Heterogeneous Impact of Brexit on Belgian Industry

Various studies have pointed to a substantially negative impact of a no-deal Brexit on the Belgian economy. As a small open economy in the heart of Europe, Belgium is strongly oriented towards its neighbouring markets. However, the UK market is not equally important for all Belgian industrial activities. Moreover, sectors differ in terms of their ability to adapt to economic shocks. Consequently, a no-deal Brexit is likely to hurt particular sectors more than others. Based on a trade shock simulation, we show that the largest short-term consequences of a no-deal Brexit would be borne by key Belgian exporters to the UK, like the automotive industry, textiles and the food industry. Other important Belgian exporters to the UK, in particular the chemical and pharmaceutical industry, appear to be more resilient against a hard Brexit. Hence, not all industries are equally sheltered in case of a no-deal Brexit.

Brave little Belgium

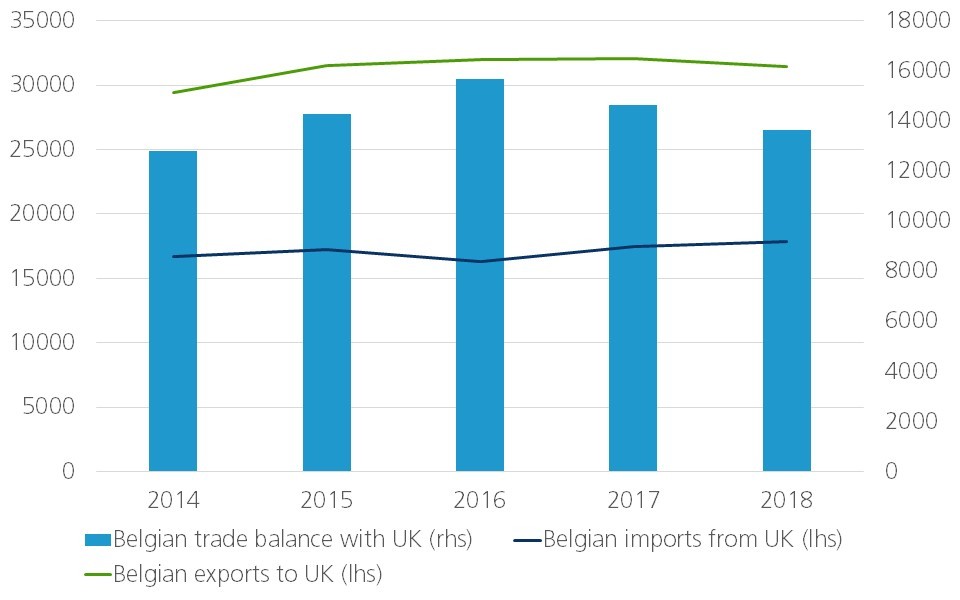

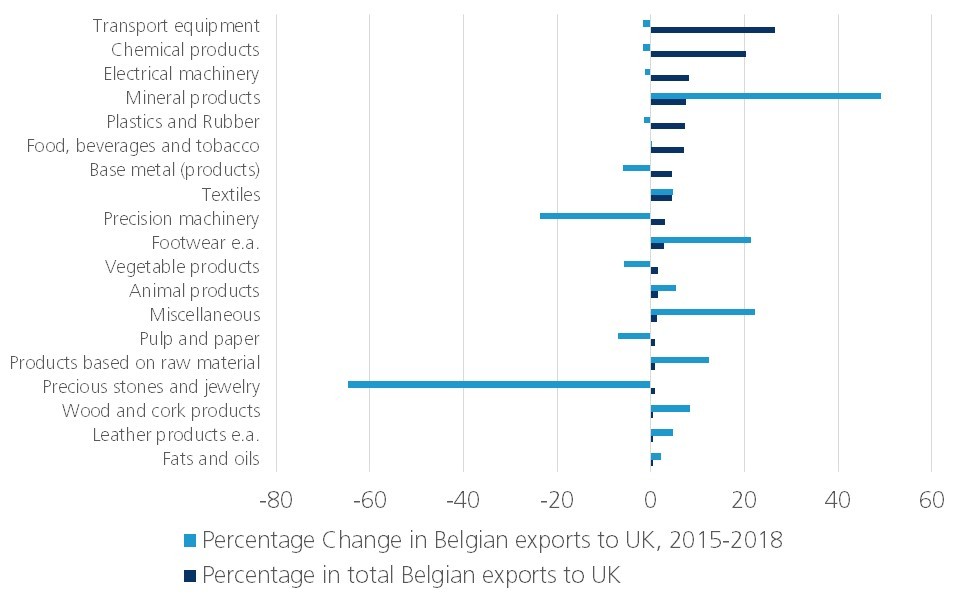

Belgian exports to the UK grew substantially between 2009 and 2015. However, in the aftermath of the Brexit referendum Belgian export growth to the UK stalled (Figure 1). This sudden stop can be explained by a combination of factors, including the depreciation of the British pound, some reorganization in industrial value chains, but above all, by the uncertainty surrounding Brexit that triggered a general deterioration in economic sentiment. Nevertheless, the British market remains the fourth most important export market for Belgian exporters. Belgium is an active exporter to the UK in many sectors. The main industrial export activities include the automotive industry (transport equipment), the chemical and pharmaceutical industry, electrical machineries, plastics and rubber, metal products, processed food, and textiles (Figure 2). This is relatively similar to the export composition of total Belgian exports. Some of these export activities have already experienced disruptive evolutions since 2015, pointing to substantial export dynamics.

Figure 1 - Belgian trade in goods with UK (Mn euro)

Figure 2 - Belgian goods exports to UK: sectoral composition and evolution 2015-2018

Many have warned of a dramatic impact on the Belgian economy from a hard Brexit. Various impact studies have underpinned this warning, forecasting on average a growth loss of about 1% for the Belgian economy. So far, these studies have been lacking in terms of calculating the impact on specific industrial activities. Moreover, not much attention has been paid to the short-term impact in the event of a no-deal Brexit. In a new simulation exercise, we aim to fill this gap.

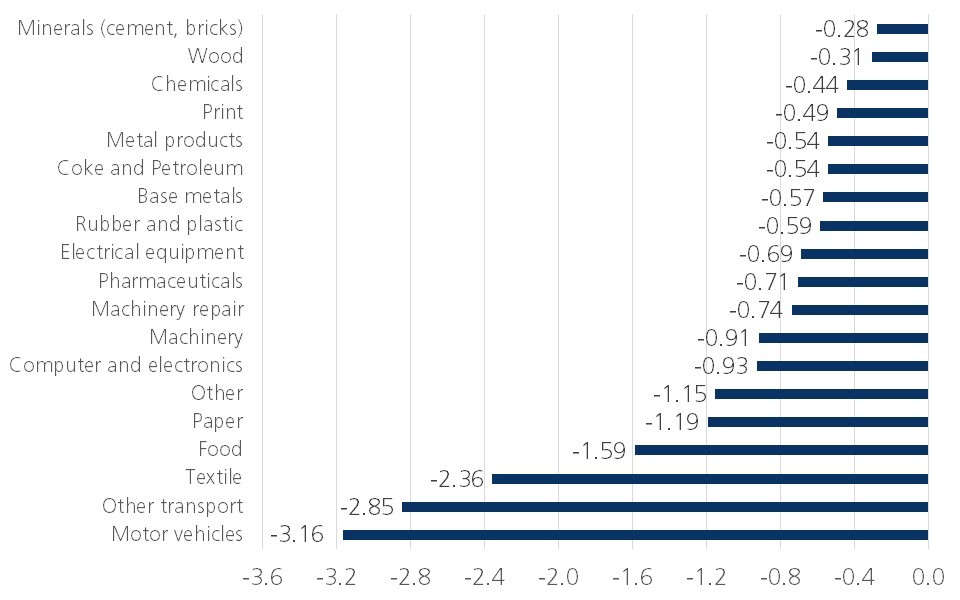

Using the KBC macroeconomic simulation model in combination with the WIOD database, which provides information on linkages between sectors and countries in the global economy, we derive the short-term impact of a trade shock between the UK and the EU on the value added generated in each Belgian industrial sector. The trade shock is modelled as a 25% decline in British imports due to logistic challenges as well as various barriers to trade. Though the absolute impact is interesting to know, we are particularly interested in the relative impact of such a shock on various economic activities. This approach has some clear advantages, but also some limitations. Its main advantage is its ability to assess the immediate and short-term impact of Brexit, which might help firms and the government to prepare for the worst-case scenario. However, this approach does not allow for assessment of the long-term impact of a hard Brexit, as in the longer run the economic environment is likely to adapt through changes in production and in international distribution networks. Hence, this approach measures to what extent sectors are able to react immediately to a hard Brexit and how this affects their generated value added. As such, this simulation analysis can be considered as complementary to previous Brexit impact assessments.

Figure 3 shows the results from this simulation analysis. It appears that the automotive industry will be hurt most in the short run. This can be explained by the combination of sizeable Belgian automotive exports to the UK and by very intensive cross-border value chains in the automotive industry. In particular, Belgium has grown into a hub for international car exports to the UK (and Northern Europe) thanks to the strategic locations of the Belgian ports (Antwerp, and in particular Zeebrugge). The textile and food industries are also heavily affected. The textile industry is strongly oriented towards the UK market. Various subsectors of the textile industry (e.g., fitted carpeting) are even almost exclusively focused on the UK. Hence, a no-deal Brexit implies a substantial disruption to their activities. Even though the textile industry’s contribution to Belgian GDP is limited, Brexit could still hit Belgian economic growth hard through the textile industry. The food industry is more geographically diversified but also has strong connections to the UK market. Food processing has become one of the leading Belgian economic activities in terms of employment and exports. As such, any shock to this important industrial activity is likely to translate to a downward effect on GDP growth.

Figure 3 - Hard Brexit impact on Belgium’s industrial sectors Based on 25% decline in UK final demand for imports from EU

National heroes

A striking result is the limited impact on the chemical and pharmaceutical industries. Both are important in terms of total Belgian exports and are strongly connected to the UK market. The relatively mild Brexit impact on these sectors is likely due to their agility. Chemical and pharmaceutical products are not specifically designed for the UK market. Hence, some geographical reorientation is possible. Moreover, most companies in the chemical and pharmaceutical industries are large firms. They are better able to adapt themselves to the logistic and economic challenges caused by a no-deal Brexit.

Brace for impact

These results show that the impact of a no-deal Brexit on the Belgian economy will be asymmetric across industries. Policies that aim to mitigate this negative impact should take into account this heterogeneity. Sector-specific approaches might be required. Hence, while companies prepare themselves for the worst, policy makers should also speed up their efforts to avoid the full blunt impact of a no-deal Brexit on the Belgian economy.