American inventories as a sign of cooling?

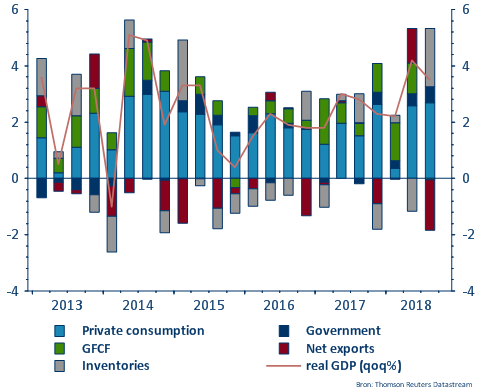

The American economy is currently a beacon in the economic eclipse that is overshadowing the world. US growth in the third quarter of 2018 (0.9%) contrasted sharply with meagre growth elsewhere in the world, particularly in the euro area (0.2%). For the US, the third quarter thus confirmed the relatively strong performance of the second quarter. An analysis of the growth components is useful to better understand the real driving force behind American growth. In both quarters, growth was very much based on consumption growth, a constant in recent years. But there were also clear differences between the second and third quarters.

In the second quarter, strong net export growth delivered fine growth figures. US companies exported a lot during this quarter in anticipation of increasing trade barriers, especially in China. The trade war therefore had a temporary positive impact on the US economy. It goes without saying that such an impact cannot last, and in the long term, on the contrary, increasing protectionism will curb export growth. Growth in the third quarter was not driven by net export growth, but mainly by increasing inventories. That is an interesting observation. Often, changes in inventories are considered as a residual feature, not as a structural factor determining growth. Mounting inventories often indicate a sign of economic cooling. In this sense, the sharp rise in the third quarter calls into question the sustainability of the current US growth rate.

The question is therefore how exceptional the rise in inventories was in the third quarter. It is striking to note that American imports from China surged by 14.5% particularly between the second and third quarter . At the same time, US exports to China fell by 8.3%. This, of course, again led to a deterioration in the US trade balance. The sharp rise in US imports from China is actually the opposite of what happened in the second quarter. Many Chinese companies are still trying to export as much as possible before the full package of tariff increases becomes applicable. A reverse interpretation is also possible: many American importers are trying to import as much as possible from China before they are confronted with higher input prices. This latter explanation seems most likely, as it may also explain why US inventories increased so sharply in the third quarter. In any case, we are witnessing the phenomenon of trade frontloading going in two directions. In this way, the trade war is artificially stimulating trade flows. In fact, this is a temporary market distortion and not a fundamental trend. In this sense, US growth was strongly distorted by these exceptional circumstances in both the second and third quarters.

The increase in US inventories is therefore not immediately a cause for great concern, but the disruption provoked by the trade war is. Fortunately, growth continues to be well underpinned by domestic consumption. US consumer confidence remains robust and is bolstering consumption growth. The impact of the Trump Administration's fiscal reforms boosted the economy in the second quarter, but significant investment growth did not materialise in the third quarter. Hence, the question is how long the US economy will be able to remain insulated from the global wave of increasing economic uncertainty and deterioration in sentiment.

Figure - US contribution to real GDP growth