Made in China... or only partly ?

The trade dispute between the US and its trading partners is getting more and more out of hand. In defence of the trade-restricting measures that have been taken, President Trump often eagerly refers to the US trade deficit and more specifically to the bilateral deficit with China. The economic logic behind this motivation is, however, far from perfect. Bilateral trade balances are, after all, not very meaningful concepts. They fail to grasp the complexity of international trade. Moreover, apart from countermeasures, trade-restrictive measures harm not only targeted countries, but also the countries that impose them.

Trump sees America as the loser in the bilateral trade play

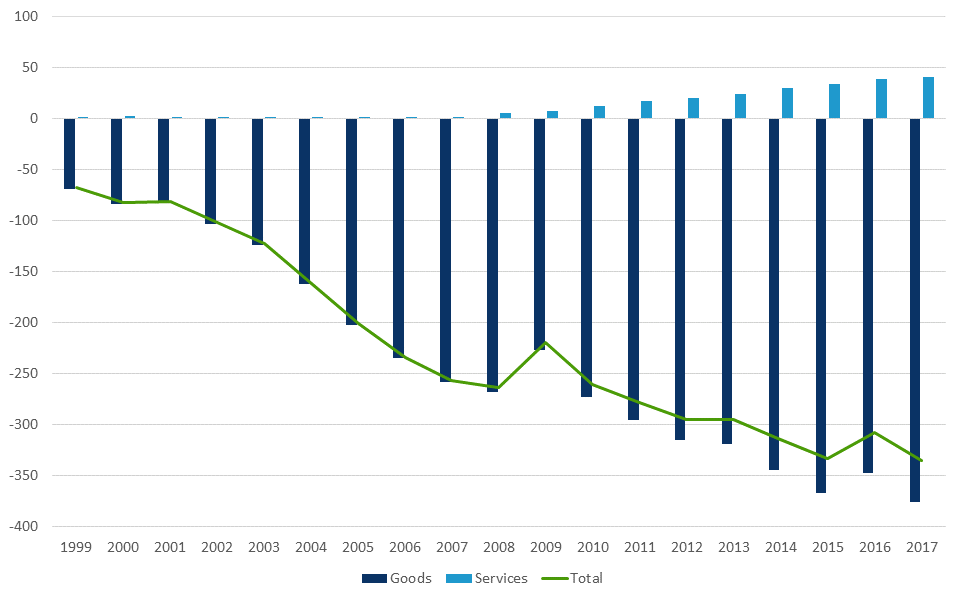

To prove that there is an imbalance in trade between China en the US, Trump often refers to the US bilateral trade deficit with China. This is the difference between the value of US exports to and imports from China. For years now, this balance has been negative for the US, meaning that the US has a trade deficit. In 2017, the US trade deficit with China was some 376 billion USD. If we also take account the trade in services, the deficit was 336 billion USD (figure 1).

Reducing this deficit is an important policy objective for Trump. After all, he sees the deficit as a sign that the US is losing the international trade game. For him, bilateral trade is a so-called zero-sum game in which there is no room for a middle way. What one party gains, the other loses. According to Trump, American jobs are directly lost to cheap labour from China. In addition, he accuses the Chinese government of unfairly granting state aid to Chinese companies. Trump’s import duties are therefore aimed at redressing the trade imbalance.

Figure 1 - American bilateral trade balance with China in the red (in billion USD)Figure 1 - American bilateral trade balance with China in the red (in billion USD)

Source: KBC Economic research based on U.S. Bureau of Economic Analysis

Nonsense of the bilateral trade balance

Trump’s fixation on the bilateral trade deficit with China is called into question by many economists. Bilateral trade balances are, after all, not very meaningful concepts. All the more so because global production chains are increasingly dominating the world economy. High specialisation and a reduction in trade barriers mean that most products are no longer produced from A to Z in the same country. This complex reality is not captured by bilateral trade balances. For example, 99% of the value of a product can be made up of imported goods, but the value of the final product will still be counted fully on the trade balance of the final assembly country. This also immediately explains why there is such a large US trade deficit with China. After all, China has been the world’s assembly plant for a long time.

The nonsense of the bilateral trade concept also becomes apparent when we look at another trade partner of the US, the Netherlands. In relation to the Netherlands, the US has a bilateral trade surplus in goods and services of around 30 billion USD. Following Trump’s logic, the Netherlands should thus impose import tariffs on the US. The same goes for Australia, Brazil, Singapore, Belgium and many others. Surpluses on bilateral trade balances arise because countries specialise in the production of those goods and services for which they have a comparative advantage, i.e. in goods and services that they can produce relatively cheaper than their trading partners. If every country does this, prosperity will increase in all countries.

American imports from China partly ‘made in America’

As mentioned above, the bilateral trade balance between two countries does not reflect the effective contribution of the exporting country to the total final value of a product. A more interesting concept than the bilateral trade balance is therefore the added value. Examples of this measure can be found in the Trade in Value Added database of the OECD and the WHO (figure 2). Of the total added value for electronic devices imported from China by the US, for example, only 45% was realised in China in 2011. This is in spite of the fact that the value of the final product is entirely counted as an export on China’s trade balance and more specifically, adds to China’s bilateral trade surplus with the US.

The US itself is also one of the countries contributing to the total added value of US imports from China. Our example of electrical appliances shows that 5.5% of the added value of electrical appliances imported by the US from China was realised in the US. This means that trade tariffs will, indirectly, harm US suppliers. In addition, many American multinationals have branches in China. Chinese exports are to a large extent the result of exports by these multinationals. Their activities will hence be directly impacted by the import tariffs.

Figure 2 - Country shares in the total added value of US imports of electronic devices from China (in %, 2011)

Source: KBC Economic research based on TiVA (2011)

We conclude that the bilateral trade balance between China and the US is not a good yardstick for describing a possible trade imbalance between the two countries. All the more so because it does not include the value of the American contribution in Chinese exports. For this - and many other reasons - it is nonsensical to use a bilateral trade balance as a motivation to impose import tariffs.