The US risk-off quantified

Liberation Day and Trump’s attack on Fed chair J. Powell highlighted the interconnectedness of political stability and market dynamics. The government bond yield differential not driving the US dollar made the loss in trust in US assets clearly visible. It concerns a risk aversion with real economic consequences, which potentially played a role in the decision to pause the tariffs just a few days after Liberation Day.

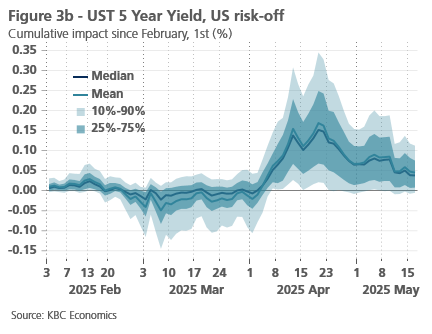

In this economic brief, we distinguish the different risk mechanisms at play and quantify the consequences of the US risk-off for the US dollar index and 5-year treasury yields.

Different types of risk aversion

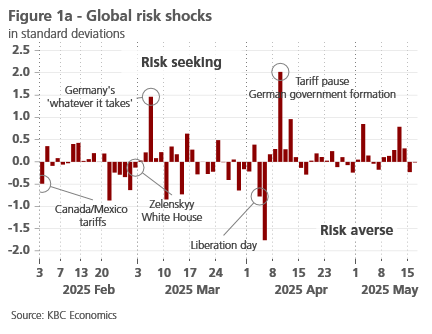

When we talk about risk aversion in financial markets, assets like US dollars and treasuries are typically seen as safe havens. Therefore, during periods of global risk aversion (Figure 1, red shocks), we expect US equities to decline while demand for dollars and treasuries increases (Höynck (2020)1.

However, in April, starting with 'Liberation Day', the narrative became more complex. Trust in US assets diminished, and Germany emerged as a safer haven. Consequently, we modelled, using a SVAR model, an additional risk shock (blue), characterized by a drop in demand for US dollars, US treasuries, and the S&P 500, alongside an increased demand for German Bunds.

Preference for equities returned quickly, trust towards the US slowly

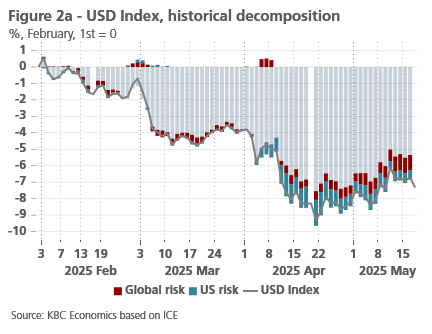

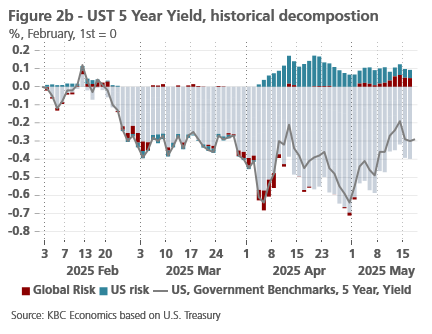

What have we observed in recent weeks? Liberation Day triggered a traditional flight to safety: equities were sold, and dollars and treasuries were bought. But once the tariff pause was announced, investors shifted back to riskier assets like equities (pushing up bond yields and depreciating the USD, see Figure 2). Simultaneously, there was a notable flight away from US assets, which persisted even after the pause announcement, albeit less pronounced on that day. This risk-off sentiment peaked when Trump attacked Fed Chair J. Powell. However, as the tone towards Powell and China became softer, the risk aversion towards the US decreased. Finally, last week‘s agreement with China to lower tariffs, equalled a strong reduction in risk aversion towards US assets.

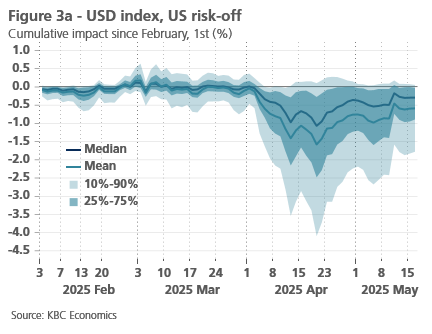

The US risk-off was significant, less than 1/3 remains

The effect of the US risk-off on the US government bond markets can be considered significant at its peak, which was reached after president Trump attacked Fed chair Powell. At that moment bond yields cumulatively increased between 0 and 35bp since Liberation Day. The US dollar index depreciated between zero and four procent. In both cases 30% of the impact remains, one and a half month after Liberation Day (Figure 3).

So for now a small US risk premium remains in place. It increases borrowing costs and makes importing goods more expensive. How easily the US risk-off risk will intensify again, how much Trump will keep the signal from the bond markets in mind, remains to be seen.

1 Höynck, Christian, and Luca Rossi. "The drivers of market-based inflation expectations in the euro area and in the US." Economics Letters 232 (2023): 111323.