Global supply chain disruptions continue to hamper European industrial recovery

Click here to open the PDF.

Amid ongoing reports of global supply chain issues, a growing number of businesses are reporting that these disruptions are suppressing their production levels. To support our economic scenario, we need to quantify the magnitude of these supply chain issues and estimate their current and potential impact on the euro area economy.

Supply and demand shocks

Supply and demand shocks are among the prime economic factors affecting supply chain performance and driving up producer prices. We use our time series model – a structural Bayesian Vector Autoregressive (BVAR) model – to ‘identify’ shocks that are not immediately observable; shocks that have certain characteristics typically associated with supply and demand shocks. Once we have identified these shocks, we can gauge the impact on GDP and producer prices.

We have incorporated a number of variables into the model related to the intermediate goods market in order to analyse the impact of the global supply chain issues on the euro area economy. Variables used in our model: the industrial production, imports and producer prices of intermediate goods, and a survey indicator that shows how many European companies in the industrial sector report disrupting factors in their production. The last variable is the euro area GDP, through which we measure the ultimate effects of the global supply chain problems on the European economy.

After incorporating all variables into the model, we can start ‘identifying’ the economic shocks (unexpected events with potential impact, both positive and adverse, on the economy). Each quarter, we use the model to monitor changes in the economic variables we could not predict based on historical data. On account of this unpredictability, the model treats these changes as ‘economic shocks’. We then focus on the economic shocks we were aiming to identify through this analysis using ‘sign restrictions’. This method allows us to identify these shocks based on a set of criteria the shocks must meet; more specifically, how the economic variables in the model are expected to react to the anticipated economic shocks.

For instance, the supply shock we consider must have a negative effect on the industrial production and imports of intermediate goods, as well as increase producer prices for intermediate goods and drive up the number of reports by European industrial companies on disrupting factors in their production. For example, temporarily shutting down a Chinese port due to a coronavirus outbreak will reduce imports of intermediate goods into the euro area, causing a disruption in the industrial production and an increase in the producer price of intermediate goods. Faced with this situation, European industrial companies will obviously be more inclined to report factors that disrupt their production, so the definition of supply shock, which is related to global supply chain issues, seems to be accurate. In addition, we consider a demand shock, which must also meet the latter two criteria (higher prices and more factors hampering production), and which – as opposed to the supply shock – creates an increase in the industrial production and imports of intermediate goods.

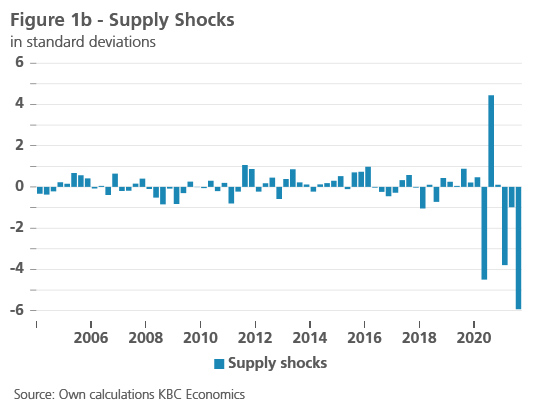

Figures 1a and 1b represent the supply and demand shocks identified. As is common in econometric analyses, they are expressed as standard deviations to demonstrate how the shocks vary in size over time. According to Figure 1a, for example, unusually large negative demand shocks occurred during the last financial crisis. In the second and third quarters of this year (the last two shocks shown in the figure), we see strong demand recovery. Figure 1b shows serious negative supply shocks in 2021 (the last three observations), confirming the higher number of reports on global supply chain disruptions.

.png/_jcr_content/renditions/cq5dam.web.960.9999.png.cdn.res/last-modified/1672991226591/cq5dam.web.960.9999.png)

Impact of the modelled shocks

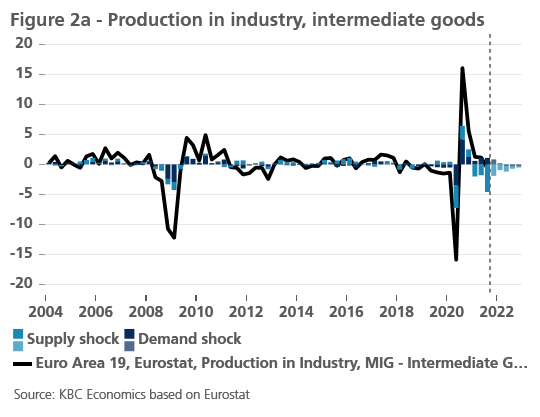

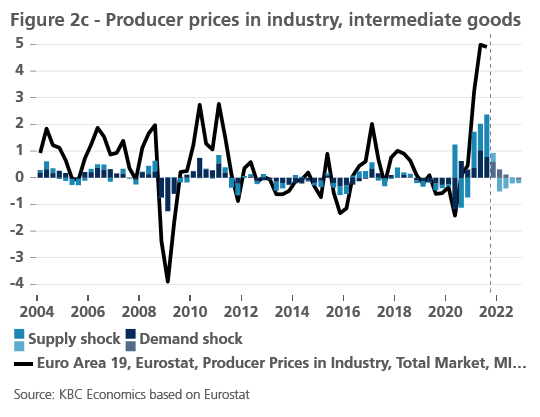

The next step is to analyse the impact of these supply and demand shocks on the variables in the model. Figures 2a, 2b and 2c show the impact on industrial production, imports and producer prices, respectively, of intermediate goods in the euro area. The light blue bars represent the impact of the supply shock, which is related to global supply chain disruptions. The dark blue bars represent the demand shock, as described in the first part of this analysis.

Looking at the impact on the industrial production and imports of intermediate goods (figures 2a and 2b), in 2021 the supply shocks clearly had a negative impact – especially compared to more recent events, where no shocks of this magnitude occurred. The higher demand for intermediate goods would justify an increase in industrial activity, but was thwarted in part by supply problems. As Figure 2C shows, a combination of both shocks will naturally result in higher producer prices. In the first three quarters of this year, the supply shocks contributed 1-1.5 percentage points each to the quarter-on-quarter growth of producer prices for intermediate goods. The shocks identified do not explain the entire recent increase in producer prices, which indicates there are supply shocks at play that are not reflected in the model. Surging energy prices have been one of the major contributors to the price increase.

Impact on GDP

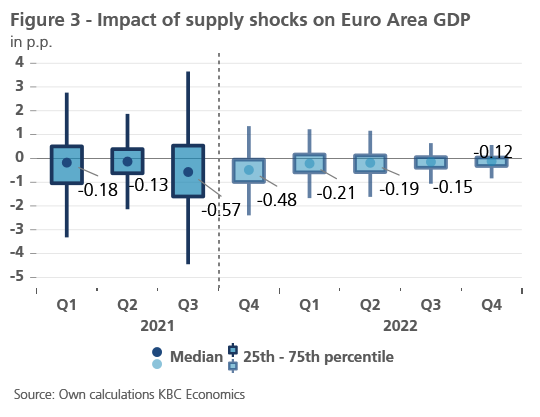

We will now take a closer look at the impact of the modelled shocks on the euro area’s GDP. Obviously, demand shocks have a positive effect on GDP and since this analysis focuses on supply chain issues, the data in Figure 3 represent the impact of the supply shocks. In this case we used a box plot to illustrate the uncertainty of this impact, whereas in Figure 2 we only showed the median impact. One of the causes of this uncertainty in the model involves the effects the different variables have on each other. Another factor is the identification strategy, which requires that economic shocks must possess certain characteristics, and which still allows for a wide variety of shocks/outcomes.

The anticipated impact of the supply shocks on GDP for this and next year remains negative. The median impact on GDP growth for the whole of 2021 is -1.38 percentage points, which is estimated at -0.69 percentage point for 2022.

It is important to note that these annual figures only reflect the impact of the supply shocks that occurred in the first three quarters of 2021, so any mention of annual figures for 2021 or 2022 refers to the impact of global supply chain disruptions already identified. Any new disruptions – caused by the Omicron coronavirus variant, for instance – could exacerbate this negative impact.

All in all we can conclude that, in the aftermath of the coronavirus shocks, the impact of international supply chain disruptions on the European economy is substantial. In the context of recent years, the magnitude of these supply shocks is nothing short of exceptional, and they have led to slower industry recovery than might be expected given the increase in demand. Along with the supply shocks identified, the strong demand has also led to higher producer prices. While the negative impact of the supply shocks already identified will last into 2022, it remains to be seen whether and to what extent new coronavirus variants will cause more major global supply chain disruptions. Our approach is to err on the side of caution in terms of our economic scenario, but with the uncertainty surrounding the Omicron variant, we will refrain from making any definitive statements regarding future supply shocks.