Trump’s policy will collide with the boundaries of the US labour market

The US economy is in a late-cyclical phase. This is accompanied by a tightening labour market and increasing wage growth. The unemployment rate is at very low levels and recently, for the first time since the start of the series, the number of job vacancies has risen above the number of unemployed persons. One of the most important objectives of President Trump’s fiscal and trade policy is to bring jobs from abroad back to the US. Given the increasing scarcity of labour, there is a good chance that he will run into the boundaries of the American labour market. Especially if Trump continues his restrictive immigration policy.

Warm, warmer, hot!

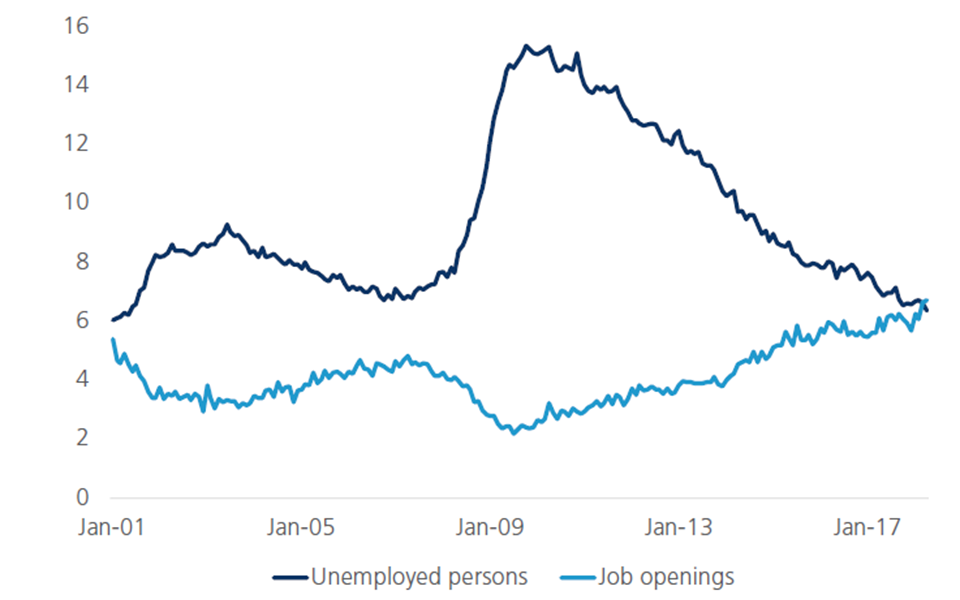

The US economic cycle is in one of the longest expansion stages in history. President Trump’s supportive fiscal policy is likely to lead to a final growth spurt this year. However, there are signs that the current situation is late-cyclical. Hence, a slowdown in growth in the medium term is not unlikely, and is, therefore, in our baseline scenario for 2019-2020. One symptom of said late-cycle dynamics can be found in the American labour market. Since its peak of 10% in 2009, the unemployment rate has fallen to 3.8%. Historically, this is exceptionally low and well below the long-term average of 5.8%. Moreover, the current unemployment rate is significantly lower than the equilibrium unemployment rate or Non-Accelerating Inflation Rate of Unemployment (NAIRU) estimated by the US Federal Reserve at 4.5%. When the unemployment rate falls below the NAIRU, inflation will rise. This is also seen in practice. US inflation, measured by the year-on-year increase in the Consumer Price Index (CPI), reached 2.8% in May. Other labour market indicators also show that tightness is increasing. Recently, for the first time since the start of the measurements, the number of vacancies has risen above the number of unemployed persons (Figure 1). Surveys of American entrepreneurs also show that it is becoming increasingly difficult for them to fill vacancies.

The labour participation rate in the US has not yet fully recovered since its dip after the Great Recession in 2008 (Economic Opinion 29 Nov. 2017). The sharp increase in the number of people returning to work or making themselves available again for work in recent years suggests that the participation rate will increase further. However, other factors, such as the ageing of the population and labour force, will put persistent downward pressure on the participation rate. Hence, there is still some room for an expansion of the labour force to fill new vacancies, but the above figures prove that this space is rather limited. We can therefore gradually speak of an overheating of the American labour market.

Figure 1 - US labour market tightness (in millions)

Not only in the US

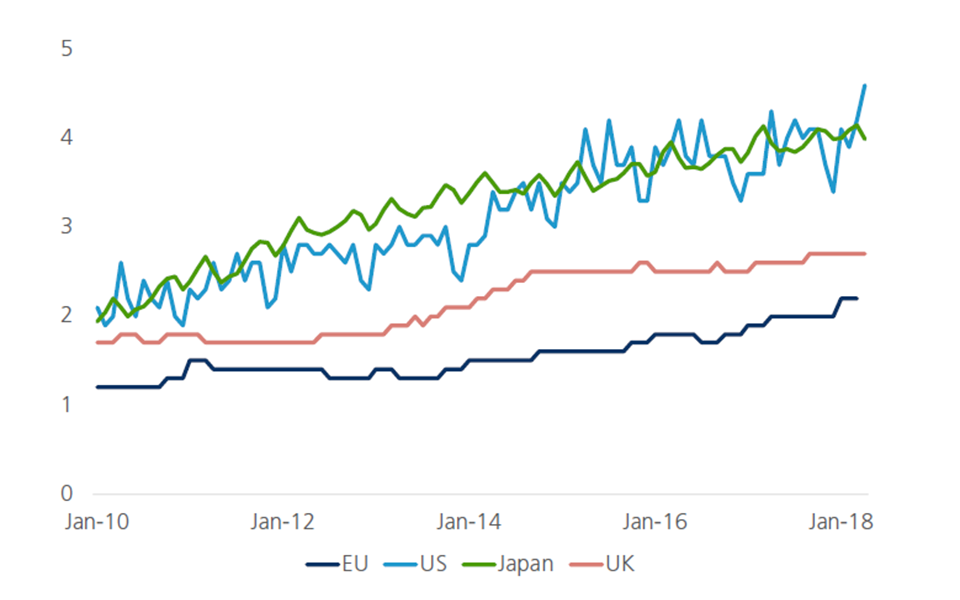

The US is not the only economy facing this phenomenon. Earlier in our Opinion series, we pointed to the lack of skilled labour in Europe (Economic Opinion 5 Sep. 2017 ) and the increasing war for talent (Economic Opinion 7 Sep. 2017). Figure 2 confirms that increasing labour market tightness is more widespread than in the US alone. In Japan, the situation is similar in terms of the vacancy rate. For every one hundred jobs, both vacant and occupied posts, there are about four vacancies. However, on the basis of other indicators, the American labour market tightness is less severe than in Japan. According to Japanese national figures, in April 2018 there were almost 1.6 job vacancies for each job-seeker, while this ratio is roughly 1 in the US. The Japanese figure must be nuanced, though, since a high share of Japanese vacancies are still for uncertain part-time, nonpermanent jobs. The jobs-to-applicants ratio for regular, full-time workers is around 1. For the EU and the UK, the indicator in Figure 2 suggests that labour market tightness is somewhat less pronounced. Nevertheless, there too, we have seen a clear upward trend in recent years. Moreover, the EU average masks large differences between Member States. Labour scarcity is the least severe in Greece, Spain, Portugal and Ireland with a vacancy rate of 1% or less in the first quarter of 2018. At the other end of the comparative stage are the Czech Republic and Belgium, where the vacancy rate is 4.8% and 3.5% respectively. Thus, difficulties in finding suitable candidates to fill vacancies are, at the current stage of the economic cycle, a problem in several developed economies.

Figure 2 - Job openings rate in developed economies (number of job openings as a % of total employment plus job openings)

Beleid vs. arbeidsmarkt

Eén van de belangrijkste doelstellingen van president Trumps budgettair en handelsbeleid is om jobs vanuit het buitenland terug te brengen naar de VS (“bring back jobs to the US”). Sinds zijn inauguratie is het aantal jobs in de VS inderdaad fors toegenomen. Al was dit niet helemaal Trumps verdienste. De positieve arbeidsmarkttrends vonden hun oorsprong immers lang voor Trump aantrad als president. Of het Trump gaat lukken om effectief jobs ‘terug te brengen’ naar de VS is onzeker. De recent ingevoerde en aangekondigde importtarieven kunnen immers voor extra jobs zorgen als bedrijven hun productie verhuizen naar de VS. Anderzijds maken de tarieven ook de invoer van productiemiddelen voor Amerikaanse bedrijven duurder, wat een negatieve impact op de jobcreatie kan hebben. Als het netto-effect toch positief zou zijn, blijft het twijfelachtig of bedrijven die jobs ook zullen kunnen invullen gegeven de huidige krapte op de arbeidsmarkt. Als president Trump er in slaagt om met zijn beleid extra jobs te creëren zal hij dus voor een bijkomende uitdaging staan: de geschikte mensen vinden om die openstaande jobs uit te voeren. Ook zijn strikte anti-immigratiebeleid zal allerminst zorgen voor een grote toestroom van nieuwe werkkrachten. Een immigratiestop betekent immers een beperking van het potentiële arbeidsaanbod. De kans is dus groot dat president Trump op de grenzen van de Amerikaanse arbeidsmarkt zal botsen.