Most recent Economic Perspectives for Central and Eastern Europe

Recently published macroeconomic indicators and economic policy measures adopted in KBC home markets in the CEE region (Czech Republic, Hungary, Slovakia and Bulgaria), reconfirm a varied economic landscape across the region. The Czech Republic exhibits steady, albeit moderate, growth with controlled inflation and low unemployment. Hungary faces a period of GDP stagnation with persistent, though declining, inflation and a contracting industrial sector. Slovakia experiences modest growth but grapples with rising inflation and a worsening trade balance. Bulgaria demonstrates comparably strong GDP growth and moderating inflation, positioning it favourably for the planned euro area entry, although it also faces a widening trade deficit. Monetary policy responses differ across the countries, reflecting their unique economic challenges.

Economic growth

The Czech Republic continued to demonstrate a trend of steady moderate expansion in the first quarter of 2025. Preliminary data indicated a real GDP growth of 2.0% year-on-year and of 0.5% quarter-on-quarter. While the economy maintains a positive trajectory, our forecast for both 2025 and 2026 does not suggest a significantly accelerating pace of growth. In fact, the prediction risks are rather on the downside as uncertainties surround the strength of the economic expansion first of all due to potential fluctuations in external demand (largely, though not exclusively, due to globally elevated trade barriers).

We expect to see growth in the Czech Republic this year driven primarily by growth in real incomes and household consumption. European and Czech industry will be hit by the US tariffs through weaker US demand and through the negative impact of uncertainty on investment at home and abroad. As a consequence, we have lowered our estimated real GDP growth rates in the period ahead and now assume only 1.7% year-on-year growth in 2025 (originally 2.1%) and 1.5% year-on-year growth in 2026 (originally 2.3%).

In this baseline scenario, we continue to assume that both Europe and the Czech Republic are able to avoid a recession. However, if international trade tensions escalate further and the postponed US and forthcoming European reciprocal tariffs come into force in the summer, a recession could become inevitable.

In Hungary, GDP contracted by 0.2% quarter-on-quarter in the first quarter of 2025, partly reversing a 0.6% gain in the preceding period, according to preliminary estimates. Despite disappointing performance in the first quarter, most medium-term predictions expect a gradual recovery from the negative GDP growth in 2023 (-0.8% year-on-year). The recovery started in 2024 (0.5% year-on-year) and it is expected to continue in 2025 and 2026. Uncertainty about the pace of the predicted recovery in Hungary is at least as large as in the Czech Republic. Hungary's economy relies heavily on the automotive and electronics manufacturing sectors, making it vulnerable to shifts in global demand within these industries in general and to implications of potentially escalating trade wars in particular. In response to the emergence of external factors with potentially adverse impact on the Hungarian aggregate economic performance, we cut down our forecast for Hungarian annual real GDP growth to 1.0% in 2025 and 3.5% in 2026.

Having exhibited a moderate real growth rate in the fourth quarter of 2024, the Slovak growth momentum appears to have slightly softened in the early months of 2025, when the country recorded a quarter-on-quarter GDP increase of 0.3%. Looking ahead, only limited expansion can be expected in 2025, potentially reflecting anticipated impact of fiscal consolidation measures. Slovakia's economy is significantly influenced by its automotive industry, making it sensitive to fluctuations in the global automotive market and (like most regional competitors) severely exposed to negative implications of the pending trade war. In anticipation of the headwinds that the Slovak economy will likely be facing in 2025 and 2026, we have adjusted our annual real GDP growth forecasts for the country to 1.5% and 1.9% respectively (down from earlier 1.9% and 2.2%).

Bulgaria's economy demonstrated robust growth of 0.9% quarter-on-quarter in the final quarter of 2024, with an annual average real GDP growth rate of 2.7% for 2024. This positions Bulgaria as the strongest performer among the CEE home markets in terms of economic expansion. Given the increased uncertainty and risks to the global economy emerging from protectionist measures hurting free trade, we have mildly reduced our domestic demand-driven real GDP growth forecasts for Bulgaria to 2.4% in 2025 and 2.6% in 2026 (from the original 2.6% and 2.7%).

Inflation

Inflation in the Czech Republic appears to be well-managed. Annual average headline HICP inflation dropped to 2.7% in 2024, marking a considerable decrease from the double-digit levels experienced before. In April this year, consumer prices fell by 0.1% month-on-month, bringing year-on-year inflation down from 2.7% to 1.8%. The latest sharp fall in annual inflation was mainly due to the favourable development of the strongly volatile food prices and can hardly be sustained. Despite inflation likely returning back above 2% in May and June, we predict a continuation of the gradually decreasing path of Czech annual average HICP inflation in 2025 to 2.4% and in 2026 to 2.2%. The controlled inflationary environment could then provide a welcome support for consumer spending and the trajectory of real wages in the Czech Republic.

While experiencing a significant moderation in 2024 compared to 2023 (annual average HICP inflation dropped to 3.7% from 17.0%), the disinflation process in Hungary has slowed down during the past year. The year-on-year inflation rate stood at 4.7% in March, down from 5.6% in February and 5.5% in January, well above levels considered satisfactory. Our projections do not indicate a return to a sustainable price growth by the end this year, either. The expected trend of weakening inflation remains reluctant, reflecting persistent inflationary pressures present in the country. Our forecast of Hungarian annual average HICP inflation is 4.5% for 2025 and 4.0% for 2026. Not surprisingly, consumer inflation remains a major concern for Hungarian policy makers, as the high levels experienced previously have eroded the real value of wages and diminished consumer purchasing power.

Compared to Hungary, consumer price growth in Slovakia presents a slightly less worrying but still concerning picture. The year-on-year national CPI inflation rate stood at 4.0% in March 2025, up from 3.8% in February and 3.9% in January. The recent trend reflects a broadly balanced economic environment, with price increases so far mainly driven by housing and utilities. Forecasts for 2025, though, anticipate a further rise in inflation, which, in our view, may temporarily climb slightly above 5%, primarily driven by the planned withdrawal of energy subsidies and increases in taxes. This expected surge in inflation poses a significant challenge for Slovak households and policymakers. As for 2025, our forecast of annual average HICP inflation stands at 4.0% (following 3.2% in 2024), while for 2026, we predict a price growth deceleration to 3.1%.

In Bulgaria, inflation held steady at 4% year-on-year in March, unchanged from February. The figure was 0.8% quarter-on-quarter in the first quarter of 2025. The recent price stability has been a result of stronger price gains in food, housing and healthcare, while transport and recreation saw price declines. Projections for 2025 suggest a further decrease in Bulgarian inflation, which should bring the country closer to meeting the criteria for euro area entry on January 1, 2026. Our forecast sees annual average HICP inflation in Bulgaria at 2.6% in 2025 and 2.5% in 2026.

Labour market

The labour market in the Czech Republic remains remarkably tight. The general unemployment rate for the 15-64 age group was reported at 2.7% in March 2025. When considering the broader demographic of the 15–74 age group, the unemployment rate stood at 4.3% for the same period. Both figures indicate a strong demand for labour. However, our forecasts for 2025 suggest a marginal increase in the unemployment rate by about 0.6 percentage points to 3.3% by the end of 2025, while we expect 3.2% by the end of 2026. This potential rise could be attributed to anticipated adjustments in economic activity or structural shifts within specific sectors of the economy. The historically low unemployment, while a positive indicator, also presents challenges such as potential long-term labour shortages given the country's aging population and demographic trends.

The unemployment rate in Hungary stood at 4.3% in March 2025. This relatively low figure suggests a tight labour market despite the overall economic stagnation. Our forecast points towards a relatively stable unemployment rate of 4.3% at the end of 2025, while slightly decreasing towards 3.9% at the end of 2026. This tight labour market could potentially support wage growth, but it might also contribute to underlying inflationary pressures within the economy.

The unemployment rate in Slovakia is relatively stable and, according to our forecasts, it should remain this way in the coming two years as we expect an unemployment rate of 5.3% in both 2025 and 2026 (coming from 5.1% at the end of 2024).

The harmonised unemployment rate in Bulgaria stands below that of Slovakia since the past five years. The Bulgarian unemployment rate reached 3.8% in March 2025 and our forecasts point towards a relatively stable unemployment rate for both 2025 (3.9%) and 2026 (3.8%).

Monetary policy

At its May meeting, the Czech National Bank (CNB) cut its key interest rate by 25 basis points, from 3.75% to 3.50%. Six board members raised their hands in favour of this decision, while one member voted for rate stability. At the same time, Governor Michl suggested that further downward movement in rates may not be certain and will be conditional on a decline in upside risks coming from the domestic economy. In our view, Aleš Michl's communication suggests that the Bank Board as a whole wants to leave room for further interest rate cuts. However, it will proceed "very cautiously", and only in line with the fading of upside risks to the domestic economy. We therefore assume a further 25 basis points rate cut to 3.25% only in the autumn of 2025 (at the end of the third quarter of 2025). Then, given our weaker outlook for growth and inflation this year, we see room for one final rate cut in 2026 to 3.0%. However, this will be largely contingent on further developments in the US-EU trade conflict.

The Hungarian National Bank (MNB) has maintained its base interest rate at 6.5% in recent months. According to the MNB, the inflation may decelerate further in April, and it may remain around the upper edge of the MNB’s tolerance range (4% year-on-year) in the coming months as well. The MNB’s Council emphasised that it is key to anchor inflation expectations, which requires cautious and patient monetary policy. Due to recent poor economic performance and expected easing of monetary policies by the ECB and by the Fed later this year, we maintain our view that the MNB will use this maneuvering room to cut the base rate two times during the second half of 2025. In our view, the base rate could drop to 6.0% by the end of 2025 and to 5.0% by the end of 2026. The base rate in Hungary is currently the highest among EU member states. The MNB's decision to keep interest rates elevated not only reflects ongoing efforts to combat inflation but also to stabilise the value of the Hungarian forint. Over the past decade, the forint has experienced a significant weakening against both the USD and EUR. This depreciation of the forint contributes to inflationary pressures within the Hungarian economy by making imported goods more expensive for consumers and businesses. It may also impact the competitiveness of Hungarian exports in international markets.

In contrast to the recent preference of base rate stability by the MNB, the National Bank of Poland (NBP), the central bank of the largest CEE country, has cut its rate by 50 basis points last week. At a press conference held the following day, NBP President Glapinski noted that the adjustment should not be seen as the start of a series of rate cuts and added that at the next meeting in June, interest rates should remain unchanged. Even though we do not overinterpret the NBP President's current hawkish statements, as he has proven several times in the past that he is able to change his mind very flexibly and thus influence the decisive majority within the Monetary Policy Committee, we expect stability of the base rate in Poland until the July NBP meeting.

The Bulgarian National Bank (BNB) has continued its policy of gradually reducing interest rates. The base interest rate was lowered to 2.24% for May 2025, marking a further decrease from 2.39% in April and 2.59% in March. This is the lowest base interest rate since March 2023. This easing of monetary policy reflects the moderating inflation and an effort to support continued economic growth. Bulgaria maintains a fixed exchange rate mechanism with the euro, at approximately 1.9558 BGN per EUR. This peg is a key element of Bulgaria's strategy towards adoption of the euro.

According to the Bulgarian Ministry of Finance, euro adoption in the country on January 1, 2026, seems to be as likely as never before at the moment. The country’s success in meeting the Maastricht criteria should be reflected in an extraordinary Convergence Report on Bulgaria’s euro readiness to be published on June 4. From the perspective of the domestic political situation, it seems probable that the current government, which has already survived two votes of no-confidence during the first 100 days in the office, will be able to withstand also the remaining external and internal pressures and successfully complete the long process of euro area entry.

Residential real estate, a strong 2024

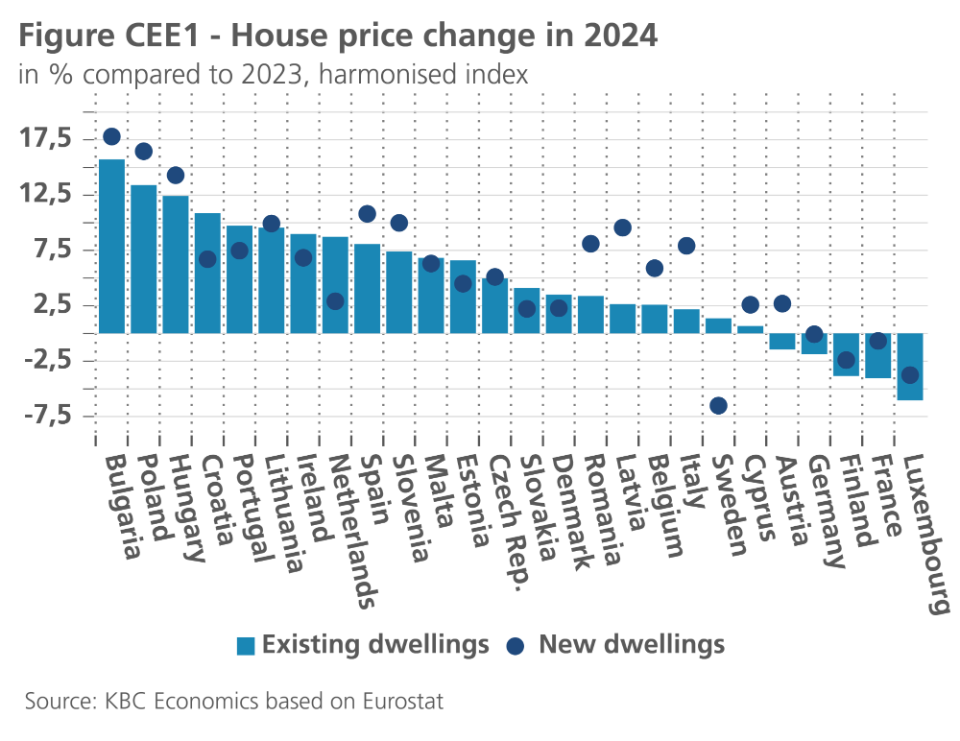

Last month, Eurostat published house price figures for the fourth-quarter of 2024. Having all data, we look back on 2024 and give an overview of our 2025 forecasts regarding the residential real estate market in Central and Eastern Europe. After a weaker 2023, house prices in the region rebounded. When looking at the overall growth for the year 2024, countries like Bulgaria (16.5%), Poland (15.0%) and Hungary (12.8%) stand out (see figure CEE1).

In 2024, most countries in the region overperformed economically, reaching growth rates above the euro area average. This growth benefited household disposable income, a key factor explaining house price growth. Moreover, policy rates of, for instance, the CNB and the MNB peaked earlier than those of the ECB. A sharper fall in policy interest rates, made mortgages cheaper, allowing larger amounts to be borrowed and consequently allowing house prices to rise more strongly. For instance, in the Czech Republic, where house prices grew by 5.0% in 2024, the total volume of new mortgages grew by 83% due partly to higher prices, but also to more than 50% growth in the number of new mortgages. Overall, it was the result of improving financial conditions of the Czech households building on fast real wage growth, persisting low unemployment and a relatively high savings rate. Slovakian house prices grew at a broadly similar rate (3.8%), despite being a member of the eurozone. This growth is especially measured in big cities like Bratislava and Košice. Part of the price growth could also be explained by an expected rise of the VAT tax rate on property sales.

The upcoming accession to the euro area contributes strongly to the Bulgarian house price increase. There is a strong believe that house prices (mostly flats in bigger cities) should become more expensive after the country joining the monetary union. Against the background of low deposit rates (less than 1.0% p.a. amid over 3.5% yoy inflation) and the underdeveloped retail segment of the capital market, households prefer to buy flats. Furthermore, there is ‘grey money’ that will be difficult/not be able to be exchanged in the banks after euro adoption. Part of this money is invested in flats. This boost to house prices is however only temporary and a decrease in transactions was already measured at the end of last year.

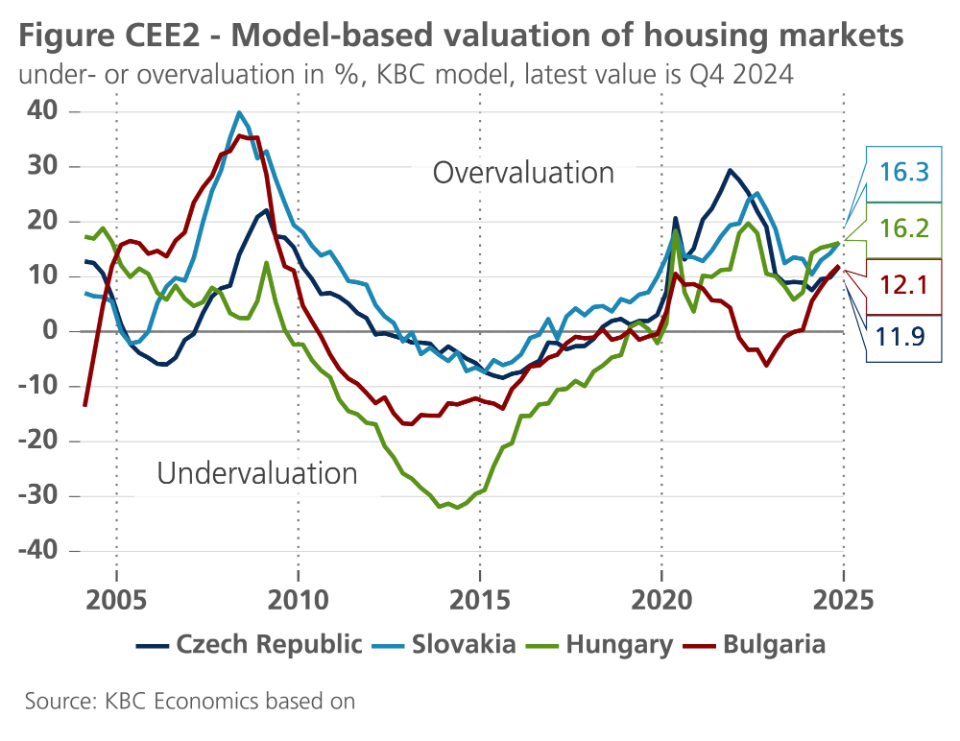

While there are valid reasons why house prices rose sharply in the CEE region, we should remain cautious. It is not easy to measure the extent of housing market overvaluation in a country and, as a result, such estimates are surrounded with uncertainty. Our model-based assessment nonetheless points at 2024 being another year of rising overvaluations in the CEE (see figure CEE2). The reversal followed a period of declining overvaluations after the necessary correction of real house prices in 2022/2023. The measured overvaluation calls for caution, but is no reason to panic for the moment as the estimates still do not reach excessively high levels.

For 2025, we expect softer annual house price growth in the CEE region. We may see a stronger decline in policy interest rates in Poland and Hungary, but the trade war with the US could still cripple GDP growth in CEE. Moreover, we mentioned a (not excessively high) overvaluation of the housing market in several CEE countries. For the countries that experienced fast price growth in 2024, we think house price growth in 2025 will be (much) slower. In particular, for Hungary we expect the 2025 price growth to be at 5.5%, for Bulgaria at 9.7%. For the Czech Republic and Slovakia, we are closer to the 2024 numbers, with an expected annual growth of 5.4% and 3.0% in 2025 respectively.