Regional public finances in Belgium on an unsustainable path

The corona crisis weighed heavily on the finances of the Belgian authorities. The deficit of the total government clocked in at 9.4% of gross domestic product (GDP) in 2020, coming from a deficit of 1.9% in 2019. Belgium thus remained well above the Euro Area, where the average deficit in 2020 was 7.2% of GDP. The federal government accounted for the vast majority (around three quarters) of Belgium's deficit. But the federal states also took a heavy hit with a combined deficit of 2.4% of Belgian GDP, coming from a deficit of 0.2% in 2019. However, the remaining government bodies - local authorities and social security - recorded a small surplus.

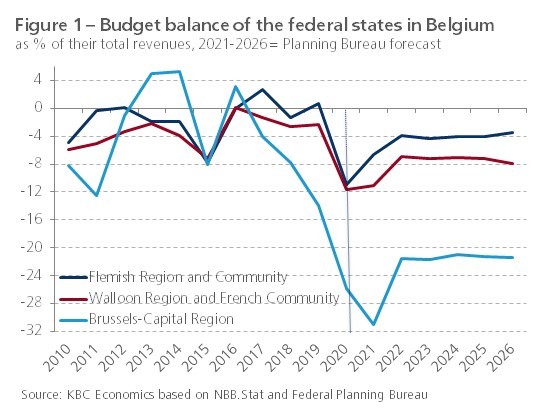

When comparing the budget figures of the federated entities with their own gross regional product, the deficits in 2020 amounted to 1.5% (Brussels-Capital Region), 2.2% (Flemish Region and Community) and 3.8% (Walloon Region and French Community) respectively. Generally speaking, their budget balances are more often expressed as a percentage of total revenues, to give an idea of the deficit or surplus in relation to the budget size of the federated entities (figure 1). Viewed in this way, the budget figure for Brussels is most worrisome: in 2020 the region recorded a deficit equivalent to no less than 25.8% of its revenues. This is more than double that of Flanders and Wallonia, where the deficit (Region and Community combined) was 10.9% and 11.6% of revenues respectively. In comparison, in 2019 Brussels and Wallonia had a deficit of 13.9% and 2.4% of their revenues, Flanders a slight surplus of 0.7%.

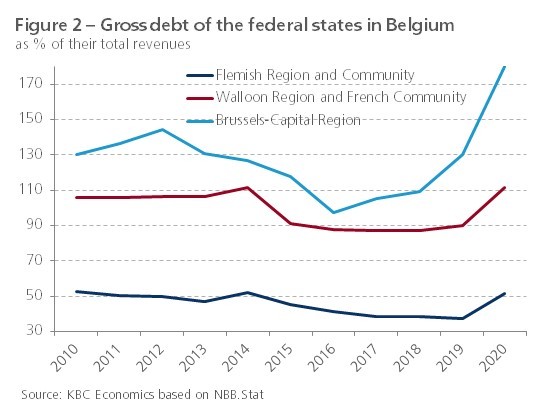

The sharp deterioration in the regional finances was also reflected in the debt figures (figure 2). Also set against total revenues, the gross debt in 2020 amounted to 51.3% in Flanders, 111.5% in Wallonia and 179.9% in Brussels. Once again, Brussels in particular is performing very badly here: the increase in the debt ratio compared to 2019 was much stronger there at 49.9 percentage points than in Flanders (+14.1 percentage points) and Wallonia (+21.3 percentage points).

Prospects are not cheerful

According to an estimate by the Federal Planning Bureau (Regional Economic Outlook 2021-2026, July 2021), the finances of the federal states remain very precarious this and the coming years, despite the stronger than expected economic recovery. With an unchanged policy, but taking into account the measures already announced (like e.g. the recovery plans) and the federal grants provided for in the Special Finance Act, their collective deficit will stabilise at around 1.2% of Belgian GDP after 2021 until 2026, a figure four times greater than that of 2019. Expressed as a percentage of the expected revenues of the federated states, Brussels' finances remain the most worrisome. In 2021, the deficit in the Capital Region is expected to increase further to 31% of its revenues, before stabilising at a high level of over 21%. But also in Flanders and Wallonia, the deficit in 2022-2026 will remain well above the pre-crisis level, at about 4% and 7% of revenues respectively (figure 1).

The Planning Bureau does not make any forecasts about the debt of the regions. In Flanders, SERV, the advisory body to the Flemish social partners, has calculated that if the policy remains unchanged, the debt will increase from 51.3% of revenues in 2020 to 96% in 2024. This would mean that it would no longer meet the Flemish debt standard, which states that the debt in relation to revenues may not exceed 65%. The other two states, and Brussels in particular, will undoubtedly see a further sharp increase in their debt, against the background of the deficits estimated by the Planning Bureau.

The unfavourable development of regional finances is not only due to the consequences of the pandemic. Especially in Brussels, and to a lesser extent in Wallonia, the situation already worsened before the pandemic crisis. Moreover, this deterioration was partly due to increased investments, in the case of Brussels mainly in infrastructure and public transport. On top of the European funds that are part of the Recovery and Resilience Facility, the regions have additional funds made available for the post-corona economic recovery in the years to come. Although these regional recovery plans give an extra impulse to investments, they weigh on the budgets. For Wallonia, the costs of reconstruction after the heavy floods of last summer are added to that. In Flanders, the extra promised resources in care and education will structurally weigh down the budget.

The pandemic struck a blow to regional public finances and their consolidation in the post-corona period is made more difficult by the fact that the federated states have little revenues that can grow along with the recovery of the economy. From 2025 onwards, the regional allocation of funds laid down in the revised Special Finance Act will also place greater emphasis on the economic performance of the federal states. Regions with a higher percentage contribution to personal income tax will receive more federal grants under the new financing system. With the introduction of this principle, Brussels and Wallonia will see their revenues fall sharply after 2024 compared to the old regime, which threatens to worsen their already unfavourable financial situation.

In the longer term, the regions' sharply rising debts are not sustainable. Therefore, the consolidation of their finances is inevitable. In doing so, one should not count on additional resources from the federal level, as the federal government itself will have to make savings, also in light of the bill for the ageing population, which is almost entirely its responsibility. Efforts will be needed at all levels. Crucial in this respect is that policy goals are set for the longer term, so that cuts can be made in non-essential expenditure. For the time being, there is no sense of urgency among policymakers to do so, which is somewhat understandable in view of the still fragile economic recovery. But once the economy has normalised, every government will have to take responsibility for reducing its own deficits and debt. This also requires responsibility for the overall Belgian budget picture. This requires that the budgetary coordination between the federal government and the federated states (laid down in the 2013 cooperation agreement) works better than it has in recent years.