The ESIs: a finger on the pulse of the European economy?

The ESI provides a timely monthly indicator of economic sentiment for the EU economies. As a composite indicator it aggregates qualitative survey-based information into a hard (quantitative) signal. This ESI indicator applies the same methodology for all EU economies which makes it also useful in cross-country assessments. This indicator aims at tracking GDP developments in the euro area economies as well as in the EU members states. The analysis in this report suggests that the ESI indicator contains relevant information for predicting the expected GDP growth for current and the next (few) quarters. Moreover, the ESI indicator is able to track (partially) the growth-at-risk in the economy. Quantile regressions indicate that lower values of the ESI indicator are typically associated with a higher risk of a negative (low) GDP growth. As such the ESI indicator provides useful information for assessing the stance of the economy. While in the report we mostly discuss the case of the euro area economy, most results carry over to the individual economies as well.

I. ESI as an indicator of economic sentiment

The Economic Sentiment Indicator (ESI), published on a monthly basis, by the European Commission is a survey-based composite indicator intended to monitor the current stance of economic activity and more concretely to track GDP. The ESI is constructed as a weighted average of the balances of replies to selected questions addressed to firms in five sectors covered by the EU Business and Consumer Surveys. The sectors covered are industry (weight 40%), services (30%), consumers (20%), retail (5%) and construction (5%). For comparability reasons these raw indices are rescaled such that the long-term average equals 100 and the standard deviation is equal to 10. One main advantage of this indicator is that it provides a common “GDP-tracker” for each of the EU members states as well as the EU and the euro area economies as a whole. As the methodology is consistent across countries, the measure can also be used in cross-country analyses.

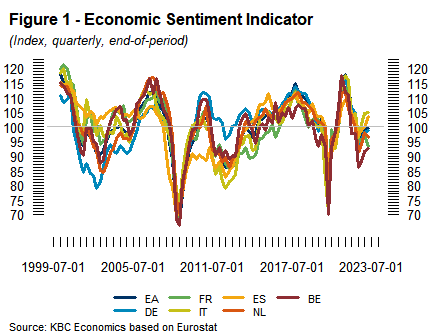

A first glance at these indicators (see figure 1) suggests indeed that the ESI indicators correlate positively with economic activity and GDP. ESI tend to fall sharply below the 100 average during crises such as the GFC and the pandemic. Moreover, the indicators seem to be significantly aligned to the actual (past) business cycles across the European economies.

Also, during the energy crisis (from mid-2021), ESIs fell sharply, although not to the levels seen, for example, during the euro crisis or in the aftermath of the dot-com bubble. In recent months, ESIs rose again in most countries to near or above 100, the indicator's long-term average.

Information in the ESI indicators?

ESIs provide timely indicators of economic sentiment across the EU economies. To what extent these indicators remain useful gauges regarding current (and possibly future) economic activity remains an open question. Early academic research provided mixed results regarding the indicator’s informational value and composition (see for instance Gelper and Croux (2007)1.

In this note, we revisit the possible information content of the ESI indicators. We look at both the ability of the ESI indicator to track current economic activity (GDP growth) as well as serve as a leading indicator for near-term forecasting. We look both at the mean forecasting power as well as the use of the indicator as a crisis or recession signalling device. In order to improve the statistical power of the analysis we use a panel approach. We combine data from Belgium, the eurozone and some large EU economies (i.e. Germany, France, Italy, Spain, the Netherlands and Belgium) while allowing for country-specific dummies in the statistical analysis. Note that we exclude the Covid crisis period from the analysis to avoid possible (positive) biases due to the extreme outliers during that period.

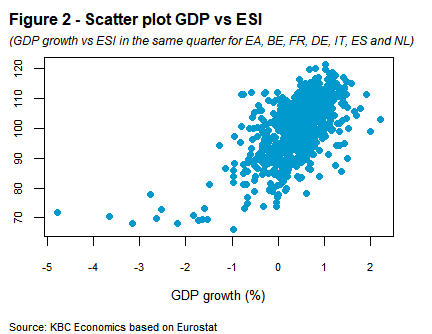

ESI indicators contain information regarding current and future growth performance. A first look at the scatter plot between the ESO reading and the GDP growth (see Figure 2) already shows some (but far from perfect) positive correlation between the ESI levels and GDP growth. Higher ESI readings are clearly associated with higher growth. Obviously, the relation is not one-to-one as many factors not captured by the ESI also impact on economic activity.

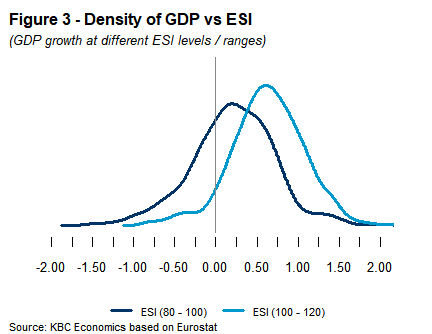

But even if imperfect, the informational content of the ESI becomes clearer when looking at the conditional growth distributions. Figure 3 shows the growth distributions for respectively time periods where the ESI was above the 100 benchmark level and when it was below the 100 benchmark level. This analysis clearly shows that, there is a shift in the distribution towards lower GDP growth when the ESI level is below 100, compared to the distribution we obtain when the ESI is above 100. ESI-values below 100 typically indicate lower growth without however fully excluding the possibility of the occasional high growth outcomes.

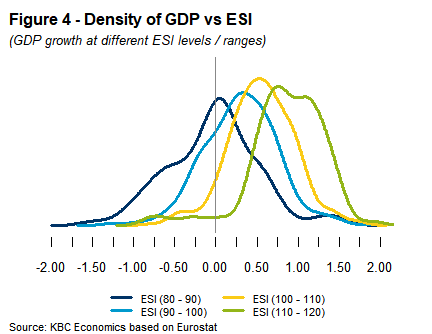

Moreover, when focusing on more extreme ESI-outcomes, the information value of ESI indicators becomes even more clear. Extreme positive (negative) readings cause the growth distributions to shift further apart (see Figure 4) which tends to build the case of the ESI as a warning signal of an (upcoming) boom or bust in economic activity. Figure 4 clearly indicates that very low ESI values are typically associated with low growth while high ESI readings typically imply high(er) growth.

II.B Mean and quantile regressions

The information contained in the ESI can be formalized based on simple statistical (quantile) models. These models focus on specific types of information contained in the indicator. This information can be related to either an optimal mean estimate of current or future growth (in a standard mean regression). This type of analysis provides optimal estimates and forecasts if one is interested in growth itself.

Alternatively, one can use the ESI indicator as a risk indicator. This approach is in particular relevant if the ESI indicator takes on more extreme values. This approach calls for quantile regressions, which estimate on the basis of the current ESI level (and past GDP growth) the percentiles of the growth distribution or could focus on specific risks. As such we introduce a growth-at-risk concept based on the ESI that allows us to estimate critical growth thresholds. One very popular measure is the 5% percentile growth-at-risk measure which gives an indication of how deep growth could fall with a 5% probability. The growth-at-risk measure gives the most optimistic value of how deep the economy could fall with 5% probability and is as such a good measure of the near-term risks that the economy is facing.

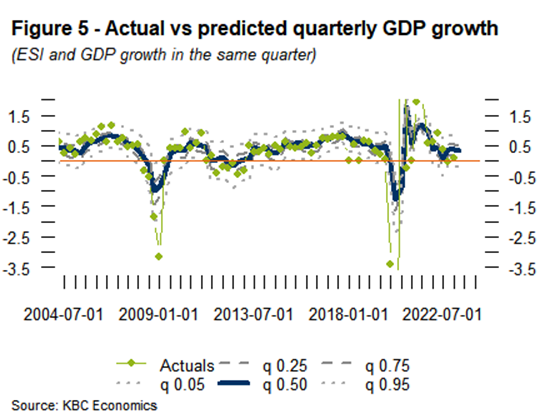

Our statistical analysis does indeed find that (at least in sample) the ESI indicator contains relevant information with respect to the current growth level. Figure 5 gives the actual and predicted quarterly GDP growth. The latter is based on a model including past growth as well as the ESI as information variables. This analysis shows that the model is capable of partially tracking GDP growth for the euro area. More importantly, we find that the ESI plays an important role in this forecast. The model indicates that, all other things unchanged, a decrease of the ESI indicator with 10 points decreases current growth with 30 basis points. This type of model can hence be very useful as a high-frequency indicator of the current (and future) stance of economic activity. Hard data on quarterly growth is typically only available with a long lag (of at least several months). As the ESI indicator is published monthly, it fills this void by providing (based on simple statistical models) first indications on economic growth.

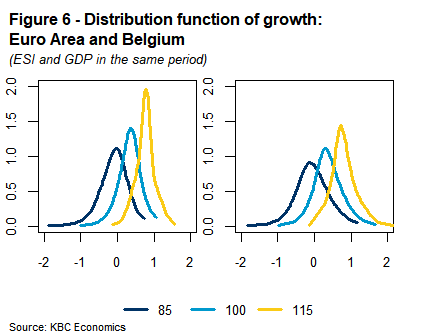

Similarly, the analysis shows that overall the ESI indicator can be used as a (partial) risk indicator as well. Quantile regressions also show that the ESI indicator tracks the more extreme percentiles relatively well. Figure 6 shows the distribution function of growth for the euro area economy (and for the Belgian economy) for different values of the ESI indicator, i.e. an ESI at 85, 100 and 115. The growth-at-risk level (i.e. the quarterly growth rate (x-axis) associated with a 5% exceedance probability y-axis) is clearly more negative if the ESI is at 85 (i.e. the qoq growth-at-risk estimate is -0.77%) than in case the ESI stands at 115 (i.e. the qoq growth-at-risk estimate is 0.37%). We observe broader distributions with heavier left tails as the ESI becomes more negative. Lower values of the ESI thus suggest not only lower expected growth, but also a higher risk of more negative growth and/or recession. In the past months the ESI indicator has been going up again, the risk of recession in the euro area seems to be diminishing. Based on the euro area GDP growth of 0.1% in Q1 and the ESI close to 100, we estimate the risk of negative growth at 15% in Q2. For the average economic growth, we obtain an estimate of 0.35%, the 'growth-at-risk' is -0.20%.

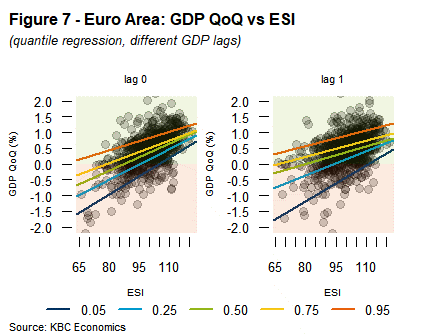

While the GDP growth is obviously affected by many factors, the survey-based ESI indicator aggregates several sources of information from the different sectors in a timely way. As such it translates qualitative information into a quantitative hard signal. The above analysis showed that this “hard” signal can be used (as a partial gauge) to assess in probabilistic terms the current or near-term future stance (and risk) of the economy. Figure 7 provides a visual of a rule of thumb on how this ESI information (x-axis) translates into an estimate (y-axis) either for the median growth or a growth-at-risk measure (i.e. the 5% quantile). Figure 7 shows these estimates for the current and next quarter, both based on the current quarter's ESI.

The analysis in the figure above clearly illustrates that from an economic point of view the ESI readings do matter. The models suggest that the ESI value tracks not only the median (and average) GDP growth rate, but also the risk in the economy. Low values of the ESI are linked to more negative values for the growth-at-risk indicating that downside risks have increased.

The ESI provides a timely monthly indicator of economic sentiment for the EU economies. As a composite indicator it aggregates qualitative survey-based information into a hard (quantitative) signal. Statistical analysis confirms the intuition that the ESI contains relevant information for current and (short-term) future GDP growth. Moreover, the ESI indicator is able to (partially) track the growth-at-risk in the economy. Lower values of the ESI suggest not only lower expected economic growth, but also a higher risk of more negative growth. Given the recent rise in the economic sentiment indicator in many countries, the risk of a recession in the euro area appears to be diminishing for now, although it cannot be completely ruled out.

1 Gelper, Sarah, and Christophe Croux. "The predictive power of the European economic sentiment indicator." Available at SSRN 1093637 (2007).