Economic Perspectives February 2019

Read the full publication below or click here to open the PDF.

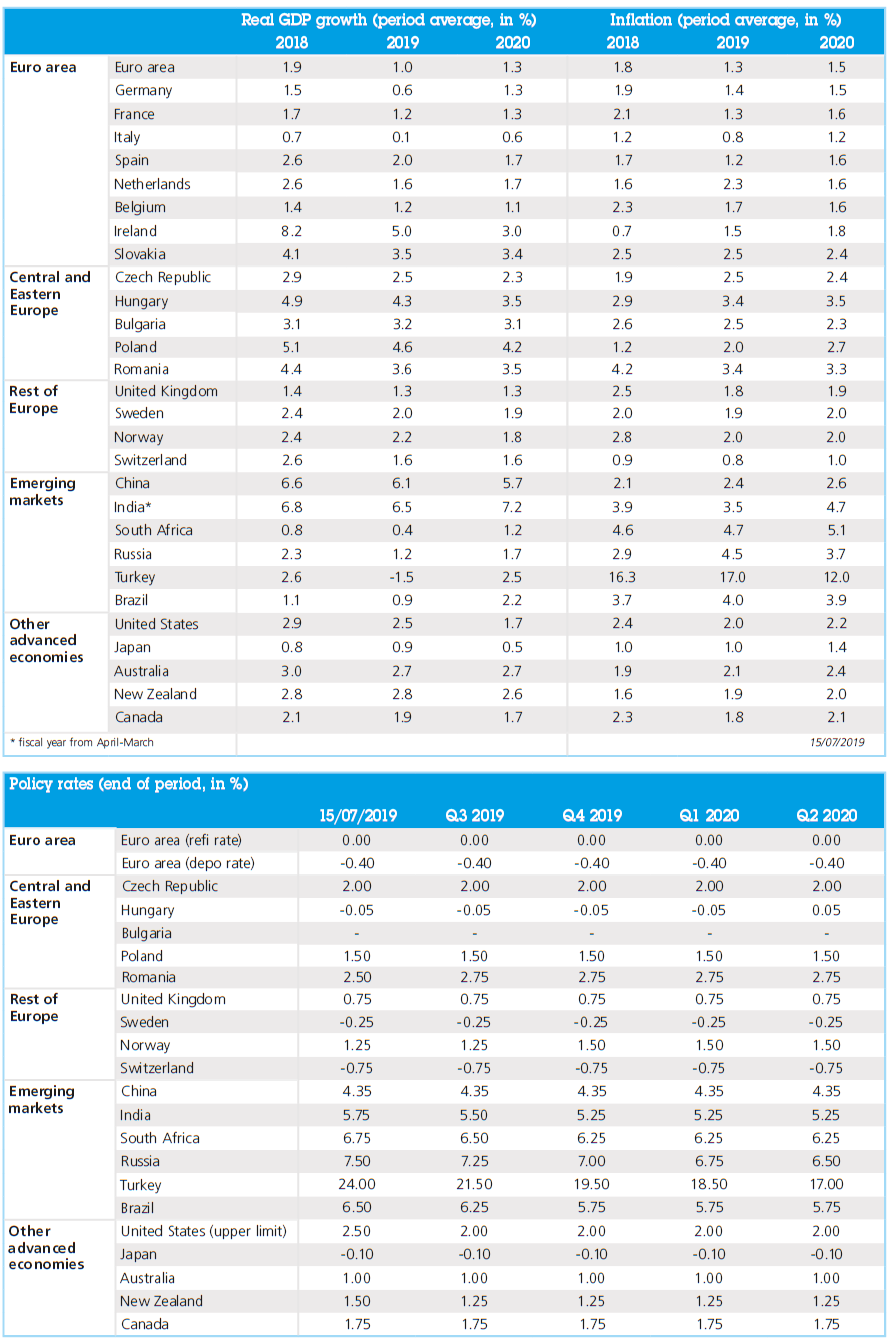

- Temporary factors that slowed euro area economic growth in Q3 2018 have proven longer lasting than expected and persisted into the final quarter of 2018. Moreover, they, look to have remained in place into early 2019 as well. The outlook is, however, not all negative. There are still several elements that suggest a modest rebound in the second half of 2019. Based on recent developments and the technical consequences of a materially weaker starting point to the year, we have downgraded our annual GDP growth forecasts for the euro area to 1.1% for 2019 (from 1.5%). For 2020, our growth forecast stays at 1.4%.

- Activity data in the US economy remain strong, but there are early signs that suggest that the growth peak is behind us. In addition to the impact of the trade war, the general global economic slowdown and the late-cycle state of the US economy are beginning to take some toll. For these reasons, we slightly lowered our US growth forecasts for 2019 to 2.3% (from 2.5%) and to 1.8% for 2020 (from 2.0%).

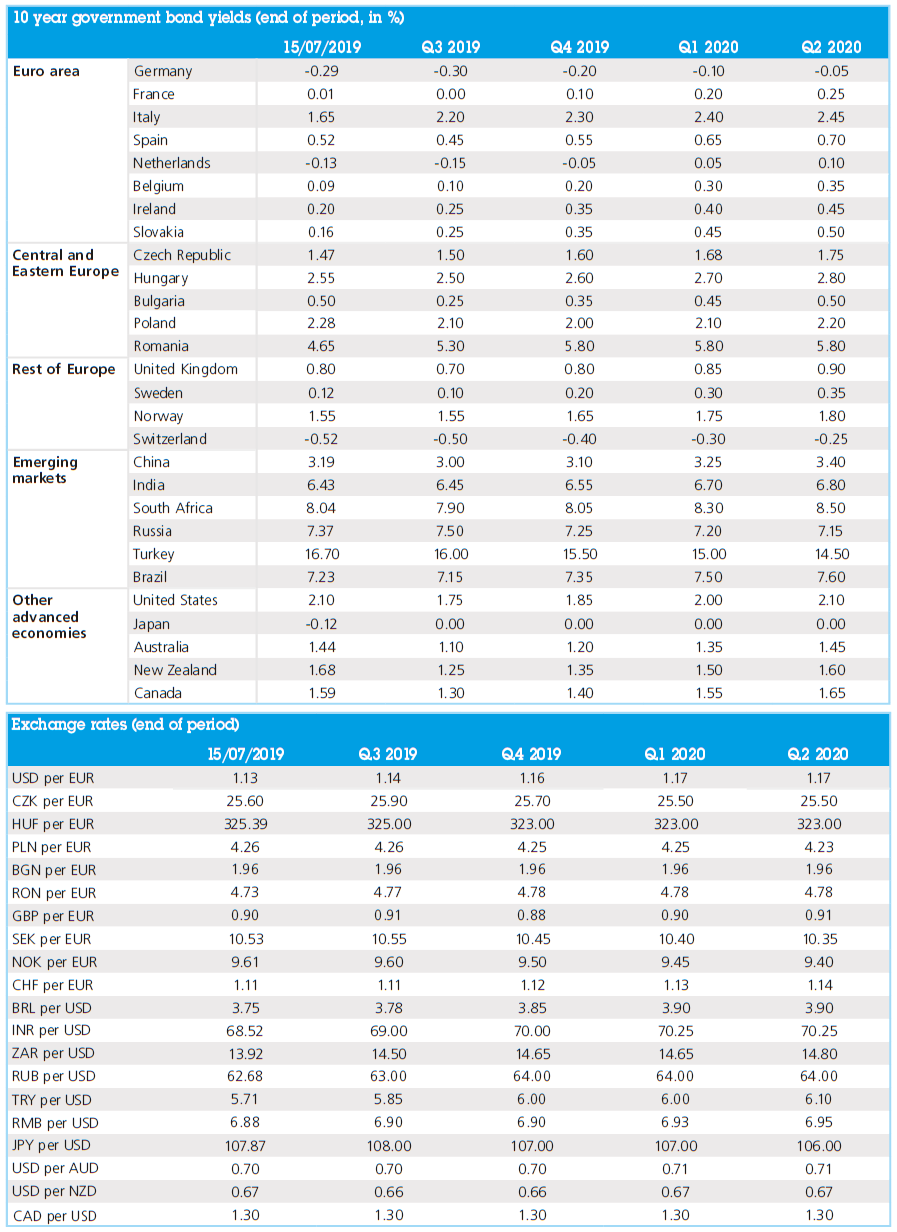

- Central banks of major economies have sounded a more cautious note given declining growth and lower inflation expectations. Both the Fed and the ECB have recently signalled that they are currently assessing the state of the economy before implementing or changing any policy plans. For the Fed, we only expect one more rate hike in 2019. For the ECB we stick to our scenario of gradually increasing interest rates starting at the end of 2019. Long-term government bond yields have been dampened by lower expectations for short-term rates and continued safe haven effects.

International slowdown

Various international institutions and professional forecasters have lowered their growth forecasts for the global economy for 2019 and beyond. This is no surprise given the uncertainty surrounding the global economy and continuing signs of economic weakening, which started in the second half of 2018 and have carried over into 2019. Though some factors are likely to be temporary, they will still weigh on the growth outlook for 2019 quite strongly, Some recovery in growth is still expected though, in particular in the European economies.

Sluggish euro area growth

The temporary factors that have been holding back euro area economic growth since Q3 2018 have lasted longer than initially expected. As a consequence, the disappointing economic results for the second half of 2018 are set to feed through into 2019 as well. A combination of external and internal factors has led to this. The loss of support from the external environment was in part due to international trade conflicts, in particular between the US and China. Although the EU is not directly targeted by any of the increased tariff rates, the bilateral US-China trade dispute, together with US threats to impose higher tariffs on car (parts) exports from the EU to the US, has significantly increased uncertainty. Related to this, but also due to other factors, there was a deterioration in the global manufacturing or tradeable goods sector.

This has all been reflected in a continued downtrend of business sentiment, in particular in the manufacturing sector. Although we saw some cautious recovery of manufacturing corporate sentiment indicators in Spain and France in January, it is too early to expect a reversal in the rest of the euro area. In particular, sentiment in German manufacturing continues to decline. Moreover, the European Commission’s Economic Sentiment Indicator, though still above its long-term average, has dropped significantly since the start of 2018. Overall, these leading indicators suggest a continuation of rather sluggish momentum at the start of 2019.

These developments in ‘soft’ indicators have also translated into weaker activity data. Euro area export growth slowed down in the second half of 2018. Import growth decelerated as well, but to a lesser extent, resulting in a negative contribution of net exports in Q3 and likely also in Q4 of 2018 (GDP growth composition for Q4 have not been published yet).

Besides external factors, euro area growth has also been dragged down by domestic or country-specific elements. Due to production challenges in the automobile sector to get certification under a new emission testing procedure, car production in Q3 was negatively impacted. While this was a disruption shared across the EU, the problems were particularly pronounced in Germany. Car manufacturers had to decrease production in Q3 and figures have only partially recovered since. Companies producing car parts were heavily affected too. The car sector difficulties were in turn also reflected in weaker private consumption figures in Q3. The struggles in German manufacturing seem to be more broad-based than the car sector though. German activity data for the industrial sector have been disappointing for several months in a row now (figure 1), with many industries facing difficulties. This suggests that especially the export-oriented German economy is suffering from global headwinds.

Figure 1 - Disappointing German manufacturing results (% change month-on-month)

The social tensions in France also seemed to put a brake on euro area growth. French corporate and consumer sentiment took a deep dive in Q4 2018, which was mirrored in a stagnation of the private consumption contribution to real GDP growth in the fourth quarter according to preliminary figures. This was despite fiscal measures implemented before the social protests that were aimed to increase purchasing power. Fiscal policy uncertainty in some Member States, in particular in Italy, weighted on GDP growth figures for the euro area as well. The Italian growth slowdown was initially mostly due to lower trade activity. More recently, domestic demand has been disappointing as the uncertainty surrounding the government’s policy and budgetary stance weighted on investments. As such, Italy entered a technical recession (two consecutive quarters of negative real GDP growth) in the final quarter of 2018.

Although the growth details are not known yet, Q4 real GDP growth for the euro area only slightly rebounded from its Q3 weakness (figure 2). Some of the above-mentioned factors are of temporary nature, but their effects are lingering on longer than initially projected. Preliminary figures point to euro area real GDP growth of +0.2% qoq in Q4 2018. The largest euro area economy, Germany, reported 0.0% qoq real GDP growth in Q4. This was slightly better than in Q3 (-0.2% qoq) and driven by solid contributions of business investment and government expenditures. The main disappointment came from Italy, with a negative growth result of -0.2% qoq, marking a second quarterly growth contraction in a row. Positive surprises came from Spain, where growth even accelerated in Q4 coming from already solid levels in earlier quarters. Despite the social unrest and the related negative impact on private consumption, French GDP growth unexpectedly held up at +0.3% qoq. These results again illustrate the large divergencies within the euro area as well as the resilience of several European economies to the international context of risks and uncertainties.

Figure 2 – Euro area growth rebound in Q4 very limited (real GDP, % change quarter-on-quarter)

Looking forward, all signs point to moderate growth in the short-term. Leading sentiment indicators haven’t shown a convincing turnaround yet and some temporary factors still linger. Nevertheless, the outlook isn’t all negative. There are still several elements that suggest a small rebound in the second half of 2019. Although euro area employment growth is likely to slow down somewhat, wage developments are expected to remain supportive for real disposable income and private consumption. Also the relatively low inflationary environment will be an underpinning factor. As the business cycle matures, capacity constraints are likely to build. In combination with support from other elements of domestic demand, this is expected to continue to support healthy growth in business investment, despite increased uncertainty.

We also assume that some of the risks and temporary factors that are currently weighing on growth will gradually fade out. The negative effects of the automotive industry problems will still linger on somewhat in H1 2019, but will eventually drop away. Regarding the trade war, we expect a muddling through scenario with no significant escalations, but also no large reversals of the protectionist measures implemented in 2018. We also don’t expect the dispute to escalate into a direct confrontation with new tariffs between the EU and the US. However, if the US government decides to implement higher tariffs on European cars and car components, this would have tremendous effects on the European automotive industry with major negative spillovers to the entire European economy. The Chinese growth slowdown is currently weighing on the demand for European cars too. It is, however, likely that the Chinese government will implement additional fiscal and monetary stimulus to avoid a hard lending in the economy (see Box 1 - Chinese stimulus moderately supportive for global growth). This factor may provide some moderate support for euro area growth later this year.

Box 1 - Chinese stimulus moderately supportive for global growth

The gradual deceleration of Chinese real GDP growth over the past years has in part been the consequence of policymakers’ strategy to transform the Chinese economy from high-speed to high-quality growth. This entails supply-side reforms tackling overcapacity and high leverage, containing financial risks and fostering new growth engines. The recent deleveraging efforts have slowed credit and infrastructure investment growth but also negatively impacted the economic growth rate. On top of this, the ongoing trade war with the US increased uncertainty affecting corporate sentiment. The deterioration in global economic momentum pushed down Chinese growth as well. In response to this, policymakers again shifted their focus to supporting economic activity in 2018. Rather than prioritising their longer-run commitments of deleveraging and structural reforms, authorities have made economic (and social) stability in the short-term their first concern.

Recent stimulus measures are intended to offset the slowdown via both the monetary and fiscal side. Cuts in the Reserve Requirement Ratio (RRR) for banks - a main monetary policy tool - and targeted medium-lending facilities are primarily aimed at boosting liquidity, especially in terms of lending to small- and medium-sized enterprises. Fiscal stimulus measures include tax cuts for individuals and corporates as well as measures to encourage increased investment spending by local governments. Nevertheless, in doing this, policymakers are still trying to find a balance between supporting growth while not derailing debt. After all, boosting investment via state-owned enterprises and local government debt accumulation will exacerbate inefficiencies and increase contingent liabilities of the state.

Overall, the Chinese stimulus measures will likely avoid a ‘hard landing’ or severe and abrupt fall in Chinese growth figures in the short term. However, since the Chinese authorities are constrained by longer-term risks and goals, the size of the measures will likely be more limited than seen during previous stimulus rounds such as in 2015-16. A rebound in Chinese growth in 2019 is therefore unlikely. This is reflected in our growth forecasts with 6.0% GDP growth for 2019 and 5.6% for 2020. In any case, Chinese policy support could also provide some moderate support for global growth, especially in the second half of 2019.

Meanwhile, despite the deadline coming closer, we still stick to our scenario of a softish but not smooth Brexit. The final result will be a deal that is acceptable (or sufficiently ambiguous) for both the UK and the EU, without fully derailing economic momentum.

Despite the fact that we project a rebound in the quarterly dynamics of GDP growth in the second half of 2019, the past and ongoing sluggishness is not without repercussions for our average annual growth forecasts. Taking into account previously mentioned developments and assumptions, this resulted in a downgrade of our annual GDP growth forecasts for the euro area to 1.1% for 2019 (from 1.5%). For 2020, our growth forecast stays at 1.4%.

US economy strong but looming headwinds

Activity data in the US economy remain strong for now. Although there are no official first estimates for GDP growth in Q4 2018 available yet (due to the government shutdown, the responsible institute was closed), all indicators again suggest a quarter of healthy growth. The labour market continues to do well, with recent job creation figures still at high levels. We expect the negative economic impact of the government shutdown to be limited in size and time. The political turmoil did spark a peak in policy uncertainty (see Box 2: Economic policy uncertainty at historic highs), but this should ease as things get solved. Consumer and corporate sentiment indicators have come down in recent months. Nonetheless they remain at levels that are consistent with solid growth levels in the near future.

Box 2 - Economic policy uncertainty at historic highs

Global economic policy uncertainty, a GDP weighted index based on quantified newspaper coverage of economic uncertainty, fiscal stability and dispersion between individual forecasts, has risen to an all-time high by the end of 2018 (figure B2). Escalating trade tensions against the backdrop of a dramatic increase in financial volatility are likely to have propelled the index. Indeed, at a country specific level we notice a considerable increase of economic policy uncertainty both in the US and China. Uncertainty in the US probably increased also due to the government shutdown. A (temporary) reopening of the US government, constructive headlines related to trade talks and strong improvement in financial market sentiment should ease the index during the first months of the year. Turning to the EU, we identify fears about the bloc’s economic performance as a major cause for the rise in uncertainty. These growth worries are at least to some extent rooted in the trade conflict. Brexit might have created negative spillovers too. However, the latter is not the case for the UK, where we observe a relatively muted increase in the policy uncertainty indicator.

Figure B2 – Fed balance sheet normalisation probably slower in thefuture (Federal Reserve balance sheet, in billions of USD)

There are some early signs that suggest the growth peak is behind us. One such element are the most recent US trade figures, showing that the trade deficit narrowed to USD 49.3 billion in November (figure 3). Although this might sound good to President Trump, the underlying details are less reassuring. The decline in the deficit was mainly driven by lower imports into the US and a smaller decline in exports. The US trade deficit also decreased across most major trading partners. While it is too early to speak of a trend decline in imports as trade data tend to be volatile, this could be a first sign that also in the US the effects of the US-China trade war are starting to kick in.

Figure 3 – US international trade (goods and services trade, in billions of USD)

Apart from the impact of the trade war, the US economy is facing several other (looming) headwinds as well. The general slowdown of global growth will continue to weigh on US export performance. Moreover, the late-cycle state of the economy is beginning to have some impact too. Consumer surveys recently show less consumer interest in buying cars and houses and, importantly, the positive effects from the fiscal reforms implemented at the end of 2017 will gradually fade. Based on these observations, we slightly downgraded our growth forecasts for 2019 to 2.3% (from 2.5%) and to 1.8% for 2020 (from 2.0%).

Fed in assessment mode…

Central banks of major economies have adopted a more cautious stance of late. The US Federal Reserve signalled a softer intended policy path going forward even as its assessment of the US economy hasn’t profoundly changed. The Fed didn’t explicitly say that the monetary tightening cycle has come to an end, but recent data might still suggest otherwise. However, the monetary statement after the most recent Fed meeting at least signalled that there is also a chance that the monetary cycle is up for a long pause, allowing the Fed to monitor economic and other developments. According to the Fed, the risk of a rapid acceleration of inflation has disappeared. This means that the central bank no longer sees this as a reason to continue the tightening cycle at the pre-set pace.

Moreover, Fed Governor Powell clearly hinted that the ‘tapering’ of the balance sheet roll-off might come sooner than was expected (figure 4). This would imply that the size of the balance sheet will remain substantially higher than expected at the start of the run-off. By doing this, the Fed’s balance sheet will become a more active monetary policy tool rather than a passive one. Implicitly, the Fed aims to keep more liquidity in the global financial system than initially planned. Based on this we adjusted out projected policy path for the Fed. The more cautious approach translates into only one rate hike by end 2019 with a policy rate peak at 2.625% - one rate hike less than in our January scenario. A slower balance sheet rundown with an earlier ending and hence a larger permanent balance sheet than initially planned is likely.

Figure 4 – Fed balance sheet normalisation probably slower in the future (Federal Reserve balance sheet, in billions of USD)

… while ECB is watching and waiting

Meanwhile, the ECB is trying to evaluate the evolving economic situation in the euro area. Rather than contemplating or preparing any near term alterations to the current policy stance, the ECB is now firmly in ‘watching and waiting’ mode. A formal acknowledgement that risks to the outlook for the euro area economy now lie to the downside implies that any material tightening of ECB policy entailing an initial rate rise is still a distant prospect. Since the first short-term priority of the ECB is to assess the persistence of the general uncertainty, incoming information will be crucial in determining the ECB’s policy path going forward. For now, we therefore hold on to our ECB scenario. The first step towards a policy rate normalisation will likely only be taken at the earliest towards the end of 2019.

Another part of the ECB’s non-standard monetary policy measures that are coming on the radar again are the targeted longer-term refinancing operations (TLTROs). These are Eurosystem operations that provide financing to credit institutions for periods of up to four years. They offer long-term funding at attractive conditions to banks in order to further ease private sector credit conditions and stimulate bank lending to the real economy. TLTROs are targeted operations, as the amount that banks can borrow is linked to their loans to non-financial corporations and households. The series of TLTROs that was introduced in 2016, will expire in 2020 and we expect it to be rolled over by a new series. An ECB announcement about this may come as early as March 2019.

Launching new TLTROs would be a means for the ECB to maintain its accommodative policy stance after the end of the APP. Moreover, it would keep the option open to raise policy rates in 2019 in order to reduce the side-effects of negative short-term interest rates. It would also prevent the ECB’s balance sheet from shrinking, especially now that the Fed will likely adjust the pace of its balance sheet rundown. New TLTROs would furthermore help to maintain required liquidity ratios (LCRs etc) of European banks. However, there appears to be a significant risk asymmetry in terms of the markets likely response to the ECB’s decision in this regard. If a new series of TLTROs is effectively announced, financial markets may react only moderately positively. On the other hand, if no new TLTROs are announced, severe adverse market reactions can be expected given their importance for the banking sector. The pressure on the link between the national sovereign and the banking sector would continue to be eased in case of a new TLTRO series, since banks could ensure their LT liquidity provision on the same scale as is currently the case.

Low long-term bond yields

The growth slowdown, a lower inflation outlook and the associated more cautious stance of major central banks, will have implications for long-term interest rates as well. Flight to quality and safe haven effects will cause the German 10y government bond yield to remain lower than previously expected. We now see it rising gradually towards 0.70% by the end of this year (down from 0.80%). We lowered our scenario for the US 10y bond yield from 3.25% by year-end to 3.0%. For the time being, intra-EMU spreads will likely remain low. However, towards end 2020 we project them to rise as global risk aversion will increase and as the ECB normalises its monetary policy.