again in April, from 6.9% to 7.0%, according to the flash estimate. This was mainly the result of the small increase in energy price inflation, but fully due to a (reversed) base effect: energy prices fell more sharply in April 2022 than in April 2023 (each considered against the previous March). Both food price inflation and core inflation fell. However, the latter was exclusively accounted for by non-energy goods, whose annual rise declined from 6.6% in March to 6.2% in April. In contrast, services inflation rose slightly further from 5.1% to 5.2%. Excluding seasonal fluctuations and looking at the underlying upward dynamics over the past few months, goods inflation seems to turn (cautiously), but there appears to be renewed upward momentum in services inflation (see figure 2). The rise in inflation is widely spread across different consumer services, with outliers in tourism and hospitality.

This is a not very encouraging observation, as the ongoing catch-up of wages to the recent inflation shock continues to support (or even boost) services inflation. Incidentally, there are indications that increasing profit margins in consumer-oriented service sectors contributed more than average to the increase of headline inflation in 2022.

We still assume that in the coming quarters, profit margins will absorb some of the rising labour cost pressures, which will allow a cooling of services inflation and, by extension, core inflation. Moreover, sharply lower energy prices compared to the second half of 2022 will trigger a substantial fall in energy price inflation (partly due to base effects) and a broad-based easing of inflationary pressures during the second half of this year. Thus, while inflation will fall, given the recent trend in services inflation, we have nevertheless slightly raised our expectation for headline inflation in the coming months. This is reflected in the expected average inflation rate, which we have raised from 5.8% to 5.9% for 2023 and from 3.0% to 3.1% for 2024.

Both headline and core US inflation decline slightly

US headline inflation declined by 0.1 percentage point to 4.9% in April. A stagnation in food prices contributed strongly to the decline. Thanks to strong base effects, food price inflation declined from 8.5% to 7.6%. Meanwhile energy inflation increased by 0.6% month-on-month as gasoline prices strongly increased. Still, on a yearly basis, energy price inflation remains negative (-5.1%).

Core inflation also declined by 0.1 percentage point to 5.5% in April. A slowdown in shelter inflation was the main driver of this decline (see figure 3). Though this slowdown is encouraging, it remains to be seen whether it can persist. Leading indicators such as the Zillow Observed Rent Index posted strong increases in recent months.

Shelter aside, goods inflation unfortunately accelerated in April to 0.6% month-on-month. The prime culprit of this acceleration were used car and truck prices. These prices had been declining for 9 straight months, but went up by 4.4% month-on-month in April. We anticipated this reversal, however. Though the Manheim Used Vehicle Value Index, a leading indicator of this component, declined somewhat in April (-3%), it remains 6% higher than its November low. Further increases in this component in the coming months would not be surprising.

Service inflation (ex. shelter) also remained high at 0.4% month-on-month. If we filter out medical care services, which again declined as a result of a methodological change, service inflation increased by 0.6% month-on-month. This high figure is not totally surprising, as wage inflation, the prime driver of service inflation, also accelerated last month. Average hourly earnings increased by 0.5% month-on-month in April.

All in all, given the lower than expected food and shelter inflation, we lower both our 2023 and 2024 forecasts by 0.1 percentage point to 4.3% and 2% respectively.

Central banks remain focused on inflation when setting policy rates

The demise of another regional US bank, First Republic Bank, shook financial markets again as it was the largest failure since 2008. Other similar regional US banks suffered major deposit outflows and saw their share price plummet. Nonetheless, we maintain our assumption that the crisis will remain contained and temporary. This is also what central banks seem to expect. Their prime concern remains high inflation. As our scenario forecasted, both the Fed and the ECB thus raised their policy rates by 25 basis points to the range of 5%-5.25% in the US and the rate of 3.25% (deposit rate) in the euro area.

In line with the Fed’s hints, we confirm our view that the current level of Fed funds rate (5%-5.25%) is expected to be the peak of this rate hiking cycle. We should also keep in mind that the Fed is operating its QT operation of reducing its balance sheet at the cruising pace of 95 billion USD per month, resulting in continued monetary tightening even at an unchanged policy rate. Our view with respect to the peak of the US rate cycle is consistent with the bulk of current market expectations. However, compared to market expectations, our view on the timing of the first rate cut differs. In our scenario, the Fed will maintain its current rate until end 2023. Consistent with our US macroeconomic scenario, which incorporates a technical recession in the second half of 2023 and a notable increase of the unemployment rate from the current historically low level, the Fed will probably start its rate-cutting cycle in the first quarter of 2024.

The ECB, on the other hand, still has more ground to cover. After the expected rate hike in early May, we except two more rate hikes of 25 basis points each, bringing the deposit rate to its terminal rate of 3.75%. In contrast to market expectations, we expect the ECB the maintain its peak rate until well into 2024. Finally, at its May meeting, the ECB also announced that it expects to end the reinvestments under its asset purchase programme (APP) from July on. The implied monthly pace would, at least at the start, be broadly comparable to the current pace of 15 billion EUR per month.

Consistent with the confirmation of our monetary policy scenario, we maintain our view on long-term bond yields. In the short term, bond yields still have some upward potential, somewhat reducing the current strong inversion of the yield curve. This is, in our view, particularly the case in the euro area, where long-term real yields are still relatively low. After peaking by the end of the second quarter, bond yields are likely to gradually decline.

During the past month, intra-EMU spreads remained broadly stable. We confirm our view that these spreads will continue to moderately and gradually normalise from still fundamentally low levels in the context of the ongoing tightening of monetary policy. The ECB’s flexible reinvestment policy of its PEPP (over time, across asset classes and among jurisdictions) and the availability of the Transmission Protection Instrument (TPI), if needed, should be sufficient to ensure that this spread normalisation continues in an orderly manner.

Finally, our view on the euro exchange rate has become slightly more optimistic for the coming quarters. Now that it has become likely that the Fed’s rate hiking cycle may be coming to an end, while the ECB still has some way to go, the euro is likely to appreciate gradually versus the US dollar, and reach 1.13 USD per EUR at the end of 2023. Even at that level, we would consider the euro to be relatively undervalued compared to its long-term fundamental value.

Euro area avoided recession

In the euro area, the preliminary flash estimate of real GDP points to modest growth of 0.1% in the first quarter of 2023 versus the previous quarter. This is in line with our expectation, although the stagnating German economy still performed somewhat weaker than expected (0.0% versus 0.1% growth expected), and the Spanish (0.5% versus 0.2%) and especially the Italian (0.5% versus 0.1%) economies grew significantly stronger than expected. In France, as expected, real GDP was 0.2% higher than a quarter earlier. It is thus increasingly clear that the feared 2022-2023 winter-recession has been (narrowly) avoided. (In the fourth quarter of 2022, the economy broadly stabilised). The resilience of the economy of the continental euro area was even slightly stronger than the GDP figures suggest: adjusting the figures for the highly volatile Irish GDP, euro area growth in the first quarter of 2023 would be as high as 0.2%. Details on the expenditure components of GDP are not yet available, but partial information from the National Statistical Institutes suggests that net exports made a significant growth contribution, while domestic consumption demand was weak.

Looking forward, confidence indicators suggest that this dynamic could be changing in the meantime. Both the PMIs and the European Commission’s surveys of business sentiment point to declining confidence in the export-sensitive manufacturing sector. In contrast, confidence is strengthening quite sharply in the more domestically driven service sectors (see figure 4). In construction, confidence was more or less stabilising in April. Consumer confidence improved slightly but remains weak, following the sharp blow it received immediately after the Russian invasion of Ukraine.

All this gives the impression that the pass-through of tighter ECB policy into the real economy is rather piecemeal. However, the impact of tightened monetary policy is already evident in a number of monetary indicators. Lending to households and businesses as well as money growth is slowing. The ECB’s recent quarterly bank lending survey points to further tightening of credit conditions and a further decline in credit demand. But then again, the European Commission’s six-monthly survey of investment expectations shows that higher interest rates are not yet inducing full investment stops. Companies plan to continue investing. Apparently, the need for investments in innovation due to the digital and green transition and for labour-saving investments due to the still tight labour market outweighs the increased financing costs. But cash-rich firms need to rely less on credit to implement these investment plans.

Last month’s developments are in line with our growth scenario. We have therefore left our growth forecasts for the coming quarters unchanged: a slight firming of real GDP growth in the second quarter, followed by another weaker second half of the year due to the tighter monetary environment, followed by a gradual strengthening of growth in 2024. However, the revision of the 2022 quarterly figures for German GDP causes a downward revision of the expected average GDP growth in 2023 from 0.2% to 0.0%, due to changed overhang effects. In contrast, stronger-than-expected growth in the first quarter in Spain and in Italy lifts the expected average growth rate for 2023 for these countries (from 1.5% to 2.1% for Spain and from 0.6% to 1.0% for Italy). On balance, these changes produce a slight downward adjustment to the euro area’s average real GDP growth forecast for 2023, from 0.8% to 0.7%.

US growth slows down in Q1

US growth slowed down significantly, reaching 0.3% quarter-on-quarter in Q1, down from 0.9% quarter-on-quarter growth in Q4 2022 (see figure 5). Inventories were the main drag on growth, dragging down growth by 1.2%. This major downside inventory pressure is unlikely to be repeated in the coming quarters. Investments also contributed slightly negatively to GDP growth as residential investments and equipment spending declined. Especially the decline in equipment spending, a leading indicator for business investments, is reason for concern. On the upside, net exports made a small contribution to GDP growth as the trade deficit narrowed significantly in March. Government spending increased by 1.2%, partly thanks to increased defense spending in the wake of the Ukraine war. It made a 0.2% contribution to GDP. The main driver of GDP growth was private consumption, which contributed 0.6%, the highest contribution since Q2 2021. The high figure was unfortunately mostly realised in January. In February and March, consumer spending growth was almost nil. Consumer spending might thus be weaker in future quarters.

The biggest strength of the US economy today remains its labour market. In April, 253.000 non-farm payrolls were added, while the unemployment rate declined to 3.4% from 3.5%. Nonetheless, as labour is a lagging indicator, we still expect the US economy to weaken substantially in the next few quarters. Continued monetary tightening and the recent turmoil in the financial sector will cause further tightening in financial conditions. Furthermore, though we still believe Congress will eventually reach an agreement to lift the debt ceiling (see our KBC Economic Opinion of 3 May), such an agreement will likely lead to tighter fiscal policy. We downgrade our growth forecast from 1.3% to 1% for 2023 and from 0.3% to 0.1% for 2024.

China’s Q1 growth figures surprise positively

The first reading of Q1 real Chinese real GDP growth came in at 4.5% year-on-year, a significant upward surprise compared to the 4.0% consensus forecast. The strong figure signals that the reopening of the economy is gaining steam after three years of Covid-lockdowns. Looking at the underlying growth components, we see that the rebound of the services sector (consumption) and investments (likely thanks to state companies) were the main contributors to growth. The tertiary sector, which was impacted most by Covid containment measures in previous years, saw a large growth acceleration in Q1 (+3.1 percentage points) compared to Q4 2022. In the primary and secondary sector, in contrast, contribution to real GDP growth moderated by -0.3 and -0.1 percentage points, respectively as the global economic environment weakens.

Looking forward, there are many reasons to remain cautious on the Chinese economy. The real estate sector is still under pressure, albeit less so than during the acute phase of the crisis. There are some positive signs coming from the real estate sector in 2023, with improvements seen in prices and the completion of new homes (+32% year-on-year) in March. The latter stands in strong contrast to the start of construction on new homes, which declined significantly in March (-29% year-on-year). The focus on finishing existing housing project, in some cases with support from local governments, is aimed at restoring confidence in the debt-laden real estate sector.

A second reason to remain cautious on the growth outlook is the external environment, with a technical recession in the US still in the cards and elevated geopolitical tensions. In this context, the relevance of the strong March export figure for China (+14.8% year-on-year) should not be overstated as the jump in exports is at least partly attributable to exporters rushing to fulfil a backlog of orders that had been disrupted by the pandemic in the past months. The April figure was already lower at 8.5% year-on-year. Another important concern around economic growth is private sector investment weakness (in contrast to public sector investment strength), especially in light of the high (off-balance) local government debt and China’s plans to crackdown on local government financing vehicles.

The strong Q1 figure puts the economy well on track to reach the government’s growth target of 5.5%. This clears the way for some much needed structural reforms of local government finances and for more stringent regulations on the financial sector to reduce corruption. We expect the central government could prioritise these changes over supporting the economy and we therefore put our growth outlook at a conservative 5.4% year-on-year for 2023, followed by a real GDP growth rate of 4.9% in 2024.

The low March consumer inflation (headline: 0.7% and core: 0.7% year-on-year) and producer price inflation (-2.5% year-on-year) figures have prompted us to lower our inflation outlook for 2023 to 2.1% year-on-year. We expect inflation to strengthen again later in the year as the impact of temporary disinflationary factors, including lower fuel prices and exceptional car price discounts, fade. For 2024, we see consumer price inflation increase to 2.3% year-on-year. The weakness in inflation and strong real GDP growth in Q1 have prompted us to take out the Medium-term Lending Facility rate cut by the PBoC that we had penciled in around Q3 2023. However, if growth conditions were to deteriorate significantly going forward, monetary policy easing is still a possibility.

Turkish elections with high stakes

Next weekend is an important one for the Turkish people. They will elect a new president and a new parliament. Election polls indicate that the battle for the presidential seat will be a nail-biter. Both incumbent President Erdogan and his main challenger Kılıçdaroglu (backed by an alliance of six parties) will garner about 46% of the vote, according to those polls. To be elected as early as the first round, candidates must secure at least 50% of the vote. It is therefore likely that a second round of elections will be needed on Sunday, May 28. In the polls for the parliamentary elections, President Erdogan’s AKP party currently has the best score (about 35% of the vote), followed by Kılıçdaroglu’s CHP party (about 30% of the vote).

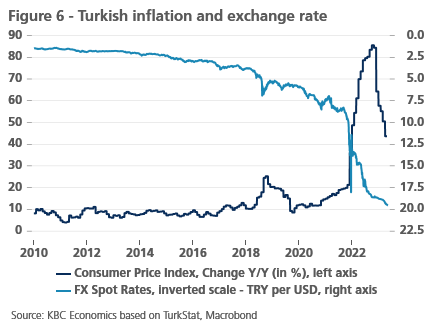

That the polls are so close is in large part due to the skyrocketing inflation and currency crisis that have eroded the purchasing power of the Turkish people. Both were fueled by the unorthodox monetary policy ordered by the president. Successive interest rate declines – notwithstanding sky-high inflation – have driven foreign (and domestic) capital away from Turkey, putting solid downward pressure on the Turkish lira (see figure 6). Central bank attempts to support the currency have led to a steep decline in FX reserves. This situation is unsustainable in the longer term. Either way, monetary policy will have to be adjusted after the election but normalisation is expected to proceed much faster and further if the opposition wins.

All historical quotes/prices, statistics and charts are up-to-date, up to 9 May 2023, unless otherwise stated. Positions and forecasts provided are those of 9 May 2023.