Board of Directors: information

The Board of Directors is responsible for defining general strategy and policy within our group. It decides on matters such as the overall risk appetite.

The Executive Committee is responsible for the operational management of the group within the confines of the general strategy approved by the Board.

Board meetings attendance

Special reports of the Board (only in Dutch)

| Report of the Board | Related Auditors’ report | |

|---|---|---|

| 13-11-2025 | Download | Download |

| 08-11-2024 | Download | Download |

| 10-11-2023 | Download | Download |

| 10-11-2022 | Download | Download |

| 15-11-2021 | Download | Download |

| 12-11-2020 | Download | Download |

| 14-11-2019 | Download | Download |

| 15-11-2018 | Download | Download |

| 15-11-2017 | Download | Download |

| 16-11-2016 | Download | Download |

| 13-11-2015 | Download | Download |

| 12-11-2014 | Download | Download |

| 13-11-2013 | Download | Download |

| 18-03-2013 | Download | - |

| 9-12-2012 | Download | Download |

| 7-11-2012 | Download | Download |

| 22-09-2011 | Download | Download |

| 24-03-2011 | Download | - |

| 9-11-2010 | Download | Download |

| 25-03-2010 | Download | Download |

| 12-11-2009 | Download | - |

| 26-03-2009 | Download | - |

| 5-11-2008 | Download | - |

| 8-11-2007 | Download | - |

| 22-03-2007 | Download | - |

The KBC Group Remuneration Policy is a framework for a sound remuneration practice within KBC Group worldwide in line with the corporate sustainability strategy and considering the European and different national legislations aiming sustainability (including article 5 of the Disclosure Regulation).

The KBC Group Remuneration Policy aims to ensure consistency with and to promote sound and effective risk management (e.g. “sustainability” is a specific parameter for the evaluation of KBC Senior Management).

Furthermore, the KBC Group Remuneration Policy aims to prevent incentives for excessive risk taking and ensures that the payment of variable remuneration is aligned with the long-term interests of KBC Group (e.g. Variable remuneration should not induce risk-taking in excess of the risk appetite of the different entities of the KBC Group and where relevant, be based on risk- and liquidity-adjusted profit, not on gross revenues. Additionally, ex ante and ex post risk adjustments to variable remuneration are possible in order to guarantee the sustainability strategy).

In order to comply with the Belgian company Code a specific Remuneration Policy for the members of the Board of Directors and the members of the Executive Committee has been approved by the General Meeting of Shareholders. This policy (incl. the result of the vote) is made available in the table below.

Other information

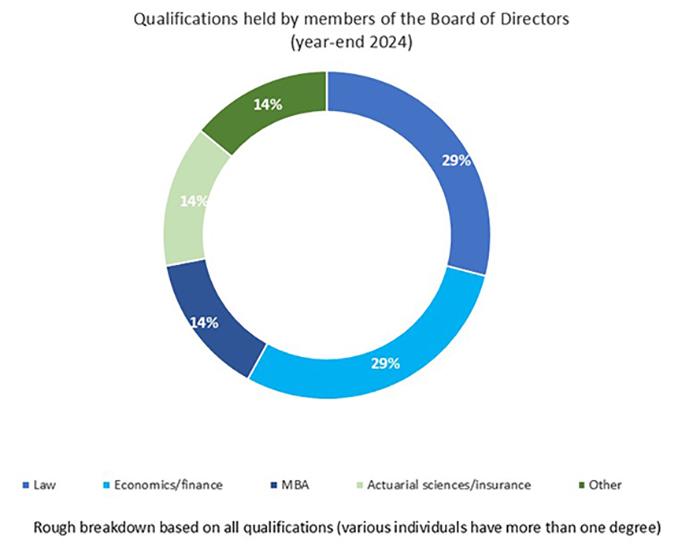

The Board of Directors has drawn up a policy regarding the desired amount of diversity in the composition of the Board itself and in the Executive Committee (EC). The aim of this policy is to guarantee diversity in terms of know-how, experience, gender and geographical background. It aims to ensure that the Board and the EC can both fall back on a broad base of relevant competences and know-how and receive diverse opinions and input for their decision-making process.

The policy stipulates that the Board should have a balanced composition to ensure that it has suitable expertise in the area of banking and insurance, the requisite experience in executive management and a broad awareness of societal and technological developments.

The policy also stipulates that:

- at least one-third of the Board’s members must be of a different gender than the other members;

- the members of the Board must be of different nationalities, with due account being taken of the different geographical areas where KBC is active;

- at least three directors must be independent within the meaning of and in line with the criteria set out in Article 7:87 of the CAC;

- three members of the EC must also sit on the Board.

The Board usually holds its meetings together with the Boards of KBC Bank and KBC Insurance. The two additional independent directors on each of these two boards provide extra expertise and diversity.

The policy also stipulates that the EC should have a balanced composition to ensure that it has suitable expertise regarding the financial sector and the requisite know-how relating to all areas in which KBC operates.

The policy also stipulates that:

- at least one member of the EC must be of a different gender than the other members;

- the EC should strive towards achieving diversity in terms of the nationality and age of its members;

- all members of the EC must have the necessary financial knowledge, professional integrity and management experience, but have followed different career paths.

Data as regards the breakdown of the Board and EC is provided in the Corporate Governance chapter of the annual report.

- Number of meetings and attendance record: see the annual report.

- Activities of the Board of Directors: see the Corporate Governance Charter

- Board committees: see the Corporate Governance Charter

- Remuneration of the members of the Board: see the annual report.