Economic Perspectives December 2024

Read the full publication below or click here to open the PDF.

- 2024 is closing as it has been for most of the time: with the growth engine at different speeds in the world's major economies. In the US, domestic demand continues to grow solidly, but the strong US dollar and the prospect of import tariffs will nevertheless bring the growth engine to a lower speed. We thus confirm our growth estimate for real GDP of 1.7% in 2025 after growing 2.7% in 2024.

- The Chinese economy shows a few positive surprises amid a sea of challenges at the start of the fourth quarter and recent promises of even stronger fiscal stimulus to come in 2025 bode well for efforts to address China’s lagging consumption. Many risks remain, however, particularly related to trade policy vis-à-vis the US. We therefore only marginally upgrade our 2025 growth forecast from 4.3% to 4.4% and keep 2024 growth unchanged at 4.8%.

- In the euro area, the better-than-expected figure for real GDP growth in Q3 2024 (0.4% against the previous quarter) was confirmed. There were admittedly large differences between countries and the figures were immediately overshadowed by disappointing monthly indicators on recent economic momentum and by political impasses in (among others) the two largest economies. Given also the imminent escalation of trade conflicts once President Trump takes office, we therefore maintain our expectation that the economy will continue to drag on at a listless growth rate of less than 1%, resulting in an annual average real GDP growth rate of 0.7% in both 2024 and 2025.

- The price of Brent oil remains relatively immune to geopolitical developments. It hovered in a narrow band in recent weeks, some 10% below the level during the first half of the year. In contrast, the first winter spike and dunkelflaute, together with the sudden halt of Russian natural gas deliveries to Austria, drove up the price of European natural gas to more than double its February 2024 low. Futures markets, however, suggest both lower oil and natural gas prices are on the horizon.

- Recent inflation data point to slow(er) disinflation in the US and the euro area. In particular, the rise to 2.7% in the US raised eyebrows as it was accompanied by signs of a new acceleration in underlying inflation. Core inflation still stands at 3.3% in the US. Inflation in the euro area also rose in November, by 0.2 percentage points to 2.2%. But this was mainly due to a base effect, reflecting the sharp fall in energy prices at the end of 2023. Core inflation stabilised at 2.7%. We expect both US and euro area inflation to receive new impulses from 2025 onwards from higher import tariffs. We therefore maintain our upwardly revised euro area inflation forecast of last month of 2.5% on average in 2025 (after 2.4% in 2024). Due to signs of stronger domestic inflationary pressures, we raised our inflation forecast for the US from 2.6% to 2.7% for 2025, after (an unchanged) 2.9% for 2024.

- Both the ECB and the Fed cut their policy rates by 25 basis points in December. We expect the ECB to cut its policy rate further in the first half of 2025 and leave it unchanged in the second half. The Fed is likely to insert a few pauses between its cuts. We expect three Fed rate cuts in 2025 by 25 basis points each at the policy meetings of June, September and December 2025 respectively. The ECB will cut deposit rates by a total of another 1 percentage point to 2.0% and the Fed will cut its policy rate by a total of 75 basis points to a range of 3.50 to 3.75%. That will lead to a stabilisation of long-term bond yields around current levels throughout 2025, with some small upward potential for the German bond yield towards the end of 2025.

2024 is closing as it has been for most of the time: with growth engines at different speeds in the world's major economies. Admittedly, there are signs that the strong growth of the US economy is waning, and some pleasant surprises surfaced in China's sputtering economy. But the latter do not warrant fundamentally greater optimism for the time being, while the US economy will continue to grow more strongly than Europe's even after the expected slowdown. Indeed, in the euro area, the better-than-expected real GDP growth rate in the third quarter - with admittedly large differences between countries - is overshadowed by new, sometimes very gloomy indicators.

After half the world's population has elected new parliaments and/or governments in 2024, 2025 will be a year heavily determined by government policy. Unfinished inflation cooling and the threat of new inflation impulses in the context of uncertain growth prospects place central banks in an uncomfortable policy dilemma. We expect both the US Federal Reserve (Fed) and the EA European Central Bank (ECB) to ease policy further. However, key questions remain, such as: (1) whether President Trump will fulfil his - from an economic point of view often poorly thought-out and inconsistent - election promises; (2) whether the Chinese authorities will put their recent words about additional stimulus to the economy into action; or (3) how the (new) governments in Europe will strike an economically meaningful and politically feasible balance between the need to stabilise public debt on the one hand and sustainable, structural strengthening of the economic tissue on the other? One thing is certain in this regard: uncertainty will be even greater in 2025 - as far as possible - than it already was in previous years.

Oil price insensitive to geopolitics

Between mid-November and mid-December, the price of Brent oil hovered mostly near USD 72 to 73 per barrel, about 10% lower than a year earlier. It thus responded remarkably moderately to geopolitical conflicts and tensions. The fall of Syrian President Bashar al-Assad also had no significant impact (for now).

The market seems more focused on Trump's re-election as US president and his potential policies. During his campaign, Trump repeatedly promised to lower inflation. But his strategy seems mainly based on lowering energy prices. To achieve this, he wants to use deregulation and tax cuts to increase domestic production (or in his own words, ‘drill, baby, drill’). He also wants to put pressure on countries such as Iran and Venezuela, and possibly Russia. However, this geopolitical strategy could do just the opposite of what Trump wants to achieve. There could be upward pressure on oil prices as a result of, for instance, new sanctions against Venezuela. The designation of Marco Rubio as Secretary of State may nevertheless indicate that Trump does want to take a tough stance against these countries. Rubio is known for his tough stance on Iran and Venezuela. Trump will have to weigh such a strict stance against his goal of lower energy prices.

Apart from these policy choices, it is likely that the realisation of Trump's target will be helped by global oil supply and demand trends. The International Energy Agency (IEA) expects oversupply in oil markets to persist into 2025, even if OPEC+'s current production cuts remain in place. This outlook makes it difficult for OPEC+ to increase production again. In November, the cartel already decided to keep the current production cut still in place.

Natural gas price on the rise

Unlike oil prices, the price of European natural gas did rise significantly in November, by about 18%. And that while it was also on the rise in the previous months. The boom began as early as the end of February 2024, when the price had reached a post-energy price shock low of around 23 euro per MWh. Since then, the price of European natural gas has more than doubled to 47.3 euro per MWh at the end of November.

The most recent climb in November can be explained in part by a first winter spike and the dunkelflaute (little wind and sun). This caused a gas consumption spike for both heating and electricity generation. As a result, EU gas stocks fell sharply from 95.2% in early November to 82% in early December. This is significantly lower than in the two previous years, but still in line with the average for the period 2011-2024 and by all means well above the level of crisis winter 2021 (see figure 1).

Another reason for the upward price pressure is the sudden suspension of gas supplies from Russian Gazprom to Austrian gas company OMV. On top of that, there is also the prospect that a five-year agreement on the transit of Russian gas through Ukraine's territory will expire on 1 January 2025. This would particularly impact Central European countries such as Hungary and Slovakia. According to the European Commission, the impact on European gas prices would be limited, as Europe should be able to replace the approximately 14 billion cubic metres of Russian gas transiting through Ukraine every year. Negotiations on this, as well as on security of supply for the countries concerned, are ongoing.

Nonetheless, the current higher gas price will sooner or later translate into higher energy bills for European consumers, even though futures markets, which set prices for the future, suggest a new relaxation of European gas prices as early as the beginning of 2025. However, the loss of purchasing power due to the higher gas price will be tempered by the lower oil price, for which the futures markets also forecast a decline.

Strong dollar curbs US economic growth

The US elections have not brought economic growth to a halt. But indicators and our nowcast (a quantitative estimate of the current pace of growth) suggest that momentum is still slowing a little compared to previous quarters. Consumption and non-residential investment continue to grow at a solid pace in the fourth quarter, but exports show signs of weakening. Admittedly, hard foreign trade figures are only available until the month of October, but we assume that the election result implies that the trade balance will not improve in November and December, and probably not in the first quarter of 2025 either. This translates into downward pressure on growth in the short term. It explains our view that real GDP growth will remain below potential in the last quarter of 2024 and the first of 2025.

The first argument for this view is the strong(er) dollar, which will work against exports (see figure 2). As in 2016, the US currency reacted extremely positively to the clear victory of Trump's Republican party. A statistical analysis shows that the dollar's subsequent appreciation can be explained mainly by the expected positive demand shock expected from this victory. But the threat of additional tariffs also played a role. Moreover, in secondary order, the relative strength of the dollar - particularly against the euro - was also the result of negative political shocks outside the US, namely the calling of early elections in Germany and the fall of the government in France. We estimate that the 5% appreciation of the dollar since the elections will cost 0.3 percentage points of real GDP growth in the fourth quarter of 2024 and the first of 2025.

A second factor that may temporarily worsen the trade balance is the impetus that the threat of new tariffs may give to imports. Companies will be keen to avoid those duties by replenishing their stocks of imported products in advance. This may cause a temporary deterioration in the trade balance.

Mixed signals were recently sent out about tariffs and the new Trump administration's intentions regarding them. Some of Donald Trump's appointments to key economic posts, such as the appointment of Scott Bessent as Treasury Secretary, have turned out to be less bad than first feared. All in all, we left our forecast for US real GDP growth unchanged at 2.7% for 2024 and 1.7% for 2025.

Core inflation bounces back in the US

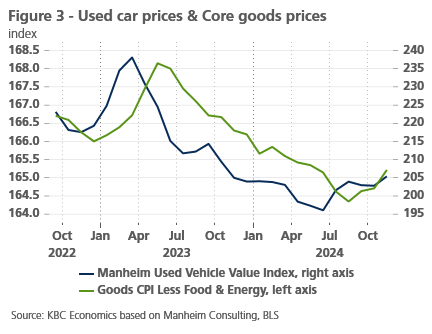

In contrast, we raised our expectation for US inflation. At first glance, it looks like just a simple adjustment to the official figure published for November. That was up to 2.7% from still 2.4% in September. But on closer examination, the detail of the new inflation figures contains more alarming signals. While core inflation stabilised at 3.3% in November, it contained a clear reversal in goods inflation in recent months. Once again, the price of used cars is the culprit (See figure 3). That was 2% higher in November than the previous month, when a 2.7% price rise was also recorded. That price rise was a major contributor to the month-on-month increase (after seasonal purge) in inflation by 0.3%, which is the highest rate of increase since March.

This unfavourable development prompts us to slightly revise upwards our forecast for both core and headline inflation for December 2024 and the first half of 2025. While we continue to expect a gradual decline in inflation, this decline will be even slower than previously thought. Moreover, should the commodity component in core inflation continue to rise more stubbornly and rental price inflation hold at current levels, there is also a risk of core inflation settling stubbornly above the 2% inflation target. Close monitoring of core inflation price developments is therefore appropriate, as are Donald Trump's comments on future tariff policy. Because even more drastic tariff adjustments than those currently expected pose the biggest risk to our current inflation outlook for 2025.

We maintain our forecast for average inflation in 2024 at 2.9% but have raised the forecast for 2025 from 2.6% to 2.7%.

Positive surprises amid a sea of challenges in China

After several quarters of slowdown, the Chinese economy is showing early signs of improvement in the fourth quarter. Both industrial production and retail trade in October grew 0.41% month-over-month or 5.3% and 4.8% year-over-year, respectively. While the November retail sales data disappointed at 0.16% month-over-month, industrial production remained strong at 0.46% month-over-month.

If strong activity data is sustained in December, this could help bring 2024 annual growth closer to the government’s target of 5.0%. We currently forecast 4.8% growth. Business sentiment indicators also support this outlook, especially with the S&P manufacturing PMI improving to 51.5 in November (above fifty signals expansion). However, there are still important uncertainties and headwinds facing the economy. Total social financing growth, a measure of credit growth, continued to decline in October to 7.8% year-over-year. Fixed asset investment by the private sector continues to contract (at -0.3% year-to-date year-over-year) while consumer confidence remains abysmally weak, holding back consumption. The crisis in the real estate sector continues to weigh on prices and confidence as well, despite new policy measures to support the sector.

Meanwhile, fiscal stimulus measures announced in November focus so far on addressing hidden local government debt — an important initiative, but one that won’t directly and quickly support higher consumption. However, policymakers have made it clear that more support is on the way. An official shift in the monetary policy stance from “prudent” to “moderately loose” last week, and a promise to introduce more fiscal policies that “vigorously boost consumption, improve investment and efficiency and expand domestic demand in all directions,” are indisputable signals that the authorities in China plan to provide more firepower to the economy in the coming year.

How exactly this will look remains to be seen. Furthermore, these much-needed counter-cyclical domestic policies will come up against a more complicated global landscape in 2025 when Trump takes power in the US and is expected to follow through on his threat of raising tariffs on Chinese imports. As a result, we keep 2024 growth unchanged at 4.8% and have only marginally upgraded 2025 GDP growth from 4.3% to 4.4%, as many uncertainties remain.

In the euro area, consumers boosted growth after all

In the euro area, initial estimates of third-quarter real GDP growth (versus the previous quarter) were confirmed at 0.4% and 0.3% when excluding the volatile Irish economy. So this remains a pleasant surprise. The spending components show a robust contribution from private consumption. On the one hand, that was the initial expectation, given the purchasing power recovery in wages and the resilient labour market. On the other hand, that expectation had been seriously tempered since the autumn as, among other things, the only shallow recovery in listless consumer confidence suggested that the expected consumption recovery would be delayed.

In the end, private consumption in the third quarter was after all up 0.7% compared to the previous three-month period. A third of this was provided by Italian consumers, while consumers in Spain and France also made a solid contribution (see figure 4). In the latter country, this was largely due to the temporary boost because of the Olympics. The contribution of consumers in Germany, on the other hand, was very modest, although quite decent compared to the previous four quarters. But the less than 12 and 18 million consumers in Belgium and the Netherlands, respectively, made a greater combined contribution to euro area consumption growth last quarter than the more than 84 million German consumers.

The growth contribution of government consumption was limited but positive. By contrast, that of gross capital formation (excluding Ireland) and especially (net) exports were negative. The latter was especially the case in the most industrialised countries (Germany and Italy). It should be noted, however, that in Germany more than in Italy this was due to a fall in exports. In Italy, by contrast, the negative contribution of net exports was also due to relatively strong import growth in the wake of strong consumption growth. As for investment, in the three largest euro area countries, equipment investment is being scaled back, while construction investment (housing and other) is at best stabilising. However, the digitalisation of the economy is still boosting investment in intellectual property products, especially in Germany and France.

The European Commission's semi-annual survey of business investment also suggests very weak investment dynamics ahead for 2025. This is in line with weak business confidence. In the manufacturing and construction sectors, confidence has been very weak for quite some time and in the service sectors it has weakened in recent months. This was particularly reflected in the Purchasing Directors' Confidence Indicator (PMI), which fell back in November below the 50 threshold associated with the difference between expansion and contraction. However, a positive correction to above 50 again followed in December.

Meanwhile, the laborious improvement in consumer confidence did not continue in November. Consumers became gloomier, especially in France and Germany, but also in the Netherlands and Belgium, perhaps not coincidentally in countries also facing serious political difficulties. The latter make it difficult to assess what impulses can be expected from fiscal policy, both for consumers and entrepreneurs. Not least in Germany, the weakening labour market is probably also affecting consumer confidence. Moreover, convincing signs of improvement in the malaise in German industry are also awaited. Next February's German elections may bring more clarity.

2025 thus announces itself as a difficult and - once again - highly uncertain year, with numerous internal European challenges. Because Trump's re-election as US president, with the accompanying high probability of escalating trade conflicts, has also worsened the external growth environment, we lowered our growth outlook for European economies last month. Today, there are signs that through the conclusion of bilateral agreements, the biggest conflicts might be avoided, at least in the short term. But these are not such as to adjust the baseline scenario of an economy continuing to drag on at a listless growth rate of below 1% for a long time to come. We therefore maintain our projections for euro area real GDP growth of 0.7% in both 2024 and 2025.

Euro area inflation higher again

As expected, euro area inflation rose further to 2.2% in November from 2.0% in October. The increase was mainly driven by less negative energy price inflation. It rose to -2.0% in November from -4.6% in October, mainly due to the base effect caused by the sharp fall in energy prices in November 2023. Food price inflation decreased slightly from 2.9% to 2.8%, while core inflation (inflation excluding energy and food prices) stabilised at 2.7%. That stabilisation was the result of a slight increase in goods price inflation (excluding energy) from 0.5% to 0.7%, while services inflation cooled slightly from 4.0% to 3.9%.

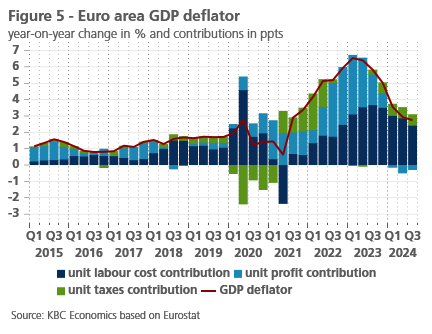

Meanwhile, analysis of the GDP deflator in the third quarter points to the gradual easing of labour cost pressures on price developments (see figure 5). This follows the slowdown in the rate of increase in the wage bill per employee and the hesitant recovery in productivity growth. However, wage cost pressures remain substantially higher than before the pandemic and, as expected, are slow to diminish. This is because the catch-up of wages to the 2021-2022 inflation shock is delayed, while the favourable employment development in the context of very weak economic growth has the downside of significantly dampening productivity growth.

Wage cost pressures are expected to continue to decline gradually. This should trigger a new, further decline in inflation after the turn of the year, when the base effects of the sharp fall in energy prices have worn off by the end of 2023. However, that decline risks being breached during 2025 by new inflationary impulses from trade tariffs in the context of expected escalating trade disputes after President Trump takes office. As a result, (core) inflation in the euro area will pick up during 2025 and on average is expected to be slightly higher on balance than in 2024. Energy price inflation will still remain slightly negative in 2025 despite the rise in natural gas prices and thanks to lower oil prices (see above). Our forecast for overall inflation therefore remains unchanged at 2.4% for 2024 and 2.5% in 2025.

Fed and ECB again cut their policy rates

On 12 December, the ECB cut its policy rate, the deposit rate, by another 25 basis points to 3%, as expected. The ECB expects the euro area's disinflationary path to continue, basing this on its new December forecast (an inflation rate of 2.1% in 2025 from the previous September forecast of 2.2%). Eurosystem economists expect this against the backdrop of a weakening economic recovery. Real GDP growth in the euro area in 2025 is likely to be lower than in the September forecast, at 1.1% (versus 1.3%).

The ECB's interest rate decision was in line with KBC Economics’ and market expectations. We expect an additional 25 basis point rate cut for each of the next policy meetings, which will bring the ECB policy rate to its cyclical low of 2% by the end of the second quarter of 2025. That trough is still somewhat higher than what the market expects, but market expectations for inflation are too low and market growth pessimism too high, in our estimation. Moreover, a floor rate below our expectation of 2% would further weaken the euro sharply, resulting in additional imported inflation. The ECB will probably want to avoid that, in our view.

The Fed also cut its policy rate again by 25 basis points on 18 December. We continue to expect three more cuts by 25 basis points in 2025, but now with pauses in between them. Specifically, we expect rate cuts at the Fed’s June, September and December meetings . As a result, the policy rate will have reached its cyclical bottom of the range between 3.50% and 3.75% at the end of 2025.

The Fed may provide forward guidance on the further path of its quantitative tightening in early 2025. Having already slowed the pace of unwinding its portfolios of government bonds and mortgage-related bonds in June 2024, it is possible that it will do so again soon. Indeed, indicators such as banks' use of the Fed's one-day reverse repo facility suggest that the amount of excess liquidity in the financial system has declined noticeably further (see figure 6). The Fed will want to take a more cautious course to avoid unforeseen liquidity shortages in the money market.

Bond yields

Against the background of a more cautious Fed communication after its December policy meeting, we have raises our outlook for US and German bond yields throughout 2025, to bring them broadly in line with their current levels. We For the German yield, we continue to assume that the market underestimates the inflation impact of an impending trade conflict and will correct towards the end of 2025. As a result, nominal German 10-year rates will also pick up again and reach 2.50% by the end of 2025. As a result, the US-German interest rate spread will remain high in the near term and create a weak euro exchange rate against the dollar.

Spreads over their peak

A second important change in our scenario concerns interest rate spreads between EMU governments and the German benchmark interest rate. We now assume that the peak of those interest rate spreads is behind us (see figure 7). At the moment, markets are not too worried about the fact that a number of national budgets for 2025 have not yet been approved, nor about the fact that a number of governments cannot rely on a parliamentary majority. In addition, the temporary fall in the German benchmark interest rate may also have played a role, increasing the search by investors for yields on other EMU government bonds. We expect the peak of the interest rate spread to be behind us. The prospect of the new German government relaxing debt brake rules after the February 2025 elections and adopting a more flexible fiscal policy with more public investment also raises the prospect of more German bond issuance. These will reduce the interest rate differential with other EMU countries.

All historical quotes/prices, statistics and charts are up-to-date, through December 16, 2024, unless otherwise noted. Positions and forecasts provided are those as of December 16, 2024.