Rising European gas prices no cause for alarm

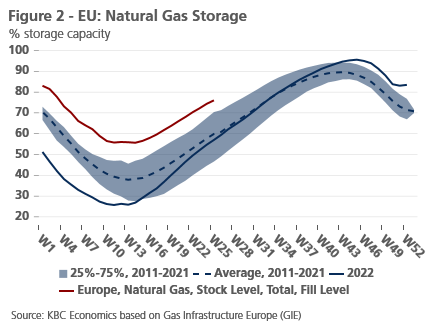

Volatile developments in the natural gas market continue with the onset of summer. After a sustained decline in prices, the spot contract for the European gas TTF traded close to 20 EUR/MWh (the average of the pre-pandemic decade was between EUR 15-20/MWh), which eased concerns of a further escalation of the energy crisis. The last two weeks however, the wholesale gas price has increased again by almost 50% to EUR 35/MWh (figure 1).

The immediate causes of the more expensive gas prices are at least twofold. First, facility outages are affecting Norwegian supply to the EU (approximately 10 percent) and are expected to last until mid-July. Second, production of natural gas in Groningen is expected to be shut down - for environmental concerns - at the beginning of October, i.e. before the start of the heating season. Keep in mind that production in Groningen has been declining sharply over the long term, but it is still the largest gas field in the EU, with untapped reserves of 450 bcm, which is equivalent to the annual consumption of natural gas in the entire European Union.

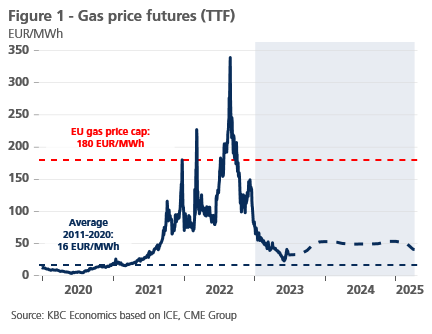

However, these developments need to be placed in a wider context. Although the natural gas market remains vulnerable to problems coming from the supply side, the overall situation is much better than last summer. This is also illustrated by looking at the storage levels in the European Union (figure 2), which are well above average for this time of year. According to analysts at JP Morgan, there is even a risk that Europe will run out of available storage capacity in August and, paradoxically, gas supply will have to be reduced.

In summary, the current gas price increase is worth noting in the context of developments last year, when prices rose to over 300 EUR/MWh, but there is certainly no reason to panic. Moreover, longer forward contracts remain relatively stable, with the price of gas one year ahead having been around EUR 50/MWh since March. This is also the price the market is counting on for the winter of 2023/2024 and the subsequent winter of 2024/2025. A colder-than-expected winter would mean more expensive gas, but no longer a scenario where Europe faces an acute shortage.