Ceasefire in US-China trade war bad news for Europe

The trade agreement between the US and China – although limited in scope - is a clear signal of de-escalation of the trade conflict and good news for the global economy. However, an improving US-China trade relationship is not necessarily positive for the European economy. The EU is caught between two fires now, and an escalating trade dispute with China and/or the US will be one of the major risks for the European economy from 2020 on.

White smoke

Since mid-2018, the trade dispute between the US and China has escalated into a real trade war. In the meantime, negotiations were started on a new trade agreement. After many ups and downs, the process resulted in the so-called Phase 1 trade deal in mid-December, a partial trade agreement between the two parties. The deal - despite its limited scope - is a clear signal of de-escalation of the trade dispute.

The trade deal includes China's pledge to increase US imports by around USD 200 billion over the next two years compared to the 2017 import value. China promises to import more American agricultural products in particular, but also more industrial and energy products, foodstuff and services. China also commits to better protect US intellectual property and to end the forced transfer of foreign technology to Chinese companies. In addition, China has committed to opening up its financial services more to US companies and to avoiding competitive currency devaluations. The US government has agreed to reverse a number of import tariff increases. In particular, the US will halve the tariff rate of 15% that is currently applied to some USD 120 billion worth of goods imported from China - which has been in force since September 2019 - to 7.5%. In addition, the US is withdrawing its threat to impose additional import duties on products such as laptops, clothing and smartphones. To ensure compliance and to resolve disputes, the deal also includes a dispute settlement mechanism. It sets out procedures to be followed in the event of either party's failure to comply with the agreement.

Incomplete and unclear

This Phase 1 deal does not mean the end of the US-China trade dispute as it does not remove all the protectionist measures introduced over the past two years. For example, the US 25% tariff increase introduced during the summer of 2018 on a wide range of Chinese imports worth around USD 250 billion will remain in place. In addition, there are many questions about the actual implementation of the agreement. For example, there is no information on potential further reductions in import duties. According to US President Trump, negotiations on a Phase 2 trade deal will start immediately, but the Chinese negotiators want to see the Phase 1 agreement implemented first. Negotiating a Phase 2 agreement will also be even more difficult than its predecessor, as more thorny issues in Sino-American trade relations - including cybertheft, digital trade and industrial subsidies to state-owned companies - will have to be addressed. If a Phase 2 agreement is a precondition for a further reduction in US import tariffs, it may be a long time coming.

Questions are also being asked about the fulfilment of the Chinese promises. After all, China does not have a very good reputation regarding the protection of intellectual property, and it remains doubtful whether this agreement will bring about a structural change in the Chinese approach. In addition, the promise to increase Chinese imports from the US by USD 200 billion may not be feasible.

Black smoke

The thaw in the US-China trade war seems to be good news for the global economy. Europe in particular should be able to benefit from the situation, all else equal, since the European economy is more dependent on international trade than the American and Chinese economies. However, a better US-China relationship does not guarantee a more favourable international environment for the European economy. Indeed, the EU is increasingly becoming the target of more assertive trade policies by both superpowers.

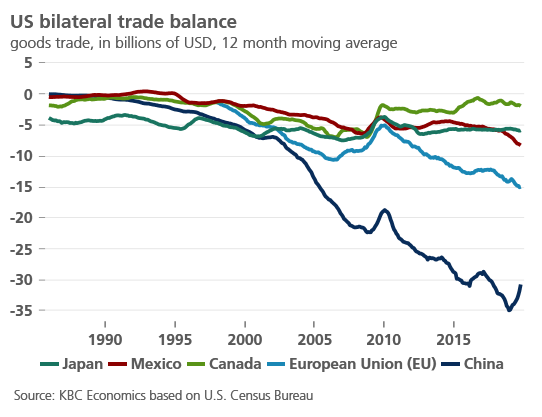

President Trump has repeatedly reiterated his concern about the US trade deficit with the EU (see figure). He accuses the EU of unfair trade practices - including a weak euro, a protectionist agricultural policy and excessive tariffs on car imports. A ceasefire with China increases the likelihood that the US will turn its attention to the EU. Such a direct trade confrontation would cause considerable damage to the European economy. After all, the US remains the main destination for European exporters and many companies are transatlantically integrated. For the time being, the conflict is limited to pinholes such as tariff increases on steel and aluminium, and threats to increase tariffs on German cars and various food products (French sparkling wine, cheeses, olive oil, etc.), among other things. These threats have mainly surfaced as a result of the EU's WTO-ruling regarding subsidies to Airbus and the conflict around the French digitax. Up to now, therefore, it has been mainly psychological warfare in the hope that the EU will make more concessions during the current trade negotiations with the US. But small pinholes can, of course, quickly lead to an escalation.

China is also approaching the EU in a more aggressive way. Recent evidence suggests that the Chinese government is putting pressure on European governments to purchase Chinese products and services. For example, European governments are being forced to allow Huawei to develop European 5G networks, despite strong objections from the US. So, Europe is caught in the middle. The Chinese threat to further close the Chinese market to European companies is a fundamental threat to the European economy.

Both the US and China may significantly affect the European economy in the near future, making this one of the major risks for the European economy from 2020 onwards. The US and China are also taking advantage of the divisions between the EU Member States. Trade policy is in principle a European competence, whereby the European Commission determines the policy for the entire EU. There is a danger that the EU Member States will be played off against each other with a combination of loud promises and hard threats and that the common European front will be broken. That would strategically weaken Europe in the global economy. It would also be a particularly painful development for the further development of the European Union. Trade has always been a common interest and free trade a building block of our European prosperity and integration.