Emerging Asia: cautiously optimistic déjà-vu

A year ago, before the outbreak of the pandemic, the economic outlook was cautiously optimistic for emerging Asia after a somewhat weak 2019. China and the US had agreed to a phase I trade deal, business sentiment in a number of Asian economies had improved, semiconductor sales had bottomed out, and a combination of low inflation and the expectation of continued low policy rates from the Fed and ECB had provided the necessary space for emerging market central banks in the region to ease policy. Then came the coronavirus outbreak, which not only set off a global health crisis but also led to a severe collapse in global economic growth. No region truly escaped the economic effects of the pandemic, but many countries in Asia managed to contain both the spread of the virus and its economic fallout relatively well compared to other regions. Now, the world is entering the end-phase of the pandemic as the (gradual) rollout of vaccines is underway. Once again, emerging Asia appears well situated to benefit from the global recovery.

Looking back

Around this time last year, before the outbreak of the Covid-19 crisis, a number of ‘green shoots’ for emerging Asia had appeared. First, a string of positive data suggested that growth in China was stabilizing after several months of deceleration, which would have positive spillovers for trade partners in the region. This positive outlook for China and international trade was supported by the announcement of a phase I trade deal between the US and China, which avoided a further escalation of tariffs and even reduced some tariffs that were in place. Second, manufacturing sentiment in a number of economies in the region, including Taiwan, Malaysia, Thailand and South Korea, had recently returned to positive territory, potentially reflecting the expectation for a slightly more favorable external environment, including an expected recovery in high-tech chip sales.

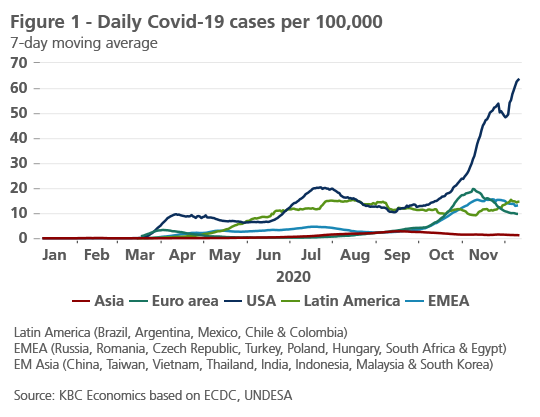

While the cautiously optimistic outlook for emerging Asia in 2020 didn’t come to fruition—thanks in no small part to the coronavirus pandemic—several Asian economies did fare relatively well this year in comparison to other major economies. Indeed, from a public health perspective, Asia as a whole managed to keep the spread of the virus itself relatively contained compared to other regions (figure 1).

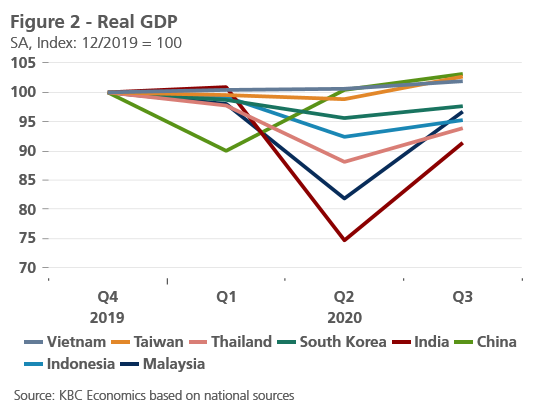

For some economies, this translated into a less severe shock to growth. Indeed, though Vietnam and Taiwan both experienced sharp drops in the pace of GDP growth in Q2 2020, both economies still managed to maintain positive year-over-year growth rates all year. The relatively decent economic performances of Taiwan and Vietnam likely reflect a strong starting position for both economies, good containment of the virus, and the fact that exports held up relatively well in the second quarter, despite the global recession. Furthermore, a comparison of Google mobility data reveals that workplace mobility remained much higher in Taiwan and Vietnam compared to the emerging markets that saw the biggest economic collapse. China’s economy, meanwhile, did shrink 6.3% year-over-year in Q1, but it bounced back impressively in Q2 and Q3, and is on track to register positive annual growth in 2020. There are always exceptions of course, and both Malaysia and India saw particularly steep drops in GDP growth in the second quarter. However, both economies bounced back more strongly than expected in the third quarter (figure 2).

Less scarring, better recovery

Looking forward, the recovery is clearly underway, with exports, industrial production, and business sentiment in the region improving. There may still be setbacks related to new waves of the pandemic (figures are currently rising in Malaysia, Indonesia and South Korea), but the recent release of safety and efficacy data for several Covid-19 vaccines suggests that the end-phase of the pandemic is upon us. Furthermore, the recent confirmation of Joe Biden as president-elect in the US removes some uncertainty related to the international trade environment. Though we don’t expect the Biden administration to embrace free trade agreements or even lift tariffs that had been imposed by the Trump administration—at least not in the short run—US trade policy will likely become less tariff- or Twitter-based. This is welcome news for many economies in emerging Asia, which faced spillover effects on growth from the US-China trade wars in 2018 and 2019.

Finally, the less severe economic shock from the pandemic for many economies in the region likely suggests that economic scarring (such as permanent employment losses and bankruptcies) that can hinder the recovery will be more limited. Thus, those economies that weathered the crisis with a less severe hit to GDP are in a good position to benefit from the global recovery in demand in 2021.

Comparing vulnerabilities

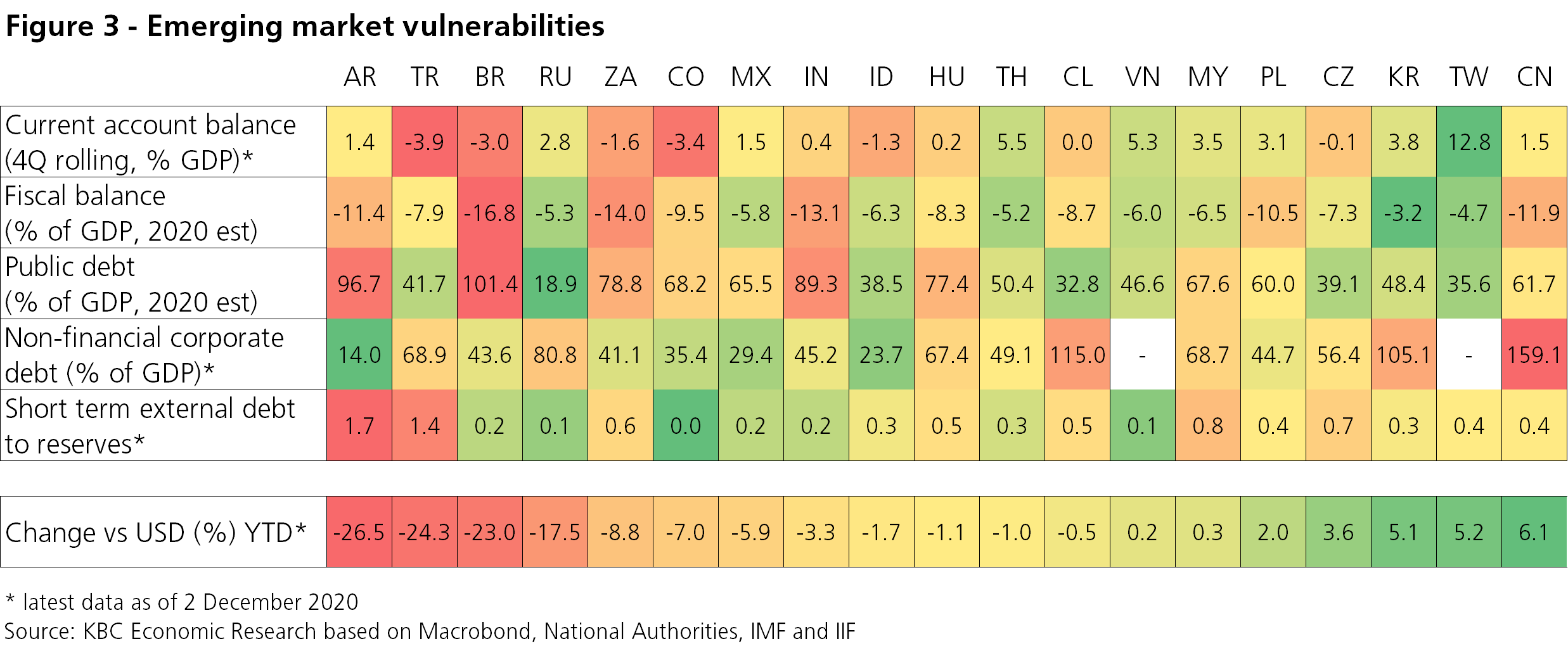

It is also important to note that though financial markets are currently experiencing a strong bout of optimism, particularly in response to the good news on the vaccine front, concerns related to emerging market vulnerabilities, and in particular, public debts and deficits, will eventually reemerge. Here, once again, emerging Asia is relatively well positioned, particularly compared to Latin America (figure 3). Emerging Asia is likely to eventually leave the pandemic behind while carrying less structural vulnerabilities than many other emerging economies. Hence, given the stronger macroeconomic fundamentals and more limited vulnerabilities in the context of having an end in sight for the pandemic, the outlook for emerging Asia is once again cautiously optimistic.