Economic Perspectives June 2022

Read the full publication below or click here to open the PDF.

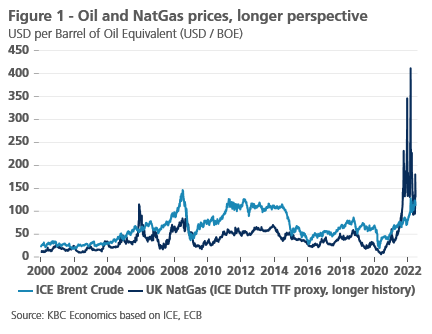

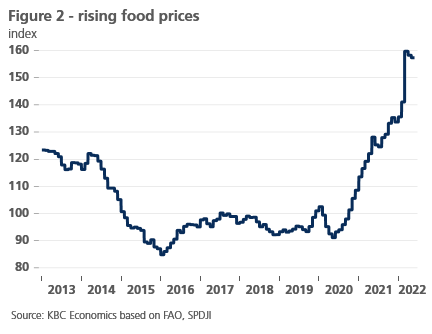

- The Russia-Ukraine war continues to destabilise the global economy and to push commodity prices upwards. The EU’s decision to ban Russian seaborne oil caused Brent prices to jump back above 120 USD per barrel in early June. The partial reopening of the Chinese economy after the COVID-related lockdowns along with OPEC+’s reluctance to ramp up production is generating further upward pressure on energy prices. We have revised our Brent oil price from 100 USD to 120 USD for the end of 2022. Food prices are also reaching all time-highs as millions of tons of grain are stuck in the port of Odessa. The FAO Food Price Index reached 157 in June, a 26% increase on a year-on-year basis. Worsening climate conditions along with high fertiliser prices make short-term relief in food prices unlikely.

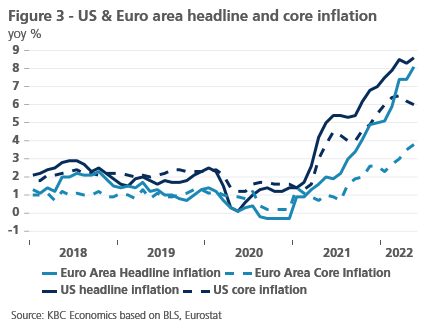

- High commodity prices have exacerbated the inflationary shock caused by supply chain issues, heavy fiscal stimulus and the rapid reopening following the COVID pandemic. Headline inflation continues to defy gravity across the globe. May headline inflation stood at 8.1% year-on-year in the euro area and 8.6% year-on-year in the US. In both economies, inflation is increasingly becoming broad-based and entrenched. May core inflation reached 3.8% in the euro area and 6% in the US. We hence expect euro area and US average inflation to reach 7.5% and 8% respectively in 2022, before dropping to 4.3% and 3.1% respectively in 2023.

- The increasing inflationary pressures along with tightening labour markets are increasing the pressure on central banks to normalise monetary policy. The ECB is set to increase its three policy rates by 25 basis points in July. It will also stop net bond purchases, though it has committed to reinvest maturing bonds, with flexibility in terms of timing and markets, in order to prevent excessive divergence in euro area bond spreads. We expect further rate hikes will bring the deposit rate to 2.50% at the end of 2023. The Fed also raised its policy rates by 75 basis points to the range of 1.5%-1.75% response to the unexpectedly high May inflation prints. We now expect the Fed funds rate to peak at 3.75%-4% in Q1 2023. Moreover, the Fed started phasing in its quantitative tightening in June mainly by not reinvesting part of the maturing assets on its balance sheet.

- The combination of higher, more persistent inflation along with tighter monetary policy will provide a hit to economic growth. Higher inflation erodes savings and reduces purchasing power, as real wage growth remains negative and negative wealth effects arise. Meanwhile higher real interest rates and elevated uncertainty drive up (precautionary) savings while discouraging investments and consumption. Consequently, we expect subdued growth dynamics (well below potential) in most advanced economies in H2 2022 and 2023. In the euro area, whose economy is particularly vulnerable to rising energy prices, we expect 2022 growth to be 2.3% and 2023 growth to be 0.9%. In the US, where the central bank tightening started earlier and fiscal stimulus has been wound down, we expect growth to be 2.0% in 2022 and to decline to 1.2% in 2023.

- In China, lockdowns in Shanghai and Beijing have begun to ease, yet the economic damage is done. Low retail sales, along with poor business and consumer sentiment bode ill for growth in 2022. We expect growth to be only 3.7% before rebounding to 5.3% in 2023. The lingering possibility of further lockdowns along with fragility in the real estate sector mean risks are tilted to the downside.

A global economy facing a wide range of challenges

The world economy is heading into the summer months mired in uncertainty. In the West, ever more persistent inflation is eroding consumer confidence while challenging existing policies of governments and central banks. The latter face an increasingly delicate balance between battling inflation and staving off a recession. China faces its own set of challenges as its real estate market is wobbly and it is still battling the Omicron variant with its zero-Covid policy. Though it has somewhat loosened Covid-19 restrictions lately, future lockdowns are very plausible given the high transmissibility of Omicron and the low vaccination rate of its elderly population. Last but not least, there is no end in sight for the atrocities in Ukraine, where the fighting is now primarily focused on the eastern Donbas region. As the chances of a peace agreement are very slim, the war will likely drag on for the foreseeable future. We maintain as a baseline scenario that the war enters a new stage moving into a frozen (longer-lasting) conflict while Western sanctions will be maintained.

Oil prices: the end of lower-for-longer

With Russia being a commodity powerhouse, the war in Ukraine and related sanctions are clearly reflected in tightening commodity markets and structurally higher commodity prices, which increase inflation and lower economic growth. Prior to the war, oil markets were already extremely tight as loose fiscal and monetary policy along with a rapid reopening of the global economy led to excess demand against the backdrop of supply constraints (by OPEC+) and a general underinvestment in production capacity. The Russian invasion and the strict Western sanctions caused Brent oil prices to surge to new levels, hovering around 105 USD in April. Last month though, Europe decided to ban all sea-borne oil imports from Russia. This decision along with eventual bans of pipeline imports in member states such as Poland and Germany will affect 90% of Russian oil exports to the EU. Though we assume Russia will be able to redirect part of its exports to Asia at large discounts, we still expect a permanent reduction of Russian oil production of approximately 1.5 million barrels per day. As a result, we revised our oil price forecast for end 2022 upwards from 100 USD to 120 USD. European gas prices also rallied again in June due to additional supply shocks; at the same time as Russian flows via the Nord Stream pipeline have been reduced, a decline in LNG supplies due to the Freeport LNG outage in Texas implies a tighter LNG market, threatening to undo the normalisation of inventory levels so far.

In the medium term, we expect the market balance to remain tight as OPEC+ is set to maintain a relatively cautious approach amid limited spare capacity, infrastructure constraints and political instability. Saudi Arabia, UAE and Iraq are effectively the only three nations able to increase output significantly (around 3 million barrels per day in total). We assume a partial lifting of Iranian sanctions in 2023 in light of a broader reinstatement of the Iran nuclear deal, implying an accelerated recovery in Iran oil output, while we do not expect sanctions on Venezuela to ease. US shale oil producers will likely remain significantly less responsive to higher oil prices. This is a result of stricter capital discipline (‘black premium’) & higher ESG/energy transition costs (‘green premium’). Higher production costs imply higher long-term oil prices as US shale is the world’s marginal oil producer. We hence upgraded our end of 2023 Brent oil forecast from 90 USD to 100 USD.

The world is headed for a global food crisis

Food markets are also experiencing a perfect storm as global food prices are up 26% year-on-year according to the FAO (see figure 2). Even before the war broke out, climate events put upward pressure on food prices as extreme temperatures in India and low rainfall in France and the US led to poor grain harvests. The Russian-Ukraine war worsened the market balance even further, as both Ukraine and Russia are major food producers and exporters. 25m tonnes of corn and wheat is trapped in Ukraine as Russia is blockading the port of Odessa. If no solution is found, millions of tons might rot. The food crisis is further exacerbated by export bans by several countries, including India.

Current market tensions are not likely to ease in the near term. Due to sanctions, Russia, the world’s largest wheat exporter, has no access to Western pesticides, grains and farming equipment and will likely see its output drop as a result. Ukraine, the world’s fifth exporter of wheat, will also suffer from a lack of manpower, fuel and reduced available land as a result of the war. Other countries will struggle to make up the shortfall. Sanctions on Russia and Belarus (a major potash producer) have caused fertilizer prices to skyrocket. Labour shortages might also hinder harvests in the Western world. High food prices are not going to be off the table anytime soon.

Inflation is becoming increasingly broad-based and entrenched

Rising commodity prices are furthering inflationary pressures. Inflation prints continue to surprise on the upside in advanced economies. Moreover, inflation is becoming increasingly broad-based and entrenched as energy inflation persists, firms continue to use their pricing power to pass-through increasing costs to final consumer prices and tightening labour markets and increasing inflation expectations push wages up.

Euro area inflation rose more than expected in May, from 7.4% to 8.1% year-on-year. The acceleration was strongest in food price inflation, but the pace of increase in energy prices and core inflation also went up. Inflation is becoming increasingly entrenched in the economic fabric and, although still modest, the first signs of somewhat higher wage pressure are also appearing. In addition, the oil price will remain high for longer than previously expected. Consequently, we have raised our forecast for annual average inflation in the euro area from 7.3% to 7.5% for 2022 and from 4.0% to 4.3% for 2023. We continue to expect inflation to eventually return to the ECB’s 2.0% target, but all indications are this inflation convergence process will be very slow, with risks tilted to the upside.

In the US, inflation figures continue to surprise to the upside and show signs of becoming ever more entrenched. May headline inflation reached 8.6%, up from 8.2% in April and above the recent peak of 8.5% of March. Non-core price inflation is a major factor behind the latest increase as gasoline prices moved significantly higher again. Unfortunately, the spike in gasoline has been extended into June, which implies that the headline year-on-year inflation might stay close to the May figure despite a negative strong base effect.

More concerning is the stubbornly high core inflation (much higher than in the euro area), which decelerated to a still elevated 6% year-on-year in May. Though core inflation increased on a monthly basis in all major categories, a few areas stand out. Prices of new vehicles and used cars & trucks increased 1.0% and 1.8% month-on-month respectively, indicating that supply chain constraints are far from over. Meanwhile, shelter prices were also up 0.6% month-on-month and we believe they will continue to put upward pressure on core inflation in the coming months, as rising mortgage repayments will push imputed rents upwards.

High core inflation is not the only indicator of entrenched inflation. Both consumers and professional forecasters revised up their long-term inflation expectations in June (to 3.3% and 2.8% respectively), sending a warning to the Fed that long-term inflation expectations are at risk of becoming un-anchored from the 2% target.

To sum up, US inflation is expected to be higher-for-longer. Given our increased oil price scenario, May’s higher-than-expected inflation print and elevated core inflation (implied by still rising housing prices and rents), we revised our inflation forecast significantly upwards from 6.7% to 8% in 2022 and from 2.4% to 3.1% in 2023.

Persistent inflation makes central banks switch gears

The higher inflation figures have led to broad-based inflation scares and a tightening of monetary policy by most central banks in advanced economies. Even the ECB, which has been more dovish, communicated a major shift in monetary policy going forward. At its next policy meeting (21/07) it is set to raise its three policy rates (deposit, refinancing and marginal lending rate) for the first time in more than ten years. ECB President Lagarde announced a 25 basis points rate hike with the intention to accelerate the tightening pace to 50 basis points in September if inflationary pressures persist or worsen. We expect the rate hikes in the euro area to continue steadily in October and December (to a deposit rate of 1.25% by the end of 2022). After that, it is expected to be raised to 2.50% by the end of 2023. A new upward revision of inflation forecasts, and the assessment that inflationary pressures will persist longer than so far expected, underlies the policy turn. The ECB now expects 6.8% inflation in 2022, 3.5% in 2023 and 2.1% in 2024 (i.e. above the medium-term inflation target of 2%. Underlying core inflation is also expected to exceed the 2% objective over the entire horizon. action.

As expected, the ECB reiterated that net bond purchases under the APP will stop at the end of June, and that it will continue to reinvest maturing assets at least until the end of 2024. Moreover, the reinvestments of maturing assets from the PEPP will be done flexibly in terms of timing, markets and asset classes to address any intra-EMU market fragmentation that may occur and jeopardise the transmission of monetary policy. Following these announcements, spreads on government bonds of the most vulnerable euro area countries rose sharply, apparently testing the ECB’s resolve to contain intra-EMU spreads. For instance, Italian and Greek spreads increased by 40 basis points and 36 basis points respectively. The speed of the movement even provoked an extraordinary ECB meeting. In a short statement, the ECB reiterated the flexibility of the reinvestment programme, in particular that they can be redirected towards bonds of vulnerable countries. In addition, the ECB added the new information that it is preparing a new ‘anti-fragmentation’ programme that will soon be adopted by the Governing Council. The day before this ad hoc ECB meeting, comments by ECB Governing Council Member Schnabel that the ECB will not tolerate changes in financing conditions that are not fundamentally justified and that the ECB has no limits in defence of the euro reassured financial markets, at least for the time being, leading to somewhat of an easing in spreads again.

The Fed accelerated its policy normalisation substantially. The unexpected increase in inflation in May led to a 75 basis point increase in the Fed funding rate, the largest rate increase since 1994. The policy rate now stands at 1.5%-1.75%. We expect similar moves in the coming few meetings raising the policy rate to above what is estimated to be a neutral rate (about 2.5%). Fed Chairman Powell stressed the need to move beyond this neutral level with a policy rate of at least 3% at the end of this year and at least 3.5% next year. We are revising our expectation for the policy rate peak at 3.75%-4% in Q1 2022. Despite these restrictive monetary conditions, the Fed expects the US economy to avoid a hard recession.

On bond markets, we are facing a period of consolidation after last month’s sharp movements. Levels of 3.5% across the curve will likely not be surpassed in the coming month. European short-term interest rates hold more upside potential, flattening the curve as the ECB starts to catch up in the monetary policy normalisation cycle.

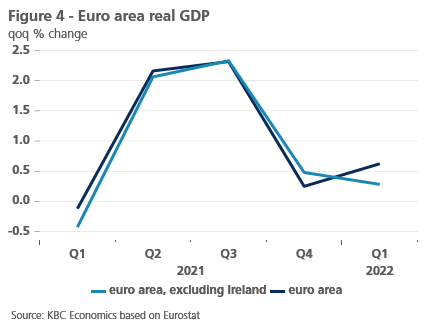

Misleading GDP figure in the euro area

In a context of high energy and commodity prices, still rising inflation and central banks having to step up the normalisation of their policies, positive economic news is hard to find. In the euro area, real GDP growth in the first quarter of 2022 was revised upwards from 0.2% to 0.6% quarter-on-quarter. However, this substantial upward revision gives a distorted picture of the underlying economic dynamics. Indeed, it is exclusively the result of exceptionally strong growth in Irish GDP. This reflects the technical impact of the activities of multinational companies in Ireland and hides the weakness of the Irish economy.

If we exclude the Irish figures, we see that growth in the Eurozone has not accelerated, but rather has slowed from 0.5% (compared to the previous quarter) to 0.3% (Figure 4). Spain in particular, but also France, Italy and the Netherlands, also entered 2022 at a slower growth rate. Some smaller countries, including Belgium, but especially Austria and Portugal, experienced a remarkably sharp acceleration in growth. There was also some resumption of growth in Germany, but not enough to completely erase the contraction in the last quarter of 2021.

Meanwhile, the more frequently available economic indicators continue to paint a not so encouraging picture. In most countries, consumer confidence improved slightly in May, but there was certainly no sign of a recovery after the sharp fall in March-April. The uncertainty caused by the war in Ukraine and high inflation clearly continue to take their toll. Business confidence in industry and construction still crumbled slightly, although compared to consumer confidence, the confidence level among businesses remains remarkably high. It does not point to a recession at all. Business confidence in the service sectors (excluding retail) still seems to be driven more by the positive month-on-month momentum of the post-pandemic reopening than by the recent war and inflationary surge. Compared to the turn of the year, recent months saw a stabilisation to a slight improvement in most countries. This may well be related to the (further) easing of restrictive measures following the Omicron wave.

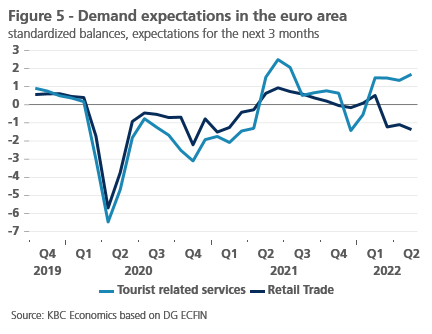

The outlook for the euro area economy remains overshadowed by the uncertainty caused by the war and by high energy prices and inflation. Consumer pent-up demand after the pandemic has certainly not yet been fully met, leaving room for recovery. But in the short term, the outlook for private consumption, which had already contracted in the first quarter, remains very weak. High inflation will weigh heavily on household disposable income in most euro area countries in 2022. Both the April effective retail sales indicator (latest figure) and the retailers’ expectations for sales in the coming months point to a further contraction (figure 5). Only in a number of tourism-related sectors, such as hotels and restaurants, tour operators, and travel agencies, is the outlook for demand positive, albeit somewhat less exuberant than a year ago.

Consequently, we have lowered our forecast for economic growth in the euro area. We think that GDP has fallen slightly more than previously expected in the second quarter, to be followed by a quasi-stagnation in the third quarter. The economic recovery in subsequent quarters is likely to be weaker against the backdrop of an upwardly revised expected oil price and a more restrictive monetary environment than previously expected. The average real GDP growth rate for 2022 masks this downgrade of our expectations because of the upward revision to the first quarter figure. Mechanically, this revision increases the average growth rate from 2.1% (our previous estimate for 2022) to 2.6%. However, the downgrade of the forecasts brings the figure for 2022 to 2.3% and 0.9% (instead of 1.4%) for 2023.

US: decent Q2 figures to be followed by sub-potential growth

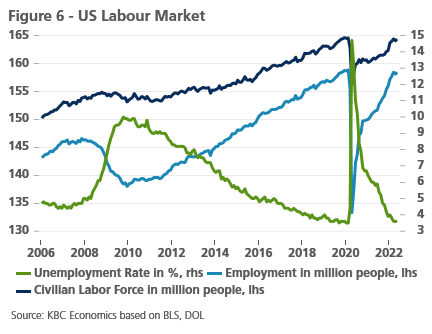

The US economy has posted mixed activity data in Q2 2022. Although the labour market looks strong as total nonfarm payrolls rose by 390,000 in May (leaving the unemployment rate unchanged at 3.6%), May retail sales were quite weak suggesting that personal expenditures could be weaker-than-expected this quarter. As such, we maintain a conservative GDP growth estimate of 1.6% quarter-on-quarter annualised for Q2 2022 (mainly thanks to an improvement in net exports), but the upcoming hard data must be monitored closely.

Nevertheless, the outlook for H2 2022 and 2023 looks less rosy, as all main drivers of the economy are likely to sputter as tighter financial conditions triggered by the Fed’s hawkish stance will start to bite. The Michigan University Consumer Sentiment Survey has already reached an all-time low of 50.2 indicating consumer spending might soon run out of steam. Export growth is also likely to remain subdued as a result of a strong dollar and slow growth in Europe and China. Investment growth will also likely be sluggish as rising policy and market rates will drive up the cost of mortgages and corporate lending. Meanwhile, inventories are likely to be a drag on growth. Businesses such as Walmart, Amazon and Target, a.o., have indicated that their inventories have grown by more than 30% year-on-year and that they might offer discounts to get rid of excess inventory. A cutback of the currently elevated inventory levels seems to be in the cards.

Hence, given the multiple headwinds facing the US economy, we have downgraded our US 2022 Q3 and Q4 growth forecast to 1.2% and 0% quarter-on-quarter annualised. Still, our scenario assumes a soft-landing of the US economy as we expect that the unemployment rate will increase by only 0.5 ppts in a 12-month horizon., Nevertheless, risks are clearly skewed to the downside and we do not exclude a technical recession scenario (two consecutive quarters of negative growth) given the combined impact on the economy of Fed policy delivered via rate hikes and the quantitative tightening process.

China: zero-Covid holds down growth figures

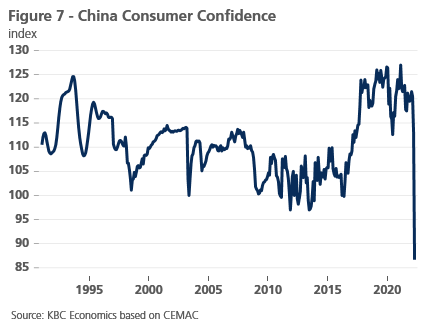

The lockdowns that kept much of Shanghai closed throughout the months of March, April, and May, and which spread to Beijing last month, have finally begun to ease as daily new covid cases have come down significantly since late April. The economic damage has been done, however, with retail sales collapsing in March and April (-3.18% and -0.71% month-on month, respectively), business sentiment surveys falling well into contraction territory, and consumer confidence plummeting in March and April (see figure 7). Some recovery could already be seen in May, with, for example, industrial production growing 5.61% month-over-month, compared to a 5.8% decline the month prior. Despite this, the second quarter as a whole was likely very weak, and we are now forecasting a 1.5% quarter-over-quarter GDP contraction before a rebound in the third quarter.

All-in-all, this drags down full-year GDP growth to only 3.7% (from 4.5% previously). However, a moderate recovery can be expected in the second half of the year, of which the carry-over effects will boost average annual GDP growth in 2023 (to 5.3% from 5.0% previously). Risks remain however, particularly as the Chinese government has given no indication that they have abandoned the zero-Covid policy that led to the previously mentioned lockdowns, and the real estate sector continues to suffer, with prices declining for the ninth-straight month in April.

All historical quotes/prices, statistics and charts are up to date, through 21 June 2022, unless otherwise stated. The positions and forecasts provided are those of 21 June 2022.