Update: global supply problems, additional supply shocks in the fourth quarter of 2021

In December, KBC Economics published a research report entitled ‘Global supply chain disruptions continue to hamper European industrial recovery’. Using a standard macro-econometric model, we identified both demand and supply shocks that capture the problems in supply chains and the corresponding increase in producer prices. Finally, we estimated the impact on the European economy of the described supply shocks, which occurred until the third quarter of 2021. In the analysis below, we provide an update for the fourth quarter of last year - based on the most recent figures - and take a look at 2022.

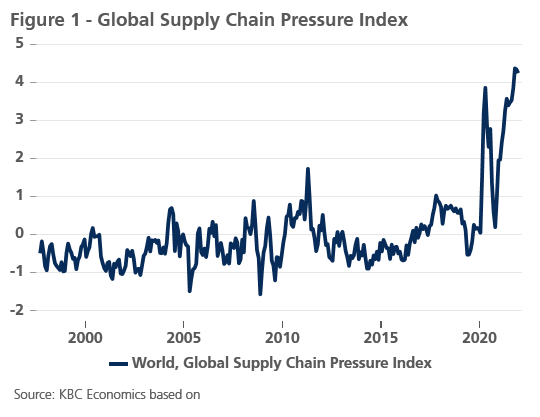

The charts and variables that can illustrate supply issues are numerous. We can look at transport costs, delivery times, production backlogs, etc. The Federal Reserve Bank of New York constructed an index that summarises such data (figure 1). This ‘Global Supply Chain Pressure index’ suggests that there was no easing of supply constraints in the fourth quarter of last year, although the index did stabilise in November and December, after rising in October.

Supply and demand shocks in the fourth quarter of 2021

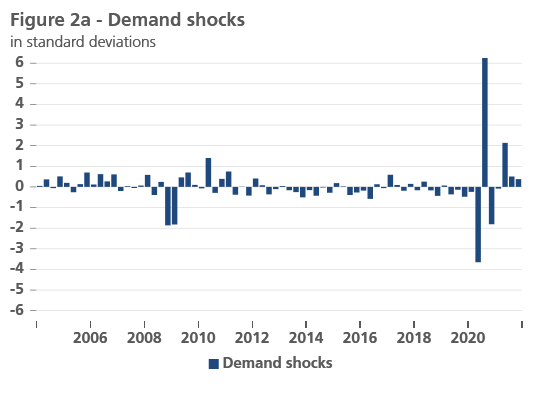

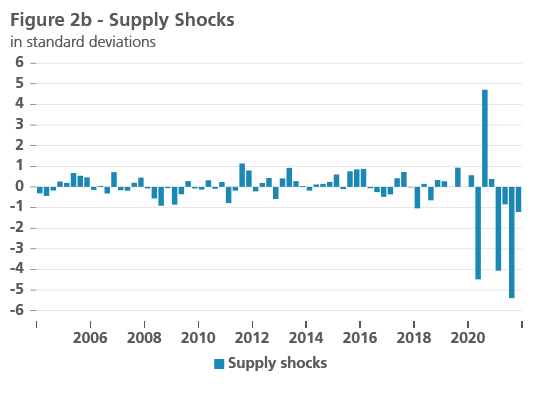

Earlier problems in global supply chains in 2021 could be explained by a strong recovery in demand combined with negative supply shocks, which were unprecedented in recent history. In Figures 2a and 2b, we see that this story continued in the fourth quarter, albeit less pronounced. New supply shocks continuing to weigh on supply chains in the fourth quarter of last year are no surprise given the global rise of the omicron variant and the ongoing problems in global logistics. The fact that we were able to record a positive demand shock despite new pandemic waves is of course encouraging, but due to increasing 'surplus-demand' (relative to capacity), this demand shock also contributes to the continued pressure on supply chains and the accompanying increase in producer prices.

Impact on euro area GDP in 2022

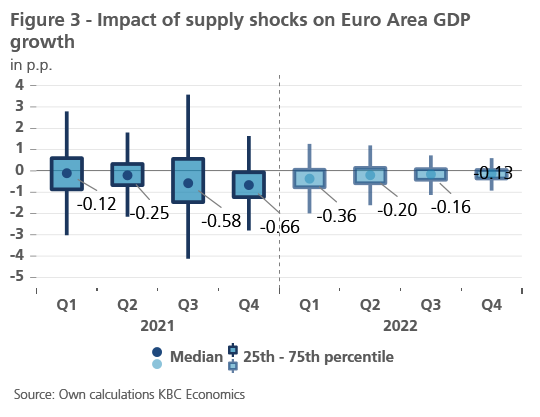

Taking into account model uncertainty, we obtain a median effect of the supply shocks on GDP growth for the full year 2021 of -1.54 percentage points. For 2022, we expect an effect of -0.85 percentage points (see Figure 3 for a quarterly breakdown). We only consider the effects of the supply shocks that already took place up to 2021. The estimate of the impact on euro area GDP in 2022 only reflects the effects of the shocks that already took place in previous years.

Can we expect further negative supply shocks in global supply chains this year? On the one hand, due to China's strict covid policy, hard lockdowns remain a possibility. But in other countries too, temporary absences due to covid contamination can weigh on business activity. Ports around the world are trying to step up their efforts to deal with the ongoing problems and meet rising demand. But labour shortages are one of the factors limiting this. Covid therefore remains a potential source of new supply shocks in the short term. On the other hand, such supply shocks are now less surprising for companies. Where possible, the inventory policy was adjusted and other and possibly more local suppliers were sought, which should alleviate the sensitivity to further international supply problems.