A decade on the oil market: how the US shale boom changed the game

A decade on the oil market: how the US shale boom changed the game

The last decade witnessed a major structural shift in the oil market that reshaped the global energy landscape. While oil prices remained comfortably anchored above $100 a barrel at the beginning of the decade, the price collapse in 2014-2016 ushered in an era of lower oil prices. The main trigger was the US shale revolution, a historic boom in unconventional oil production with far-reaching implications. For starters, the highly responsive model of US producers helps to keep oil prices range-bound and cushions the impact of geopolitical shocks. What’s more, the shale oil boom that turned the US into the world’s largest producer has made the American economy far less vulnerable to price shocks and has strengthened its energy security.

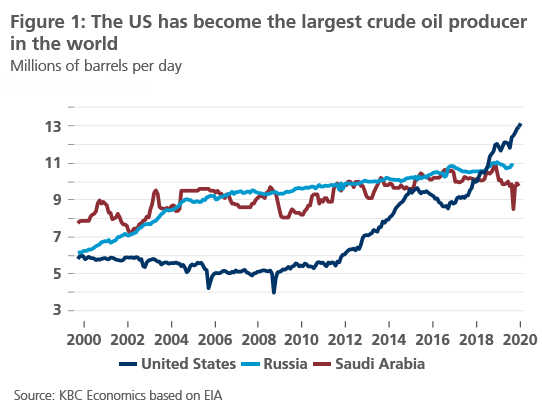

The last decade witnessed a major transformation of global energy balances. The oil market stands as a prime example with a gradual shift from an era of high oil prices and concerns about short supplies to an era of lower oil prices and supply abundance. Such a paradigmatic shift in supply dynamics was triggered by the US shale oil revolution, a massive boom in unconventional oil production that turned the country into the world’s largest producer, ahead of Russia and Saudi Arabia. Importantly, apart from upending the global oil market, the shale revolution has had far-reaching implications for the US economy as well as for geopolitics.

Shale oil boom in numbers

The advent of the shale oil boom dates to the beginning of the 2010s when advances in hydraulic fracturing and horizontal drilling techniques made accessible (and economically viable) a vast amount of unconventional oil from tight rock formations. This has spurred the resurgence of the US oil industry with crude oil output more than doubling from 5.5 million barrels per day in 2010 to a record of nearly 13 million barrels per day in 2019 (Figure 1). As such, the shale boom now represents the largest production increase in the oil history, ahead of the first surge in Saudi output in the 1970s.

Although the first wave of the shale boom was buoyed by high oil prices, the US producers successfully managed to adapt to a sustained lower price environment. After all, oil prices collapsed from $115 to below $30 in 2014-2016 precisely because of the unprecedented shale supply surge. Essentially, a supply glut made the shale oil industry more sustainable through increased pressure on implementing cost-cutting measures and achieving further productivity gains. This proved particularly critical in the face of OPEC’s failed strategy to flood the market and force the US competitors out of the market.

The resilience of US shale eventually triggered a different response from OPEC; they joined forces with Russia and collectively started to cut output – a strategy that has been underpinning the oil market up until now. While output curbs have supported prices, they also spurred the second wave of the shale oil boom, which has been even more dynamic in terms of output growth. Hence, in 2018 and 2019 the US alone was able to satisfy all growth in global demand. The vast majority of the incremental growth comes from the Permian Basin on the border of Texas and New Mexico, where output has soared by 2.5 million barrels per day since 2017. And with a total production of 5.5 million barrels per day, its output surpassed that of Iraq, the second-largest OPEC producer.

Implications for the oil market…

Such extraordinary supply growth has upended the global oil market. For the first time in history, there is an extremely flexible model of production (so-called start-stop) that is highly responsive to oil price movements (responsiveness is estimated to be between 10-12 months vs. a few years in case of conventional projects). In other words, US shale has made the oil supply curve more elastic. Taking it a step further, the US has assumed a role of marginal producer that has anchored the oil price at relatively lower levels (estimations vary between $55-75 a barrel depending on the calculations of breakeven prices). Also, this is a major reason why the recent geopolitical shocks and even supply disruptions did not have a more dramatic or lasting impact on oil prices as was historically the case.

…and the US economy

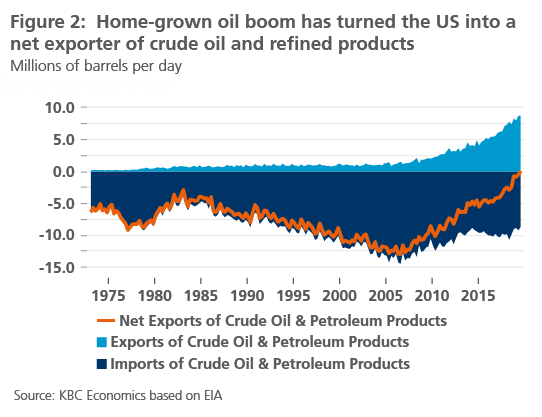

The home-grown oil boom has had equally important implications for the US economy. Thanks to the boom, the US has turned from the largest net importer of crude oil and refined products into a net exporter, substantially reducing its dependence on foreign oil supplies (Figure 2). This, together with a sharp decline in energy intensity, has made the US economy far less vulnerable to oil price shocks. That is to say, while historically higher oil prices were a net negative for the US economy as a whole, the overall effect is now more neutral with reduced household disposable income being somewhat offset by more investment in oil exploration and drilling.

Overall, we expect that US shale output growth will extend well into the new decade, cushioning the global oil market against shocks. In other words, the shale oil industry has, in our view, the necessary capacity to overcome existing challenges, such as strict capital discipline, further productivity gains or environmental issues. And even as the shale boom is currently slowing down, we see it as a major source of incremental supply in coming years. As such, it continues to underpin our outlook for range-bound oil prices in the foreseeable future.