Why the Fed is unlikely to lose its independence

Laurent Convent - Senior Economist KBC Economics

Financial markets panicked when Trump briefly attacked the Fed over the Easter weekend. The concern is understandable, as a loss of Fed independence would have major economic implications as it would risk a de-anchoring of inflation expectations. That said, a loss of independence remains unlikely. Trump cannot legally fire Jerome Powell without due cause. Trump is also weighing a nomination of an independent Fed Chair when Powell’s term expires in May 2026, given the pressure from financial markets and US Senators. Even if he were to confirm a pliant Fed Chair, the Fed has other guardrails to maintain its independence.

During the Easter weekend, while people around the world were searching for eggs, Donald Trump searched for a scapegoat for the current economic slowdown. He landed on Jerome Powell, the current Fed Chair. He called him “Mr. Too Late” and said his “termination cannot come fast enough”. Markets were rattled on the reopening on Easter Monday. The S&P 500 dropped by 2.2%, while 10Y Treasury yields increased by 8 basis points and the dollar depreciated by 1% against the euro. The next day, Trump reversed course, saying he has “no intention of firing Jerome Powell”, calming down markets.

Importance of central bank independence

Market worries about the Fed’s independence are understandable. As political interference in central bank policy would likely result in artificially low interest rates, inflation expectations would de-anchor, resulting in permanent upward inflationary pressure. Furthermore, the unpredictability of US monetary policy would increase risk premia on US assets and put downward pressure on the dollar. The Peterson Institute modelled the impact of an erosion of Fed independence. It estimated that the risk premia on US assets versus other assets would increase by 2 percentage points. Capital flows out of the US economy would depreciate the US nominal effective exchange rate by 17% in 2025, and by around 1.4% each year thereafter. The consumer price index would increase by an extra 11% over the course of Trump’s term, while GDP would be 1.2% lower than their baseline scenario.

How can Trump undermine Fed independence?

Notwithstanding Trump claiming he can fire Jerome Powell when he wants to, there is currently no legal basis for him to do so. According to a 1935 precedent, Humphrey’s Executor v United States, the US president lacks an “illimitable power of removal” for executive agencies with “quasi-judicial” or “quasi-legislative” powers that were established by Congress. This means in practice that the Fed Chair or other Fed governors can only be fired “for cause”, i.e., malfeasance or dereliction of duty. Though a pending Supreme Court case called “Trump v Willox” about the recent firing of officials on two labour boards could weaken the Humphrey’s Executor ruling, most legal experts expect the Supreme Court to maintain the Fed’s independence.

That said, Jerome Powell’s term as Fed Chair will end in May 2026. In theory, Trump could replace him with a more pliant Chair. This action would trigger a worse response from financial markets than the one seen during the Easter weekend. Trump would likely back off in the face of such financial market turmoil, as he did in April.

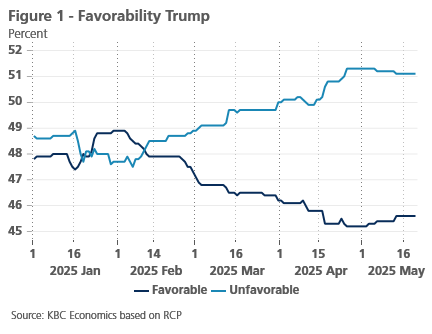

Even if Trump were to press ahead with a plan to nominate a more pliant Fed Chair, his nominee is unlikely to get confirmed by the US Senate. Though Republican senators have confirmed other controversial nominations by Donald Trump, they are unlikely to pass such a controversial pick right before a midterm election. Many Republican senators will face tough reelection battles and will want to show some independence from an increasingly unpopular president (see figure 1).

Other guardrails protect the Fed

Even if Donald Trump were to succeed in replacing Jerome Powell with a more pliant Fed Chair, the Fed disposes of other important guardrails. Indeed, though the Fed Chair has more control over the agenda of the FOMC and more public visibility than other members, he remains a primus inter pares within the 12 FOMC members. He has only one vote and decisions within the FOMC are made on a majority basis.

As mentioned, the FOMC consists of 12 members. 5 members are presidents of regional reserve banks, i.e., the president of the NY Fed and four presidents of other regional reserve banks (who rotate annually). The president has no sway in their nomination. The other 7 FOMC members are nominated by the president (the so-called Board of Governors), but serve 14-year terms. Only two members will thus see their terms expire during Trump’s term, far too few for Trump to fully sway the Fed’s decision making.

Presumptive heir

It is notable that the name circulating most for Powell’s replacement is Kevin Warsh, a former governor of the FOMC (he left the Fed in 2011). Some of Mr. Warsh’s views will indeed please Mr. Trump. He has criticized the Fed’s “mission creep”, on themes such as sustainability. That said, he tends to have more hawkish views. He is a critic of the quantitative easing programs and chided Powell on letting inflation spike in the post-covid area. Warsh would thus be unlikely to let inflation run wild if he were to be nominated.

Overall, this is a further indication that Trump’s attacks on the Fed are more bluster and scapegoating than full-throated assaults. The Fed seems to be an institution Trump can’t get a grip on.