Economic Perspectives March 2019

Read the full publication below or click here to open the PDF.

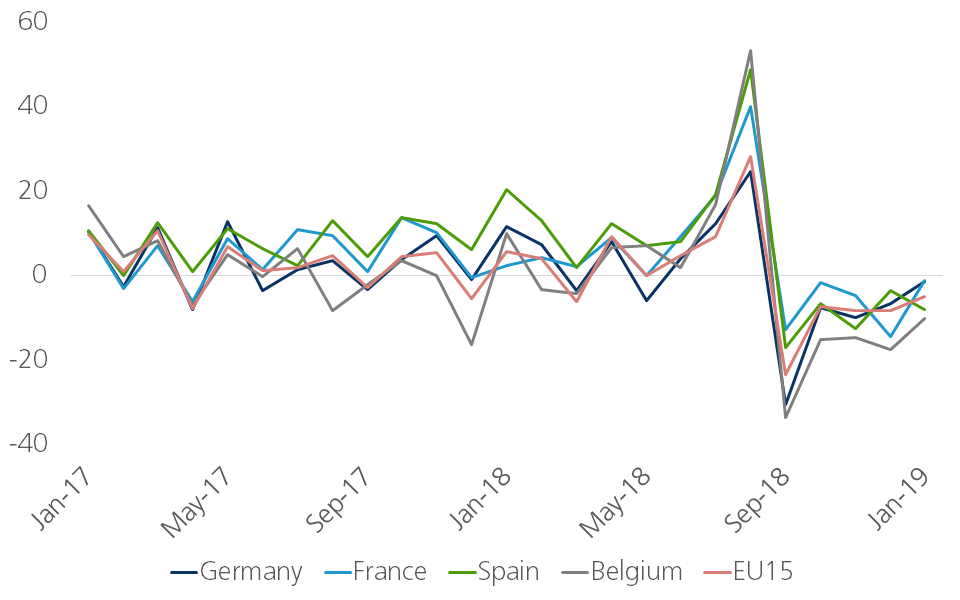

- The general downward trend in corporate sentiment that has been around for several months still remains. Businesses remain pessimistic, particularly in the manufacturing sector, which suggests that a significant rebound is not yet in sight. However, a closer look at the details suggests that some specific countries, such as France, are showing cautious signs of bottoming out in the first months of 2019. Corporate sentiment in the services sector has also shown a partial recovery of late.

- While the picture is constantly changing, it remains the case that, unless there is a decisive intervention in the coming week, the UK will exit the EU on March 29th 2019 as set out in the terms of its EU Treaty Article 50 declaration. As the current debate in the British Parliament is mainly concentrated on the Irish border rather than on a wide range of issues, we believe a deal is still possible with further ‘clarifications’ or re-structuring of commitments around the Irish border. For this reason, a ‘softish but not smooth’ Brexit remains KBC’s base scenario.

- Given the ECB’s downwardly adjusted forecasts for inflation and growth and the new forward guidance, we altered our projected monetary policy path. In our updated scenario, we expect the ECB to postpone its first rate hike until Q2 2020. Moreover, the ECB announced further long term funding arrangements (TLTRO-III) for euro area banks providing two year funding. These would be launched at a quarterly frequency running from September 2019 until March 2021.

- Fewer expected rate hikes from the Fed together with the dovish stance of the ECB will give emerging markets some respite and ease pressures on emerging market currencies in general. There are, however, some risks on the horizon. A sharper than expected global growth slowdown, a deterioration of the ongoing trade war negotiations and some country-specific vulnerabilities will still contribute to volatility. South Africa may be one such emerging market where mounting risks and vulnerabilities keep it on an especially rocky path going forward.

End of sentiment deterioration in sight?

The general downward trend in corporate sentiment that has been around for several months now still remains. Businesses remain pessimistic, particularly in the manufacturing sector, which suggests that a significant rebound is not yet in sight. Factors such as the ongoing uncertainties around the Brexit negotiations, trade war jitters and a continued slowdown in Chinese growth are still weighing on manufacturing firms that are heavily dependent on the international trade environment. These negative effects are the most visible in economies with a high trade openness, such as the euro area and Japan. In February, the Markit manufacturing PMI of both countries dropped below the 50-level which theoretically separates expansion from contraction. This has also been reflected in disappointing data for exports and industrial production.

However, a closer look at the details suggests that some specific countries are showing cautious signs of bottoming out in the first months of 2019. In France, manufacturing sentiment measured by the PMI rose in February for the second month in a row. Social unrest had a clear negative impact on sentiment towards end 2018, but these effects were temporary. Also, the more domestically-oriented services sector reported an improvement in sentiment in most developed markets. This signals that underlying growth determinants such as supportive labour market conditions are still in good shape. Investment growth remains positive despite the worse sentiment. While it is not entirely clear that there is a trend reversal in global sentiment indicators, the recovery in the services sector and the uptick in some specific countries might indicate that the downward trend is coming to an end. This is in line with our expectation of a better second half of 2019, in particular in the euro area where the growth momentum slowed down markedly in the second half of 2018.

Less buoyant growth projections

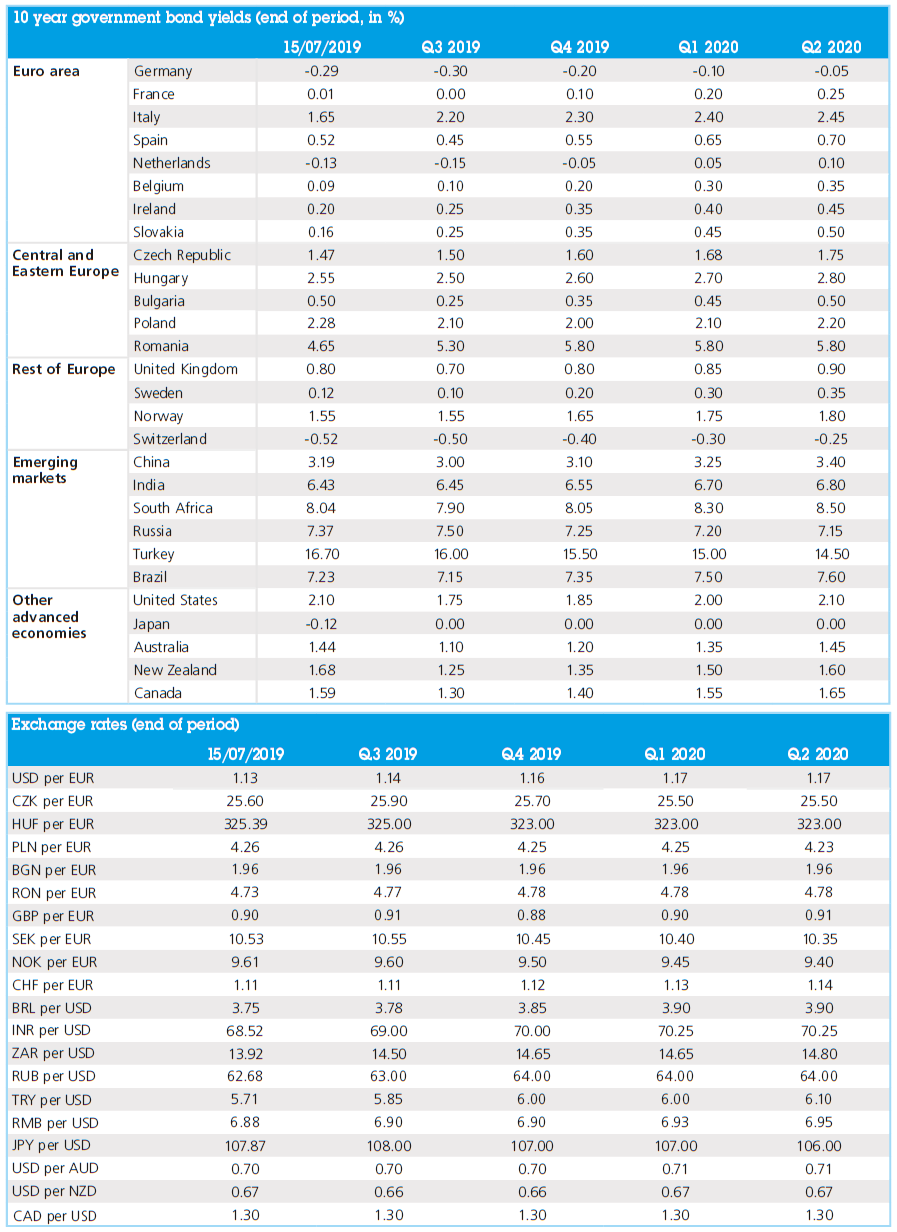

The continuous sentiment deterioration since early 2018 that has been linked to global uncertainties, inevitably translated into weaker activity data and slower growth figures. Indeed, compared to our previous growth projections for 2018-2019, there have been several downgrades in the past months. The significant downward revision of real GDP growth in the euro area for 2019 we implemented in February was in line with forecast adjustments by other large institutions such as the European Commission, the OECD and most recently the ECB. The main disappointments came from Italy and Germany. An important distinction though is that the growth issues in Germany are likely of a more temporary nature, while more structural weaknesses might cause Italian figures to remain sluggish. Troubles in the car manufacturing sector, which was one of the main factors causing weak German growth in H2 2018, seem to be fading out. Figures for new passenger car registrations have been showing a cautious recovery in recent months (figure 1). Indicators for German manufacturing were mixed in January, with still declining new orders, but turnover is increasing again.

Figure 1 – Passenger car registrations showing cautious recovery (new passenger car registrations, % change year-on-year)

To reach our 1.1% real GDP growth forecast for the euro area in 2019 - which matches that of the new ECB projection and is 0.1 percentage point higher than the OECD number - a rebound in the second half of the year is required. We think this is not unlikely. The euro area labour market is still doing well and wage developments are expected to remain supportive of gains in real disposable income and private consumption. Business investment should show healthy growth figures as capacity constraints are building in the later stages of the business cycle. We also assume that some of the risks and temporary factors that are currently weighing on growth will gradually fade out throughout the year, leading to a rebound of activity in Germany later this year. Hence, although our annual GDP growth forecasts for the euro area might seem rather pessimistic for 2019, the underlying quarterly dynamics are actually above potential growth in Q3 and Q4 of 2019. Moving into 2020, the quarterly growth dynamics will moderate again. However, given the growth pick-up we expect in the course of 2019, this will nevertheless numerically translate into a higher annual growth rate in 2020 than in 2019. Consequently, we confirm our forecasts of 1.1% annual real GDP growth in 2019 and 1.4% in 2020. It should be noted that this is an aggregate figure for the euro area. Significant growth differences across EMU countries will likely persist.

We have become less optimistic about the outlook of the US economy as well, particularly for 2020. We expect growth to slow down despite the impressive growth performance in 2018. Recently published official figures confirm our forecast of 2.9% for the US economy last year. As an illustration of waning optimism, our 2020 forecast US GDP growth was 2.0% a year ago, compared to 1.6% currently. Policy decisions, such as the increases in trade tariffs implemented by the Trump Administration, combined with other global headwinds, such as the Chinese growth slowdown and the persistent uncertainties around the Brexit negotiations, have weighed on the prospects for US growth.

Moreover, some internal issues will drag on US growth as well. The positive effects of the fiscal stimulus measures will gradually fade out. Given the current political differences between Democrats and Republicans, broad-based political support for a new fiscal stimulus package ahead of the 2020 presidential elections is highly unlikely. Additionally, there is the possibility of a so-called ‘fiscal cliff’ if discretionary spending caps for fiscal year 2020 are not raised. The 2018 Bipartisan Budget Act significantly increased fiscal year 2018 and 2019 discretionary spending caps established in the 2011 Budget Control Act (BCA). This sets up a funding cliff with discretionary spending levels set to drop sharply in the remaining two years - 2020 and 2021 - of the BCA’s discretionary caps. Hence, we think that the growth acceleration in Q1 and Q2 2020 is unlikely, and we remove it from our scenario. Assuming stable quarterly growth dynamics in the first half of 2020 puts our annual US real GDP growth forecast for 2020 at 1.6% compared to 1.8% in February.

Brexit uncertainty continues

While the picture is constantly changing, it remains the case that, unless there is a decisive intervention in the coming week, the UK will exit the EU on March 29th 2019 as set out in the terms of its EU Treaty Article 50 declaration. A week of political chaos in the UK in mid-March saw the government unable to obtain support in the British Parliament for the proposed withdrawal agreement and an accompanying clarification. That clarification was intended to ease concerns in the UK that the wording of the withdrawal agreement could mean that the UK could be permanently trapped in the EU. However, this proposal was rejected by the UK parliament on March 12 by an unusually large margin, 391 no-votes against 242 yes-votes. Subsequent parliamentary votes ruling out a ‘no deal’ Brexit and calling for an extension to the March 29th exit date emphasise concerns among British politicians but have no legal force to deliver their preferred outcomes.

With just under two weeks to go before the scheduled exit date, the margin of the Government defeat on its agreement proposals might suggest that a ’crash out’ Brexit is likely. For this to be avoided, a level of political realism and compromise not evident in the UK to this point will need to emerge. That said, as the debate is mainly concentrated on the Irish border rather than on a wide range of issues, we believe a deal is still possible with further ‘clarifications’ or re-structuring of commitments around the Irish border. For this reason, a ‘softish but not smooth’ Brexit remains KBC’s base scenario. It should also be noted that financial markets are strongly of the view and perhaps even overly complacent that some solution will be found to ensure the UK does not crash out of the EU on March 29th.

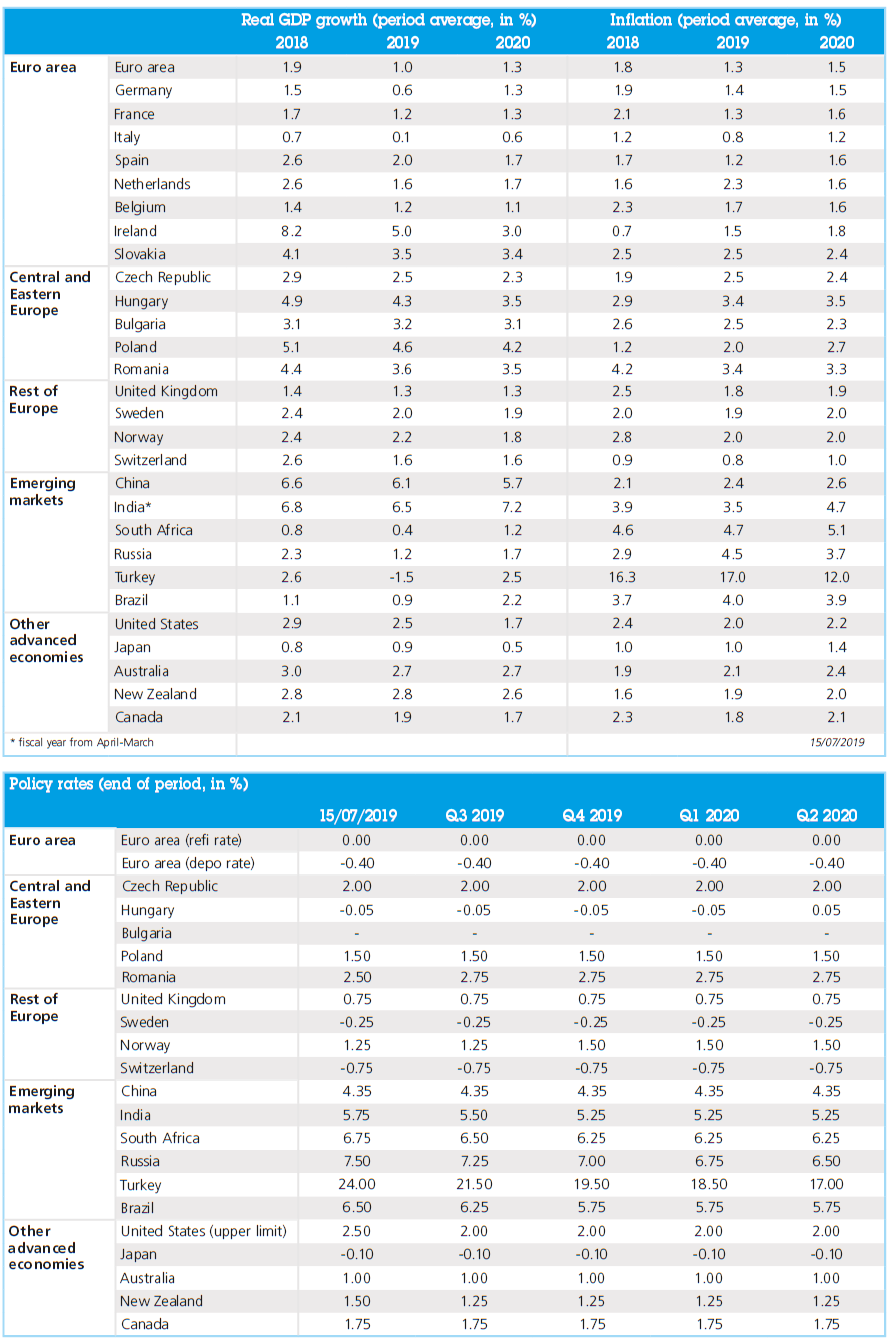

While a range of indicators suggest the UK economy is seeing some negative impact from Brexit related uncertainty in areas such as consumer sentiment, home prices and business investment (figure 2), growth overall has remained modestly positive if slower of late. The initial estimate of monthly GDP growth did fall unexpectedly in December but rebounded in January. The outlook for the coming year is very unclear because of continuing uncertainty about the timing and manner of the UK’s proposed departure from the EU. However, if a withdrawal agreement is reached, GDP growth for 2019 should be close to 1.5%. If no deal is struck, GDP growth is likely to be negative. Market expectations could change quickly and repeatedly because of notable difficulties in arriving at a workable compromise. This means that the next month could see Brexit concerns causing further volatility but this bumpy path is broadly consistent with our long held expectation of a ‘softish but not smooth’ Brexit process.

Figure 2 – Some negative impact from Brexit on UK indicators

ECB on hold for now

As a notable confirmation of market expectations that ECB policy rates will remain ‘lower for longer’, the ECB signalled a significant change in its policy outlook at its March meeting. The ECB pushed back the earliest possible timing of it first rate hike beyond the end of 2019. The key aspect of this wording is that it only identifies the earliest possible date for a rate increase. So, there remains quite a bit of uncertainty about when the first rate hike by the ECB will exactly take place. Moreover, the ECB announced further long-term funding arrangements (TLTRO-III) for euro area banks to replace those maturing through the next year. The new series of Targeted Long-Term Refinancing Operations (TLTROs) providing two year funding would be launched at a quarterly frequency running from September 2019 until March 2021.

In our updated scenario, we expect the ECB to postpone its first rate hike until Q2 2020. Our reasons for this delay are the ECB forward guidance itself and the low core inflation rate which is well below the ECB’s own policy target. Indeed, the latest ECB Staff projections suggest that the Governing Council have become a good deal less convinced of a clear upward path in the trajectory of inflation. With projected inflation reaching only 1.6% in 2021 (we expected 1.5%) - decidedly below the ECB’s target of an inflation rate ‘below, but close to, 2% over the medium term’ - the new forecasts support the ECB’s decision to postpone the timing of a first possible rate hike into 2020.

Nevertheless, we expect that the postponement of a possible rate hike will not lead to a permanent cancellation in this economic cycle. From a growth and inflation perspective, there may not be a compelling reason to raise policy rates any time soon. However, we expect the ECB will move its policy rates away from their current levels that are close to their effective lower bounds. We see a number of reasons for the ECB to do so. First, by introducing the new series of TLTROs, the ECB acknowledges that the euro area financial sector is still fragile and in need of stable longer term liquidity provision by the central bank. This is particularly the case in Southern European economies. Against this background, the ECB will likely want to get rid of the distorting impact of negative money market rates on European banks as soon as feasible. Second, the ECB is in practice will likely be unable to lower its policy rates further from current levels in case the euro area economy drifts into a new recession. Related to this are financial stability concerns that would argue against encouraging perceptions that current rate settings are semi-permanent which might lead to an unhealthy dependence on such an environment.

We therefore expect that the ECB will want to sustain expectations of a normalisation path even if this now appears to be more gradual than previously envisaged. It should also be emphasised that uncertainty in terms of the timing and magnitude of ECB policy normalisation will remain an important feature of the interest rate climate for some time to come in part because of uncertainty about the broader economic backdrop in terms of activity and inflation. Indeed such a partial policy normalisation would have been easier to sustain in the more favourable growth environment up to early 2018.

Specifically we now expect the ECB to raise its deposit rate the first time by mid-2020 and to finish 2020 just out of negative territory at 0%. For 2021, we expect three more rate hikes, bringing the deposit rate to 0.75%. The refinancing rate is expected to be 25 basis points higher, i.e. at 0.25% and 1.00% at the end of 2020 and 2021 respectively. As already mentioned, the risk to this timing and number of rate hikes is significant. Wanting to partially normalise its policy rate is one thing, being able to do so in the upcoming state of the business cycle is another.

The expected combination of ‘lower for longer’ short-term interest rates and the continued presence of abundant excess liquidity in the euro area implies that long-term bond yields will be lower than previously expected. After the ECB announcement, the German 10 year government bond yield even dropped to marginally above 0%.

At the same time, these extreme low levels also indicate the reasons why we nevertheless expect bond yields, and intra-EMU sovereign spreads, to moderately rise again beyond the next few quarters. We expect the German 10 year bond yield to rise more moderately, reaching 0.60% (versus 0.70% in February) and 1% (versus 1.10% in February) at the end of 2019 and 2020 respectively.

At current levels, the German benchmark bond yield includes a highly negative term premium, which is not the case to the same extent for US or Japanese yields. This artificially depressed term premium is the direct effect of the ECB’s monetary policy and not likely to be sustainable. This highlights a major difference between the euro area and Japan. Despite similar long term bond yields in Japan and Germany at this moment, European inflation expectations are higher than those of Japan. We think that it will be the European nominal bond yields that shift sooner or later and bring the current strongly negative real yields closer to zero, where they broadly are already in the Japan at this stage.

In the short term, the expected upward move of bond yields may be triggered by a somewhat normalised risk aversion from its current magnitude that almost pushed German yields below 0%. Furthermore, in the second half of 2019, we expect further ECB forward guidance about its expected policy rate path. To the extent that our expectations of a first hike in mid-2020 turns out to be correct and reflected in the ECB’s communication, bond markets will start to price that into moderately higher yields as well. This also applies to intra-EMU sovereign spreads. As was the case for ECB policy, substantial risks are attached to our bond yield scenario as well.

Our adjusted outlook for short-term and long-term interest rates, in particular for the US-euro area differentials, also implies a weaker expected path for the EUR versus the USD. This is the case even against the background of the recent Fed thinking in terms of a lower number of remaining rate hikes in this cycle and its intention to end the balance sheet rundown by the end of this year. Compared to last month our expectations for Fed policy remain unchanged although we acknowledge that we are slightly more hawkish than current market expectations.

KBC Economics’ unchanged expectations for Fed policy and a more dovish ECB suggest that the EUR may slightly depreciate further to 1.11 USD per EUR. Later and more moderately than we previously expected, the EUR will start to appreciate again versus the USD. This will happen from mid-2019 on. More specifically, we see it rising towards 1.15 USD per EUR by end 2019 and 1.25 USD per EUR by end 2020. The main reasons for a stronger EUR are the bottoming out of the interest rate disadvantage for the EUR versus the USD, and the expected growth rebound in the second half of this year in the euro area (which we do not expect for the US). Moreover, the expected appreciation of the EUR should also be viewed as a partial reversal of its current cheap valuation. The EUR‘s current level of 1.12 USD per EUR is much weaker than our estimate of a fundamental fair value of about 1.33 USD per EUR. Our scenario still leaves the EUR well below that level by the end of 2020.

Emerging markets: some respite amidst risks

Despite several internal and external headwinds, economic growth in emerging markets generally held up reasonably well through 2018 (figure 3). Nevertheless, the official lowering of growth expectations by the Chinese government is a clear signal of a general cooling down in the emerging markets. After an annual GDP growth rate of 6.6% in 2018, the Chinese government now expect growth to be between 6% and 6.5% in 2019, below its previous official target. This is a clear acknowledgement of a faster downward growth trend. However, to avoid a hard landing, Chinese authorities are still implementing more growth stimulus measures.

Figure 3 - Annual GDP growth rates in emerging markets (real GDP, annual % change)

Too much pessimism is inappropriate. The global growth slowdown with in particular the Chinese growth deceleration, the still-unresolved trade war, and general emerging market financial turbulence midway through last year didn’t derail emerging markets’ growth. Furthermore, easier financial conditions due to a shift in expectations for monetary policy normalization in advanced economies is growth supportive. Less expected tightening from the Fed together with the dovish stance of the ECB will ease pressure on emerging market currencies in general.

There are, however, also some signs of weakness on the horizon. Risk aversion among investors remains high and there are indeed several risks that could still present significant headwinds to growth in emerging markets going forward. Such risks include a sharper than expected global growth slowdown or a deterioration of the ongoing trade negotiations. Outstanding country-specific vulnerabilities, such as high indebtness, and certain idiosyncratic developments will still contribute to volatility (also see Box 1 - South Africa’s potentially rocky outlook). Despite these potential risks, we nevertheless hold on to our view of no general systemic emerging market crisis over the forecast horizon.

Box 1 - South Africa’s potentially rocky outlook

South Africa may be one emerging market where mounting risks and vulnerabilities keep it on an especially rocky path going forward. South Africa is no stranger to weathering macroeconomic ups and downs, and the economy has long been plagued by a ‘twin deficit’ problem - i.e. sizable deficits on both its current account (3.5% of GDP) and fiscal account (4.4% of GDP). These deficits make South Africa vulnerable to negative shocks, whether external or internal, that can dry-up financing. This is particularly true regarding South Africa’s capital account given that a substantial portion of it is financed by portfolio flows, which tend to be more volatile.

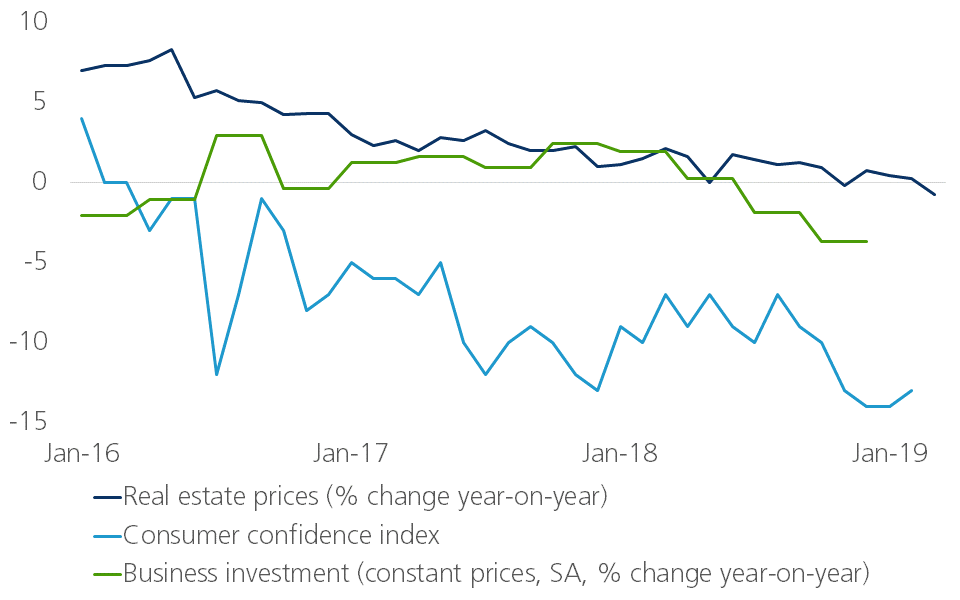

Focus more recently has been on South Africa’s fiscal outlook. In late February the government released its 2019 budget review. The budget received notable attention due to two factors. The first is a financing crisis unfolding at Eskom, a state-owned electricity company that generates 95% of South Africa’s electricity. The government has stepped in to not only restructure Eskom, but also to provide monetary support over the next three years amounting to roughly 0.5% of South Africa’s GDP per year (ZAR 23 billion annually for a total of ZAR 69 billion). The second important factor is that South Africa’s government debt is teetering on the edge of being downgraded to ‘junk status’ by Moody’s, the last major rating agency that gives South Africa’s long-term foreign currency debt investment-grade status (currently Baa3). With a review coming up at the end of March, the 2019 budget was a crucial opportunity to signal to the ratings agency that South Africa’s fiscal situation is under control, and that government debt will stabilise.

While the authorities have not agreed to absorb Eskom’s debt, the fiscal support for the struggling company on top of weak tax revenue growth will weigh on South Africa’s fiscal consolidation efforts going forward. Indeed, the main budget deficit relative to GDP in fiscal year (FY) 2018/2019 was 0.6 percentage points wider than anticipated in the 2018 budget (4.4% vs 3.8% budgeted), due mostly to tax revenue shortfalls (Figure Box 1). Furthermore, the main budget deficit target for FY 2019/2020 has been revised up to 4.7% of GDP (from 3.8% of GDP anticipated in the 2018 budget). The authorities in South Africa have pencilled in a narrowing deficit going forward, which they project will help stabilise public debt at 60.2% of GDP in 2023/2024. Moody’s however, may not be so easily convinced. The rating agency responded to the 2019 budget by noting it reveals a “further erosion in fiscal strength,” and that the government has “limited fiscal flexibility amid a challenging economic environment.”

A downgrade to below investment grade status would likely be significantly disruptive to South Africa’s economy, triggering capital outflows and downward pressure on the currency. Such a downgrade would also raise the interest rate on South Africa’s debt, making it even more difficult for the government to bring down its fiscal deficit. The South African rand has depreciated more than 5% over the past month, reflecting investors’ concerns over such an outcome. However, while the implied 1-month volatility of the South African rand has surpassed that of the Turkish lira—a currency that has been hammered by financial markets the past year—the implied volatility remains much lower than levels reached only 6 months ago. At the moment, it therefore remains a wait-and-see game for South Africa. In the short-term, the wait is on Moody’s rating decision. In the long term, the wait is on assessing whether the government can in fact follow through with its promises to bring down the fiscal deficit.

Figure B1 - South Africa’s fiscal accounts (in % of GDP)

Source: KBC Economic Research based on South African National Treasury, 2019 Budget