In depth review: Slovakia (seulement en anglais)

Credit Research: Slovakia

2018 funding need declines to €4.4 bn and expected to remain low in next years

New (long?) 10-yr benchmark in Q1? 2030 maturity

Rating upgrade expected by Moody’s: A1 from A2

Decent economic growth, but overheating labour market

Public finances improve further; debt to GDP expected to drop below 50%

2019 funding outlook

The Slovak debt agency (Ardal) raised €3.9 bn this year compared with an originally planned €4.5bn. The eventual funding need was lower thanks to better cash deficit developments. The €3.9bn consisted of €1.5bn via syndication (€1bn 10y SD 234 1% Jun2028 + €0.5bn 50y SD 235 2.25% Jun2068), €0.8bn via T-Bills and €1.6bn via regular bond auctions. The average life of outstanding Slovak debt increased further to 8.5 years by the end of Q3 2018. This year’s bond issuance (€3.1bn) was much lower than the €6.1bn raised last year and €5.45bn in 2016.

We expect next year’s funding need to be in line with this year (€4.4bn). Total redemptions amount to €2.4bn, consisting of a small (originally SKK) bond in May (€1.3 bn 5.3% May2019), a T-Bill (€0.8bn June2019) and a foreign denominated CHF bond (€0.3bn Oct2019). The budget deficit is expected to be around €2bn.

Ardal aims to raise €1 bn of next year’s funding need via the launch of a syndicated new bond. Ardal’s preference is probably a long 10y bond (2030) or a 20y deal (2039) depending on market circumstances and investor demand. There are currently no bonds outstands at those tenors. A regular 10y deal is probably no option given almost €3bn redemptions in 2029. A second new bond is possible, but less likely and will probably a have shorter maturity. Exploring the Slovak curve in the 3-7yr sector automatically brings us to a 2021-2022 redemption date given rather large outstanding amounts in 2023 and 2024. Each new line Ardal opens will be reopened until it reaches a maximum of €3 bn with exception of last year’s very long bond (Oct2047; up to €5 bn). Unlike last year, the debt agency doesn’t intend to issue a new T-bill.

The remaining issuance will be covered by the regular monthly auctions (3rd Monday of the month). Slovak funding is expected to remain low in coming years (2020-2022) given low redemptions and given the government’s efforts to reduce the deficit.

Slovak redemption profile

PSPP update

The ECB bought €11.69 bn Slovak bonds up until the end of November. Net purchases were negative in November (-€0.68bn) with the ECB unable/unwilling to reinvest their maturing part of SD 226 (1.5% Nov2018). We warned that the Slovak national bank would need to slow PSPP purchases because the country was at risk of hitting the issuer limit. The ECB/NBS can only buy maximum 33% of outstanding eligible bonds (currently reached given €35bn Slovak bonds outstanding). Without changing the issuer limit, we expect that the ECB’s reinvestment policy won’t be a big additional support for the Slovak bond market as the central bank is basically maxed out. If the ECB nevertheless tries to reinvest the November redemption and the expected one in 2019, we expect Slovak purchases to the tune of €0.85bn. That represents 20% of next year’s Slovak bond issuance, down from 144% in 2015, 65% in 2016, 45% in 2017 and 49% this year.

ECB’s push in the Slovak back during APP

Slovak Asset purchases by ECB on monthly basis

Moody’s rating upgrade from A2 to A1?

Slovakia is rated A+ at S&P and Fitch (outlook stable) and A2 at Moody’s, which is one notch lower. However, in April 2017 Moody’s raised the outlook of the Slovak A2 rating from stable to positive. The rating agency pointed to two drivers. First, Slovakia’s continued strong (economic) growth prospect in coming years. Second, an anticipated pick-up in the pace of public sector debt reduction supported by robust growth and continued fiscal consolidation. We expect a rating upgrade in the first half of 2019 as the Slovak government’s consolidation process managed to restore fiscal buffers to levels closer to A1-peers and as further convergence of the Slovak economy to EU-levels occurred.

The Slovak ratings compare with AA/AA-/Aa3 (stable) for Belgium and AA- (stable)/AA- (stable)/A1 (positive) for the Czech Republic.

Market performance

Slovak asset swap spreads widened between mid-May and mid-June. The move was mostly supply-related, as is often the case in the less liquid Slovak bond market, and partly related to spill-over effects ahead from the Italian government formation. Once the 10-yr and 50-yr benchmark deals were priced, ASW-spreads hovered around the highs until Italian tensions eased. Slovak government bonds rallied in line with other EMU debt. The second bout of Italian stress caused a new, modest, ASW spread widening going into year-end. The expected launch of a new syndicated deal is probably at play as well. The ECB’s slow normalization process has no negative influence for now. In absolute terms, SLOVGB’s remain rich in in line with most other EMU government debt. We don’t expect (global) interest rates to rise strongly during 2019. The lower expected funding need for Slovakia in the years ahead and underlying macroeconomic fundamentals suggest that SLOVGB’s will remain in the “semi-core” spectre (Belgium, France) of EMU government debt. At the front end of the curve, SLOVGB’s are traditionally cheaper because of the liquidity argument. Liquid OLO’s or OAT’s are much better suited to secure cheap repo-funding.

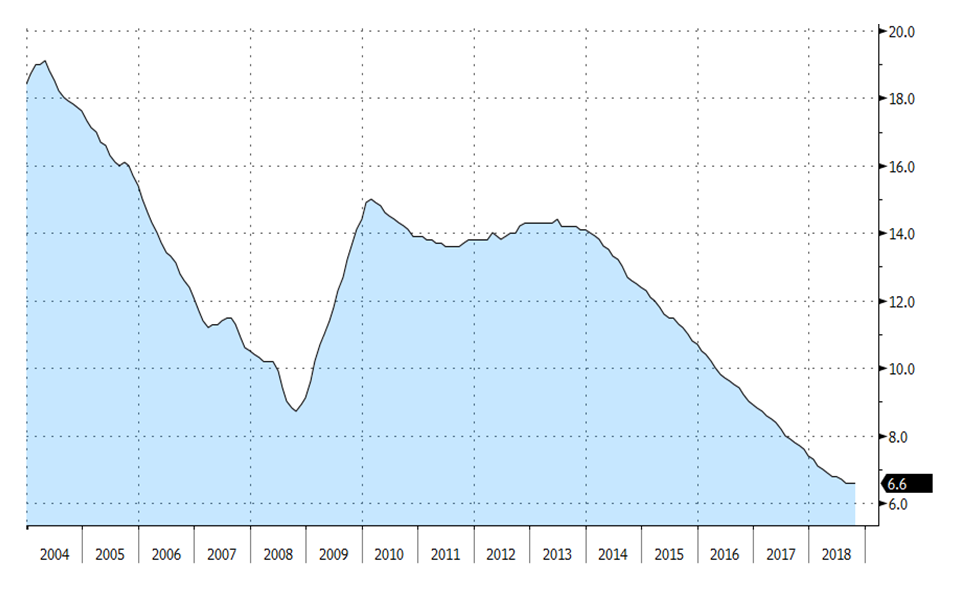

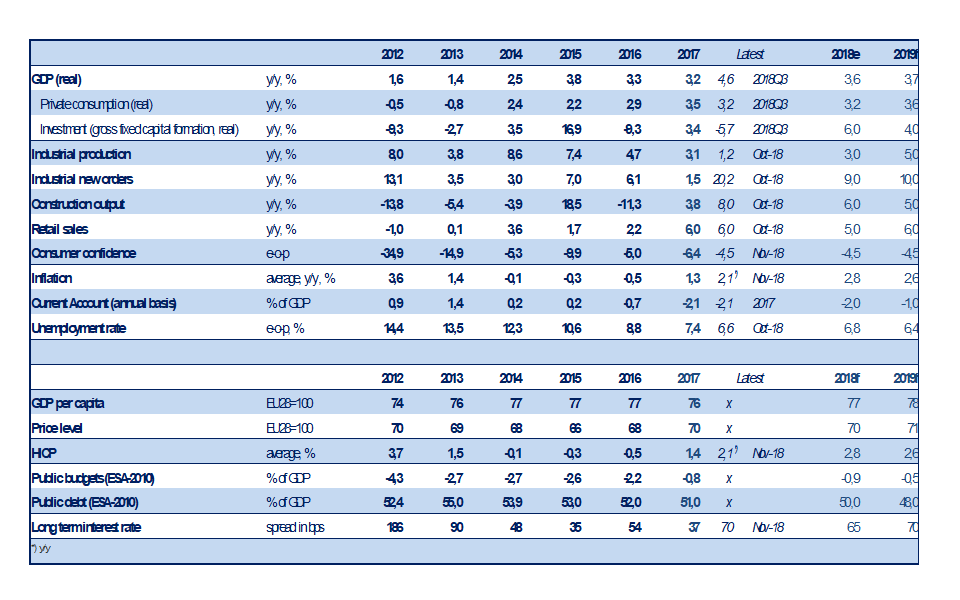

Overheated labor market

Slovak economic growth continued to accelerate throughout 2018 after reaching 3.2% in 2017. Real GDP growth reached 4.6% Y/Y in Q3 2018 compared to 3.0% Y/Y in Q3 2017. This growth acceleration is supported by strong domestic demand and a favourable external environment. Household consumption stayed strong, accelerating from 2.0% Y/Y in Q2 2018 to 3.2% Y/Y in Q3 2018, thanks to low interest rates and to developments on the labour market which even shows signs of overheating. The unemployment rate decreased to a new all-time low of 6.6% in October 2018 according to Eurostat. That’s well below the E(M)U level and down from 7.7% in October last year. We expect a further decline in 2019, though at a slower pace.

The number of job vacancies hit an all-time high and some economic sectors are already for some time signalling the lack of skilled and qualified workers. They started to look for new employees in Romania, Serbia, Bulgaria or Ukraine. The government announced measures to simplify the access of workers from such third countries. The employment of foreigners is at a record high and will probably rise further. Average nominal wage growth reached 6.4% Y/Y in Q3, but real wage growth decelerated due to stronger price rises. Real wages rose by 3.7% Y/Y in Q1-Q3 2018.

Demand for housing loans decelerated slightly to 11.2% Y/Y in October 2018, coming off a 15% Y/Y peak in March 2017. The central bank already implemented measures to curb demand which is expected to weigh further on loan demand. Easy access to credit lifted property prices in past years, but also here we witness a decelerating trend. Average property prices grew by 3.9% Y/Y in Q3 2018, down from 6.4% Y/Y in Q3 2017.

Investments grew strong in the first half of 2018 led by the car industry: by 8.1% Y/Y in Q1 and even by 18.5% Y/Y in Q2. However, most of these flows disappeared after the new Jaguar plant opened in the autumn. Gross fixed capital formation decreased by -5.7% Y/Y in Q3 2018, also due to the high comparative base from the previous year (+14.9% Y/Y). The public sector rather than foreign flows drove investments in Q3 via new highways and railway reconstructions with support of EU funds. Government spending increased by 1.6% Y/Y in Q3.

Exports of goods and services rose by 5.6% Y/Y in Q3 2018, matching the Q3 2017 outcome. Exports are expected to continue contributing positively thanks to capacity increase in the automotive sector (Jaguar plant). Netto export was marginally positive in Q3 with imports rising by 5.4% Y/Y.

The supply side of the economy paints a relatively positive picture. Industrial production decelerated from 3.1% Y/Y in 2017 to 1.6% Y/Y in the Jan-Oct period of 2018, but this was mainly due to a drag in the mining and energy sector. Growth in the most important sector, manufacturing, slightly accelerated from 2.8% Y/Y in 2017 to 3.1% Y/Y (Jan-Oct 2018). Car demand coming from main Western-European countries is a question mark for next year, but the production expansion should nevertheless support the sector. The construction sector was relatively volatile with monthly outcomes ranging between 1.3% Y/Y and 22.4% Y/Y. Overall, the picture is positive as the sector benefited from infrastructure investments and rising demand for flats. New highway/railways modernization projects and the building of new flats could support the sector also in 2019. The latter might be hampered by the central bank’s measures though. The retail sector grew by 6% Y/Y in October 2018. Strong employment figures and real wages suggest that there is still scope for consumer spending and rising retail sales in 2019.

We expect GDP growth to reach 3.7% in 2019. General conditions of the economy looks well for now but there are signs of weakening growth at the key external partners. Risks for next year are external shocks (e.g. Brexit, trade war or increase of peripheral spreads). However, the finalization of the new car plant and start of its production/export should have still positively influence the Slovak economy.

Slovak Asset purchases by ECB on monthly basis

Inflation influenced by food

Slovak inflation ranged between 2% Y/Y and 3% Y/Y throughout the year, mainly influenced by food prices which have a significant share in the Slovak consumer basket. Rising regulated fuel prices starting from January 2019 will probably floor inflation going forward. Demand side price pressures are also on the rise and expected to continue to play a role. We expect inflation around 2.6% on average in 2019.

(Expected) evolution of public finances and debt ratio

Public finances

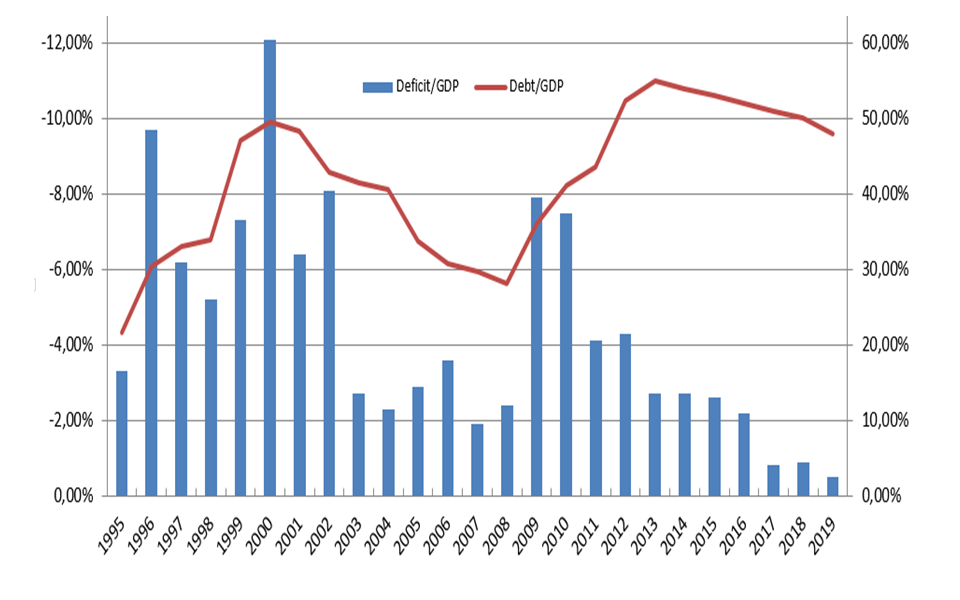

The budget deficit decreased from -2.2% of GDP in 2016 to -0.8% in 2017, the lowest ever. Solid growth is the main factor helping the deficit reduction. It should continue to support the government’s consolidation efforts during the next two years even if they face requests for higher wages and defence spending. We expect a budget deficit of -0.9% of GDP in 2018 and -0.5% in 2019.

The combination of higher deficits during the financial crisis and slowing nominal GDP growth resulted in rapidly rising debt‐to‐GDP levels. Slovak debt climbed from about 28.2% in 2008 to 54.7% in 2013. The debt ratio stabilized in 2014-2015 thanks to recovering growth and started to slowly but gradually decline. Lower budget deficits helped public debt to stabilize which dipped below 51% at the end of 2017. A stabilization at levels well below the EMU average is expected during the next couple of years (50% in 2018 and 48% in 2019).

Current account moving towards surplus

In the past, Slovakia accumulated current account deficits (as did most other Central European countries). The profound restructuring of the economy around the turn of the century, the prospect of and later on the entry in EU (2004) (and EMU in 2009) lured a lot of capital flows. In the case of Slovakia, the money largely found its way to sound investments that strengthened the fabric of the economy. The period of high current account deficits (around 8% of GDP in 2004‐2006) is over now. 2012 was the first year since 1995 in which Slovakia registered a current account surplus (0.9% of GDP), due to a historically high trade surplus. The country kept the current account in surplus also between 2012 – 2014. However, the recovery of domestic demand and restart of investment flow slightly increased the current account deficit again during 2015-2018. We expect a deficit of -2.0% in 2018 which could decline again because of higher export production. We expect a current account gap around of -1% of GDP in 2019.

Healthy banking sector

The Slovak banking sector is doing well, reflecting positive economic conditions. Non-performing loans as a share of the total banking portfolio of loans is very low (4.17% in September). However, the pressure impact from the low interest rate environment is already visible in net interest income (main source of income). Loans to non-financial corporations reached +8.2% Y/Y in October 2018 (latest available figure). For comparison, the total loans in the economy (including retail) increased by 10.5% Y/Y.

Key macroeconomic variables Slovakia (EU Commission, Bloomberg, KBC-CSOB forecasts)

Overview outstanding €-denominated Slovak Government Bonds (SLOVGB’s; Dec 18)